"Plantação descontrolada de novos olivais acabou por estrangular a capacidade transformadora das três únicas unidades industriais existentes na região. Os impactes ambientais são enormesQue incentivos estão no terreno para gerar estes overshoots? Não me venham dizer que é tudo plantado sem generosos apoios comunitários.

...

No Alentejo, mais olival com as mesmas fábricas de extracção de bagaço de azeitona tinha de dar no que deu. Quase se esgotou a capacidade para receber o subproduto produzido nos lagares de azeite a meio da campanha de 2019/2020. E o problema ambiental que a sua actividade gera pode assumir outra amplitude, obrigando as unidades a trabalhar o ano todo, aumentando assim as emissões gasosas e o protesto das populações, como acontece na aldeia de Fortes em Ferreira do Alentejo.

...

“A quantidade de bagaço é tal que o sistema existente não chega para proceder ao seu tratamento nos três equipamentos que existem na região do Alentejo”, constata ao PÚBLICO Aníbal Martins, gerente da Ucasul, empresa que tem capacidade para receber 200 mil toneladas de bagaço/ano. O industrial admite que dentro de cinco anos o subproduto (bagaço) libertado pelos lagares de azeite possa chegar às 800 mil toneladas, lembrando que a instalação de novos olivais não pára enquanto outros que foram plantados nos últimos três anos já entraram em fase de produção."

segunda-feira, dezembro 23, 2019

Faroeste

O Público de ontem publica um artigo interessante e revelador "Boom do olival no Alentejo deixa fábricas de bagaço no “vermelho”":

Um clássico: biologia e economia

Dois artigos que pouco têm a ver com o que se escreve neste blogue, mas que nos deixam a pensar na relação entre biologia e economia. Essa sim, um clássico deste blogue:

- "Soil’s Microbial Market Shows the Ruthless Side of Forests"

- "Bacterial Organelles Revise Ideas About ‘Which Came First?’"

Por exemplo, da fonte 1:

"plants and their fungal conspirators are not just cooperating with each other but also engaging in a raucous and often cutthroat marketplace ruled by supply and demand, where everyone is out to get the best deal for themselves and their kind.

...

Microbes are not simple, passive accessories to plants, but dynamic, powerful actors in their own right. Fungi can hoard nutrients, they can reward plants that are generous with their carbon reserves and punish ones that are stingy, and they can deftly move and trade resources to get the best “deal” for themselves in exchange.

...

fungi might not be just nutrient traders but also sophisticated information processors.

...

“I had this realization … that I’m less interested in cooperation and I’m actually much more interested in the tension,” Kiers said. “I think there’s an underappreciation of how tension drives innovation. Cooperation to me suggests a stasis.”[Moi ici: Não consigo deixar de pensar naquele número que sempre que o procuro aqui no blogue nunca o encontro. Dos anos 60 do século passado até aos nossos dias, o número de patentes registadas por independentes ou PMEs cresce muito mais depressa que o número de patentes registadas por multinacionais e empresas sem falta de financiamento e e com os laboratórios mais apetrechados. Faz lembrar a frase de Taleb "Stressors are information"]

...

It seemed the relationship between the bacteria and the soybeans, far from being a happy friendship, was an uneasy détente, with the plant imposing crippling sanctions on any bacterial partners that failed to earn their keep.

...

A spoonful of soil contains more microbial individuals than there are humans on Earth. “It’s the most species-dense habitat we have,” said Edith Hammer, a soil ecologist at Lund University in Sweden. A single plant might be swapping molecules with dozens of fungi — each of which might in turn be canoodling with an equal number of plants. It’s a promiscuous party down there.

...

After some time, they measured the fungi’s growth and found that the fungi with phosphorus to trade received much more carbon from the plants.

...

The plant with more sugar to trade had received far more fungal phosphorus (which in this experiment was recognizable as the “heavy” isotope phosphorus-32).

.

In 2011, Kiers’ team reported in Science that not only can plants reward high-performing fungal partners and punish poor performers, fungi apparently do the same.

...

Together, the results turned scientists’ understanding of the plant-fungal relationship on its head. No longer could mycorrhizal fungi be seen as servants or passive accessories to their plant masters. Rather, life forms below the surface control their own fate, just as much as those above. It’s a dynamic marriage of equals.

...

She also began developing an economic framework for thinking about relationships between plants and fungi. Based on observations of the free-market system, Kiers suspects that what has stabilized plant-fungal mutualisms for at least 470 million years is not that individual organisms are committed to the good of the community, but rather that, in most cases, both plants and fungi benefit more from trading with each other than from keeping resources to themselves.

...

Most impressively, the fungi moved nutrients from the “rich” to the “poor” region and grew faster in the poor region. Kiers’ team believes that’s because the fungi could extract a higher “price” from the plants in the form of carbon-rich sugars where phosphorus was scarce — though Kiers notes that they couldn’t track the carbon directly."

Da fonte 2:

"Given that all of life is connected — whether in the deep evolutionary past, or in current symbiotic relationships (just think about all the bacteria residing in the human gut) — this new understanding of evolutionary history can give us more clues about where we came from. At the very least, “people are recognizing that there’s more diversity out there in the environment,” Dacks said, “and that the nice clean stories just don’t cut it anymore.”"

domingo, dezembro 22, 2019

"How to Break Out of the Efficiency Trap"

"The nature of work is evolving in two complementary directions. In one direction, managers are redesigning jobs to take advantage of new opportunities to automate workflow processes. Their aim: transform how workers execute tasks in order to boost efficiencies and reduce costs. At the same time, some managers are redefining work to take advantage of new capacity freed up by job redesign. With work redefinition, work is no longer simply about task execution; it’s about creating new sources of value for customers and the business.

...

The less familiar but more expansive approach is to redefine what work is all about: It shifts the primary objective of work from efficiency to broader value creation. When work is appropriately redefined, workers focus on identifying and addressing unseen problems and opportunities instead of executing tasks.

...

Without an overriding strategy of redefining work, workers represent cost savings rather than freed capacity to create new value for the business or the customer.

.

Companies won’t be able to significantly improve value creation if they redesign jobs to optimize processes with the goal of reducing costs.[Moi ici: Recordar a 3M e o 6-sigma]

...

The workforce challenge for most companies is to make the transition from fixed work outcomes that deliver limited value to dynamic work outcomes with higher levels of potential value. A major part of this shift is to recognize that virtually all workers at every level of the organization, aided by machines, have the ability to anticipate what customers really want or need and to develop new approaches to meet those needs.

...

How to Break Out of the Efficiency Trap.

Many companies engaged in redesigning jobs today are caught in a kind of efficiency trap that prevents managers from realizing, or even pursuing, the potential of redefining work. To understand the scale and scope of this issue, executives need to embrace the fact that they are in the midst of a shift from scalable efficiency, where value creation in steady-state business environments focuses on optimization and predictability, to a future state of scalable learning, where conditions and requirements change rapidly and value creation focuses on learning and adaptation.

...

Many companies continue to see their workforce as resources to be managed, controlled, and mechanized. (We have spent the past 100-plus years exploiting models of Frederick Taylor’s ideas of scientific management.)

.

To overcome the obstacles — of short-term cost optimization, Taylorism, and a single-minded focus on automation — leaders must first develop a compelling longer-term vision of the opportunity.

...

1.Zoom out to develop a sense of what the unmet needs of the marketplace might be, what types of impact might be most valuable, and what the most meaningful metrics will be.

...

2.Redesign jobs to free up capacity for redefined work. Use automation or other technologies and workforce alternatives to perform rote work that prevents the workforce from spending more time on better understanding and addressing customer needs."

Trechos retirados de "Redefining Work for New Value: The Next Opportunity"

O salto sem rede!

Estão a ver aqueles que acreditam que os académicos, ou os políticos sabem quais as decisões a tomar para gerir uma empresa?

Estão a ver a leviandade com que se afirma que uma empresa que entra em insolvência tem sempre por trás um caso de gestão danosa? Ainda recentemente Catarina Martins usou essa técnica no caso da Helsar, "Helsar: Catarina Martins afirma que gestão danosa não pode ficar impune".

De "I’m a scientist. This is what I had to ‘unlearn’ to build a successful business" sublinhei:

"Having a background in science was key in the inquiry, but I quickly realized that my degree in genetics and biotechnology didn’t exactly equip me with the skills to successfully bring it to market. In fact, I’d even say I had to “unlearn” a few aspects of my scientific training in order to become an entrepreneur.O salto sem rede! O abandono da navegação de cabotagem! Nadar na zona sem pé! Apostar no optimismo não documentado. Ah! "Following the bliss".

...

In getting my company off the ground, however, I learned that entrepreneurs have to go about things from the other direction—asking instead, “How do we make this happen?” Rather than focusing on questions, it’s about focusing on answers, assuming solutions are out there, and working to find them.

...

The scientist in me could have happily stayed in the lab forever, tweaking chemistries in an effort to gather more information and hit on a more “perfect” formulation. But as anyone who’s even dabbled in business knows, getting something to market, and iterating based on real feedback from customers, is essential.

You have to trust you’ll find the answers as you go, not hold yourself back until you think you’ve got every potential problem figured out. The more I let go of my scientist’s tendency to continually ask “what if,” the more I found that the concrete “how to’s” began to reveal themselves.

...

I couldn’t have imagined back in my basement lab where I’d be today. Science got me started on this path, and I couldn’t keep up with the progress our team is making in our labs and workshops without that background. But the entrepreneurial toolkit—one so rarely taught formally or in schools—has been equally important: the confidence to chase answers, not just questions, and move, however haltingly, from theory to solutions that create real value and impact."

E já agora uma leitura de há algumas semanas, "Why Business Strategy Shouldn’t Be “Scientific”":

"Feynman’s point was that we can’t merely mimic behaviors and expect to get results. Yet even today, nearly a half century later, many executives and business strategists have failed to learn that simple lesson by attempting to inject “science” into strategy. The truth is that while strategy can be informed by science, it can never be, and shouldn’t be, truly scientific.

...

We’d like strategy to be scientific, because few leaders like to admit that they are merely betting on an idea. Nobody wants to go to their investors and say, “I have a hunch about something and I’d like to risk significant resources to find out if I’m right.” Yet that’s exactly what successful business do all the time.

.

If strategy was truly scientific, then you would expect management to get better over time, much as, say, cancer treatment or technology performance does. However, just the opposite seems to be the case. The average tenure on the S&P 500 has been shrinking for decades and CEOs get fired more often.

.

The truth is that strategy can never be scientific, because the business context is always evolving. [Moi ici: A crítica que faço aos que acreditam que economia é ciência galilaica/newtoniana] Even if you have the right strategy today, it may not be the right strategy for tomorrow. Changes in technology, consumer behavior and the actions of your competitors make that a near certainty.

So instead of assuming that your strategy is right, a much better course is to assume that it is wrong in at least some aspects. Techniques like pre-mortems and red teams can help you to expose flaws in a strategy and make adjustments to overcome them. The more you assume you are wrong, the better your chances are of being right."

"leaders eat last"

"Officers Eat Last is a phrase used by U.S. Marines that effectively means servant leadership.Lembrei-me desta expressão e do livro de Simon Sinek, "Leaders Eat Last" ao ler:

It’s also an action used by Marine leaders.

The most senior leaders of the organization actually eat last when the unit has a meal together during field training and in certain combat environments. When the leaders eat last it is a physical expression of servant leadership.

...

The key piece is that in order to be successful as a leader you must put your people first.

It doesn’t mean you must be easy on them. It doesn’t mean that you don’t hold them accountable. It means that you take care of everyone of them and if you do, they will take care of the mission and you.

I have been the last to eat many times throughout my career.

There have been times where there wasn’t any food left.

It is extremely unfortunate when this happens, but the best people to fix logistic issues or any other issues are the leaders. The front line people in most organizations are critical to the overall effectiveness of the organization."

Trecho retirado de "What does “Officers Eat Last” really mean?"

sábado, dezembro 21, 2019

"o tal futuro que já está entre nós, mas mal distribuído"

Encontrei no WSJ de 19.12.2019 um artigo que representa o tal futuro que já está entre nós, mas mal distribuído:

Trechos retirados de "Disney Strikes Back—Against Sellers of DIY Baby Yoda Dolls" publicado no WSJ de 19.12.2019

"On the night “The Mandalorian” premiered on Disney+ last month, Arlene Esplin could be found snuggling up with her family in rural Idaho. As the Star Wars show drew to a close, Ms. Esplin, like millions of viewers across the country, was introduced to the 50-year-old green infant whom fans have christened Baby Yoda.

.

Instantly Ms. Esplin not only wanted—she somehow needed—to have it. Unable to find any Baby Yoda toys for sale, Ms. Esplin, a maker of lifelike infant dolls known as “reborns,” took matters into her own hands.

...

“I knew I had to see what I had in my doll room,” said the 33-year-old mother of five.

.

She rifled through her stock of baby parts, eventually figuring a chimpanzee kit would work best. Over a week, Ms. Esplin slowly dyed the monkey’s body green, sculpted pointy ears out of polymer clay and adorned its head with white fuzz. Her children suggested she post the doll, which didn’t look quite right for their tastes, on Etsy Inc. ’s online marketplace. She did, writing in her ad: “If Yoda had a long lost baby with an ewok...this could be it!”

.

Ms. Esplin sold her Baby Yoda for $599. Then she made and sold a second doll, which more closely resembles the character, for $1,000.

...

Since the character first appeared on Disney’s new streaming service, Baby Yoda has become hugely popular, launching countless memes and causing obsessed fans to scour the internet in search of merchandise. The problem is, customers can’t buy an official Baby Yoda they can hold and admire—at least not in time for Christmas. Sanctioned Baby Yoda dolls, figurines and plush toys won’t be available until early 2020.

...

Cottage manufacturers and obsessed do-it-yourselfers are filling the void. “All I want for Christmas is a Baby Yoda” T-shirts, Baby Yoda Christmas ornaments and an odd-looking collection of Baby Yoda dolls made from felt, yarn and resin are for sale. Baby Yoda giving a sweet look adorns a coffee mug, with the words “Yoda Best Dad.”

...

DIY merchandise hitting the market is a trickier legal question. The notices sent by Disney are “good legal housekeeping,” said Mr. Sammataro, since it can prompt sellers to shut down voluntarily and can signal to a judge that Disney took steps before suing if it goes that far. “You have to teach people how to treat you,” he said"

Trechos retirados de "Disney Strikes Back—Against Sellers of DIY Baby Yoda Dolls" publicado no WSJ de 19.12.2019

Estratégia, Economia Circular, Novos Modelos de Negócio

Três leituras de ontem, que ilustram alguns temas que costumam ser tratados aqui no blogue.

Ao ler este texto recordei as modistas da minha infância, recordei uma cultura em que os bens eram usados, reparados, remendados e passavam de irmão para irmão, e de primos para primos.

Mais um sintoma de que o modelo do século XX está a encolher e voltamos a práticas anteriores à industrialização, por causa de Mongo e por causa do ambiente.

- "The Future of Fashion is Circular: Why the 2020s Will Be About Making New Clothes Out of Old Ones".

Ao ler este texto recordei as modistas da minha infância, recordei uma cultura em que os bens eram usados, reparados, remendados e passavam de irmão para irmão, e de primos para primos.

Mais um sintoma de que o modelo do século XX está a encolher e voltamos a práticas anteriores à industrialização, por causa de Mongo e por causa do ambiente.

Centros comerciais que apostam nas experiências estão melhores do que nunca.

Centros comerciais baseados no preço-baixo não têm hipótese de competir com o comércio online.

"Resale platforms like the RealReal, ThredUp, and Depop have made shopping for used clothing easier than ever—and consumers are buying in."

sexta-feira, dezembro 20, 2019

Reshoring e reshaping

Recordar Fevereiro de 2012, Dezembro de 2011 e Maio de 2006.

"Back in 2010, a company could employ 8.3 Chinese manufacturing workers for the same price as one American worker. By 2018, the figure had plummeted to just 2.9, according to calculations based on the two countries’ statistical bureaux. Real average wages in the advanced country constituents of the G20 rose just 9 per cent between 1999 and 2017. In emerging G20 states, meanwhile, they tripled, according to the International Labor Organization.

.

Given this trend, it is unsurprising that the offshoring of jobs from high wage countries to what were far cheaper emerging economies is no longer the contentious political issue it once was in some parts of the world..

“Asia is growing richer quicker than everybody else. That means that their competitive advantage is diminishing very quickly,” says Gabriel Sterne, head of global macro research at Oxford Economics.

...

The McKinsey Global Institute, a think-tank, reported this year that in 2017, 43 per cent of trade in textiles and clothing was based on labour-cost arbitrage — defined as exports from countries whose GDP per capita is a fifth or less than that of the importing country. This is compared with 55 per cent in 2009.

...

For furniture, toys and other labour intensive goods, the corresponding figure fell from 43 per cent to 35 per cent over the same period..

“The image of globalisation as companies searching for the lowest labour cost around the world is increasingly outdated,” says Susan Lund, co-author of the McKinsey report. “Companies are looking at a whole range of factors, like the talent base and workforce, the quality of the infrastructure and logistics, the ability to tap into innovation ecosystems,” adds Ms Lund, who also cites the growing importance of speed to market as consumer tastes change rapidly.

.

Peter Colson, assistant economist at consultancy Oxford Economics, says “the tables have turned”, in terms of US manufacturers’ desire to shift production to China, with “reshoring” activity in the opposite direction starting to pick up. He notes that the gap in unit labour costs between the US and China will be even smaller than the hourly wage gap suggests, given higher US productivity."

Trechos retirados de "Wage compression slows offshoring of jobs" na versão internacional do FT de ontem.

Velocidade de aprendizagem (parte III)

Parte II.

Trechos retirados de "Cross-Silo Leadership"

"But all of us are vulnerable to forgetting the crucial practice of asking questions as we move up the ladder. High-achieving people in particular frequently fail to wonder what others are seeing. Worse, when we do recognize that we don’t know something, we may avoid asking a question out of (misguided) fear that it will make us look incompetent or weak. “Not asking questions is a big mistake many professionals make,” Norma Kraay, the managing partner of talent for Deloitte Canada, told us. “Expert advisers want to offer a solution. That’s what they’re trained to do.”

.

Leaders can encourage inquiry in two important ways— and in the process help create an organization where it’s psychologically safe to ask questions.

...

When leaders show interest in what others are seeing and thinking by asking questions, it has a stunning effect: It prompts people in their organizations to do the same.

Asking questions also conveys the humility that more and more business leaders and researchers are pointing to as vital to success.

...

one way a leader can make employees feel comfortable asking questions is by openly acknowledging when he or she doesn’t know the answer. Another, she says, is by having days in which employees are explicitly encouraged to ask “Why?” “What if…?” and “How might we…?”...

Get People to See the World Through Others’ Eyes

.

LEADERS SHOULDN’T JUST encourage employees to be curious about different groups and ask questions about their thinking and practices; they should also urge their people to actively consider others’ points of view. People from different organizational groups don’t see things the same way.

...

Creating a culture that fosters this kind of behavior is a senior leadership responsibility. Psychological research suggests that while most people are capable of taking others’ perspectives, they are rarely motivated to do so."

Trechos retirados de "Cross-Silo Leadership"

quinta-feira, dezembro 19, 2019

Os loucos tomaram conta do jornal

Há textos escritos nos jornais económicos, ou supostamente económicos, que custam a perceber. Um dos últimos que descobri foi este "A maldição das exportações". Vejamos um aperitivo:

Deve ser um "lesboeta" que ficou algures nos anos 70.

Segundo este teórico se trabalharmos para o mercado interno podemos subir na escala de valor mais depressa do que a trabalhar para o mercado externo... faz-me lembrar o Bicicletas. O Bicicletas Mamede também acha que quando exportamos baixamos os preços para conseguir vender. Recordar "Dedicado ao Bicicletas"

Analisar os números, trabalhar com factos, é lixado, dá cabo de qualquer aprendiz de feiticeiro sem skin-in-the-game. Por exemplo, do World Footwear Yearbook de 2017 retirei esta tabela para Portugal. Recomendo a consulta da coluna dos preços.

Como é que alguém em 2019 consegue acreditar que o futuro é trabalhar para um mercado interno pobre, pequeno, a encolher demograficamente, impostado por todos os lados (interessante, no mesmo dia o blogue do Blogue de Esquerda e o Observador do mesmo lado da barricada: "A morrer lentamente como o sapo dentro da panela" e "É tão fácil viver de impostos…")

Deve ser um amigalhaço do Desventura Sousa Santos a pregar para seguirmos as pisadas da desgraçada Venezuela.

Como é que o Japão começou? A exportar produtos da treta - recordar Bob Hope e o Made in Japan em 1944.

Como é que Taiwan começou?

Como é que Hong Kong começou?

Como é que a Coreia do Sul começou?

Como é que a China começou?

Como é que a Estónia começou?

Como é que a Roménia está a começar?

Como é que todo o Bloco de Leste começou?

Produtos básicos e depois subiram na escala de valor a trabalhar para mercados cada vez mais competitivos.

É preciso começar por vender e acumular capital para investir. Por cá, o modelo mental instituído ronda este tweet:

Lembro-me de ser um jovem engenheiro à espera de uma entrevista de emprego para a UTA em Valongo a ler Drucker a citar Schumpeter: "Lucro = O custo do futuro"

"Nos últimos anos tem prevalecido a ideia de que as empresas se devem orientar para os mercados externos esquecendo e ignorando o mercado interno.[Moi ici: Aqui neste blogue ainda recentemente se bateu na tecla do by-pass]A teoria deste economista é simples:

...

As consequências, desta orientação para a exportação, são desastrosas e de longo prazo e traduzem-se em empobrecimento e emigração fatores que consubstanciam o declínio de qualquer nação.[Moi ici: Extraordinário!!!]

.

Vejamos, então, porque é que o modelo exportador não é positivo para o país:

.

1º Porque produzindo essencialmente para exportar implica, necessariamente, tudo ter de importar;

.

2º Portugal exporta bens de baixo valor acrescentado como sapatos, têxteis e produtos agrícolas (como o vinho), cuja competitividade assenta não na tecnologia, não no design ou na marca, mas nos baixos salários e também produtos de tecnologias intermédias, como carros e equipamentos, mas que são produzidas por empresas estrangeiras sendo, neste caso, o nosso valor acrescentado limitado à mão-de-obra barata."

"Na verdade só interessa especializar-se nas exportações quem venda produtos de alto valor acrescentado e importe maioritariamente produtos de baixo valor acrescentado.Um tipo fica sem palavras e tem de deixar passar uns dias para digerir estas ideias.

...

Há outro caminho. O da substituição de importações, o da aposta no mercado interno, o da educação e da ciência, o do investimento nas empresas públicas e privadas de média e grande dimensão. Por acréscimo virão as exportações, mas garantir, dentro de limites possíveis, o autoabastecimento é imprescindível para o país prosperar e não se transformar numa região periférica de uma Europa permanentemente em crise."

Deve ser um "lesboeta" que ficou algures nos anos 70.

Segundo este teórico se trabalharmos para o mercado interno podemos subir na escala de valor mais depressa do que a trabalhar para o mercado externo... faz-me lembrar o Bicicletas. O Bicicletas Mamede também acha que quando exportamos baixamos os preços para conseguir vender. Recordar "Dedicado ao Bicicletas"

Analisar os números, trabalhar com factos, é lixado, dá cabo de qualquer aprendiz de feiticeiro sem skin-in-the-game. Por exemplo, do World Footwear Yearbook de 2017 retirei esta tabela para Portugal. Recomendo a consulta da coluna dos preços.

Como é que alguém em 2019 consegue acreditar que o futuro é trabalhar para um mercado interno pobre, pequeno, a encolher demograficamente, impostado por todos os lados (interessante, no mesmo dia o blogue do Blogue de Esquerda e o Observador do mesmo lado da barricada: "A morrer lentamente como o sapo dentro da panela" e "É tão fácil viver de impostos…")

Deve ser um amigalhaço do Desventura Sousa Santos a pregar para seguirmos as pisadas da desgraçada Venezuela.

Como é que o Japão começou? A exportar produtos da treta - recordar Bob Hope e o Made in Japan em 1944.

Como é que Taiwan começou?

Como é que Hong Kong começou?

Como é que a Coreia do Sul começou?

Como é que a China começou?

Como é que a Estónia começou?

Como é que a Roménia está a começar?

Como é que todo o Bloco de Leste começou?

Produtos básicos e depois subiram na escala de valor a trabalhar para mercados cada vez mais competitivos.

É preciso começar por vender e acumular capital para investir. Por cá, o modelo mental instituído ronda este tweet:

Lembro-me de ser um jovem engenheiro à espera de uma entrevista de emprego para a UTA em Valongo a ler Drucker a citar Schumpeter: "Lucro = O custo do futuro"

"o possível é o que respeita a necessidade"

Sou um fã de Joaquim Aguiar há muitos anos, por exemplo "Fim das Ilusões, Ilusões do Fim". O texto que se segue é um exemplo do porque gosto de o ler. E isto não se aplica só à política. Uma auditoria interna realizada por estes dias pôs-me a ter uma conversa, com a Administração de uma PME, que não anda longe disto. A diferença entre os sonhos que tardam a gerar facturação e a necessidade de dinheiro para comprar melões, deixem-se de tretas e concentrem-se no que pode não ser sexy, mas dá o pão com manteiga. Até sugeri a criação de um grupo desgarrado para aproveitar essa via:

"Apolítica[Moi ici: A gestão] é a arte do possível, e o talento do político está na sua capacidade para identificar a realidade efectiva das coisas. A qualidade dopolítico[Moi ici: gestor] avalia-se no modo como traduz, tanto para os seus apoiantes como para os seus opositores, a linha da necessidade, para que os apoiantes não se afastem do campo das possibilidades e para que os opositores sejam forçados a reconhecer que não podem escapar à força gravitacional da necessidade. Na estratégia eleitoral, o possível é o que conquistar votos. Mas em termos de governação, o possível é o que respeita a necessidade - há quem ganhe eleições para começar a perder o que ganhou logo que governa. Há vitórias que são apenas o prefácio da derrota.

.Trecho retirado de "O possível e o necessário"

Em política, o confronto com realidade exige o reconhecimento das mudanças das circunstâncias, e isso implica aceitar e vencer o confronto com os que, por fixação na memória ou por recearem perder posição no processo de mudança, recusam reconhecer que as circunstâncias mudaram."

quarta-feira, dezembro 18, 2019

Investigação de sistemas biológicos

Sabem como considero a economia uma continuação da biologia.

Sabem como tenho medo dos fragilistas, dos intervencionistas ingénuos. Sabem como aprendi a apreciar a Via Negativa: primeiro, não provocar mal!

Sabem como tenho medo dos engenheiros sociais que querem mudar o mundo.

Pois bem, esta semana tive uma conversa com um investigador que usa sistemas biológicos para produção. Não falei com ele por causa de economia, mas por causa de melhorias na sua empresa. Enquanto ele falava, eu sorria por dentro.

Sabem do que eu digo sobre a estupidez de pensar que a ciência newtoniana ou galilaica se aplica aos sistemas humanos?

Dizia ele:

- Na biologia 1 + 1 = 3 ou 4, ou zero

- A biologia não gosta de revoluções

- Com a biologia compensa ser conservador

- Com a biologia a inovação tem de ser por pequenas experiências

- Recordo as paramécias do russo Gause em Julho de 2006.

- Recordo Beinhocker no Verão de 2008.

- Recordo McArthur e as suas toutinegras:

Sabem como tenho medo dos fragilistas, dos intervencionistas ingénuos. Sabem como aprendi a apreciar a Via Negativa: primeiro, não provocar mal!

Sabem como tenho medo dos engenheiros sociais que querem mudar o mundo.

Pois bem, esta semana tive uma conversa com um investigador que usa sistemas biológicos para produção. Não falei com ele por causa de economia, mas por causa de melhorias na sua empresa. Enquanto ele falava, eu sorria por dentro.

Sabem do que eu digo sobre a estupidez de pensar que a ciência newtoniana ou galilaica se aplica aos sistemas humanos?

Dizia ele:

- Na biologia 1 + 1 = 3 ou 4, ou zero

- A biologia não gosta de revoluções

- Com a biologia compensa ser conservador

- Com a biologia a inovação tem de ser por pequenas experiências

Trabalhar uma marca a sério.

Artesãos versus industrialistas.

Artesãos versus carcaças ocas.

Artesãos versus aristocratas arruinados.

Trechos retirados de "‘Challenger thinking is how brands drive growth’: Peter Field on 20 years of challenger brands"

Artesãos versus carcaças ocas.

Artesãos versus aristocratas arruinados.

"The danger — expressed most simply — is living by the quarter. If there’s one thing that leaps out from the work done by eatbigfish around challenger brands, it’s that these businesses knew building a brand takes time.

...

Unfortunately, short-termism is the business climate of our time. We live in the short-term. The danger is that because so few in the c-suites of major businesses these days have marketing experience they don’t understand that imposing short-term disciplines on marketing kills brands.

...

if you pursue efficiency solely you walk away from effectiveness, and we know this very well now. The most efficient way to use marketing and advertising is to achieve mediocre results at minute cost. That way you get immense returns on investments, but unfortunately you’ll do nothing in the long-term.

.

Long-term growth is reaching, not for low-hanging fruit, but the fruit at the top of the tree. It’s about bringing tomorrow’s consumers into your brand. If all you’re doing is going for the low-hanging fruit at the bottom of the funnel, you can kiss goodbye to that really profitable long-term growth."

Trechos retirados de "‘Challenger thinking is how brands drive growth’: Peter Field on 20 years of challenger brands"

terça-feira, dezembro 17, 2019

ISO 9001 - estar atento à evolução do contexto

Ontem em conversa numa empresa dava conta de um aperto na exigência dos clientes de artigos de moda. Coisas que no passado não eram assunto, agora dão origem a reclamação, devolução ou pedido de abatimento no preço. Depois, à noite, apanhei este artigo no FT "US retailers hit by ‘worst year since 2008’ for big discounts":

"US department stores and clothing retailers, trying to weather the continued onslaught of online shopping, are resorting to some of the biggest discounts since the 2008 crisis to woo consumers, heightening concerns of a squeeze in profit margins.Eis mais um exemplo da importância de estar atento à evolução do contexto que envolve as empresas:

...

“This is the worst year for discounting since 2008,” said Jan Rogers Kniffen, a retail consultant, of clothing and mall-based retailers. He noted that the discounts came in spite of robust US consumer spending. “Outside of a recession, it’s the deepest I’ve seen.”

...

Mastercard forecasts that US retail sales will rise 3.1 per cent between the start of November and Christmas Eve from the same period a year ago, led by ecommerce.

At mid-market department stores, about two-thirds of merchandise was still on sale last week, according to data companies StyleSage and Refinitiv. Average discounts, at 27 per cent, were only slightly less deep than during the Black Friday weekend."

Como está a evoluir o contexto da sua empresa?

- Como vai a evolução do pricing dos seus concorrentes?

- Como vai a evolução da inovação da sua empresa e dos concorrentes?

- Como vai a evolução do acesso a recursos estratégicos?

- Como vai a evolução da distribuição?

- Como vai a evolução da propriedade intelectual da sua empresa e dos concorrentes?

- Como vai a evolução da economia?

- Como vai a evolução das operações?

- Como vai a evolução da legislação e/ou regulação?

- Como vai a evolução da qualidade?

- Como vai a evolução da reputação da empresa?

- Como vai a evolução da ...

Já agora:

“Overcoming myopia begins with situating the organisation and its transactional environment within the broader context of society. Such a perspective recognises the deeper causal relationships that enable and drive industry dynamics and outcomes. Understanding what these causal relationships are, how they might change and how they could affect future operating dynamics is the essence of scenario planning.

The transactional environment is the arena in which the organisation participates, where the perceived value or benefits it creates are exchanged to satisfy perceived wants and needs. The organisation has an immediate relationship with this environment.”

Trechos retirados de “Rethinking Strategy” de Steve Tighe.

"one-size-fits-all minimum wages"

Interessante:

Trecho retirado de "Does a One-Size Fits All Minimum Wage Cause Financial Stress for Small Businesses?"

"one-size-fits-all minimum wages cause some small businesses, industries, and areas frictions in absorbing the increased cost of labor. As a result, affected businesses experience financial stress or defaulting.Conjugar isto com a actual situação demográfica. Ainda na semana passada assisti numa empresa a uma conversa sobre a qualidade de trabalhadores: venezuelanos versus brasileiros versus colombianos.

.

Not all affected firms would have the flexibility to immediately adjust their capital–to–labor ratio or pass on the increased minimum wage costs to their customers. Small, young, labor-intensive, minimum-wage sensitive establishments and businesses located in competitive and low-income areas experience higher financial stress. This eventually leads to a higher exit rate and a lower entry rate.

...

the study finds that increases in the federal minimum wage worsen the financial health of small businesses in the affected states.

.

The study evaluates the likelihood that a business will make payments to suppliers or vendors on time, suggesting that the minimum wage can affect the availability of credit and interest rates for small businesses. The authors find that a dollar increase in the federal minimum wage corresponds to an almost 1.0 percentage point reduction in an establishment’s credit in affected states.

...

Small and young establishments, which are more likely to have financial constraints, experience a more significant decrease in their credit scores. Establishments that are labor-intensive such as restaurants and retail, find it more difficult to absorb minimum wage increases and hence experience a more significant decline in their credit scores.

.

The study also finds that increases in the minimum wage lead to lower bank credit, higher loan defaults, lower employment, a lower entry and a higher exit rate for small businesses. The results are robust to using nearest-neighbor matching and geographic regression discontinuity design. These results document some potential costs of a one-size-fits-all nationwide minimum wage on small businesses."

Trecho retirado de "Does a One-Size Fits All Minimum Wage Cause Financial Stress for Small Businesses?"

segunda-feira, dezembro 16, 2019

Teorias e periferias

Ontem ao ler "How to Survive a Recession and Thrive Afterward" fixei-me neste trecho:

Já têm alguma teoria sobre o que se está a passar?

Quem está na periferia onde a neve derrete primeiro?

"In a 2017 study, Raffaella Sadun (of Harvard Business School), Philippe Aghion (of Collège de France), Nicholas Bloom and Brian Lucking (of Stanford), and John Van Reenen (of MIT) examined how organizational structure affects a company’s ability to navigate downturns. On the one hand, “the need to make tough decisions may favor centralized firms,” the researchers write, because they have a better picture of the organization as a whole and their incentives are typically more closely aligned with company performance. On the other hand, decentralized firms may be better positioned to weather macro shocks “because the value of local information increases.”"Fiz logo a ponte para algo que li em "Seeing around corners" de Rita McGrath:

"Evidence of an emerging inflection point doesn’t present itself neatly on the conference table in the corporate boardroom. It is the people who are directly in contact with the phenomenon who usually notice changes early.E pensei nas empresas daqueles sectores que estão com evoluções negativas:

...

If snow melts from the edges, it behooves you to have mechanisms in place to see what is going on there.

...

A very common reason that leaders miss potentially important inflection points is that they are isolated from the people who could tell them what is really going on.

...

Snow melts from the edges. The changes that are going to fundamentally influence the future of your business are brewing on the periphery. To avoid being taken by surprise by an inflection point, you need to be exposed to what is happening at the edges.

The upheavals created by major strategic inflection points usually take quite some time to unfold. They are also not “complete” when you first see them. But if you are paying attention, you can begin to see the implications of their trajectory early on, when it is still possible to influence them."

Já têm alguma teoria sobre o que se está a passar?

Quem está na periferia onde a neve derrete primeiro?

ISO 9001: Processes and risks (without complication)

I believe the relationship between processes and risks need not be complicated. I believe it is much easier to understand how to approach this relationship from the example of a company without any quality system. Consider the process "Manufacture parts":

The process starts when Production Manager gives a Production Order to a Production Operator.

The Production Operator starts producing parts and recording process control items in the Production Order. Then, the Production Operator Packages the parts.

Now, ask: What can go wrong? What can go wrong with our intended results? What undesirable results can come out of this process?

Evaluate each situation and decide if any action is needed to avoid or reduce that risk. For example:

And the process can be modified to include two new steps:

Lesson: We do not need to complicate things.

The process starts when Production Manager gives a Production Order to a Production Operator.

The Production Operator starts producing parts and recording process control items in the Production Order. Then, the Production Operator Packages the parts.

Now, ask: What can go wrong? What can go wrong with our intended results? What undesirable results can come out of this process?

Evaluate each situation and decide if any action is needed to avoid or reduce that risk. For example:

And the process can be modified to include two new steps:

Lesson: We do not need to complicate things.

domingo, dezembro 15, 2019

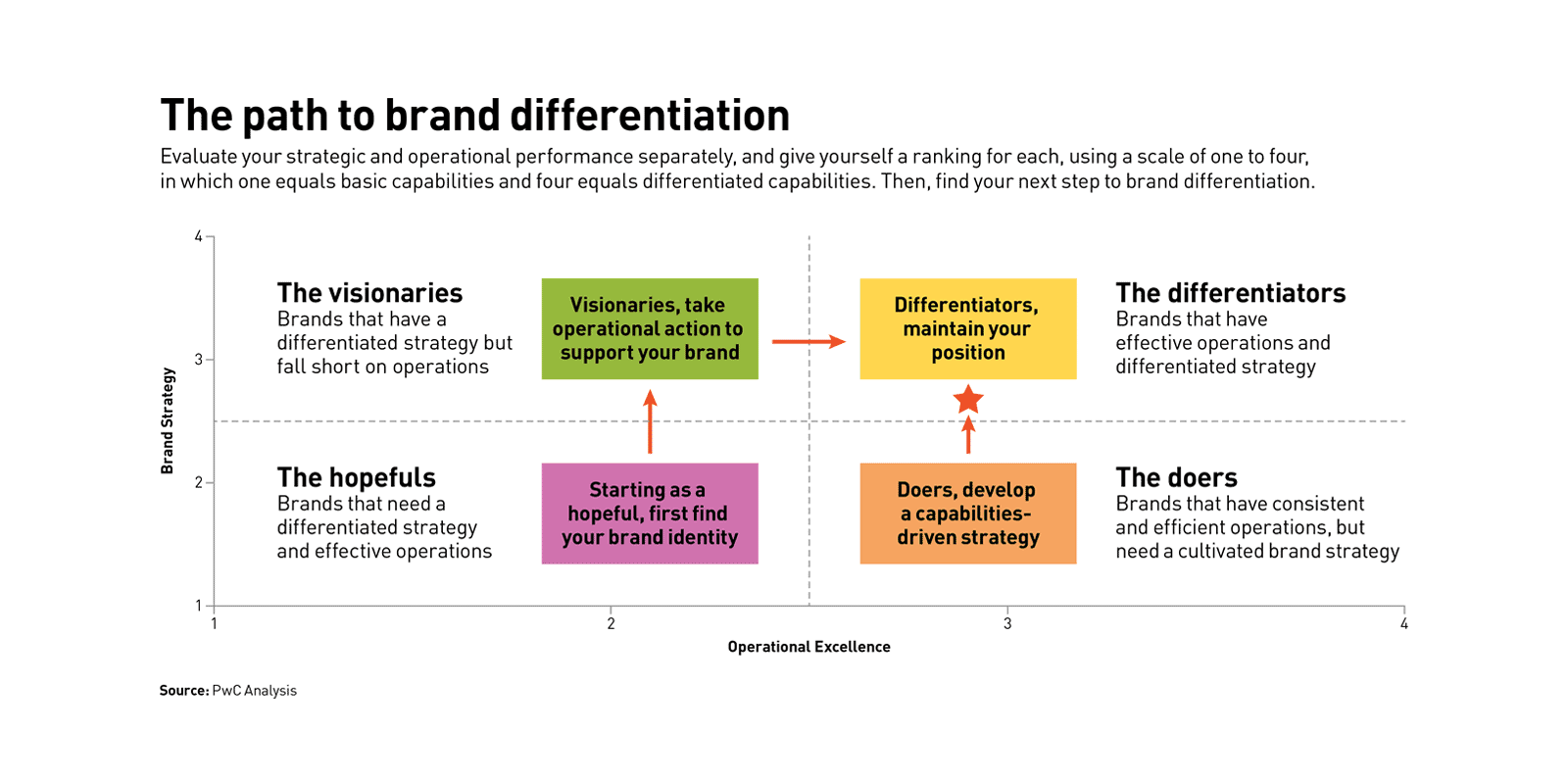

Apostar na diferenciação

Recordar daqui "innovation and differentiation positions lead to superior pricing power"

Trechos retirados de "How to stand out in a crowded marketplace"

"An inability to connect with customers is a big part of the problem for companies that find themselves lost in the undifferentiated middle. In a PwC consumer survey, 73 percent of respondents said customer experience was an important determinant in their purchasing decisions. In fact, the survey revealed that consumers are willing to pay as much as a 16 percent premium for a superior experience, and they are more likely to stay loyal to the brand that offers it.

...

Becoming a differentiator

The path to differentiation (and to thriving as a differentiator) depends on whether your company is currently a hopeful, a doer, a visionary, or a differentiator.

- Hopefuls: The most important step is to build a strong brand strategy. This starts with defining the right brand identity.

- Doers: Rather than starting from square one, you’d benefit from a capabilities-driven strategy. Identify your competitive advantage and build your strategy around that.

- Visionaries: Your focus should be on building operational capabilities so you can take action on your strategy. Be mindful to allocate resources in a way that aligns well with your brand strategy. For example, if your brand focuses on innovation, then product development and R&D would take precedence over other investments.

- Differentiators: The key is to grow strategically — through innovation, strategic alliances, and more — to stay on top.

...

Build strategy, then operationsFor hopefuls and doers to become visionaries and eventually differentiators, they

have to put customers at the center of their approach to the four important brand strategy components — identity, value, perception, and awareness — and then build operational capabilities on top of that strategy. Here’s how. Focus on what you do best for your customers.

...

...

Realize that value involves more than just price.

...

Make sure you know who your customers are.

...

Get the word out.

...

Winning the brand challenge

The challenge of being caught in the middle is not likely to fade away. If anything, it will become more pronounced. But with a plan centered on first defining a customer-centric strategy, then bolstering operations, and then continually checking and protecting your reinvigorated brand identity, you’ll be on the path to lasting differentiation."

Trechos retirados de "How to stand out in a crowded marketplace"

Contexto, estratégia e bolha azeiteira

Tem uma PME? Está atenta ao contexto e às suas alterações?

O que acontece quando a quantidade de uma commodity que é colocada no mercado aumenta?

O preço baixa!

O que acontece a um produtor dessa commodity com custos de produção mais elevados?

Não consegue competir.

Quais são as alternativas para esse produtor com custos mais elevados?

Quando não se pode competir pelo preço/custo, aposta-se na subida na escala de valor, foge-se da via cancerosa e aposta-se na joalharia, procura-se a diferenciação.

BTW, lembram-se da "indústria mais sexy da Europa"?

O que acontece quando a quantidade de uma commodity que é colocada no mercado aumenta?

O preço baixa!

O que acontece a um produtor dessa commodity com custos de produção mais elevados?

Não consegue competir.

Quais são as alternativas para esse produtor com custos mais elevados?

- Fechar!

- Ou mudar de vida e abandonar a competição baseada no preço, deixar de vender o produto puro e simples e, oferecer algo mais

Ontem li esta notícia, "Sector do azeite vive “verdadeiro pesadelo” no Douro e Trás-os-Montes":

"Olivicultores e lagareiros do Douro e Trás-os-Montes queixam-se de uma “campanha difícil” devido à diminuição do preço do azeite e da azeitonaResolvi pesquisar a evolução dos preços do azeite a granel:(fonte)

...

a questão do tratamentos dos subprodutos da colheita de azeitona veio juntar-se à “baixa acentuada do preço do azeite no mercado nacional e internacional e, por inerência, da azeitona”."

"As últimas estimativas apontam para um crescimento de 25% no volume de produção de azeite, relativamente à campanha anterior. Prosseguiu a campanha de comercialização, com a oferta a aumentar e escoamento regular.Resolvi pesquisar a evolução dos preços do azeite a granel em Espanha e Itália (fonte)

.

A cotação mais frequente a granel do azeite virgem extra foi de 2,60€/kg."

- Itália - 4,70€/kg

- Espanha - 2,21€/kg

- Grécia - 2,60€/kg

Entretanto, achei interessante esta "guerra", "No request to look into different olive oil prices, Commission says":

"The issue was put forward by Spanish farming association Unión de Uniones (UDU) at the start of August, after the publication of the July monthly report on the market situation in the EU’s olive oil and table olives sectors.Voltemos aquelas duas alternativas:

.

The Spanish press reported that the association would ask the Commission to investigate potential disruption in the olive oil market, hinting that Italy was enjoying a more favourable treatment in comparison to other producers like Spain and Greece.

...

At the same time, olive oil prices showed a 13% increase in Italy compared to the previous year, while a decrease was recorded in Greece and in Spain, at 2% and 19%, respectively.

...

EU agriculture Commissioner Phil Hogan explained in a letter sent in mid-August that the main reason behind the price collapse is a record harvest of 1.79 million tonnes for the 2018/19 marketing year, a 42% increase compared to the previous year."

- Fechar!

- Ou mudar de vida e abandonar a competição baseada no preço, deixar de vender o produto puro e simples e, oferecer algo mais

O que está a acontecer ao olival transmontano? Incapaz de competir no custo com a produção intensiva. Recordar:

"No contexto nacional, o Alentejo acabou por se tornar, desde 2007, na região com mais produção de azeitona, tendo chegado a garantir 75% do total do fruto produzido no país, em 2018, quando há 20 anos representava apenas 25% desse total. Para isso contribuiu o aumento da área de olival na região que, nos últimos 11 anos, cresceu 10%, para 172 mil hectares, assinala o estudo."Quando não se pode competir pelo preço/custo, compete-se com uma marca. Recordo um postal publicado aqui em Dezembro de 2010:

"façam como se fez para o vinho que teve sucesso. Criem uma cooperativa da região, criem uma marca, desenvolvam uma marca, pensem em castas de azeitona, pensem em regiões demarcadas, não pensem em quantidade, isso fica para os olivais que pertencem às grandes distribuidoras de azeite. Pensem em boutique de azeite, pensem em azeite = luxo, pensem em azeite = néctar, pensem em azeite = saúde."Recordo o que escrevi aqui recentemente em "E sem intenção, e sem querer, apareceu na minha mente a decisão de pôr de lado o azeite alentejano" e em "Todos vão perder".

Quando não se pode competir pelo preço/custo, aposta-se na subida na escala de valor, foge-se da via cancerosa e aposta-se na joalharia, procura-se a diferenciação.

BTW, lembram-se da "indústria mais sexy da Europa"?

sábado, dezembro 14, 2019

Curiosidade do dia - comunismo e Chega (parte III)

Parte I e Parte II.

BTW, lembrem-se que a mensagem da esquerda para estes trabalhadores é "Quantos mais forem para o desemprego, mais a produtividade agregada do país cresce". E qual é a mensagem da direita tradicional? Não é diferente, "Empresas que não consigam pagar 750 euros daqui a quatro anos são ficção, diz Bagão Félix". Gente instalada na vida, sem skin in the game, são o máximo a mandar postas de pescada.

Trecho retirado de "How the Rise of Chinese Textile Manufacturing in Italy Fuelled the Far Right".

"Mr. Nesi’s father was a lover of Beethoven, literature and timely payment. He bestowed to his son a lucrative arrangement: He sent wool to overcoat manufacturers in West Germany, and they unfailingly sent back money 10 days later. His father assured him that this was a formula for enduring success. Be honest, produce quality fabric, “and you will be as happy as I am.”O que aconteceu em Itália em nada difere do que aconteceu em Portugal. No entanto, a economia de bens transaccionáveis recuperou mais depressa e melhor em Portugal. Recordo que no caso do têxtil português, ainda antes da China, já a Turquia provocava estragos na segunda metade dos anos 90 do século passado. Recordo que isto é um sobe e desce permanente, e que quanto mais barreiras à entrada e saída mais raerefeita é a paisagem competitiva.

.

“We lived in a place where everything had been good for 40 years,” Mr. Nesi says. “Nobody was afraid of the future.”

.

In retrospect, they should have been. By the 1990s, the Germans were purchasing cheaper fabrics woven in Bulgaria and Romania. Then, they shifted their sights to China. The German customers felt pressure to find savings because enormous new retailers were carving into their businesses — brands like Zara and H&M, tapping low-wage factories in Asia.

.

Chinese factories were buying the same German-made machinery used by the mills in Prato. They were hiring Italian consultants who were instructing them on the modern arts of the trade.

.

Some companies adapted by elevating their quality. One local mill, Marini, followed the American clothing brands that were its customers as they gravitated to China, shipping its fabric there. But this was clearly the exception. From 2001 to 2011, Prato’s 6,000 textile companies became 3,000, as those employed in the industry dropped to 19,000 from 40,000, according to Confindustria, an Italian trade association.

.

Mr. Nesi tried making clothes for Zara, which constantly demanded lower prices. “You started to work on how to pervert your own quality in order to sell it to Zara,” he says. “They wanted the best look. It had to be something that looks like your quality without actually being it. That’s more or less a description of what they wanted our life to become. Something that looks like your life but is of lesser quality.”[Moi ici: Recordo uma das mensagens mais antigas deste blogue - competir pelo preço não é para quem quer, é para quem pode]

.

Eventually, he sold the business to spare his father from “an old age full of shame.”"

BTW, lembrem-se que a mensagem da esquerda para estes trabalhadores é "Quantos mais forem para o desemprego, mais a produtividade agregada do país cresce". E qual é a mensagem da direita tradicional? Não é diferente, "Empresas que não consigam pagar 750 euros daqui a quatro anos são ficção, diz Bagão Félix". Gente instalada na vida, sem skin in the game, são o máximo a mandar postas de pescada.

Trecho retirado de "How the Rise of Chinese Textile Manufacturing in Italy Fuelled the Far Right".

Fluxo por todo o lado

Em 2005 no livro, "Balanced Scorecard - concentrar uma organização no que é essencial", no capítulo III, escrevemos:

"A organização é um sistema, a entidade que gera os resultados que temos sob estudo. A caracterização de um sistema permite, por um lado, uma melhor compreensão do porquê do desempenho actual, e por outro, um ponto de apoio para influenciar, para determinar os resultados futuros desejados. Aliás, o mais importante são os resultados, tudo o resto é detalhe, podemos pois começar por visualizar a organização como uma caixa negra que gera os resultados que temos sob estudo.

Cada vez gostamos menos desta imagem, a da caixa negra, pois a apresentação de uma caixa, com linhas rectas, ângulos rectos, transmite uma ideia de ordem, de conhecimento talvez demasiado arrogante.

Em boa verdade acreditamos que a organização, apesar de ser uma criação humana, se comporta como, é uma espécie de ser vivo. E como ser vivo que é, está em permanente contacto com o meio que a rodeia e a agir e reagir sobre esse meio, essa acção e reacção vai transformando a organização, ou seja, em rigor não podemos afirmar… eis a organização, porque isso não passaria de um instante, um fotograma temporal, por isso cada vez mais visualizamos a organização como uma amiba, um ser vivo tridimensional, em permanente mutação de forma para melhor se ajustar ao meio em que se encontra."Ontem, apanhei este artigo, "Reconceptualising organisations: from complicated machines to flowing streams":

"Too often we still view organisations through a mechanistic lens and this impacts on the flows we pay attention to. If we see them instead as living systems, organisms or ecosystems, it soon becomes clear that flow is central to every aspect of the organisation.Temos muito a aprender com esta abordagem dos fluxos. Como referi neste postal "Uma bofetada que recebo como um aviso":

...

If we look at organisations not as machines, but as living entities — ecosystems or organisms, we have to look at them as flow systems. Flow, therefore, becomes a beneficial lens to help us think about new ways of working, new organisational structures and new forms of management.[Moi ici: Recordo um "processo é fluxo"]

...

In nature, form follows flow. In human systems, we tend to design our structures first and then try to force flow through them."

"nature evolves away from constraints, not toward goals"

sexta-feira, dezembro 13, 2019

PME e Pricing Power

Stephan Liozu é um craque quando se fala de pricing.

Pricing é um dos temas mais importantes para o futuro das PME portuguesas, embora 99% desconheça o tema. Um tema fundamental quando se quer subir na escala de valor e aumentar preços sem perder clientes., ou seja, fugir da estratégia cancerosa da competição pelo preço.

Trechos retirdaos de "It’s Time to Pay Attention to Pricing Power"

Pricing é um dos temas mais importantes para o futuro das PME portuguesas, embora 99% desconheça o tema. Um tema fundamental quando se quer subir na escala de valor e aumentar preços sem perder clientes., ou seja, fugir da estratégia cancerosa da competição pelo preço.

"After years of cost cutting and expense optimization, business executives in many of these organizations have realized that they cannot cut their way to prosperity and that managing the business for value and pricing excellence has become inevitable. They also know that fighting solely on price never ends well.

...

"You can't compete with the lowest-cost producer on price and not expect your stock to get clobbered.”

.

There you have it. Pricing power is formally on Wall Street’s radar.

...

In November 2011, Warren Buffet said:

.

“The single most important decision in evaluating a business is pricing power. If you’ve got the power to raise prices without losing business to a competitor, you’ve got a very good business. And if you have to have a prayer session before raising the price by 10%, then you’ve got a terrible business”.

...

I identified six items or activities helping with that:

.

1.Ability to successfully defend our price premium versus competitors:

...

2.Ability to make price moves first in the marketplace:

...

3.Ability to capture a large share of the value delivered to customers:

...

4.Ability to price and launch innovative and differentiated offerings at a premium:

...

5.Ability to raise prices consistently every year without losing demand:

...

6.Ability to capture a large share of our intended price increases:

...

Bottom line, innovation and differentiation positions lead to superior pricing power. This is not a real surprise, but it reinforced the need for manufacturing and B2B firms to focus on these two dimensions and to invest in a robust pipeline. More interesting is the lack of significance of the relationship between competitive intensity and pricing power.

...

Pricing power does not come on its own.

...

So are you paying enough attention to your pricing power? Is it time for your organization to better control your pricing destiny? Join the pricing revolution!"

Trechos retirdaos de "It’s Time to Pay Attention to Pricing Power"

É fácil mandar postas de pescada

Em "exploiting our gullibility and sucker-proneness for recipes that hit you in a flash as just obvious" voltei às pernas que tremem.

Em dois dias:

Em dois dias:

- Helsar. Fábrica de sapatos dos famosos em processo de insolvência

- Credores decidiram pelo fim da dona das bicicletas Órbita

Recordar: "Quantos mais forem para o desemprego, mais a produtividade agregada do país cresce". Recordo também um texto de Daniel Bessa em 2006: "Se tudo correr bem", para a economia, "o desemprego vai subir."

É fácil mandar postas de pescada.

Ainda é assunto

Esta semana, duas empresas, dois sectores económicos completamente diferentes. A mesma mensagem: por mais que a paisagem competitiva B2B pareça estar tomada por concorrentes estabelecidos, por mais que pareça que existem barreiras à entrada intransponíveis ... os clientes desesperam por bom serviço, os clientes desesperam por quem se dê ao trabalho de cumprir as especificações. Já nem falo de prazos, falo do cumprimento básico da especificação.

Aprendi há muitos anos que numa relação comercial puramente transaccional há três parâmetros fundamentais, o QCD:

Aprendi há muitos anos que numa relação comercial puramente transaccional há três parâmetros fundamentais, o QCD:

- Qualidade;

- Custo (Preço);

- Disponibilidade.

Se a disponibilidade for crítica o cliente pôe o preço para segundo lugar.

Se o preço for crítico, mesmo assim, o cliente está disposto a pagar mais para ter a qualidade que precisa. Sem qualidade, o propósito da transacção perde-se e tudo o resto, preço e disponibilidade é irrelevante.

Portugal, 2019, e a qualidade, como cumprimento das especificações explícitas, ainda é assunto.

Talvez um sintoma de que se continua a valorizar mais o preço de compra do que o Total Value Ownership. Ao longo dos anos tenho encontrado a loucura dos savings nas compras e os bonus ganhos pelos Departamentos de Compras:

Talvez um sintoma de que se continua a valorizar mais o preço de compra do que o Total Value Ownership. Ao longo dos anos tenho encontrado a loucura dos savings nas compras e os bonus ganhos pelos Departamentos de Compras:

quinta-feira, dezembro 12, 2019

"we must redefine art"

Em "A alternativa", um postal de maio de 2016, e em "A ascensão do artesão e da arte na produção, um postal de Abril de 2017, voltei à arte como a alternativa para fugir às estratégias cancerosas que nunca serão sustentáveis num país pequeno e pouco habituado a rigor e planeamento.

Como diria MacGyver:

That's our edge!

É afinal o twist na estória de David vs Golias, enquanto Saúl pensava que o puto David ia combater de igual para igual, David tira um seixo branco de um saco só com seixos pretos (parte I e parte II).

Ontem, apanhei este texto de Esko Kilpi, "Art, entrepreneurship and the future of work":

"Art creates suggestions for fresh ways of defining the world we live in.

...

Artists are like entrepreneurs, and entrepreneurs are like artists. They turn nothings into somethings. Thus, artists give a form to ideas that for some other people might be nothing more than vague notions or emotional impulses. But it is often not easy.

...

Fostering creativity is a genuine goal for all in the post-industrial society. A creative economy needs individuals with the freedom, courage and capacity to think, learn and live imaginatively. We need people who can conceive ideas and who can realize them. Maybe all schools in the future are going to be art schools and all offices creative studios.[Moi ici: Mas não com a Nomenklatura que por lá anda agora]

.

But we must redefine art. Art today often stands apart from everyday life. It is a pastime and an indulgence, admired in a gallery, museum or a concert hall from a contemplative distance.

.

In the future art are not only objects we contemplate, but also experiences we possess and create."[Moi ici: Relacionar com o tema dos artesãos, dos nichos e Mongo]

Exportações YTD - tendências

- Mobiliário continua a crescer

- Metalomecânica recuperou uma trajectória de crescimento?

- Aeronaves e Óptica continuam a crescer fortemente e vão fazer de Portugal um player interessante

- Agricultura continua a crescer, embora infelizmente muitas vezes à custa de estratégias cancerosas que vão dar problemas com a sua insustentabilidade

- Têxtil e calçado continuam com a evolução negativa. Calçado reforçou a tendência negativa face à 1 ano

- Exportações de produtos farmacêuticos a evoluir a bom ritmo, em linha com a explicação que dou para a sua falta nas farmácias.

quarta-feira, dezembro 11, 2019

Para reflexão

"College-educated workers are taking over the American factory floor. New manufacturing jobs that require more advanced skills are driving up the education level of factory workers who in past generations could get by without higher education, an analysis of federal data by The Wall Street Journal found.

.

Within the next three years, American manufacturers are, for the first time, on track to employ more college graduates than workers with a high-school education or less, part of a shift toward automation that has increased factory output, opened the door to more women and reduced prospects for lower-skilled workers.

...

“Now, we need workers who can manage the machines.”

.

U.S. manufacturers have added more than a million jobs since the recession, with the growth going to men and women with degrees, the Journal analysis found. Over the same time, manufacturers employed fewer people with at most a high-school diploma.

.

Employment in manufacturing jobs that require the most complex problem-solving skills, such as industrial engineers, grew 10% between 2012 and 2018; jobs requiring the least declined 3%, the Journal found.

...

Specialized job requirements have narrowed the path to the middle class that factory work once afforded. The new, more advanced manufacturing jobs pay more but don’t help workers who stopped schooling early. More than 40% of manufacturing workers have a college degree, up from 22% in 1991.

.

“The workers that remain do much more cognitively demanding jobs,” said David Autor, an economics professor at MIT.

...

Large manufacturers also are tilting their workforce toward more educated employees."

Trechos retirados de "Factories Seek White-Collar Degrees for Blue-CollarWork" publicado no WSJ de 10.12.2019.

"Offering as input"

A continuar a minha leitura de "Prime movers" de Rafel Martinez e Johan Wallin apanhei esta figura:

Como não sorrir ao encontrar naquele eixo das ordenadas:

Como não sorrir ao encontrar naquele eixo das ordenadas:

- Offering as output

- Offering as input

Recordar:

Q.E.D.

Há dias li "PME portuguesas só ganham 5,8% dos concursos públicos (a média na Europa é de 51%)". Do texto retiro algum juízo negativo do autor sobre a situação. Contudo, ao ler o artigo não pude deixar de pensar:

- Ainda bem! Meter-se com o Estado é meter-se com uma entidade pedo-mafiosa.

E não pude deixar de recordar postais de 2008 a 2013 sobre o by-pass ao Estado, ao país e à banca:

- Ainda bem! Meter-se com o Estado é meter-se com uma entidade pedo-mafiosa.

E não pude deixar de recordar postais de 2008 a 2013 sobre o by-pass ao Estado, ao país e à banca:

- Fazer o by-pass ao país (Abril de 2008)

- Há anos que aconselho isto... (Outubro de 2011)

Ontem, entretanto, li "Empresários portugueses são os que mais se queixam de “ligações políticas”"

E pensei:

- Q.E.D.

terça-feira, dezembro 10, 2019

This time is different!

Há tempos uma empresa com que trabalho há vários anos negociou uma parceria com uma empresa alemã. Depois, ficou meses e meses há espera do contrato que nunca mais chegou.

Talvez essa estória seja explicada por isto:

Entretanto,

Trecho retirado de "German industrial output hit by downturn" publicado no FT Weekend 7/8 Dezembro.

Talvez essa estória seja explicada por isto:

"Biggest decline since 2009 seems likely toweigh on overall eurozone growthQual o impacte disto na economia portuguesa?

.

Germany’s industrial sector is suffering its steepest downturn for a decade, underlining how the engine of the eurozone’s biggest economy is sputtering.

.

Industrial output, which includes Germany’s dominant factory sector, dropped 5.3 per cent in October from the same month in 2018, according to the federal statistics office. The figures suggest the German industrial slowdown is likely to weigh on overall eurozone growth in the fourth quarter.

Combined with data published this week showing industrial orders fell sharply in October, and with most manufacturers expecting a further shrinkage in November, the figures suggest the two-year downturn in German manufacturing is far from ending."

Entretanto,

2,9% o mesmo valor de Sócrates em 2009. Não sei se sabem que a economia está a tankar, não sei se sabem de onde vem o dinheiro que paga os salários da função pública, o xerife de Nottingham vai ter de cobrar mais aos saxões https://t.co/me3mVfTDUI— Carlos P da Cruz (@ccz1) December 9, 2019

Trecho retirado de "German industrial output hit by downturn" publicado no FT Weekend 7/8 Dezembro.

Subscrever:

Comentários (Atom)

/https%3A%2F%2Fwww.industryweek.com%2Fsites%2Findustryweek.com%2Ffiles%2FLiouz-chart-1.png)

%2006.21.jpeg)