"No points for busy.

.

Points for successful prioritization. Points for efficiency and productivity. Points for doing work that matters."

domingo, março 31, 2019

Para reflexão

Pensar a sério na mensagem deste postal de Seth Godin, "Busy is not the point":

Value Chain Marketing (parte II)

Parte I.

Quando faz sentido aplicar o value chain marketing?

Em "Value Chain Marketing - A Marketing Strategy to Overcome Immediate Customer Innovation Resistance" de Stephanie Hintze pode ler-se:,

Quando faz sentido aplicar o value chain marketing?

Em "Value Chain Marketing - A Marketing Strategy to Overcome Immediate Customer Innovation Resistance" de Stephanie Hintze pode ler-se:,

"In order to target downstream customers, a supplier firm must offer added value. That is often the only way to create downstream customers’ preferences. If supplier products have no positive differentiation value compared to available alternatives or competition, the prerequisite to pursue VCM is not fulfilled. This implicates that supplier firms would have no ‘sales’ arguments, and downstream customers would have no reason to prefer final products that contain a particular supplier’s material. More to the point, products sold on price like commodities do not provide innovative attributes or distinguishing characteristics which can be promoted down the value chain. By contrast, specialty goods like coatings and sealants often provide a benefit for downstream customers by improving the performance of final products. Still, this benefit must be communicable to relevant end applicators. It implicates that only if they are convinced that using a specific supplier’s material is particularly advantageous, they are willing to change their buyer behavior. To overcome this problem, suppliers can present prototypes, delivers samples, or results of product tests to demonstrate the benefit of their products. Also, suppliers have to ensure the identification of their materials at subsequent stages."Em "Which types of multi-stage marketing increase direct customers' willingness-to-pay? Evidence from a scenario-based experiment in a B2B setting" de Ingmar Geiger, Florian Dost, Alejandro Schönhoff, e Michael Kleinaltenkamp, publicado por Industrial Marketing Management pode ler-se:

"1) A supplier's offering has to offer superior value compared to competitors or substitutes to some actors down the value chain.

(2) This value needs to be communicable.

(3) The supplier's offering needs to be identifiable in downstream

market stages.

(4) The supplier needs to possess a minimum of relevant marketing

know-how.

(5) There need to be a sufficient degree of certainty that the desired

demand pull cannot be obstructed by opposing measures by intermediate market stages."

sábado, março 30, 2019

"Sorry folks, but not even one of these responses is a strategy"

"At the start of my public seminars on strategic planning I ask attendees, who rank from board members and CEOs to middle management, to write down an example of a strategy on a sheet of paper. They look at me quizzically at first as they realize that this is a tough assignment. I reassure them that this is indeed a hard question and they plow ahead.Trecho retirado de "Your Strategic Plans Probably Aren’t Strategic, or Even Plans"

.

The results are always astonishing to me and them. Here are some of the responses from the list I received at my most recent session: actions (“launch a new service”; “review our suitability to the retirement business”); activities (“marketing our products through the right channels”); objectives (“achieve $100m net revenue”) and broad descriptions of what goes on (“planning process from beginning to end of product”; “working for your stakeholders”).

.

Sorry folks, but not even one of these responses is a strategy."

"One must first understand the main source(s) of value"

"One must first understand the main source(s) of value; only then is it possible to have the real value reflected in the price. This statement does not imply that the general model of value leads directly to a pricing decision or that there is some formulaic relationship between value and price, only that once one truly understands the value provided, the pricing potential becomes much more apparent."Trecho retirado de "Understanding Value Beyond Mere Metrics" de E. M. (Mick) Kolassa

sexta-feira, março 29, 2019

Não é nem roubo nem desigualdade

Recomendo uma reflexão baseada em dois textos de Niraj Dawar.

O primeiro texto é "The Critical Role Of Context In Building Brands" e parte do vídeo com alguns anos, que muitos terão visto, de um reputado violinista a tocar anonimamente no metro de Washington, quando dias antes tinha enchido o Symphony Hall de Boston com os bilhetes a $100. A mensagem de Dawar é: o contexto é tudo.

O segundo texto é "Brands And The Consumer Hourglass Theory" e vai de encontro a muitos desabafos que faço quando vejo empresas a deixarem dinheiro em cima da mesa - Damn! It's not about the price!!!

E no seu caso, como é?

O primeiro texto é "The Critical Role Of Context In Building Brands" e parte do vídeo com alguns anos, que muitos terão visto, de um reputado violinista a tocar anonimamente no metro de Washington, quando dias antes tinha enchido o Symphony Hall de Boston com os bilhetes a $100. A mensagem de Dawar é: o contexto é tudo.

"But ultimately, where does context reside? In the mind of the customer. By creating context, marketers play with the customers’ mind. They shape it to create the most receptive setting for the brand and the product."O meu ponto de vista é: não podemos servir todo o tipo de clientes e para alguns, ainda que o nosso produto ou serviço seja de topo, não seremos a melhor solução pois o resultado que procuram obter nas suas vidas pode ser conseguido com uma oferta alternativa, ou mais barata, ou mais fácil, ou mais luxuosa, ou mais amizade genuína, ou mais ...

O segundo texto é "Brands And The Consumer Hourglass Theory" e vai de encontro a muitos desabafos que faço quando vejo empresas a deixarem dinheiro em cima da mesa - Damn! It's not about the price!!!

"Citigroup calls it the Hourglass Theory. As income inequality increases, consumers are polarizing into two groups – the few looking for high-end, highly differentiated and high value-added products, and the many looking for value, and sometimes extreme value.O ponto de Dawar, com o qual estou totalmente de acordo, é que isto, o desaparecimento do mercado do meio termo, não acontece por causa do aumento das desigualdades económicas. Quantas pessoas conhecem com um bruto carrão, e que não têm onde cair mortas com dívidas? Quantos estudantes não querem gastar um cêntimo em livros e propinas, mas não hesitam em ir à discoteca da moda derreter dinheiro? [Apesar desta linguagem não faço julgamentos de valor, cada um é livre de decidir onde e como gastar o seu dinheiro, a menos que depois eu tenha de contribuir para fazer o bail-out de uns quaisquer lesados-[colocar nome dos maus de turno]]

.

The middle, which was the staple target market of consumer goods companies since at least the mid-twentieth century, has shrunk, and continues to shrink." [Moi ici: Isto faz-nos recuar a 2005 e à polarização dos mercados]

"But while the data on income inequality are incontrovertible, there is another explanation for the hourglass that marketers should not rule out: attention scarcity.Acredito profundamente nisto que se segue:

.

What if the scarce commodity at the source of the hour glass is not so much consumer income or spending, but consumer interest and attention?

.

Consider for a moment that consumers now make thousands of purchase decisions in hundreds of product categories every year. They can’t possibly be experts in all of these product categories, nor do they have an interest in optimizing their choice in each product category. They just want something that will do the job."

"for most of the thousands of choices consumers make, they merely want a reasonable product – give me something that works at a price that makes sense. This is the very definition of value.Por isso, tento convencer os empresários que quando um concorrente conquista um cliente que entra num mercado pela primeira vez, o mais certo é que esse cliente ainda não esteja no patamar [de atenção] que os torna como a oferta mais adequada. O seu interesse e conhecimento vai ter de aumentar porque, por exemplo, querem subir na escala de valor, só nessa altura estarão maduros para uma outra oferta.

Some consumers are willing to spend the time to learn about product categories about which they are passionate, and are usually also willing to spend more money on the better products in those categories. For all other product categories, they couldn’t care less.

...

So the bifurcation of the market into what looks like an hourglass occurs, but due to attention disparity, not income disparity.

.

If it is interest and consumer attention that are creating the hourglass"

E no seu caso, como é?

Value Chain Marketing

O que tenho feito nos últimos 15 anos com tantas empresas, quando trabalhamos o ecossistema da procura.

"To deal with the consequences of derived demand, he argues that B2B sellers need to consider not only the next immediate customer in their marketing plans but also aim their marketing activities at subsequent stages.

...

VCM goes beyond traditional marketing, missionary selling, as well as primary demand stimulation. It represents a holistic marketing strategy which covers the entire marketing mix and thus encounters the complexities of the value chain in which a firm operates. As mentioned before, the pull strategy is frequently limited to the promotional part of the marketing mix. The author uses the term VCM “to refer to the practice of influencing an entire industry value chain for the benefit of the marketing function”. The ultimate goal of VCM is to develop comprehensive marketing intelligence and to promote innovations across all levels of the value chain. To stay competitive in the market, B2B marketers have to cover a broader framework to analyze the chain. They “must understand not only the cost and revenue dynamics of its intermediate target buyer firms, but also the cost and revenue dynamics facing the buyers’ buyers, from whose demand the demand of the immediate market is derived”. [Moi ici: Recordar "aplicar a análise Value Stream Mapping o fizessem à utilização do produto durante o ciclo de vida do utilizador final,"]

...

This mapping process requires a high degree of market orientation. [Moi ici: O trecho que se segue parece tirado aqui do blogue. Basta recordar a figura deste postal] Also, they should integrate influencers like procurement and engineering consultants, industrial designers, experts for complementary products, lawyers, or architects when mapping the value chain. Their special characteristic is to influence both the buying decision of immediate and downstream customers. They are well- informed on present upstream and downstream marketing projects and are open to innovative ideas. Furthermore, influencers establish relationships to manufacturers and applicators and are able to get them interested and to induce them to stimulate demand for supplier innovations.

...

Instead of relying on just one marketing strategy, VCM comprises push and pull marketing equally and covers the whole marketing mix. It includes the kind of product, how it is promoted to customers in a value chain, the method for distributing products to customers, and the amount the customers are willing to pay for a product. The crucial point is that in VCM the adapted and tailored marketing activities of the push and the pull strategy complement each other and are incorporated into one universal marketing strategy.

...

...

First, VCM reduces the risk of substitutability of suppliers’ materials or product inputs by demonstrating their importance for the end product. This means that suppliers no longer operate anonymously and address customers down the value chain directly. They create problem awareness among downstream customers by presenting the distinguishing features of their innovative products. As VCM allows a two-way communication, it increases the efficiency of the entire marketing mix. It implies that suppliers receive unfiltered feedback from downstream customers and the chance to better solve their problems in real time. As a result, suppliers gather valuable market information and translate this information into product improvements or innovations. If suppliers succeed in positioning and differentiating their products in a favorable way, substitutability becomes less likely. By creating preferences at the stage of downstream customers, VCM assures suppliers’ sales-political independence in the vertical production and distribution process. VCM allows suppliers to strengthen their position in a value chain and motivate downstream customers to invest in long-term partnerships. In consequence, suppliers are able to enhance control over different value-chain activities and anticipate fluctuations in demand more readily."

Trechos retirados de "Value Chain Marketing - A Marketing Strategy to Overcome Immediate Customer Innovation Resistance" de Stephanie Hintze,

quinta-feira, março 28, 2019

"creative destruction means that low productivity plants are displaced by high productivity plants"

O Nuno enviou-me um artigo que me pôs a pensar. Vários tópicos positivos e um sinal de preocupação.

Nunca esquecer:

Trechos retirados de "TrimNW é uma empresa de Santarém à conquista do mercado europeu"

"A TrimNW foi criada em Março de 2015 na sequência do fecho da antiga Ipetex do Cartaxo, que abriu insolvência nesse ano. Vários trabalhadores acreditaram na mais-valia de uma das áreas de negócio – a do sector automóvel – e avançaram por sua conta e risco, sendo bem sucedidos.[Moi ici: Este parágrafo faz-me lembrar Maliranta e Taleb. A empresa fechou e foram os trabalhadores num novo projecto, com skin in the game, que encontraram uma resposta para o aumento da produtividade necessária]

...

A empresa produz para nichos de mercado e tem vários clientes importantes, incluindo marcas de automóveis de luxo do Reino Unido, para quem chega a produzir séries limitadas de até 10 mil peças por ano.

.

A experiência e conhecimento adquiridos ao longo dos anos, juntamente com a qualidade dos seus produtos e da prática de preços competitivos, fazem da TrimNW um nome forte na Europa na produção daqueles materiais. [Moi ici: Este é o trecho que me deixa alguma preocupação. Se trabalham para nichos e fazem séries limitadas o preço não devia ser um factor crítico]

...

Os negócios fazem-se desde que a gente corra atrás deles. Se ficarmos aqui quietos à espera que venham ter connosco eles não vêm. O nosso material é muito específico, temos de procurar os nossos clientes, procurar as oportunidades que eles nos possam dar."[Moi ici: Proactividade, uma postura tão necessária nos tempos que correm]

Nunca esquecer:

"It is widely believed that restructuring has boosted productivity by displacing low-skilled workers and creating jobs for the high skilled."Mas, e como isto é profundo:"In essence, creative destruction means that low productivity plants are displaced by high productivity plants." Por favor voltar a trás e reler esta última afirmação. Pensem nos teóricos que dizem que a produtividade só cresce com mais educação académica.

Trechos retirados de "TrimNW é uma empresa de Santarém à conquista do mercado europeu"

"suppliers are in a weak position in the value chain and operate anonymously"

Há cerca de 15 anos que comecei a ajudar empresas a fugir do push marketing:

Há cerca de 15 anos que comecei a trabalhar o conceito de ecossistema porque acredito que é fundamental para subir na escala de valor, para aumentar preços, para aumentar a produtividade sem ser pela via cancerosa do crescimento a todo o custo.

Ontem, ao ler os trechos que se seguem, retirados de "Value Chain Marketing - A Marketing Strategy to Overcome Immediate Customer Innovation Resistance" de Stephanie Hintze, estava sempre a pensar: está aqui muita da razão porque temos uma produtividade tão baixa. Como não temos marcas somos fornecedores de materiais ou produtos que outros vão ainda processar e/ou vender e continuamos anónimos, sem capacidade de intervenção e com pouco reconhecimento:

Há cerca de 15 anos que comecei a trabalhar o conceito de ecossistema porque acredito que é fundamental para subir na escala de valor, para aumentar preços, para aumentar a produtividade sem ser pela via cancerosa do crescimento a todo o custo.

Ontem, ao ler os trechos que se seguem, retirados de "Value Chain Marketing - A Marketing Strategy to Overcome Immediate Customer Innovation Resistance" de Stephanie Hintze, estava sempre a pensar: está aqui muita da razão porque temos uma produtividade tão baixa. Como não temos marcas somos fornecedores de materiais ou produtos que outros vão ainda processar e/ou vender e continuamos anónimos, sem capacidade de intervenção e com pouco reconhecimento:

"By solely relying on immediate customers, suppliers are faced with the problem of limited and distorted information and are also confronted with a loss of control over their product quality. More to the point, immediate customers withhold information about application trends and needs. They act as gatekeepers by controlling the types of information the supplier receives. Their aim is to remain the channel of communication between the supplier and the end applicator and thus stay in control of the business relationship. For that reason, supplier firms are unable to anticipate change and plan product improvements or new ideas. Due to isolation from the application market, suppliers are in a weak position in the value chain and operate anonymously. Even if they develop innovations, these rest with the intermediaries, i.e. the manufacturers, as the former are often unwilling to promote supplier innovations aggressively. That is why suppliers cannot demonstrate the importance of their product inputs for the final product. Manufacturers prefer to wait until they receive strong signals from their customers indicating the need for an innovation. They do not want to jeopardize their goal of efficiency. As a result, only standardized and highly substitutable materials that restrict suppliers’ profits and margins are sold in the value chain. Instead of pursuing a proactive product innovations management, suppliers are forced to be reactive. Due to the absence of suppliers’ contact with end applicators, the distance to the application market remains big. Suppliers have no chance to build long-term relationships with downstream customers which could reduce their dependence on manufacturers."

quarta-feira, março 27, 2019

From pull to Value Chain

"In pull marketing, the second dominant marketing strategy for dealing with derived demand, suppliers no longer restrict their marketing activities to those who apparently make the procurement decision. By stimulating downstream customers, suppliers try to pull their innovative products through the entire value chain. They bridge the gap to the application market and gather valuable information regarding downstream customer needs. This supports a supplier’s proactive innovations management. As a result, the supplier is able to reduce his dependence on the manufacturer.Trechos retirados de "Value Chain Marketing - A Marketing Strategy to Overcome Immediate Customer Innovation Resistance" de Stephanie Hintze.

.

In this marketing strategy, the role of the manufacturer tends to be passive but the applicator’s role becomes very active. The supplier tries to generate demand at the stage of applicators through extensive advertising and personal selling activities...

Thus, applicators become more informed about the available products and solutions that might be applicable to their business. Instead of pushing the product to immediate customers, suppliers make downstream customers request it.

...

With a pull strategy, the supplier does an end-run, circumventing the more direct value-chain actors, concentrating on those further down the value chain.

...

the objective of a pull strategy is to establish a bottom-up demand base so that the immediate customer has little choice but to adhere to these demands and to place orders with the respective supplier

...

Involving downstream customers like in pull marketing leads to another marketing strategy that addresses an even bigger audience. This strategy is called Value Chain Marketing (VCM) and describes the practice of influencing the entire value chain to succeed in marketing innovative products. It requires a firm to have a deep and complete understanding of the value chain in order to maximize marketing effectiveness."

"value, like price, should be deduced, and not calculated" (parte II)

Parte I.

Trechos retirados de "Understanding Value Beyond Mere Metrics" de E. M. (Mick) Kolassa

"The most important questions the pricer can ask are, “What problem does my product solve, and who owns that problem?” Answering those questions is the first step in understanding and clarifying value. For any new product or service, the value will be determined in the context of current options. I argue that value is comprised of multiple components, including both negative aspects of value (such as risk in use) and positive aspects (such as the incremental benefits of the product) that drive the value of the product.

...

...

Put another way, value is determined by the interaction of the utility of the product (as defined in the model) moderated by the risk (also defined in the model) in using it; ... The implications of this relationship are fairly straightforward: increasing the utility of a product or decreasing the risk in its use can both result in increased value, which can translate into either a higher price or an enhanced value proposition in which the buyer understands that the price paid is far below the value received.

...

The positive aspects (or sources) of value begin with a determination of the need for the product or service, which is driven, or moderated, by the criticality of the situation in which it is needed or used and the number and quality of alternatives that are available.

Criticality is the urgency of the need for the outcomes of the use of the product. This urgency is not strictly temporal but also captures the likelihood and severity of the negative consequences if the product is not used or acquired. Higher levels of criticality will positively affect the level of need. Criticality is moderated by a number of alternatives in that the level of criticality of the situation is a key driver of value, while the availability of alternatives can mitigate the level of need."

Trechos retirados de "Understanding Value Beyond Mere Metrics" de E. M. (Mick) Kolassa

terça-feira, março 26, 2019

"you have to find a niche market and work to be the best at it"

Leiam o que se segue e comparem com o que este anónimo da província escreve por aqui há milhares de anos:

"The economy is changing and we will see increasing market fragmentation. The only ones who will win in mass markets will be the big platform owners.Trechos retirados de "Crowd-milking"

...

It seems that to be successful in the network era you have to find a niche market and work to be the best at it. Ross Dawson makes a strong point by stating that “in a connected world, unless your skills are world-class, you are a commodity“. Expertise, relationships, and innovation will mark the successful people in the emerging network era economy according to Ross.

...

It’s not easy finding new market niches but that seems to be the only option for most of us who are not in Silicon Valley building the next social media platform. The only way to make our talent profitable in the network era is to turn it into a highly specialized capital asset. Feeding crowd-milking platforms is not a sane small-business operating model. It’s better to find your own cow than be milked by someone else."

"value, like price, should be deduced, and not calculated"

Em Maio de 2007 - "Value is a feeling not a calculation, o poder de perguntar porquê?".

"I first wish to assert that value is not a simple monetization of the benefits of a product, but, in fact, encompasses much more. Value cannot be reflected totally in dollars and cents, despite what many may prefer or even claim. Attempts to calculate value solely in monetary terms ignore important aspects of human behavior, as well as the various ways price influences purchases, regardless of value. Many aspects of value defy monetization: no useful metric exists that can be applied directly to the happiness or emotional fulfillment that a buyer receives from certain purchases. This statement applies equally to consumer purchases as well as many B2B situations. Rather than attempting to measure precisely the value of a product or service and then set a price based on that information, we must first seek to identify and understand the sources and importance of the many facets of value, without economic blinders, and understand how that will enhance or support pricing decisions.Trechos retirados de "Understanding Value Beyond Mere Metrics" de E. M. (Mick) Kolassa

...

“Mathematics has given economics rigor, but alas, also mortis.” The economist or pricer who believes that value can be understood through mere mathematical calculation and the manipulation of sets of numbers misses the subtlety of value, and its many forms, by foregoing the rigor of investigation and relying on the mortis of metrics.

...

value, like price, should be deduced, and not calculated.

...

The most important questions the pricer can ask are, “What problem does my product solve, and who owns that problem?” Answering those ques- tions is the first step in understanding and clarifying value."

segunda-feira, março 25, 2019

Curiosidade do dia

Fábricas flexíveis, fábricas para Mongo

O meu parceiro das conversas oxigenadoras chamou-me a atenção para este artigo "Inside Toyota's Takaoka #2 Line: The Most Flexible Line In The World":

"Ever since the first cars rolled down Ford’s assembly line a little more than 100 years ago, a Gordian knot strangulated carmakers the world over: Assembly lines are fast, but inflexible. After pulling a few strings to get into the Takaoka plant, you will see the Gordian knot become untied.Bem na senda de "O que protegerá Portugal dos robôs?"

...

Why would you want a flexible car plant? Isn’t it enough that the damn thing spits out cars in ever increasing numbers?

.

Did we just hear “ever increasing numbers?”

.

Assembly lines are great at building cars in great numbers and at relatively high speed. At the same time, assembly lines abhor change. Assembly lines pretty much have two speeds: On, or off. They hate to go much faster, or much slower, than their rated speed. Try introducing a new car model to the assembly line of old, and you sometimes face months of retooling. When demand for the car increases, customers sometimes must wait months for the long-tailed assembly line beast to catch up. When demand slackens, plants often must be idled. Takaoka is a marvel of production engineering that solves all that, and then some.

...

“Alright,” you say, “you replaced a robot with a human, but how does this make the line flexible?”...

For other automakers, substantial increases or decreases in capacity often mean building new factories, or idling current ones. At Toyota, it can be done over the weekend. Workers lay down cable trays on a flat shop floor. Instead of a mess of cables, only one fat cable is connected. Where cables must cross the line, a gate shaped cable tray on casters is rolled into place. Platforms are set down left and right to guide motorized dollies for cars in nascent state. Formerly fixed stations are rolled in place down the line, and on Monday, the plant has a completely different capacity than what it was on Friday. In the course of a year, this magical capacity conversion can happen several times."

Os artistas, os paraquedistas, os feiticeiros e os malabaristas (parte II)

Ao ler o título "Canis cada vez mais sobrelotados após lei que proíbe abate de animais saudáveis. Bastonário critica pouco combate ao abandono" sorri.

Há muitos anos que detectei a tendência dos políticos espertos para darem cada vez mais ênfase aos temas em que as consequências das suas decisões só podem ser avaliadas muito mais tarde, para não apanharem surpresas.

Por exemplo, a preocupação com as alterações climáticas.

Este caso dos cães e dos canis foi uma argolada que cometeram pois foge da regra. Rapidamente os factos da realidade emergem como uma parede contra a qual a argumentação dos políticos esbarra violentamente.

Quando um cidadão ou um opositor diz que uma dada medida está errada é uma opinião, quando a mesma medida aparece esmagada no pós-choque com a realidade ... não há desculpas.

Imaginem a malta que faz asneiras deste calibre, que acredita que a transmutação do ouro é possível, que acredita que o TGV serve para transportar carvão ou madeira de eucalipto, que acredita que os comboios de mercadorias devem circular a 300 km/h, que acham que um TGV pode funcionar como metro de superfície, que diziam que a Portela estava esgotada. E não esqueçam os copos menstruais. E já agora a falta de noção da realidade.

Como não se pode duvidar da capacidade intelectual das pessoas que acreditam nestas petas, "A revitalização do território e o papel da indústria". As pessoas reais, as que não estão nas listas de ajustes directos dos governos e autarquias, e as empresas sem ligações aos corredores, carpetes e biombos do poder, sabem que tudo o que vem das mentes destes seres na assembleia, são mais um escolho que vão ter de considerar no caminho árduo que trilham diariamente.

BTW, João Cravinho teve azar, disse e defendeu as SCUTs com argumentos que poucos anos depois caíram sobre ele como uma bomba... o que o deve ter salvo no carrossel das nomeações políticas foi o ter informação comprometedora sobre alguém, só pode.

Há muitos anos que detectei a tendência dos políticos espertos para darem cada vez mais ênfase aos temas em que as consequências das suas decisões só podem ser avaliadas muito mais tarde, para não apanharem surpresas.

Por exemplo, a preocupação com as alterações climáticas.

Este caso dos cães e dos canis foi uma argolada que cometeram pois foge da regra. Rapidamente os factos da realidade emergem como uma parede contra a qual a argumentação dos políticos esbarra violentamente.

Quando um cidadão ou um opositor diz que uma dada medida está errada é uma opinião, quando a mesma medida aparece esmagada no pós-choque com a realidade ... não há desculpas.

Imaginem a malta que faz asneiras deste calibre, que acredita que a transmutação do ouro é possível, que acredita que o TGV serve para transportar carvão ou madeira de eucalipto, que acredita que os comboios de mercadorias devem circular a 300 km/h, que acham que um TGV pode funcionar como metro de superfície, que diziam que a Portela estava esgotada. E não esqueçam os copos menstruais. E já agora a falta de noção da realidade.

Como não se pode duvidar da capacidade intelectual das pessoas que acreditam nestas petas, "A revitalização do território e o papel da indústria". As pessoas reais, as que não estão nas listas de ajustes directos dos governos e autarquias, e as empresas sem ligações aos corredores, carpetes e biombos do poder, sabem que tudo o que vem das mentes destes seres na assembleia, são mais um escolho que vão ter de considerar no caminho árduo que trilham diariamente.

BTW, João Cravinho teve azar, disse e defendeu as SCUTs com argumentos que poucos anos depois caíram sobre ele como uma bomba... o que o deve ter salvo no carrossel das nomeações políticas foi o ter informação comprometedora sobre alguém, só pode.

domingo, março 24, 2019

Mateus 13:9

Recordo "Mongo a bater à porta. Tão bom!!!" e:

"O artigo é um exemplo da tendência que enquadramos no fenómeno a que chamamos de Mongo. Os gigantes, emaranhados com o seu umbigo, muito preocupados com a eficiência e os custos, tentando ser tudo para todos, abrem as oportunidades a novos actores."Agora encontro "When Patients Become Innovators":

"Patients are increasingly able to conceive and develop sophisticated medical devices and services to meet their own needs — often without any help from companies that produce or sell medical products.Recordo também "Os humanos são todos diferentes":

...

Unlike traditional producers, who start with market research and R&D, free innovation begins with consumers identifying something they need or want that is not available in the marketplace. To address this, they invest their own funds, expertise, and free time to create a solution. Rather than seeking to protect their designs from imitators, as commercial innovators do, we found that more than 90% of consumer innovators make their designs available to everyone for free.

...

The ability of patients to develop new medical products to serve their own needs is growing, and we expect the system to become stronger over time for several important reasons. First, the DIY design tools that patient innovators need are becoming cheaper and increasingly capable. People with fairly rudimentary engineering skills can acquire powerful design software that can run on an ordinary personal computer either for free or for very little money. Second, the materials and tools used to build products from DIY designs are also becoming both cheaper and increasingly capable."

“There is no perfect product, because there is no perfect patient” and “It’s a good product, but it’s not right for everyone.”Recordo também esta leitura de 2007:

"In 1970, 5% of global patents were issued to small entrepeneurs, while today the number is around one-third and rising. When P&G realized this, it saw that its old model of purely internal innovation was suboptimal. Why not tap these entrepeneurs and scientists?"E esta outra de 2011:

"The mass market — which made average products for average people was invented by organizations that needed to keep their factories and systems running efficiently.E deixo-vos com os industrialistas e a sua tendência para a suckiness.

.

Stop for a second and think about the backwards nature of that sentence.

.

The factory came first. It led to the mass market. Not the other way around."

E chegamos a isto: uma espécie de Ponzi pelo emprego?

Na sequência de:

- Cheira-me a tiro no pé (Julho de 2013)

- Cheira-me a tiro no pé (parte II) (Julho de 2013)

- Cheira-me a tiro no pé (parte III) (Agosto de 2013)

- O poder de uma marca (Fevereiro de 2014)

- Cheira-me a tiro no pé (parte VIII) (Março de 2016)

Agora "Sport TV usa trabalhadores para travar queda de clientes".

Sublinho de "Fundamentals of Business-to-Business Marketing - Mastering Business Markets" editado por Michael Kleinaltenkamp, Wulff Plinke, Ian Wilkinson e Ingmar Geiger.:

Quando é que vão parar de cavar?

O artigo publicado ontem é doentio...

Sublinho de "Fundamentals of Business-to-Business Marketing - Mastering Business Markets" editado por Michael Kleinaltenkamp, Wulff Plinke, Ian Wilkinson e Ingmar Geiger.:

"When analyzing benefit differences, we need to focus on the meaning of differences in competencies, processes, and programs for the buyer. A seller’s competitive strength is its ability to offer greater benefits or lower costs, i.e., greater net benefits, to the buyer compared to competitors.

...

Whereas, it may have been sufficient to pursue a policy of customer orientation to gain a lead, it is now the relative position of the supplier compared with its competitors that is critical. In the first chapter, we described this position as a customer advantage from the point of view of the customer. Since customer advantage describes the net difference in benefit between two suppliers, competitor analysis becomes part of customer analysis: the supplier—competitor—customer orientation triangle is the paradigm, which we term market orientation

...

...Chamar aos clientes "parque", avaliar a qualidade da oferta sem considerar a comparação com o concorrente e a opinião do cliente... tão... sem palavras.

The marketing triangle illustrates this. Whereas focusing on the supplier’s own functions dominated initially (supplier orientation), as competition became more intense and markets shifted from sellers’ to buyers’ markets, it was the turn of the second corner of the triangle—customer orientation. The marketing triangle is complete when the third corner is included: we then speak of market orientation. The marketing concept with its market orientation is the answer to predatory competi- tion and forces management to gear all the processes of the supplying firm to generating customer advantage. Markets are thus developing to the point that customers ultimately dictate the offer. Or, in other words, suppliers who fall behind their competitors in the eyes of the customers will fail without any regret on the part of the customers. The fact that competition is evolving in this way is not based on the behavior of the suppliers alone—customers also contribute to this. Due to competition with regard to innovation, performance, and price, customers are learning that they can continuously demand more. This spiral has no foreseeable end."

Quando é que vão parar de cavar?

O artigo publicado ontem é doentio...

sábado, março 23, 2019

"no longer operate anonymously and address customers down the value chain directly"

"VCM [value chain marketing] is the marketing strategy that describes the practice of influencing the entire value chain to succeed in marketing innovations. This strategy requires a firm to have a deep understanding of the value chain in order to maximize its marketing performance. Adopting VCM implies at first that firms must cover a broader framework to map the value chain. They have to analyze and properly understand the players and their relationships at each level. This also includes identifying industry developments and drivers as well as government regulations.

...

firms intending to practice VCM should adapt and tailor their marketing mix. This includes the type of product, how it is promoted to customers, the method for distributing it to customers, and the amount the customers are willing to pay for it.

...

Customer intimacy is not only essential to understand the value chain and its processes but also to reduce the distance to downstream players. Therefore, a supplier no longer has to be separated from the stage of his downstream customers through his given position in the value chain. In fact, the value chain converts more and more into a value network and the distinction between immediate and down- stream customers becomes less clear cut. By acquiring knowledge in the surrounding fields, suppliers are able to increase the overlap between their knowledge base and that of the downstream actors. They learn about applicators and develop communication strategies to reach them and to persuade them. This enhances interpersonal interaction and the applicators’ feeling about the suppliers’ competence to discuss on innovative topics."

"VCM reduces the risk of substitutability of suppliers’ materials or product inputs by demonstrating their importance for the end product. This means that suppliers no longer operate anonymously and address customers down the value chain directly. They create problem awareness among downstream customers by presenting the distinguishing features of their innovative products. As VCM allows a two-way communication, it increases the efficiency of the entire marketing mix. It implies that suppliers receive unfiltered feedback from downstream cus- tomers and the chance to better solve their problems in real time. As a result, suppliers gather valuable market information and translate this information into product improvements or innovations. If suppliers succeed in positioning and differentiating their products in a favorable way, substitutability becomes less likely. By creating preferences at the stage of downstream customers, VCM assures suppliers’ sales-political independence in the vertical production and distribution process. VCM allows suppliers to strengthen their position in a value chain and motivate downstream customers to invest in long-term partnerships. In consequence, suppliers are able to enhance control over different value-chain activities and anticipate fluctuations in demand more readily."

Trechos retirados de "Value Chain Marketing - A Marketing Strategy to Overcome Immediate Customer Innovation Resistance" de Stephanie Hintze.

Compras em segunda-mão

Tantas coisas ...

Há tempos numa empresa prestadora de serviços à indústria perguntavam-me como se explicaria o abaixamento na actividade das PMEs, as suas clientes.

Falámos da economia das experiências, falámos do efeito Norte de África, Turquia e Leste da Europa, ... nunca me passou pela cabeça este factor:

"The 2019 thredUp Resale Report, in conjunction with GlobalData, analyzed the trends and drivers pushing this revitalized sector. Researchers found that 56 million women bought secondhand products in 2018, an increase of 12 million new secondhand shoppers from the year prior. And they’re not done yet: 51% of resale shoppers plan to spend even more on thrift in the next five years.

...

ThredUp reports that increased growth can be credited to millennials and gen-Z, who adopt secondhand items 2.5 times faster than the average consumer. This is partially because they prefer to wear the latest styles, meaning last season’s fads get quickly deposited through the thrift cycle. According to the report, it’s why secondhand, rental, and subscription are the top three fastest-growing retail categories.

...

- As consumers partake in the resale market, they now own 28 fewer items, on average, than two years ago.

- The resale market grew 21 times faster than apparel retail over the past three years.

- 72% of secondhand shoppers shifted spend away from traditional retailers to buy more used items.

- The secondhand clothing industry is expected to grow 1.5 times the size of fast fashion within 10 years.

- One-third of consumers polled by ThredUp said they would spend more with their favorite retailers if those retailers also sold secondhand apparel."

sexta-feira, março 22, 2019

"How long should a long-term strategy be?"

"I find that giving strategy an a priori time frame is the wrong way around. Instead, the time frame should depend on the strategy. To be clear, “What time frame should we have for our strategy?” is the wrong question. The better question is, “What changes does our strategy need, and how much time do we need to implement them?” In other words, leaders have a five-year strategy if the changes they want to make to their strategy will take five years to implement.Trechos retirados de "Strategy talk: How long should a long-term strategy be?"

...

The ideal time frame depends more on what changes leaders want to make to their strategy than on the business they are in.

...

Great strategies are, among other things, highly specific about a company’s target customer, value proposition, and leading capabilities. It’s impossible to know with much specificity what these should be a decade from now. Imagine how much water will pass under the bridge between now and then, let alone over the next century. Yet it’s also impossible to change overnight the essential elements of a strategy in any meaningful way. Choosing a time frame that’s too short will force leaders into a mode of incremental strategy, and that is a recipe for failing to keep pace with a changing world."

Para reflexão

“The purpose of price is not to recover cost, but to capture the value of the “product” in the mind of the customer” (Dan Neimer)

A alternativa ao eficientismo

Mais um exemplo retirado de "Fundamentals of Business-to-Business Marketing - Mastering Business Markets" editado por Michael Kleinaltenkamp, Wulff Plinke, Ian Wilkinson e Ingmar Geiger. Mais um exemplo do uso de linguagem que uso aqui no blogue há muitos anos, basta recordar eficientismo versus eficácia.

Há alternativas ao eficientismo como vantagem competitiva.

Há alternativas ao eficientismo como vantagem competitiva.

quinta-feira, março 21, 2019

Curiosidade do dia

"Navigator procura terras com eucalipto em Espanha. Já tem um projeto na Galiza" e "Odemira já mal respira sob o plástico das estufas" são sintomas da aplicação do mesmo modelo de negócio baseado no volume.

Em vez de subir na escala de valor, a única forma de aumentar o rendimento é continuar a crescer, a crescer, a fomentar a monocultura.

Em vez de subir na escala de valor, a única forma de aumentar o rendimento é continuar a crescer, a crescer, a fomentar a monocultura.

Mais do que o custo

"The ability to create an advantage for the buyer is dependent on a seller’s competitive strength. This strength is reflected in its ability to offer better exchange ratios.

...

At equal prices, a seller with a cost advantage will gain greater profits than its competitors. At lower prices, the seller will increase its market share and strengthen its cost advantage, creating the basis for higher profits in later periods. A seller that provides its buyers with a greater net benefit is valued more highly by them; it strengthens its reputation, and buyers satisfied with its performance will become repeat customers. These are the conditions for profits being greater than competitors’ and for increased market share.

Profits that are the outcome of an advantageous position can be used by the seller as additional investments that competitors can only finance from other sources. The effects are as follows: a competitive advantage facilitates investment and thereby it helps to protect existing advantages and/or create new ones. Hence, it is vital for every competitor to create, find, or extend its competitively advantageous position. It is the very nature of competition that success or failure depends on the firm’s competitive position and every action has to be analyzed in terms of its effects on this position—how it improves or degrades it and how it utilizes it."Lembram-se dos economistas da Junqueira? Julgo que eles ainda pensam com as redes neurais que foram criadas na sua mente quando aprenderam as regras de funcionamento do Normalistão, afinal o mundo onde nasceram. Para eles só existem duas posições: vantagem de custo ou desvantagem de custo.

Mongo e a liberdade de escolher

"Henry Ford’s first great contribution to America was the Model T, which rolled off the assembly lines at his Highland Park, Michigan, plant at the rate of one every 24 seconds. At the time, it was an amazing display of industrial efficiency. By streamlining automation in his factories, Ford advanced an era of mass production that built his fortune and brought the automobile within reach of an emerging middle class. But while the miracle of mass production delivered the goods, it didn’t adapt easily, so all Model T’s looked alike. Ford’s approach can be summed up in what he said about the car’s exterior: “The consumer can have any color he wants so long as it’s black.”...

Ford’s take-it-or-leave-it attitude wouldn’t cut it in today’s economy.

...Estes trechos retirados de um texto de 1999, "The Right Stuff", foram escritos antes da entrada da China no mercado mundial, algo que atrasou a tendência de Mongo, a tendência para esta variedade de produtos.

This proliferation of products, models and styles isn’t capitalism run amok. Variety shouldn’t be dismissed as a trivial extravagance. It’s a wealthy, sophisticated society’s way of improving the lot of consumers. The more choices, the better. A wide selection of goods and services increases the chance each of us will find, somewhere among all the shelves and showrooms, products that meet our requirements.

...

Until 1914, Model T’s were available in red, blue, green, gray and black. The move to all black was a concession to mass production that made the car a commodity of sorts, but standardization wasn’t a winning strategy in the long run. By 1927, competition forced Ford to rethink variety. The Model A came in several body styles and an array of colors. With each decade, Ford gave consumers more choices,

...

They do it because pleasing the customer isn’t just about producing more stuff. It’s about producing the right stuff.

Just what is the right stuff? It’s more of what we do want and less of what we don’t want. The economy provides more of what we do want by customizing products to our particular tastes.

...

The economy’s progression to customization isn’t a fad. It arises from the free market’s relentless drive to bring what we buy closer to what we want. What we buy yields a lot more utility when it exactly matches our needs, and Americans are reaping enormous benefits as new tools help business cater to markets of one. We’re getting more for less, helping keep inflation in check.

.

There’s just one glitch in this otherwise serendipitous story: traditional measures of the economy may not reflect how much our living standards are improving. Conceived in an era of mass production, the nation’s GDP and productivity statistics may ably count more stuff, but they give little credit for right stuff. Mass customization and prevention—just like variety— deliver their gains in important but subtle ways, so gross domestic product and productivity statistics fail to capture the extent of our progress."

Interessante conjugar isto com:

"What Corbyn doesn’t understand is that competition is what makes the economic world go round.

.

It is what has given us civilisational wonders like iPhones and Teslas and the Greggs vegan sausage roll. It is what makes companies work in your interests, rather than their own. It is why Pret a Manger can’t charge you £10 a sandwich – because it knows that there’s an Eat down the road.

.

And here’s the big problem. Across America, Britain and Europe, competition is falling and market concentration is increasing, as big firms get remorselessly bigger."

"Capitalism is not “a system of competition” any more than any other system. Capitalism (at least in its free-market, laissez-faire ideal) is a system of the voluntary exchange of goods and services in the absence of physical coercion, theft, compulsion or fraud, predicated upon the fundamental right to own and accumulate property.

...

The miraculous wonder we miss when we focus our attention upon the competition, which derives from choice, is the ability to choose, itself.

...

The primary feature of free-market capitalism is not competition, but choice.

.

Because people make choices with scarce resources and limited time, competition will be an inherent part of any economic system so long as there is scarcity. The primary feature of free-market capitalism is not competition, but choice. Rather than moderate the amount of competition in an economy, state intervention will replace competition to serve customers and convince them to voluntarily spend their money on a wide array of ever-expanding goods and services. We can contrast this with other systems in which competition rages over who can gain the favor of those who control the levers of government. That is where the real “tooth and nail” begins."

quarta-feira, março 20, 2019

Curiosidade do dia

A propósito disto:

Vejam e revejam os frames entre os 58-59 e 60 segundos.

Vejam e revejam os frames entre os 58-59 e 60 segundos.

Portugal é isto, Portugal é esta leviandade com que se fala de tudo sem preparação, sem estudo, sem escrutínio, sem consequências. Assim se explica o sucesso de Cravinho depois do que disse sobre as SCUTs, apesar de nunca se ter retratado.tão bom, tão paradigmático da bola, da política, da economia, da ... https://t.co/tb9PwL5Ul2— Carlos P da Cruz (@ccz1) March 18, 2019

Acerca da vantagem competitiva

E continuo a minha leitura matinal de "Fundamentals of Business-to-Business Marketing - Mastering Business Markets" editado por Michael Kleinaltenkamp, Wulff Plinke, Ian Wilkinson e Ingmar Geiger.

"When analyzing benefit differences, we need to focus on the meaning of differences in competencies, processes, and programs for the buyer. A seller’s competitive strength is its ability to offer greater benefits or lower costs, i.e., greater net benefits, to the buyer compared to competitors.

In order to analyze this ability, we can make use of the description of the market transaction given above. Let us once again consider condition. With freedom of choice, no buyer will choose a particular seller if he perceives that other problem solutions offer a more favorable exchange ratio. The buyer will choose seller S if S offers a higher net benefit (the difference between benefits and costs) than a competitor SC. Therefore, S will have to have a positive difference between the net benefits of S and SC on the critical dimensions. Figure 1.21 summarizes the elements of such a net benefit difference.

...

From this perspective, it is not absolute values that affect purchase decisions—it is the relations between values that count.

...

Figure 1.22 shows the comparison. Cost differences and benefit differences between S and SC are shown. The price of seller S’s offer is slightly higher, but S offers the buyer significantly lower costs of use, maintenance, and disposal. Overall, the buyer is better off buying from S than SC, the difference being the “perceived cost difference S/SC.”

...

Levittown

Quando quero usar uma metáfora sobre o modelo económico do século XX uso os termos Metrópolis, por causa do filme de Fritz Lang, e Magnitogorsk ou Magnitograd por causa do bairro operário dessa cidade do tempo de Estaline. Centenas ou milhares de casas todas iguais, todas com o mesmo mobiliário. A única diferença é que algumas casas tinham candeeiros brancos e outras tinham candeeiros laranja.

Não se pense que as Magnitogorsk eram um apanágio do mundo comunista. Não, eram uma consequência de um modelo industrialista baseado na produção em massa e com pouco ou nenhum cuidado com o que os utilizadores pretendiam ou valorizavam.

Ontem, ao folhear uma publicação do Federal Reserve Bank of Dallas reencontrei uma imagem que procurava à muito:

Não se pense que as Magnitogorsk eram um apanágio do mundo comunista. Não, eram uma consequência de um modelo industrialista baseado na produção em massa e com pouco ou nenhum cuidado com o que os utilizadores pretendiam ou valorizavam.

Ontem, ao folhear uma publicação do Federal Reserve Bank of Dallas reencontrei uma imagem que procurava à muito:

"In July 1947, on potato fields 20 miles from Manhattan, William Levitt pioneered the mass production of affordable homes. Variations in the 17,477 houses were minor; each had two bedrooms, a bath, living room and kitchen on a 750-square-foot concrete slab. By standardizing the units, Levitt eventually was able to put up more than two dozen a day, helping fill the enormous postwar demand. Over the years, innumerable changes to the homes have transformed the community. But even now, Levittown remains a kind of shorthand for the sameness of mass production that’s starting to give way to mass customization."

terça-feira, março 19, 2019

Curiosidade do dia

Isto é tão doente...

País desgraçado este...

Eu sei o que ele quer. Criar barreiras às PMEs, aumentar-lhes os custos para fazer menos mossa às empresas associadas da CIP.

Trecho retirado de "Patrões querem plano nacional para conciliar trabalho e família"

"Ouvido pela TSF, o presidente da CIP, António Saraiva, lembra que as novas formas de trabalho trazem desafios a que o Estado ainda não deu resposta: "Falta uma estratégia nacional sobre este facto, porque as relações de trabalho, a nova forma de trabalho, os novos postos de trabalho, as novas realidades como a robótica, o teletrabalho, precisam ser analisados num diálogo social construtivo para o nosso desenvolvimento."Um "líder" de associação empresarial a pedir a intervenção do governo para os encarneirar. Se querem fazer alguma coisa, porque não avançam por si próprios, porque não criam algo bottom-up, porque têm de esperar pelo top-down?

.

O presidente da CIP lembra que o binómio família-trabalho tem impacto direto no desenvolvimento económico e social e considera que o Governo deve fazer mais para promover a vida familiar e profissional dos trabalhadores."

País desgraçado este...

Eu sei o que ele quer. Criar barreiras às PMEs, aumentar-lhes os custos para fazer menos mossa às empresas associadas da CIP.

Trecho retirado de "Patrões querem plano nacional para conciliar trabalho e família"

"the type of advantage, which may be by means of cost advantages or benefit advantages"

E continuo a minha leitura matinal de "Fundamentals of Business-to-Business Marketing - Mastering Business Markets" editado por Michael Kleinaltenkamp, Wulff Plinke, Ian Wilkinson e Ingmar Geiger.

"the sources of competitive advantage. In competition, every seller has certain capabilities or competencies based on its skills and resources, including all the people and their knowledge, the plant and equipment, customer relationships, and corporate image and reputation. Competencies are all the factors a seller can use in order to achieve its goals. It is essential for success in competition that the capabilities it has fit with the problem solutions desired by buyers. A seller who strives for competitive advantage will try to develop or acquire better talents and resources than competitors and will try to protect them against imitation.

Also essential for competitive success is the way in which processes within a firm are organized.

...

Competencies and processes together determine the output of a company and we call this a firm’s program. It includes the outputs offered to the market and what it expects from others in return. The program is the firm’s total offer including the nature of the product, the product range, services, communication, distribution, and price. The program is what distinguishes one firm from others. It is its visible source of differentiation for the buyer. Once achieved, a company usually tries strongly to defend an established differential advantage.

Competencies, processes, and programs together are the means by which a seller tries to create and defend differential advantage over his competitors. Every effort to improve a firm’s competitive position has to start at one or more of these three components.

...

As a result of its particular mix of competencies, processes, and program, a seller achieves a certain competitive position. This position has various dimensions. First is the type of advantage, which may be by means of cost advantages or benefit advantages. The former describes the seller’s average costs as compared to competitors; the latter describes the net benefits perceived the buyer, compared to buyers’ perceptions of competitors’ offers."

"selling projects rather than products" (parte III)

Parte I e parte II.

Como são as coisas... não há coincidências, todos os acasos são significativos.

Ontem à tarde, estive numa reunião de exploração estratégica numa empresa num sector tradicional da economia.

Empresa desenvolveu um produto a pedido dum cliente-fabricante. Entretanto, esse cliente chegou junto da marca e resolveu declinar o convite para produzir.

Marca, com produto na gama média-alta, resolveu avançar com a produção em Itália. Empresa resolveu fazer algo que nunca tinha feito antes, entrou em contacto com a marca, apresentou-se e ofereceu-se para continuar a fornecer a produção.

A internet ajudou-os a resolver o problema da distância (engraçado que antes da reunião ouvi este texto, "The Problem For Small-Town Banks: Technology Has Redefined Community" e, durante a reunião recordei "O fim da barreira geográfica")

Ou seja, a empresa está a considerar entrar no mundo da venda de projectos, em vez da venda de produtos, ou de soluções.

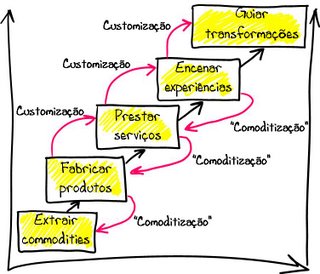

Também ando a pensar na relação da venda de projectos com o último nível desta cadeia:

Como são as coisas... não há coincidências, todos os acasos são significativos.

Ontem à tarde, estive numa reunião de exploração estratégica numa empresa num sector tradicional da economia.

Empresa desenvolveu um produto a pedido dum cliente-fabricante. Entretanto, esse cliente chegou junto da marca e resolveu declinar o convite para produzir.

Marca, com produto na gama média-alta, resolveu avançar com a produção em Itália. Empresa resolveu fazer algo que nunca tinha feito antes, entrou em contacto com a marca, apresentou-se e ofereceu-se para continuar a fornecer a produção.

A internet ajudou-os a resolver o problema da distância (engraçado que antes da reunião ouvi este texto, "The Problem For Small-Town Banks: Technology Has Redefined Community" e, durante a reunião recordei "O fim da barreira geográfica")

Ou seja, a empresa está a considerar entrar no mundo da venda de projectos, em vez da venda de produtos, ou de soluções.

Também ando a pensar na relação da venda de projectos com o último nível desta cadeia:

segunda-feira, março 18, 2019

Uma pregação em prol da ... concorrência imperfeita

Continuo a minha leitura matinal de "Fundamentals of Business-to-Business Marketing - Mastering Business Markets" editado por Michael Kleinaltenkamp, Wulff Plinke, Ian Wilkinson e Ingmar Geiger.

Estão a ver o choradinho e a falta de noção deste senhor, "Boas notícias, Portugal a ser abandonado pelo negócio do preço (parte II)"?

Imaginem o que diria desta linguagem:

Sabem o que vem aí?

Uma pregação em prol da ... concorrência imperfeita.

Estão a ver o choradinho e a falta de noção deste senhor, "Boas notícias, Portugal a ser abandonado pelo negócio do preço (parte II)"?

Imaginem o que diria desta linguagem:

"We have come to understand the market process as a never-ending process of learning for all involved, a process that is kept running by the entrepreneur who detects profit opportunities. Entrepreneurs sense differences in the market, they discover the possibility to sell something at a higher price than they can buy it for, and they disperse this knowledge—voluntarily or involuntarily—to other market participants. This process is a competitive one that rewards the capable and punishes the less able. Competition among sellers, therefore, has a selection function that creates better problem solutions for the buyer.Depois, o livro apresenta esta figura:

The Austrian economist Ludwig von Mises described the situation in the following way: “The entrepreneur can only act a step ahead of his competitors if he strives toward serving the market more cheaply and better. More cheaply means richer supply; better means supply with products not yet in the market”"

Sabem o que vem aí?

Uma pregação em prol da ... concorrência imperfeita.

"Homogeneity: The offers in a market are homogeneous if they resemble each other in all aspects, so that the buyer perceives no difference among them. Offers are heterogeneous if they differ either objectively or as perceived by the buyer.

• Knowledge: Buyers have complete market knowledge if they know without delay about all offers in the market.

• Barriers: Barriers hinder free market entry: new sellers cannot enter the market without entry costs or constraints, and sellers already in the market cannot imitate the characteristics and behavior of other sellers.

...

Information shortages and quality differences that initially exist will tend to disappear, and the temporary profits of cases 2–4 will disappear, shifting the situation to case 1.

.

Cases 5 and 6 differ from cases 1 to 4 because barriers exist. Barriers act as an obstacle to competition for new entrants as well as for those already in the market. Market entry barriers are always disadvantageous for new entrants compared to incumbent sellers, because the latter can approach buyers more easily than new entrants. And if a seller has a first mover advantage compared to its competitors then others cannot catch up—either because they are unable to (the advantage is too great) or because they do not want to (e.g., they are afraid of the first movers’ response).

...

Hence, barriers are, among other things, the reason for sellers earning profits significantly higher than competitors.

...

The picture of competition created in cases 5 and 6 provides the basis for an analysis of competitive advantage. Dynamic seller competition means that sellers are permanently searching for and experimenting with new products or services in order to find or create ones that distinguish themselves from those of other sellers, in terms of value to the buyer and/or the costs they incur. If a competitor succeeds in operating with lower costs than its competitors, then it can offer lower prices to buyers, which can increase its market share and profits. If a seller succeeds in offering a better product or service without higher costs, then it can increase prices and earn higher profits. This never-ending search and experimentation has only one aim: By differentiation, the seller wants to avoid being substitutable. Furthermore, a seller strives to establish a difference that is sustainable; it wants to avoid being imitated."

"selling projects rather than products" (parte II)

Na Parte I Antonio Nieto-Rodriguez deu o exemplo da Philips sobre como deixar de vender produtos e passar a vender projectos. Fez-me lembrar o fabuloso livro de Ramirez & Manervik e os seus ecossistemas da procura:

E a propósito de ecossistemas da procura, a minha primeira experiência, em 2004, de transformar a venda de produtos em projectos para "Subir na escala de valor". O mesmo "truque" usado pela Jofebar:

E a propósito de ecossistemas da procura, a minha primeira experiência, em 2004, de transformar a venda de produtos em projectos para "Subir na escala de valor". O mesmo "truque" usado pela Jofebar:

- Um sistema de gestão que começa no negócio (Novembro de 2015)

- A mensagem de quem sabe quem são os seus alvos (Setembro de 2016)

- Não esquecer (Dezembro de 2016)

Interessante que o sector da pedra tenha apostado na mesma estratégia (Portugal exportou mais 10,5% de pedra natural em 2018):

"Há uma inversão da exportação do material em bruto para uma tendência para o material transformado”E volto a "Selling Products Is Good. Selling Projects Can Be Even Better":

...

“Há quatro anos tínhamos a China como principal mercado”, pelo que “o setor exportava sobretudo bloco”. Agora, é França o principal mercado, com um crescimento superior a 5%, sendo que este país “consome sobretudo produto acabado”.

...

As associadas da Assimagra estão, neste contexto, “a fornecer sobretudo obra à medida”, aumentando o valor acrescentado face à venda mais indiferenciada de blocos de pedra. “Hoje o setor consegue estar nos principais projetos mundiais, disputá-los e vencê-los”, adiantou Miguel Goulão."

"Clearly, the shift to becoming a project-driven organization and selling projects rather than products or services presents sizeable challenges to corporations and their business models. Working in projects throughout my career, I have identified these as the important ones:

.

Revenue streams. Revenues will be generated progressively over long periods of time, instead of right after the sale of a product. This will affect the way revenues are recognized, as well as accounting policies and the overall company valuation.

.

Pricing model. New pricing models will need to be developed. It is easier to price a product, for which most of the fixed and variable costs are known, than a project, which is influenced by many external factors.

.

Quality control. Delivering quality products will not be enough to meet customer expectations. Implementation and post-implementation services will also have to be of the highest possible quality to ensure that clients continue to buy projects.

.

Branding and marketing. Traditional marketing has focused on short-term immediate benefits. Marketing teams will need to promote the long-term benefits of the projects sold by the organization.[Moi ici: Estou constantemente a dizer isto às empresas, fujam do preço da troca, calculem o custo do ciclo de vida do produto/serviço. Ajudem "get the customer to appreciate a bigger picture"]

.

Sales force. The buyer of the project will no longer be the procurement department of an organization. Sales will be pitched to leaders of the business, so the sales force and sales skills will have to be upgraded with strategy and project management competencies.

.

Stop for a moment and consider what your organization is selling. Is it a project? Increasingly, the answer is clear and affirmative. If not, beware, your products might soon become part of a project sold by someone else."

domingo, março 17, 2019

"selling projects rather than products"

Outro texto delicioso e em sintonia com Mongo, "Selling Products Is Good. Selling Projects Can Be Even Better":

Continua.

BTW, confesso que me estou a tornar num fan de Antonio Nieto-Rodriguez.

"In the beginning companies sold products. And then they sold services. In recent years, the fashionable suggestion has been that companies sell experiences and solutions, solving the needs and aspirations of customers.Há tempos a trabalhar num projecto de reflexão estratégica para exactamente fazer esta transição de empresa de produtos para empresa de projectos, fui surpreendido no inicio pelo pedido para fazer uma análise Value Stream Mapping ao seu ciclo produtivo. Entretanto, com o andar do projecto passei a mensagem que se quisessem aplicar a análise Value Stream Mapping o fizessem à utilização do produto durante o ciclo de vida do utilizador final, como naquele "running and the maintenance of the new center".

.

Companies, indeed, do all of these things. But increasingly, what companies sell are projects. To understand the difference, think of an athletic shoe company, such as Nike or Adidas. A focus on products means a focus on selling running shoes. A focus on experiences might mean they sell you a membership to a local running club. A focus on solutions might mean they figure out how to help you reach your goal weight. While these clearly offer more value than simply selling you a pair of shoes, they also have limitations. Selling products limits the revenues you can make from clients: Unless you are innovating and continually updating your product offering, customer attrition tends to be high, and incentivizing repurchases can be hard. Selling experiences provides intangible benefits that are hard to quantify and measure, often focusing on meeting the needs of one single customer, preventing any mass production. Selling solutions became popular in the early 2000s when customers didn’t know how to solve their problems. But today, in the internet age, people can do their own research and define the solutions for themselves.

.

A focus on selling projects would mean helping someone do something more specific, such as running the Boston Marathon.

...

The project would have a clear goal (finish the marathon) and a clear start and end date.

.

And that is just one type of project. More so than products, the possibilities with projects are endless. [Moi ici: Como não recordar - as pessoas e as empresas não compram o que compram, mas o que vão conseguir, processando o que compraram]

...

Soon after launch, products are copied by the competition, which means they must be priced more cheaply. Soon, they become a commodity. This removes any opportunity for steady, high margins over the long term. Philips has experienced this even with its high-end health care products. Shifting its emphasis to selling projects rather than products was a strategic response to this problem.

.

For example, Philips sells high-tech medical devices. In the past it sold them simply as products (and it still does). But now Philips seeks out the projects in which its products will be used. If a new health care center is being considered, Philips will seek to become a partner from the very beginning of the project, including the running and the maintenance of the new center."

Continua.

BTW, confesso que me estou a tornar num fan de Antonio Nieto-Rodriguez.

Subscrever:

Mensagens (Atom)