Em Abril, escrevi este postal "

Acerca da importância de uma estratégia, não acreditar em boleias!".

.

Os números que estiveram na sua origem são poderosos e exemplares, infelizmente.

.

Um sector não transaccionável em 2014, em Portugal, teve um crescimento de 19% no número de clientes.

.

Mas esperem...

.

Antes de começarem a celebrar, vejam o que esse número esconde:

.

Quase 50% das unidades (47%) a operar no sector perderam clientes...

.

Só 40% das unidades a operar no sector ganharam facturação.

.

Assim, pode-se concluir que houve mais unidades a ganhar clientes do que facturação e, mais unidades a perder facturação do que clientes. Ou seja, além das unidades que perderam clientes e, por isso perderam facturação, temos também as que ganharam clientes mas à custa da quebra do preço unitário, à custa da quebra da margem.

.

O que é que isto quer dizer?

.

Que muita gente ainda só vê o preço como a única variável para seduzir clientes, que muita gente continua prisioneira de uma

visão tradicional acerca da criação de valor, que muita gente tem tudo a ganhar com uma

mudança de perspectiva e uma mudança de estratégia.

.

Estas unidades que perdem clientes e/ou facturação têm, cada uma, a sua estratégia. Podem até nem realizar que têm uma estratégia, podem até nem ser capazes de a descrever mas têm-na, traduzida num conjunto de padrões de comportamentos e de decisões.

.

Essas estratégias particulares traduziram-se naqueles resultados:

- Quase 50% das unidades (47%) a operar no sector perderam clientes; e

- Só 40% das unidades a operar no sector ganharam facturação.

Se queremos resultados diferentes, temos de ter estratégias diferentes. Aqueles resultados não são nenhuma anormalidade, não são manifestações de uma doença ou problema, são a consequência perfeitamente natural de um conjunto de estratégias obsoletas.

.

E a sua empresa, tem uma estratégia obsoleta?

.

.

.

Não está na hora de a rever? (Podemos ajudar?)

.

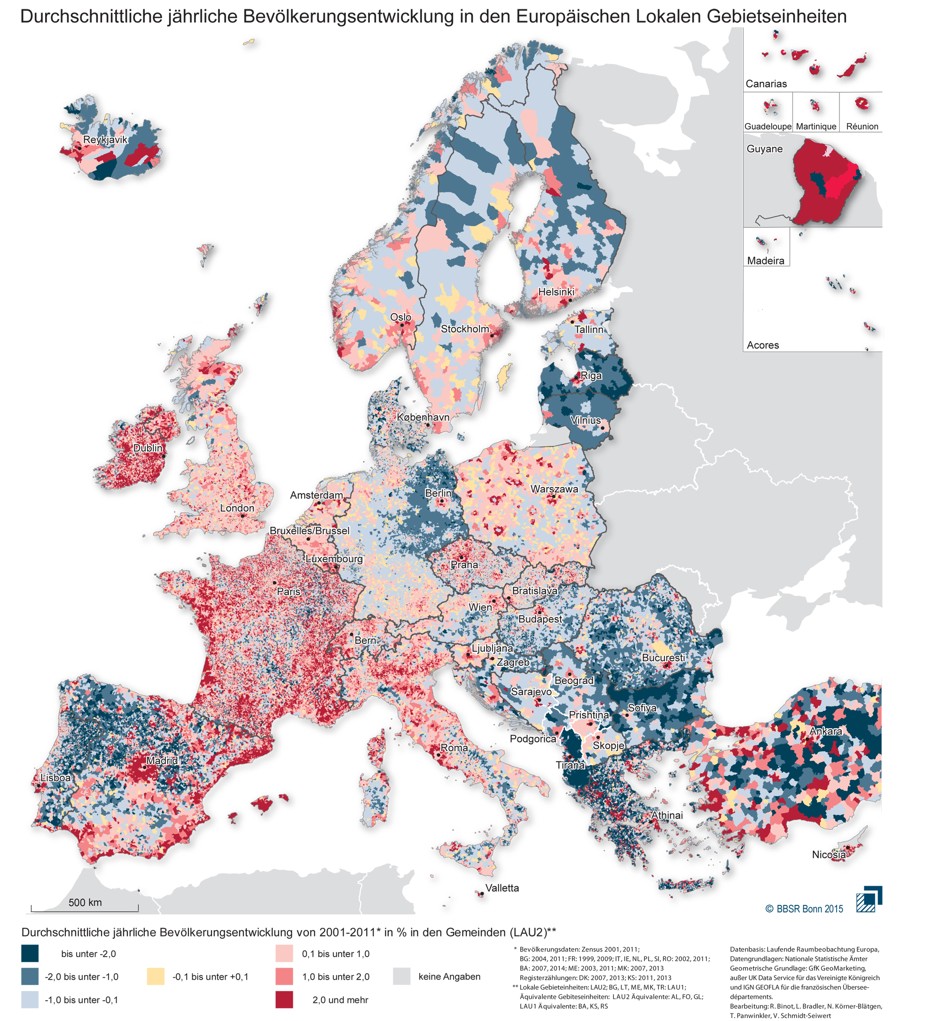

Na parte II vamos ver como esta necessidade está espalhada por grande parte da economia portuguesa.