domingo, abril 30, 2017

Antes da proposta de valor

"Before focusing on the value proposition and the other elements of a business model, it is very important to get a deep insight and holistic understanding of the customers' world, their contexts, activities and experiences. In this block, the customers' explicit and latent reasons for buying and the benefits that the customer desires are analyzed. The questions to be answered include:E volto à figura do ovo e da galinha...

- How do we get a deep insight and holistic understanding of the customer's world, their future strategies, and their own customers' world?

- Why does the customer buy?

- What kind of benefits (functional, economic, emotional, social, ethical, environmental, symbolic) does the customer desire?"

E ao tema do concreto para o abstracto...

Também proponho às PME que comecem por identificar os clientes-alvo antes de pensar na proposta de valor. No entanto, antes de identificar os clientes-alvo recomendo que se faça o recenseamento do que se tem. Uma PME tem de partir daquilo que tem, daquilo que pode funcionar como um ponto forte, daquilo que pode servir de alicerce para a construção de um modelo de negócio.

Trecho inicial retirado daqui.

Ecossistemas de serviço

"As one zooms out from dyadic interactions and discreet transactions, the first thing noticed is that these dyadic interactions do not take place in isolation, but rather within networks of actors, of which the dyad is just a part. These networks can be seen at various levels of aggregation (e.g., macro, meso, micro). Structurally then, these networks reflect what S-D logic captures axiomatically in the resource-integration specification of Axiom 3 [All social and economic actors are resource integrators]. Likewise, they emphasize that the benefit (value) realized by a beneficiary (e.g., a “customer”) does not occur in isolation either, but rather through integration of the resources from many sources, [Moi ici: Recordar o objectivo de maximizar a criação de valor a nível do ecossistema, "The market is a goal collective"] thus best understood as holistic experiences (FP9/Axiom3 and FP10/Axiom4).[Value is always uniquely and phenomenologically determined by the beneficiary]

At first glance, it might appear that there is little new here, just the acknowledgement that service provision, value cocreation and value realization take place in networks, ... However, the S-D logic framework adds several key characteristics that are not in all cases typical of these network conceptualizations. Most obvious among these is that the connections represent service-for-service exchange, rather than just connections of resources, people, or product flows; thus, in S-D logic, network actors are linked by common, dynamic processes (service provision). Second, the actors are defined not only in terms of this service provision (resources applied for benefit) but also in terms of the resource-integration activities that the service exchange affords. Finally, the network has a purpose, not in the sense of collective intent but rather in the sense of individual survival/wellbeing, as a partial function of collective wellbeing."

Trecho retirado de "Service-dominant logic 2025"

Qual é a distribuição?

Uma forma interessante de analisar um setor de actividade e a sua cadeia de fornecimento (ecossistema):

Quem é que emergiu e teve uma década seguinte de sonho?

E na cadeia de fornecimento em que a sua empresa participa, qual é a distribuição?

Imagem retirada de "If You're in a Dogfight, Become a Cat!: Strategies for Long-Term Growth"

Quem é que emergiu e teve uma década seguinte de sonho?

E na cadeia de fornecimento em que a sua empresa participa, qual é a distribuição?

Imagem retirada de "If You're in a Dogfight, Become a Cat!: Strategies for Long-Term Growth"

Pensa que só acontece aos outros?

"Aon's 2107 Global Risk Management survey has revealed a host of daunting challenges driven by today’s divisive and yet interdependent environment. The report focuses on the elected Top 10 risks for detailed discussion, one of the perennial highlights:

...

cyber risk stands out as another illustration of the influence of news events on risk perception.

...

cyber crimes have evolved from stealing personal information and credit cards to staging coordinated attacks on critical infrastructures. ... Cyber threat has now joined a long roster of traditional causes—such as fire, flood and strikes that can trigger business interruptions because cyber attacks cause electric outages, shut down assembly lines, block customers from placing orders, and break the equipment that companies rely on to run their businesses."

Nem de propósito, este exemplo, "Hacker rouba série da Netflix: “Ou pagam o resgate ou ponho tudo na Internet”":

"A empresa já reagiu e reconheceu que uma pequena produtora com sede em Los Gatos, na Califórnia, que trabalha com vários dos grandes estúdios de televisão, foi alvo de um ataque cibernético. De acordo com o serviço de streaming, o FBI e outras autoridades já estarão a investigar o caso."Pensa que só acontece aos outros?

sábado, abril 29, 2017

Curiosidade do dia

"Os portugueses não são avessos à liberdade por desconhecerem os respectivos benefícios. Os portugueses são avessos à liberdade por conhecerem as respectivas desvantagens – e as vantagens da atitude oposta. Na medida em que deposita o destino nas mãos de cada um, a liberdade implica responsabilidade, risco e uma trabalheira desgraçada, em suma exactamente aquilo que o português evita, ou procura evitar, ao roçar-se diligentemente no Estado."Trecho retirado de "Não me levem a mal, mas não haverá revolução liberal"

"when we have these resources in excess, we don’t become efficient"

Em "Expose Your Constraints Before Chasing Additional Resources" encontro um excelente texto não só aplicável a startups mas também a empresas em sectores tradicionais.

Numa outra onda, recordo o empresário que recentemente defendeu que é tempo da sua empresa deixar de estar viciada em stress e começar a investir em recursos humanos e não só.

E como não recordar os keynesianos e outros degenerados que defendem que a produção cria a sua própria procura...

"We all hustle, struggle, and fight to acquire more resources for our projects. But ironically, when we have these resources in excess, we don’t become efficient. We become wasteful.Como não pensar na moda corrente de dinheiro público ser despejado em ideias que ainda andam à procura de product-market fit.

.

Much has been written about how by limiting choices, constraints force the requisite creativity needed to innovate.

...

Constraints force the requisite focus needed to innovate."

Numa outra onda, recordo o empresário que recentemente defendeu que é tempo da sua empresa deixar de estar viciada em stress e começar a investir em recursos humanos e não só.

E como não recordar os keynesianos e outros degenerados que defendem que a produção cria a sua própria procura...

"Harness Immediate Benefits to Increase Your Persistence"

"The importance of delaying gratification is universally recognized. Being able to forgo immediate benefits in order to achieve larger goals in the future is viewed as a key skill.Algo que me faz recuar ao final do século passado e à descoberta em 1992 na HBR, no mesmo número que apresentou o primeiro artigo sobre o balanced scorecard, do autor Robert Schaffer:

...

But wouldn’t immediate benefits also help us follow through on our long-term goals?

...

We found that enjoyment predicted people’s goal persistence two months after setting the goal far more than how important they rated their goal to be.

.

Yet people overestimated how much delayed benefits influenced their goal persistence. When we asked people what would help them stick with their goal in the upcoming months, they believed both immediate and delayed benefits—enjoyment and importance—mattered for their success. In actuality, delayed benefits had less influence on persistence; they mainly played a role in setting the goal in the first place.

.

We found this pattern—immediate benefits are a stronger predictor of persistence than delayed benefits—across a range of goals, in areas including fitness, nutrition, and education.

...

Harness Immediate Benefits to Increase Your Persistence

...

First, factor in enjoyment when choosing which activity to pursue to achieve your goals.

...

Second, give yourself more immediate benefits as you pursue long-term goals.

...

Third, reflect on the immediate benefits you get while working toward your goal."

- A dança da chuva e outros rituais (Julho de 2006)

- Small Wins (Junho de 2009)

- Uma sucessão de pequenos projectos que produzem resultados rapidamente (Dezembro de 2012)

Escolher desafios relevantes e alinhados com a estratégia e desdobrá-los em vários projectos mais pequenos que não só reduzem o tempo para obter resultados como o tempo para obter feedback.

Trechos retirados de "What Separates Goals We Achieve from Goals We Don’t"

O típico para as nossas PME

O típico para as nossas PME:

Segundo trecho retirados de "A revolução das malhas na TMG"

"Conhecida pela marca ROQ, a empresa constrói máquinas customizadas e de alta performance e precisão para a indústria têxtil, com recurso a tecnologia de ponta, nas áreas do corte a laser e da quinagem."E ainda:

"Aqui conseguimos fazer amostras no tempo que eles pretendem – às vezes temos de fazer amostras em três, quatro dias e em malhas não é fácil. Mas é a amostra que vai trazer o cliente e isso diferencia-nos»"Primeiro trecho retirado de "ROQ reforça liderança mundial e cria mais 31 empregos em Famalicão"

Segundo trecho retirados de "A revolução das malhas na TMG"

sexta-feira, abril 28, 2017

Curiosidade do dia

Excelentes noticias: O desemprego já está abaixo dos 10% (@pt_INE). Quem esteve contra a reforma laboral de 2012 deve estar arrependido pic.twitter.com/OdIg7K5AVI— Alvaro SantosPereira (@santospereira_a) April 28, 2017

Volume is vanity, Profit is sanity

"Market leadership is even more precarious. The percentage of companies falling out of the top three rankings in their industry increased from 2% in 1960 to 14% in 2008. What’s more, market leadership is proving to be an increasingly dubious prize: The once strong correlation between profitability and industry share is now almost nonexistent in some sectors. According to our calculation, the probability that the market share leader is also the profitability leader declined from 34% in 1950 to just 7% in 2007. And it has become virtually impossible for some executives even to clearly identify in what industry and with which companies they’re competing."

Como não recordar o clássico "Manage For Profit, Not For Market Share: A Guide to Greater Profits In Highly Contested Markets"

Trecho retirado de "Adaptability: The New Competitive Advantage"

"People buy products for one reason only"

This simple principle has changed the way I view product design: pic.twitter.com/HxNgZNgKFf— Justin Jackson (@mijustin) April 26, 2017

Produtividade para o século XXI (parte V)

Parte I, parte II, parte III e parte IV

O artigo é de 2004, descobri-o em 2011.

Continua.

"the only theoretically correct and practically relevant approach to measuring service productivity seems to be to base productivity calculations on financial measures. In principle, the correct way of measuring service productivity as a function of cost effects of internal efficiency, revenue effects of external efficiency and cost and revenue effects of capacity efficiency is, therefore, the following measure:

As a global productivity measure of the operations of a service provider, the following measure can be used:

the productivity of service processes can be measured as the ratio between revenues and costs. This is a true measurement of service productivity. If revenues increase more than costs, productivity goes up. On the other hand, if a cost reduction leads to lost revenues, but the decline in revenues is less than the cost savings that have been achieved, productivity still improves. However, this may be a less recommendable strategy because in the long run it may lead to a negative image and unfavorable word of mouth, which can have a further negative effect on revenues. Thus, cost reductions may lead to a bigger drop in revenues than the savings on the cost side. If this is the case, in the long run service productivity declines."A equação que uso há anos, talvez desde 2007.

O artigo é de 2004, descobri-o em 2011.

Continua.

Onde trabalhar?

Excelente figura:

Valor é criado quando uma empresa consegue criar uma oferta em que a willingness to pay (WTP) supera o cost to serve (CTS). A diferença entre o WTP e o CTS define a dimensão do valor criado. valor esse que terá de ser dividido entre o cliente e o produtor.

Tal como na figura, a vantagem competitiva de uma empresa pode ser uma função de conseguir fornecer o mercado com custos mais baixos, ou uma WTP superior ou uma mistura de ambas.

Infelizmente, muitas PME contentam-se em trabalhar na zona A muito mais do que na zona B (se soubessem o que aprendi com Marn e Rosiello naquele mês de Janeiro de 1992, na verdade só aprendi mais tarde - nunca é tarde para aprender, ás vezes é demasiado cedo)

Continua.

Trecho e imagem retirada de "If You're in a Dogfight, Become a Cat!: Strategies for Long-Term Growth"

Valor é criado quando uma empresa consegue criar uma oferta em que a willingness to pay (WTP) supera o cost to serve (CTS). A diferença entre o WTP e o CTS define a dimensão do valor criado. valor esse que terá de ser dividido entre o cliente e o produtor.

Tal como na figura, a vantagem competitiva de uma empresa pode ser uma função de conseguir fornecer o mercado com custos mais baixos, ou uma WTP superior ou uma mistura de ambas.

Infelizmente, muitas PME contentam-se em trabalhar na zona A muito mais do que na zona B (se soubessem o que aprendi com Marn e Rosiello naquele mês de Janeiro de 1992, na verdade só aprendi mais tarde - nunca é tarde para aprender, ás vezes é demasiado cedo)

"Where does price fit in? As shown in the right-hand panel of figure 5.2, companies can choose to price their products anywhere between WTP and CTS. This is a strategic decision that reflects how a company wants to divide the product value between itself and its customers. Consumers benefit from lower prices by enjoying a higher consumer surplus, the difference between what a consumer is willing to pay for a product and the actual price charged. High consumer surpluses spur sales, increasing growth and customer satisfaction. Producer surplus is an equivalent concept from the opposite perspective—the difference between the price a company charges and its unit cost. Obviously, companies that enjoy a competitive advantage in the marketplace have more pricing flexibility when choosing how to allocate value between the company and consumers."A não ser que uma empresa queira ser o fornecedor com o custo mais baixo o truque é trabalhar para aumentar o WTP, trabalhar na zona B.

Continua.

Trecho e imagem retirada de "If You're in a Dogfight, Become a Cat!: Strategies for Long-Term Growth"

quinta-feira, abril 27, 2017

Curiosidade do dia

A 5 de Abril de 2017 escrevi:

Hoje, 27 de Abril o mesmo governo volta a aparecer na capa do Público com:

E Santana Lopes é que fazia trapalhadas...

Como não recordar o 1º Princípio de Deming:

"Ontem ao ler "Costa garante: Malparado não vai fazer “nascer um banco mau”" lembrei-me logo de "Costa quer tirar 'lixo' dos bancos. E passá-lo para um 'banco mau'"".

Hoje, 27 de Abril o mesmo governo volta a aparecer na capa do Público com:

E Santana Lopes é que fazia trapalhadas...

Como não recordar o 1º Princípio de Deming:

Constância de propósito

"Pricing is a game"

"Pricing is a game – one with asymmetric and imperfect information. So what does this mean for you? Basically, you’re very unlikely to nail pricing the first time. And even if you do come close, you’ll have to adjust as your product and market mature.Trechos e imagem retirados de "Want to Nail Pricing? Understand Market Dynamics First."

...

Price elasticity of demand is the basic economic insight that price influences demand and that in most cases (with the exception of certain luxury goods) demand will increase as the price goes down.

...

Cross-price elasticity is the tendency of customers to switch vendors (or products from the same vendor) in response to price changes. In some markets, there are well understood alternatives and when the price of one increases some customers will abandon it for the alternative."

Clareza estratégica

"To put the issue of strategic clarity in context, let's start by defining terms. Figure 5.1 illustrates the four hierarchical elements required to formulate and execute effective business strategy. The starting point is a set of overarching goals that establish a company's long-run intent and management priorities. ... A company's stated goals identify the broad boundaries of business scope and the areas of business activity and performance of greatest concern to management, e.g., consumer satisfaction, employee safety and welfare, shareholder value, and sustainable business practices.

...Pessoalmente trabalho com outra versão daquela hierarquia:

A company's strategy describes how it plans to meet its stated objectives. Strategy is all about making choices, and a company's strategy guides which market opportunities to pursue, which products to create, which distribution channels to exploit, and which business partnerships to form. Strategic choices to ignore certain opportunities are just as important as actionable commitments."

E mais, às vezes interrogo-me se não fará mais sentido trabalhar com esta versão:

Trechos e imagem retirados de "If You're in a Dogfight, Become a Cat!: Strategies for Long-Term Growth"

"despedir é sempre resultado de uma maldade ou de preguiça da gestão" (parte V)

Aproveitei umas horas do 25 de Abril para descarregar uns caixotes de livros no meu novo escritório. A certa altura passou-me pelas mãos um livro que muito me marcou, "Grow to be Great: Breaking the Downsizing Cycle", e com ele na mão, olhando para a capa sorri e recordei-me de alguns postais com mais de 10 anos.

OK, por vezes regras como o LIFO levam a despedir não com base em critérios alinhados com a estratégia o que não é muito saudável. No entanto, IMHO, pode fazer sentido encolher uma empresa quando ela precisa de mudar de vida, quando uma estratégia deixou de fazer sentido e a empresa tem de se renovar.

E recordo a série "despedir é sempre resultado de uma maldade ou de preguiça da gestão" (parte IV) e a imagem:

Por vezes, encolher é a única alternativa para poder recomeçar.

E foi daquela frase "You cannot shrink to greatness" que me recordei ao ler "If You Think Downsizing Might Save Your Company, Think Again".

Confesso que o artigo me pareceu algo infantil:

"we tested the theory that downsizing could lead to a host of problems that eventually increases the likelihood of bankruptcy.Por que é que estas empresas encolheram? Porque já estavam com problemas!

...

We found that downsizing firms were twice as likely to declare bankruptcy as firms that did not downsize. While downsizing may be capable of producing positive outcomes, such as saving money in the short term, it puts firms on a negative path that makes bankruptcy more likely."

OK, por vezes regras como o LIFO levam a despedir não com base em critérios alinhados com a estratégia o que não é muito saudável. No entanto, IMHO, pode fazer sentido encolher uma empresa quando ela precisa de mudar de vida, quando uma estratégia deixou de fazer sentido e a empresa tem de se renovar.

E recordo a série "despedir é sempre resultado de uma maldade ou de preguiça da gestão" (parte IV) e a imagem:

Por vezes, encolher é a única alternativa para poder recomeçar.

"What he did was both obvious and, at the same time, unexpected. He shrunk Apple to a scale and scope suitable to the reality of its being a niche producer in the highly competitive personal computer business. He cut Apple back to a core that could survive."Uma coisa é encolher para sobreviver numa versão 2.0, outra é encolher porque sim, para pressionar aumentos de eficiência.

"nature evolves away from constraints, not toward goals" (outra vez)

"nature evolves away from constraints, not toward goals"

Foi uma frase que captei em 2007.

E foi dela que me lembrei assim que o Paulo Vaz me chamou a atenção para este artigo "I Have Seen The Future, And The Future Is a Free Market".

Por um lado a ideia de que a economia é uma espécie de ser vivo em permanente mutação:

"The “economy” is not some granite block that remains unchanged for decades and decades. Like any other thing, manifestations of it arise and then pass away. But they do not disappear. They become something else. It’s like people think the Earth came into being, it’s a done deal, and everything here is permanent and remains the same for thousands of years. No. Things come into being here, pass away, and become something else."Por outro lado a ideia de Mongo relacionada com as empresas grandes:

"as Nature shows, the bigger will always fall to be replaced by the smaller. Thus, the big retailers will go out of business. Of course! The malls will fall into ruins. Of course! And why? Because people can shop online, yes, that’s one reason. But another is because there are literally tons upon tons of consumer goods, clothes, and various other things in perfectly good condition out there to be had for a penny on the dollar of original purchase price."E ainda:

"None of this means the economy is getting ready to pop another Great Depression on us. It means the economy is changing as all things must. There is no such thing as any human creation being a permanent structure.

...

The little restaurants of the shopping mall food courts discovered they could do better business as “food trucks” and not bother with paying rent or having furniture. The smaller shops of the malls found they could move into lower rent strip malls. Chain retailers flooded the markets with thousands of tons of consumer goods that thrift stores sell used and, therefore, no one needs to go get this stuff from the chain retailers anymore. In a word, what is happening is a free market is coming into existence right under everyone’s noses and few see it.

.

How so? Because those food trucks have found a way to beat the government out of property tax or the malls out of rent. The second-hand shops have found a way to sell goods without buying them from major corporations. What’s more, ethnic populations often import goods direct from their own countries, often from their own families, and sell them in their own independent shops and offer new goods at a fraction of the price of what the mall would ask.

...

The big retailers and malls need to understand that their time has passed. The free market is coming into existence as we speak.

...

So, no, the economy is not tanking. It is changing.

...

The free market scares the government because it carves huge chunks out of government revenue garnered through taxes. [Moi ici: Algo que escrevemos aqui há anos] Food trucks alone represent huge losses in property taxes they can’t levy against a moving vehicle that parks where it pleases and vends food. The free market scares Wall Street because they’re locked out of it. Thrift stores move into abandoned or vacant buildings paying cheap rents to landlords just grateful someone moved in after Big Retailer, Inc. went belly up. And they sell all the tons of goods the big retailers flooded America with for decades.

...

This free market changes faster than the government can adapt and come up with new taxes to go after them. [Moi ici: Daí aquela frase lá de cima "nature evolves away from constraints, not toward goals"] I have seen de facto swap meets pop up in vacant lots and just garner passers-by as customers. They sell out of vans and pickup truck beds and communicate locations on Facebook and through text messages to their customers. They move around from abandoned storefront parking lots to empty lots where buildings once stood. Food trucks passing by see them and pull in and set up. Sometimes it’s all coordinated between them. And the cops don’t care. The presence of people like that deters crime."

...

The free market does not mean Wall Street gets to continue to exist and run it. In fact, Wall Street is passing away as we speak.

...

I have seen the future and the future is the true free market. It is being created by people. Not the government, not some political party, not corporations, and not Wall Street. All of them are headed for the same destination as the dinosaurs: Museums."

quarta-feira, abril 26, 2017

Curiosidade do dia

Aldous Huxley é a primeira coisa que me vem à mente.

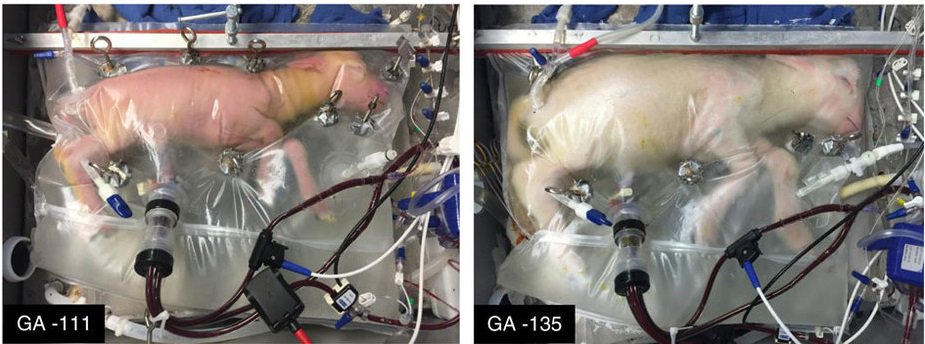

Ler "Artificial womb helps premature lamb fetuses grow for 4 weeks" e pensar em tudo o que se pode "desenvolver" a partir daqui.

Produtividade para o século XXI (parte IV)

Parte I, parte II e parte III.

"According to the traditional manufacturing-related productivity concept, productivity is defined as the ratio between outputs produced and inputs used, given that the quality of the outputs is kept constant (the constant quality assumption), or

Only if the quality of the production output is constant and there is no significant variation in the ratio between inputs used and outputs produced with these inputs, productivity can be measured with traditional methods. The constant quality assumption is normally taken for granted and not explicitly expressed. Therefore, the critical importance of this assumption is easily forgotten. [Moi ici: Forgotten por todos este pormaior fundamental. Subir na escala de valor é uma forma de dinamitar a constant quality assumption. É ela que gera o fenómeno da perseguição entre gato e o rato (salário e produtividade)] However, in most service processes it does not apply.

In services, it is not only the inputs that are difficult to calculate, it is also difficult to get a useful measurement of the outputs. Output measured as volumes is useful only if customers are willing to buy this output. In manufacturing, where the constant quality assumption applies, customers can be expected to buy an output produced with an altered input or resource structure. However, in services we do not know whether customers indeed will purchase the output produced with a different input structure or not. It depends on the effects of the new resources or inputs used on perceived process-related and outcome-related quality. Hence, productivity cannot be understood without taking into account the interrelationship between the use of inputs or production resources and the perceived quality of the output produced with these resources. The interrelationship between internal efficiency and external efficiency is crucial for understanding and managing service productivity."

Industria 4.0 e a cadeia de fornecimento

"The digitization of the supply chain enables companies to address the new requirements of customers, the challenges on the supply side, and the remaining expectations in efficiency improvement. Digitization leads to a Supply Chain 4.0, which becomes …Imagem e trechos retirados de "Supply Chain 4.0 in consumer goods"

- … faster. New approaches to product distribution can reduce the delivery time of fast runners to few hours. ...

- … more flexible. Supply Chain 4.0’s ad hoc, real-time planning allows companies to respond flexibly to changes in demand or supply, minimizing planning cycles and frozen periods. ...

- … more granular. With customers looking for more and more individualization in the products they buy, companies must manage demand at a much more granular level, through techniques such as microsegmentation, mass customization, and more-sophisticated scheduling practices. ...

- … more accurate. Next-generation performance management systems provide real-time, end-to-end transparency throughout the supply chain. ...

- … more efficient. The automation of both physical tasks and planning boosts supply-chain efficiency."

Analogias interessantes

Nesta interessante apresentação, "14 Tips to Entrepreneurs to start the Right Stuff", encontrei este slide:

Que logo relacionei com o mapa da estratégia e o balanced scorecard:

Que logo relacionei com o mapa da estratégia e o balanced scorecard:

"Sequencing markets correctly is underrated"

“Sequencing markets correctly is underrated, and it takes discipline to expand gradually. The most successful companies make the core progression—to first dominate a specific niche and then scale to adjacent markets—a part of their founding narrative.” – Peter Thiel, Zero to OneTrecho retirado de "Modeling Your Total Addressable Market"

terça-feira, abril 25, 2017

Curiosidade do dia

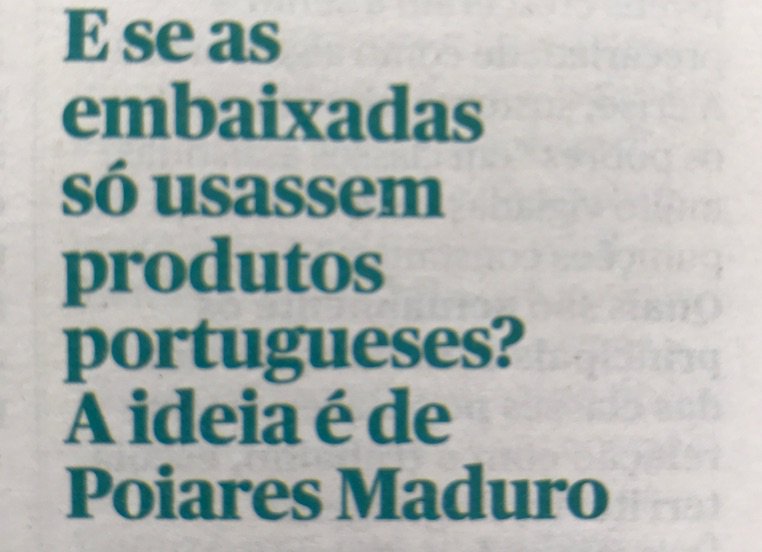

Gente sem noção:

Estou a imaginar batatas de Chaves a um custo interessante em Jacarta...

Estou a imaginar morangos de Gaia a um custo espectacular em Camberra...

Estou a imaginar tomate ribatejano a um custo de amigo em Joanesburgo...

Gente sem skin in the game farta-de fazer propostas deste calibre, é imaginar a mesma bitola na Saúde, na Educação, na Justiça, na Agricultura, ...

Estou a imaginar batatas de Chaves a um custo interessante em Jacarta...

Estou a imaginar morangos de Gaia a um custo espectacular em Camberra...

Estou a imaginar tomate ribatejano a um custo de amigo em Joanesburgo...

Gente sem skin in the game farta-de fazer propostas deste calibre, é imaginar a mesma bitola na Saúde, na Educação, na Justiça, na Agricultura, ...

Estratégia, essa neblina

"According to research recently cited in the Harvard Business Review, [Moi ici: Pena que não a identifiquem] only 29 percent of employees of high-performing companies with publicly stated strategies could correctly identify their company's strategy out of six choices. As such, a majority of employees are not in a position to link their personal work initiatives and decision-making to the desired direction of the firm.' Think of it like this: a racing scull with rowers each choosing their own pace or direction would not win many races.

...

Discouragingly, this problem exists between senior executives and their boards as well. Of the 772 directors surveyed by McKinsey in 2013, a mere 34 percent agreed that the boards on which they served fully comprehended their companies' strategies. Only 22 percent said their boards were completely aware of the ways their firms created value, and just 16 percent claimed that their boards had a strong understanding of the dynamics of their firms' industries."

Para fazer uns cortes epistemológicos

"The number of patent applications filed by emerging market countries has overtakenthose filed by the developed world for the first time.Trecho retirado de "Emerging markets file more patents than the west"

The 12 leading EM nations applied for 1.49m patents in 2015, outstripping the 1.48m in developed market countries, according to figures from the World Intellectual Property Organisation, collated by Comgest, a Paris-based asset manager, as the first chart shows.

The figures are a far cry from 2004, when the 12 emerging market countries, which account for the vast majority of developing world filings, made just 372,000 applications, 29 per cent of the 1.3m made by the advanced world.

“This signals the dawn of a new age of innovation as EM economies start to shake off their image as purely centres for low-cost manufacturing for companies in developed markets,” said Emil Wolter, co-head of Comgest’s global emerging markets team."

"Da 'comoditização' para os artesãos - subir na escala de valor "

Agora aqui está um bom exemplo sobre o que escrevemos e defendemos acerca do caminho a seguir pelas PME para lidar com a China e com o advento de Mongo.Da 'comoditização' para os artesãos - subir na escala de valor pela diferenciação c/c @ccz1 https://t.co/PXIFg7f2EU— Jorge Cangaia (@jcangaia) April 24, 2017

"Com menos de uma dezena de funcionários, e com uma carteira de fornecimento que assenta no trabalho de artesãos externos, a UrbanMint, a empresa que detém as marcas Munna e Ginger & Jagger, é ainda o protótipo representativo do sector mobiliário português.Recordar o que escrevi ao longo dos anos quando não era cool falar do mobiliário (ou do calçado, ou do têxtil, ou do ...):

.

A empregar cerca de 30.000 trabalhadores, o sector é muito disperso e de dimensão quase familiar. Das 4466 empresas registadas no final de 2015, 3837 tinham menos de dez trabalhadores; cerca de 600 empregava, entre 10 e 249 pessoas e apenas quatro empresas é que não caberiam na definição de pequena e média empresa, por terem mais de 250 trabalhadores.

...

reconhece ao sector do mobiliário um peso crescente nas exportações de Portugal: passou de uma quota de 1,67% em 2012, para os 2,08% atingidos no final de 2016.

.

Apesar de ser um sector com um tecido produtivo muito disperso e atomizado, exportou cerca de 66% da sua produção, que em 2016 atingiu um volume de negócios de 1586 milhões de euros.

...

o sector enfrentou uma reestruturação do seu tecido produtivo, e uma análise ao rácio entre empresas produtoras e exportadoras mostra alterações relevantes. Se em 2011 existiam 5252 empresas a produzir mobiliário em Portugal, apenas 2500 é que eram consideradas exportadoras.

.

Em 2016 o tecido produtivo encolheu (desapareceram 806 empresas), mas aumentou aquelas que se dedicam à exportação: das 4466 empresas registadas, 3187 são exportadoras."

- O exemplo do mobiliário (parte I), (parte II), (parte III), (parte IV) e (parte V)

- Trabalhar para aumentar os preços

- Campeões escondidos versus campeões nacionais

- ""Às vezes somos alcunhados de loucos, uns miúdos que fazem umas asneiras."

- Autópsia de uma estratégia (parte I e parte II)

Empresas mais pequenas, menos dependentes da quantidade pura e dura.

BTW, e encadear isto nos postais recentes sobre os artesãos? (aqui e aqui , por exemplo)

Trechos retirados de "Micro empresas de mobiliário contribuem para 2% das exportações nacionais"

A ascensão do artesão e da arte na produção (parte II)

Ontem publicámos "A ascensão do artesão e da arte na produção". Depois, ao princípio da tarde fui brindado com:

Entretanto, ao fim da tarde de ontem ainda deparei com:

— highalpha (@veryhighalpha) April 24, 2017

Entretanto, ao fim da tarde de ontem ainda deparei com:

- Barbearias. “Para se ser barbeiro tem de se ter amor à arte”

- Este pão antigo é fresco e só tem cereais portugueses

- The Artisanal Economies, Entry # 1: the Sofi interview (muito bom, a ler na íntegra)

"Several things happen in this conversation but one of them is that we begin to see into the history, we might even say the “intentions,” of the objects on the shelves. We begin to see that these things come from someone, that they were crafted to a purpose that begins with “coffee mug” and then scales up to include the lifestyle, the community, the economy, the culture that might be loosely designed artisanal.

Ah, now we get it. That’s why things cost more. That object on the shelf of Wal-mart doesn’t have a story. It was made by a stranger in a factory in Chengdu, shipped across an ocean, and banged around in the distribution system until it just happened to roll to a stop here on a shelf. It doesn’t mean very much because capitalism was so busy giving it value, it forgot to give it meaning.

And that’s what Sofi is for, to gently help you see what the mug means. Yes, we can buy a cheaper mug somewhere. But ,by this standard, cheaper doesn’t feel better, it feels poorer. As if everyone in the production – consumption chain as been diminished by the effort.

So, we could say, if we were rushing to conclusions (and that is what we do here), that retail is not merely the last moment in the distribution chain. It completes the meaning making process. And more to the point, it helps consumers understand and grasp the “artisanal premium” they are required to pay. It’s always true to say “we get what we pay for.” The very point of Olives and Grace is to help us see what we’re paying for. It helps solve the problem of cheap food."

segunda-feira, abril 24, 2017

"não saem da cepa torta"

Ler este texto "What’s the Second Job of a Startup CEO?":

"A CEO’s first job is to build a product users love; the second job is to build a company to maximize the opportunity that the product has surfaced; and the third is to harvest the profits of the core business to invest in transformative new product ideas.Lê-lo e pensar nas muitas PME que não saem da cepa torta porque, sem o percepcionarem, estão prisioneiras do tecto de vidro. Talvez por causa desta dificuldade em passar do perfil da fase 1 para o perfil da fase 2.

...

As a Phase 2 CEO, you need to transition from “Doer-in-Chief” to “Company-Builder-in-Chief.” This is how you scale as a CEO, and CEO scaling is the first step in company-building. For most founders, this is very difficult. When you’ve been a successful Doer-in-Chief, it’s hard to stop. It’s hard to stop coding, designing product specs, and interacting with customers on a daily basis. It’s hard to stop answering support tickets, doing all the product demos, and debugging the latest build. It’s even hard to delegate the random and sometimes menial tasks that you’ve accumulated over the years because they were “no one’s job.” But you have to stop doing all of these things so that you can safeguard your time for high leverage tasks that only CEOs can do."

Produtividade para o século XXI (parte III)

Parte I e parte II.

Trechos retirados de "Service productivity Towards a conceptualization of the transformation of inputs into economic results in services"

"From the firm’s point of view, managing productivity is a matter of the management of the economic results. By increasing productivity, the economic results are assumed to improve. As long as this indeed is the case, managing productivity makes sense. However, if improved productivity does not lead to better economic results, increasing productivity does not make sense.

The traditional productivity concept has been developed for manufacturers of physical goods as a production efficiency concept. Existing productivity models and produc- tivity measurement instruments are also geared to the context of manufacturers. Moreover, they are based on assumptions that production and consumption are separate processes and that customers do not participate in the production process. [Moi ici: E a co-criação?] Although following market research customer preferences are incorporated into the manufactured products, traditional production systems in manufacturing are closed systems, and traditional productivity models and measurement instruments are developed for such systems. In such closed systems where customers are not directly involved in design and production processes, these assumptions make perfect sense, of course. In service contexts, where the service process (or service production process) to a large extent is an open system, they create confusion, lead to misleading measurements and may guide decision making astray.

...

A totally different approach to productivity has to be taken to obtain a global measure of how well a service provider uses resources to create outputs in the form of acceptable perceived quality and customer value. This is the case for most high-tech and high-touch services."

Trechos retirados de "Service productivity Towards a conceptualization of the transformation of inputs into economic results in services"

"The habits we groove become who we are, one minute at a time"

"The difference between who you are now and who you were five years ago is largely due to how you've spent your time along the way.Também por isto, a minha fixação em "começar pelo fim". Visualizar um ponto de chegada, lançar uma corda ninja e começar a convergir, sem magia, sem estalidos de dedos, um passo de cada vez.

...

The habits we groove become who we are, one minute at a time. A small thing, repeated, is not a small thing.

[And the same thing is true for brands, organizations and movements.]"

E destaco ainda:

"If you spend a little bit more time each day whining or feeling ashamed, that behavior will become part of you."Como não recordar os cortisol-addicted.

E a sua empresa? Qual é a cultura que é alimentada todos os dias?

Trechos retirados de "Who are we seeking to become?"

A ascensão do artesão e da arte na produção

"Craft skills have been embraced by the fashion world in recent years as the boundaries between art and fashion blur. Today, artists collaborate on designer collections, while fashion brands sponsor art fairs. Increasingly, labels are exploring artisanal craft through clothesEm alinhamento completo com o que escrevemos aqui há milhares de anos sobre Mongo (Estranhistão), sobre a importância da arte na democratização da produção contra o vómito industrial, sobre a ascensão do artesão. E a reforçar o que penso será o futuro da impressão 3D, não na casa de cada um mas no artesão dos ciber-bairros que frequentaremos.

...

And designers are creating artisanal-minded homeware

...

the old notion of faceless, mechanised luxury is dead. He believes fashion brands today must be borne out of craftsmanship skills that recognise the value of the human hand. “Craft is our bread and butter at Loewe,” says the 32-year-old designer."

- Há sempre uma alternativa (parte II) (Maio de 2011)

"Sildávia!!!

.

Não arrisquei escrever Albânia como símbolo de país pobre e atrasado, porque desconfio que nos hão-de ultrapassar enquanto tivermos estas políticas chavistas-de-gravata-à-europeia.

.

Qual a alternativa?

.

Ainda e sempre a ARTE!!!

.

Mentes algemadas olham para a fotografia da realidade e desesperam... e enterram a cabeça entre as mãos e prolongam a espiral viciada que há-de levar ao fim "at some stage".

.

Quem aposta na arte, faz como os artistas, em vez de ver nos obstáculos algo a derrubar, tenta tirar partido da situação, procurando uma pedra angular de onde possa começar a construir uma diferença.

.

Se o pintor usa uma tela, usa pincéis, tintas e luz para criar a obra de arte, o que as empresas devem fazer é reunir o equivalente a esses materiais:"

- Não é passado, é futuro (Setembro de 2015)

- H2H (Fevereiro de 2017)

- Acerca do futuro da impressão 3D (parte II) (Fevereiro de 2017)

E recordo este slide daqui (12:36):

Trechos retirados de "Why fashion is turning to craft"

Já depois de escrever o texto acima encontrei "The Crafting Organisation":

Já depois de escrever o texto acima encontrei "The Crafting Organisation":

"What if we were to evolve craftsmanship as a true practice for all of us? What if we talked about the ‘Crafting Organisation’, a business operating from a position of deep self-belief, always in beta, curious and confident to face the future? The Crafting Organisation is elegant in everything it does. Seeing the potential of creating beautiful outcomes in the most unusual ways.

...

Is this not a more beautiful way to describe business which not only embraces our humanity, but celebrates it? Tim Smit founder of the Eden Project likes to say that beauty will be the most important word we use over the next 15 years. I would also argue that craft is not far behind."

domingo, abril 23, 2017

Curiosidade do dia

"For the 55 million Americans who make their living as freelance workers, tax day is more than just a headache. It’s an annual fleecing.Por cá é a mesma coisa, ou pior.

.

Freelancers now constitute a third of the American workforce, and over the past decade, 94% of new jobs added to the U.S. economy were created in the so-called gig economy. Yet freelancers must retrofit themselves into an archaic system designed for the industrial era, one that taxes independent workers disproportionately even as they benefit less from the social safety net.

...

But the real rub is that freelancers are paying taxes toward a social safety net to which they have little access. Many pay both employer and employee contributions to Social Security, yet are ineligible for unemployment benefits and workers’ compensation.

.

Freelancers who make just enough to receive little or no subsidy for their health insurance are arguably the most penalized. Though they usually live in expensive urban areas, they may bring in only $35,000 or $40,000 a year, and are often subject to unpredictable swings in income that make them highly susceptible to debt."

Trechos retirados de "Why tax day is a nightmare for freelancers"

"Entretanto, no retalho físico a mortandade continua" (parte II)

Parte I.

Trechos retirados de "Nearly Ten Thousand Stores Could Close This Year As Retail ‘Bubble’ Bursts"

"In the first four months of 2017, retailers have announced a total of 2,880 store closures, and some financial services firm Credit Suisse predicts that around 8,600 stores will close this year. That’s more than closed during the financial crisis in 2008, and twice the number that closed in 2016.A sua PME está a par disto? Tem um plano B?

...

The convenience of online shopping is a big reason for declining store sales, but retailers also misread the markets in the past few years, opening more stores than their businesses could sustain."

Trechos retirados de "Nearly Ten Thousand Stores Could Close This Year As Retail ‘Bubble’ Bursts"

Produtividade para o século XXI (parte II)

Parte I.

Continua.

"What is meant by productivity?The productivity of an operation is related to how effectively input resources in a process (manufacturing process, service process) are transformed into economic results for the service provider and value for its customers. As a consequence of high productivity, a favorable profit impact should be achieved for the service provider and good value created for the customers. This productivity concept is normally stated in a simplified form as the effective transformation of input resources into outputs, the quality of which is unchanged (a constant quality assumption). In services, especially for two reasons, it has turned out to be difficult to use such a productivity concept. First of all, it is seldom possible to clearly define ‘‘one unit of a service.’’ Because of this, productivity measurements in services are normally only partial measurements, such as how many customers are served per period by one waiter in a restaurant or how many phone calls are dispatched by one employee in a call centre.Pois, e se tudo for serviço?

...

However, cost-cutting changes in the resources used may equally well have the opposite effect. They may create a servicescape and service process where the perceived quality deteriorates, and customers become dissatisfied with the value they get and start to look for other options. In that case, as less value for customers than before is created in the service process, the service provider’s revenue-generating capability declines. Using a traditional productivity concept, Anderson et al. studied the relationship between customer satisfaction, productivity and profits in manufacturing and service industries, respectively. [Moi ici: É pensar no hara-kiri em curso dos bancos, por exemplo] They found that in services a high level of either customer satisfaction with quality or productivity measured in a traditional way was associated with higher profit, but not both simultaneously. In manufacturing higher customer satisfaction and productivity levels were found to be associated with improved profits.

In manufacturing, productivity is a concept related to production efficiency. However, the problem with being an effective service organization is that productivity and perceived quality are inseparable phenomena. Improving productivity may have a neutral or positive impact on quality, but equally well it may reduce perceived quality. If the latter happens, satisfaction with quality declines, customer value goes down, and the risk that the firm will lose customers increases. Revenues go down and this may have a negative effect on the economic result, in spite of the fact that costs may have been reduced as well."

Continua.

"Push the envelope in a stable market, but focus on efficiency in an uncertain one"

Esta semana ao ler "If You're in a Dogfight, Become a Cat!: Strategies for Long-Term Growth" achei interessante o autor reforçar esta mensagem:

Sempre que a Apple foi first-mover deu barraca.

Ontem li ouvi este interessante artigo "Sometimes, Less Innovation Is Better":

Sempre que a Apple foi first-mover deu barraca.

Ontem li ouvi este interessante artigo "Sometimes, Less Innovation Is Better":

"in certain situations, more innovation led to poorer performance. Their conclusion: sometimes, less innovation is better.

...

A time of turbulence is mainly defined by three factors. One: the magnitude of change. How much is the industry changing compared with other times? Two: the frequency of change. How often are changes coming at you? And three: predictability. Can you see changes coming? The most important of these is predictability. You can absorb almost any change you can see coming. But if predictability is low, and either frequency is high or magnitude is large, you should scale back innovation until things get more stable. Certainly if all three are working against you, you should innovate less.

...

anytime exogenous forces or shocks to the system happen in their markets—for instance, a new set of regulations or a major political shift—innovators tend to lose. Sudden changes create instability that seem to beg for innovation, but it’s probably better to sit tight and focus on execution and efficiency.

...

Push the envelope in a stable market, but focus on efficiency in an uncertain one."

Almas gémeas!

Ontem de manhã o @joaops chamou-me a atenção para este texto de Nassim Taleb "On Interventionistas and their Mental Defects". Quando ao final da manhã, durante uma caminhada, o ouvia não pude deixar de ficar surpreendido.

Primeiro, Nassim Taleb conta a história de Anteu, muito forte quando estava em contacto com o chão (ou a Terra, a sua mãe), e muito fraco se fosse levantado ao ar:

Segundo, Nassim Taleb martela nos neocons usando aquilo que há anos chamo aqui de amadores a jogar bilhar:

Primeiro, Nassim Taleb conta a história de Anteu, muito forte quando estava em contacto com o chão (ou a Terra, a sua mãe), e muito fraco se fosse levantado ao ar:

"like Antaeus, you cannot separate knowledge from contact with the ground. Actually, you cannot separate anything from contact with the ground. And the contact with the real world is done via skin in the game –have an exposure to the real world, and pay a price for its consequences, good or bad. Most things that we believe were “invented” by universities were actually discovered by tinkering and later legitimized by some type of formalization."Não pude deixar de relacionar esta estória de Anteu com o tema das sanitas da passada sexta-feira.

Segundo, Nassim Taleb martela nos neocons usando aquilo que há anos chamo aqui de amadores a jogar bilhar:

"O que acontece é que os políticos tomam as decisões, como eu jogo bilhar… quando jogo bilhar só consigo jogar a pensar naquela jogada. Um profissional do bilhar quando pensa na jogada que vai fazer, equaciona e prepara já o terreno para as jogadas seguintes."Versus:

"these interventionistas not only lack practical sense, and never learn from history, but they even make mistakes at the pure reasoning level, which they drown in some form of semi-abstract discourse. The first flaw is that they are incapable in thinking in second steps and unaware of the need for it –and about every peasant in Mongolia, every waiter in Madrid, and every car service operator in San Francisco knows that real life happens to have second, third, fourth, nth steps."Terceiro, algo que me fez lembrar o que aprendi com Deming com o jogo/experiência do funil:

"And when a blow up happens, they invoke uncertainty, something called a Black Swan, not realizing that one should not mess with a system if the results are fraught with uncertainty, or, more generally, avoid engaging in an action if you have no idea of the outcomes."Almas gémeas!

sábado, abril 22, 2017

Curiosidade do dia

Há dias tivemos:

Não admira que tenhamos "Economia paliativa":

Não admira que tenhamos "Economia paliativa":

"Apesar de tudo isto, persiste o mesmo problema que condenou o feito de Teixeira dos Santos e, mais cedo ou mais tarde, destruirá o de 2016: os cortes e apertos orçamentais foram importantes, e difíceis de conseguir, mas nunca passaram de ajustamentos superficiais, longe do cerne estrutural da dificuldade. A qual, em certas dimensões, está pior do que em 2008. Em ambos os casos, a política é meramente "paliativa", usando analgésicos e esteroides para conseguir exames positivos, sem extirpar o cancro que rói o doente. De novo, iremos de vitória em vitória até à derrota final."

Para assentar ideias

Relativamente a esta imagem

e ao uso do termo "realidade aumentada" em "Do you know what your strategy is?", assentemos algumas ideias.

Existe uma realidade. A moça da figura por trás daqueles adereços virtuais existe mesmo. Só que com a ajuda de uma aplicação num smartphone ela modificou-se e criou uma realidade aumentada.

A minha ideia é pegar nisso e aplicar ao dia a dia. Todos nós, fruto da nossa experiência de vida em curso, vamos como que criando e usando aplicações que influenciam a nossa capacidade de perceber o mundo que nos rodeia. Essas aplicações são tão boas que nem nos apercebemos que elas existem e, por isso, pensamos que os outros humanos vêem a mesma realidade que nós. Só que os outros, porque têm outro "cadastro de vida" têm outras aplicações a funcionar. Assim, enquanto eu vejo a moça da direita da figura, estou a comentar a sua aparência com alguém que olha e vê a moça do centro da figura. Pensamos ambos que estamos a falar da mesma moça mas estamos a falar de uma moça diferente apesar de ser a mesma. Agora imaginem que em vez da moça estamos a falar de produtividade, défice, austeridade... estou a lembrar-me duma personagem do Twitter, super-dragão deste governo, em sentido figurado; que defende, sem se rir, que acabou a austeridade.

e ao uso do termo "realidade aumentada" em "Do you know what your strategy is?", assentemos algumas ideias.

Existe uma realidade. A moça da figura por trás daqueles adereços virtuais existe mesmo. Só que com a ajuda de uma aplicação num smartphone ela modificou-se e criou uma realidade aumentada.

A minha ideia é pegar nisso e aplicar ao dia a dia. Todos nós, fruto da nossa experiência de vida em curso, vamos como que criando e usando aplicações que influenciam a nossa capacidade de perceber o mundo que nos rodeia. Essas aplicações são tão boas que nem nos apercebemos que elas existem e, por isso, pensamos que os outros humanos vêem a mesma realidade que nós. Só que os outros, porque têm outro "cadastro de vida" têm outras aplicações a funcionar. Assim, enquanto eu vejo a moça da direita da figura, estou a comentar a sua aparência com alguém que olha e vê a moça do centro da figura. Pensamos ambos que estamos a falar da mesma moça mas estamos a falar de uma moça diferente apesar de ser a mesma. Agora imaginem que em vez da moça estamos a falar de produtividade, défice, austeridade... estou a lembrar-me duma personagem do Twitter, super-dragão deste governo, em sentido figurado; que defende, sem se rir, que acabou a austeridade.

"making customers better makes better customers"

Um texto que gostava que fosse lido por alguns empresários com que trabalhei ao longo dos anos e que tiveram muita dificuldade em abandonar o ADN pré-China. Tinham a estratégia preço tão bem entranhada e ela já lhes era tão instintiva que sentiram muita dificuldade na transição que tiveram de fazer para reordenar as suas empresas para um mundo onde não podiam ser os chineses europeus antes de haver China.

A tentação é continuar a aumentar o que fazemos, quando talvez haja tanto ou mais valor em acompanhar o "crescimento do cliente, a sua evolução, o seu progresso" (recordar o JTBD) e ir alterando/acrescentando oferta em função dessa evolução.

"making customers better makes better customers. While delighting customers and meeting their needs remain important, they’re not enough for a lifetime. Innovation must be seen as an investment in the human capital and capabilities of customers."O primeiro pensamento que lhes vem à cabeça, a reacção instintiva, é a que critico no texto da subdirectora do DN em "TRETA!"

A tentação é continuar a aumentar o que fazemos, quando talvez haja tanto ou mais valor em acompanhar o "crescimento do cliente, a sua evolução, o seu progresso" (recordar o JTBD) e ir alterando/acrescentando oferta em função dessa evolução.

Produtividade para o século XXI (parte I)

Li este artigo, "Service productivity Towards a conceptualization of the transformation of inputs into economic results in services", em Guimarães, à porta de uma fábrica, em Agosto de 2011.

Na altura fiquei contente por encontrar, finalmente, corroboração alheia para as ideias que defendia e aplicava no meu trabalho e que usava para explicar a evolução da economia transaccionável do país.

Primeira: pode parecer, segundo estes trechos, que se pode manter a metodologia de medição da produtividade da produção de produtos e só se precisa de mudar quando estivermos a falar de serviços.

Só que depois de ter descoberto a service-dominant logic e de ter agarrado a ideia de Dave Gray, por exemplo em "Tudo é serviço - Uma história sobre como Mongo se torna inevitável": Tudo é serviço. E os produtos não passam de um avatar dum serviço.

Segunda: a minha clássica luta para medir a produtividade não pela quantidade pura e dura mas pela margem alcançada.

Continua.

Na altura fiquei contente por encontrar, finalmente, corroboração alheia para as ideias que defendia e aplicava no meu trabalho e que usava para explicar a evolução da economia transaccionável do país.

"Productivity is a concept used to manage production efficiency in manufacturing. In services, for example, due to the nature of service production processes as open systems and the participation of customers in those processes, such a productivity concept is too limited. Normally, only measure- ments of partial productivity are obtained and no control of the global productivity and its effects on the economic results of the service provider and on customer value is exercised.Só nesta introdução há logo duas mensagens que considero importantes.

...

In the present article, the problems of using a traditional productivity concept in services are discussed and a productivity concept which is geared towards the nature of services and service production processes is developed.

...

It is concluded that measuring productivity as an efficiency issue may be less appropriate in services and that it for measurement purposes may be more appropriate to view service productivity as a profitability concept."

Primeira: pode parecer, segundo estes trechos, que se pode manter a metodologia de medição da produtividade da produção de produtos e só se precisa de mudar quando estivermos a falar de serviços.

Só que depois de ter descoberto a service-dominant logic e de ter agarrado a ideia de Dave Gray, por exemplo em "Tudo é serviço - Uma história sobre como Mongo se torna inevitável": Tudo é serviço. E os produtos não passam de um avatar dum serviço.

Segunda: a minha clássica luta para medir a produtividade não pela quantidade pura e dura mas pela margem alcançada.

Continua.

As 5 questões

"Great strategies answer five critical questions (“the strategic five”) in ways that are unique to your company: (1) What business or businesses should your company be in? (2) How should you add value to your businesses? (3) Who should be the target customers for your businesses? (4) What should be your value propositions to those target customers? (5) What capabilities should differentiate your ability to add value to your businesses and deliver their value propositions?O mesmo se passa com a ISO 9001. Ela não só não fornece estas respostas como nem chega a colocar estas questões. A grande vantagem do balanced scorecard é ajudar a lidar com pelo menos quatro daquelas perguntas de forma muito pão pão queijo queijo.

.

You won’t find the answers to these questions in most strategy concepts."

"Instead of asking “Should we adopt TQM?” leaders should ask “How can TQM improve our answers to the strategic five?” A company such as Danaher, which actively seeks to add operational value to each business in its portfolio, would have an answer very different from those of Berkshire Hathaway or IKEA, because the three companies have different strategies for adding value to their businesses. Furthermore, because these companies can answer each of the strategic five questions with precision, they can be disciplined about whether they use TQM and, if so, how. In other words, their strategies are not just unique and specific, but also complete. This enables them to get the most out of strategy concepts without becoming hostage to them."[Moi ici: Como não recordar a diferença entre a caneta e o escrevedor]Por isso, há uns anos mudei o nome deste blogue. Gosto de trabalhar com o balanced scorecard. Se pudesse só trabalhava sobre o balanced scorecard. No entanto, não passa de uma ferramenta, mais importante é perceber ao serviço de que projecto está.

Trechos retirados de "Why Popular Strategies Always Fade"

sexta-feira, abril 21, 2017

Mais sanitas - Curiosidade do dia

Esta semana num almoço com um empresário, ele fez-me ver a importância de uma reunião que tinha tida nessa manhã com os trabalhadores por causa de problemas com as sanitas do balneário fabril.

- Sanitas há em todo o lado. Todos em casa temos uma ou mais.

O problema com as sanitas foi visto por ele como um bom território para exercitar a capacidade crítica dos seus trabalhadores. Ele quer que eles sejam actores cada vez mais críticos, cada vez mais humanos na acepção mais nobre da palavra, cada vez mais capazes de não seguirem as ordens que chegam ao chão de fábrica porque têm uma alternativa melhor.

Como é que se atinge esse nirvana? Não é com um estalido dos dedos! É uma caminhada longa.

Lembrei-me disto ontem ao ouvir as intervenções numa tertúlia nocturna. E recordei o que escrevi recentemente sobre o bispo Berkeley. Penso que foi ele o criador da frase "Se uma árvore cair no meio de uma floresta e não estiver lá ninguém para ouvir, a queda não produzirá som".

O que a vida cada vez mais me leva a concluir é que a realidade existe. No entanto, nós humanos nunca vemos a realidade. Nós só conseguimos percepcionar uma espécie de realidade aumentada

E o que percepcionamos está fortemente influenciado pelas experiências de vida que nos vão acontecendo e que nos vão construindo permanentemente.

O empresário lá de cima, há meses que criou um clube leitura na empresa porque, explicou-me então:

- Como posso aspirar a ter gente com espírito crítico se as pessoas não lêem.

E depois, o desafio seguinte foi libertar as pessoas para a possibilidade de criticar, de não concordar com o que estava escrito.

- Sabe Carlos, para quem não está habituado a ler o que está escrito tem uma aura de sagrado, de não criticável.

O empresário usou a sanita. Eu costumo falar de um programa de televisão que nunca vi com a mesma intenção: "Benvindo a Beirais"

Ou estas Curiosidades do dia (esta e esta)

E cansado, não sou coruja, não tive espírito para me levantar e dizer naquela tertúlia o que tento agora ao almoço transmitir com estas linhas.

Talvez precisemos todos de falar de mais sanitas, de recorrermos menos a abstracções e mais a referências a coisas que as pessoas percepcionam melhor e relacionam com a sua vida... como o filme da "comprativa" que queria apoderar-se da enxada do trabalhador e nisso ele não foi.

BTW, que melhor exemplo:

Uma banda desenhada, um sketch e uma plataforma de divulgação seria muito mais real para os tais tansos que arriscam:

- Sanitas há em todo o lado. Todos em casa temos uma ou mais.

O problema com as sanitas foi visto por ele como um bom território para exercitar a capacidade crítica dos seus trabalhadores. Ele quer que eles sejam actores cada vez mais críticos, cada vez mais humanos na acepção mais nobre da palavra, cada vez mais capazes de não seguirem as ordens que chegam ao chão de fábrica porque têm uma alternativa melhor.

Como é que se atinge esse nirvana? Não é com um estalido dos dedos! É uma caminhada longa.

Lembrei-me disto ontem ao ouvir as intervenções numa tertúlia nocturna. E recordei o que escrevi recentemente sobre o bispo Berkeley. Penso que foi ele o criador da frase "Se uma árvore cair no meio de uma floresta e não estiver lá ninguém para ouvir, a queda não produzirá som".

O que a vida cada vez mais me leva a concluir é que a realidade existe. No entanto, nós humanos nunca vemos a realidade. Nós só conseguimos percepcionar uma espécie de realidade aumentada

E o que percepcionamos está fortemente influenciado pelas experiências de vida que nos vão acontecendo e que nos vão construindo permanentemente.

O empresário lá de cima, há meses que criou um clube leitura na empresa porque, explicou-me então:

- Como posso aspirar a ter gente com espírito crítico se as pessoas não lêem.

E depois, o desafio seguinte foi libertar as pessoas para a possibilidade de criticar, de não concordar com o que estava escrito.

- Sabe Carlos, para quem não está habituado a ler o que está escrito tem uma aura de sagrado, de não criticável.

O empresário usou a sanita. Eu costumo falar de um programa de televisão que nunca vi com a mesma intenção: "Benvindo a Beirais"

Q pena ñ se fazer um "Benvindo a Beirais" passado no day-after da saída de Portugal do euro. A avalanche de "Marmites" seria linda— Carlos P da Cruz (@ccz1) October 13, 2016

Ou estas Curiosidades do dia (esta e esta)

E cansado, não sou coruja, não tive espírito para me levantar e dizer naquela tertúlia o que tento agora ao almoço transmitir com estas linhas.

Talvez precisemos todos de falar de mais sanitas, de recorrermos menos a abstracções e mais a referências a coisas que as pessoas percepcionam melhor e relacionam com a sua vida... como o filme da "comprativa" que queria apoderar-se da enxada do trabalhador e nisso ele não foi.

BTW, que melhor exemplo:

Conversa que a maioria das pessoas não entende...Fala em linguagem q as pessoas entendam. Coisas concretas não fales em abstracções https://t.co/DSeGWPUkQ0— Carlos P da Cruz (@ccz1) April 20, 2017

Uma banda desenhada, um sketch e uma plataforma de divulgação seria muito mais real para os tais tansos que arriscam:

"Qualquer reestruturação da dívida a envolver um “haircut” afecta os aforradores portugueses, que em Dezembro detinham 41% do seu montante total."Imaginem um sketch em que os super-vilões Jerónimo & Martins num comício defendem a reestruturação da dívida e são aplaudidos por todos. Então, surge uma espécie de Batman e pergunta aos presentes quantos são aforradores de dívida portuguesa. E muitas pessoas levantam a mão. Então, com uma paciência andragógica, ao estilo de um Cristo e as suas parábolas, ou de um Sócrates (grego) e as suas perguntas, leva as pessoas a perceberem as consequências para a sua carteira do que estavam a apoiar. No fim, os super-vilões carregados de alcatrão e penas são observados por um Lucky Luke.

Subscrever:

Mensagens (Atom)