"Growth requires:Trechos retirados de "Where the Path Ends and the Forest Begins"

.

Not knowing.There’s nowhere to grow if you already know.

Making mistakes. Success solidifies who you are. Failure changes you.

Feeling like an impostor. You have to try on new behaviors to ignite growth.

...

Most leaders want to grow, but not everyone wants to step from the known into the unknown.

.

Growth occurs where the path ends and the forest begins. You can’t grow and cling to the comfort of the status quo."

quarta-feira, maio 03, 2017

"You can’t grow and cling to the comfort of the status quo"

"algo mudou mesmo nos últimos anos"

Basta unir os pontos:

Subindo na escala de abstracção, para perceber que algo mudou mesmo nos últimos anos:

(1) - Os azeites de ouro de Portugal

(2) - Vinhos portugueses brindam aos EUA

(3) - Líder das exportações mostra-se na maior feira industrial do mundo

Subindo na escala de abstracção, para perceber que algo mudou mesmo nos últimos anos:

"Foram 27 os azeites portugueses distinguidos com “medalha” de ouro na edição de 2017 da Competição Internacional de Azeite de Nova Iorque. Houve ainda 11 distinções para Portugal na categoria prata, no concurso em que participam produtores de dez países." (1) [Moi ici: Não basta produzir, é preciso subir na escala de valor]E a reforçar o "Portugal faz bem":

"Desde 2011, o investimento da Viniportugal nos EUA rondou os €9 milhões. Portugal somou prémios e críticas positivas, ganhou notoriedade, posicionou-se no segmento médio, nos vinhos vendidos ao consumidor entre os 8 e os 11 dólares (€7,58 a €9,47) e “começou a vencer a batalha da visibilidade nas prateleiras dos supermercados, o que permite começar a apostar em ações de promoção destinadas ao consumidor final”, refere.E a acrescentar ao calçado, ao têxtil, à cerâmica, por exemplo:

.

O que fez a diferença no destino “terá sido o reconhecimento das revistas da especialidade”, mas a base de tudo esteve deste lado do Atlântico, “onde fazemos bons vinhos, diferentes e com excelente relação qualidade/preço”, sublinha.

.

Na batalha de afirmação dos vinhos lusos, um dos dados a apresentar é o facto de o preço médio por litro na exportação, à saída da cave, em Portugal, bater o de Espanha por uma margem confortável de €2,62 contra €1,18." (2)

"Da fábrica da Tekon, em Aveiro, saem todos os dias sistemas de medição industrial que são utilizados, por exemplo, na área das tintas. Esta unidade de negócio da empresa de automação Bresimar nasceu em 1982 mas só depois da crise financeira de 2008 é que começou a vender para o estrangeiro." (3) [Moi ici: A propósito de expandir a zona de conforto]

(1) - Os azeites de ouro de Portugal

(2) - Vinhos portugueses brindam aos EUA

(3) - Líder das exportações mostra-se na maior feira industrial do mundo

Estranho texto graças ao newspeak

Recentemente em "Onde trabalhar?" usei esta figura:

e escrevi:

Entretanto, leio "Stop Focusing on Profitability and Go for Growth" e começo por acreditar estar perante um convite descarado ao fragilismo:

Imaginem alguém que acredita no poder da frase: "Volume is vanity, Profit is sanity" apanhar um texto em que "more growth" quer dizer uma coisa diferente do habitual e "more profit margins" quer dizer exactamente o contrário do que é costume.

BTW, recordando esta figura:

Se o custo do dinheiro baixa, baixa a necessidade de rentabilidade, reduz-se a necessidade de pureza estratégica, logo, vai aumentar a competição pelo preço mais baixo.

e escrevi:

"Infelizmente, muitas PME contentam-se em trabalhar na zona A muito mais do que na zona B"Trabalhar na zona A é trabalho honesto. No entanto, ter sucesso à custa do trabalho na zona A não é para quem quer, é para quem pode.

Entretanto, leio "Stop Focusing on Profitability and Go for Growth" e começo por acreditar estar perante um convite descarado ao fragilismo:

"In these circumstances, strategies that generate faster growth create more value for most companies than those that improve profit margins."No entanto, a continuação da leitura surpreendeu-me de outra forma. Por "strategies that generate faster growth" o autor entende tratarem-se das estratégias de subida na escala de valor. Ou seja, trabalhar na zona B. E, por "those that improve profit margins" o autor entende as abordagens obcecadas com a redução de custos, o trabalhar na zona A. Um autêntico newspeak!!!

Imaginem alguém que acredita no poder da frase: "Volume is vanity, Profit is sanity" apanhar um texto em que "more growth" quer dizer uma coisa diferente do habitual e "more profit margins" quer dizer exactamente o contrário do que é costume.

"Historically, when debt and equity costs were high, for most companies the trade-off between profitability and growth favored profitability. Accordingly, business leaders sought to improve efficiency by employing Six Sigma, process reengineering, spans and layers, and other tools."Fantástico newspeak!!! Mais lucro à custa de mais eficiência. Será que a inteligentzia americana não vê outra alternativa para aumentar os lucros que não passe pela redução dos custos unitários?

"So if companies should value growth more than margins these days, why don’t they? In our experience, companies still focus more on cutting costs than on developing and executing new growth strategies. Reuters found that total new capital expenditures and spending on R&D was less than the amount many companies devoted to share repurchases last year. Finally, in earnings call after earnings call, we hear CEOs describing one or two bets — at most — on growth, and devoting most of the time to showcasing the results of restructuring, offshoring and other cost-focused initiatives."Estranho texto este em que parte da mensagem replica o que aqui defendemos há mais de 10 anos com uma linguagem que usa com outro significado o que costumamos criticar.

BTW, recordando esta figura:

Se o custo do dinheiro baixa, baixa a necessidade de rentabilidade, reduz-se a necessidade de pureza estratégica, logo, vai aumentar a competição pelo preço mais baixo.

O renascimento

Desde 2008 que acredito que a nossa indústria agarrou o touro pelos cornos e achou (palavra usada intencionalmente) a alternativa para um renascimento que não tem parado desde então. Infelizmente, o mainstream e os media, sobretudo, preferiram, por motivos políticos, por gostarem de ver "sangue" literal ou figurado nas primeiras páginas, apostar em não ver a revolução que estava a acontecer.

BTW, mais cedo do que pensam, as nossas PME devem começar a pensar nisto:

""When we talk about American manufacturing, people mean GE and Caterpillar and Honeywell," says Greenblatt. "They are important, but they rely on the little guys for their supply chains. And this swath is going to do very well in the future."Trechos retirados de "How an Old Baltimore Steel Factory Pivoted From Bagel Baskets to Airplane Parts"

...

revitalization is already happening, in the small, 25-, 50- and 100-year-old manufacturers hanging on in Baltimore and places like it. Over the past decade these companies have emerged from hard times by ramping up technology, rethinking how to use labor, and reinventing what they make and for whom.

...

The combination of cutting-edge and older techniques is typical of small manufacturers, which can't afford to replace everything at once.[Moi ici: Uma limitação que é uma benção uma vez que obriga a focalizar muito mais] The new technologies enable production of shorter runs, ranging from one piece to 100, says Danko. That keeps companies like these competitive with much smaller orders.

...

the introduction of more high-tech goods will allow the company to begin repatriating production, ideally to additional micro-facilities--which she calls "pods"-- located close to large customers.

...

"I see a confluence of positive developments," says Greenblatt. "American manufacturing is going to have a renaissance.""[Moi ici: Como sorri ao ler este trecho. Durante a arrumação dos livros no meu novo escritório passou-me pelas mãos este livro "Manufacturing Renaissance", escrito na sequência do choque japonês em 1995 e pensei que um outro precisa de ser escrito. Até sobre a experiência industrial portuguesa. Primeiro sobre a resposta ao choque de 1986 que decapitou a nata da nossa indústria e fez-nos um concorrente temível como os chineses europeus antes de haver China. Depois, sobre a resposta ao choque chinês que matou muitas empresas e obrigou as que quiseram sobreviver e as novas a procurar novas formas de competir]

BTW, mais cedo do que pensam, as nossas PME devem começar a pensar nisto:

"The company struggles to attract young people to what at first glance looks like a legacy smokestack company. "We have been hosting tours from high school robotics leagues," says Danko. "Middle schools. Scouts. Colleges. We make parts for the Johns Hopkins University Baja team. Kids come over here and make castings for their transmissions."

.

"We'll do anything to get the word out that manufacturing is cool," says Danko. "Manufacturing is fun.""

terça-feira, maio 02, 2017

Curiosidade do dia

Qual é a 1ª Lei dos Buracos?

Quando descobrir que está num buraco, pare de cavar.

Por cá, "Dívida pública aumenta em Março para máximos de seis meses".

Nunca mais aprendemos.

Brevemente:

E sem air-bag.

Strategy is Context Sensitive

Recordar:

Acerca da velha mania dos ignorantes teimarem em querer que as PME apliquem as mesmas receitas que as empresas grandes e queridas das revistas de gestão. O que funciona para umas é veneno para as outras.

Acerca da velha mania dos ignorantes teimarem em querer que as PME apliquem as mesmas receitas que as empresas grandes e queridas das revistas de gestão. O que funciona para umas é veneno para as outras.

"Strategy is Context Sensitive Formulating the right strategy depends on the hand you've been dealt. For example, the appropriate focus for a profitable market leader should differ from the strategic imperatives of a weaker competitor struggling to survive. One way to quickly establish a company's current business context in order to guide strategic priorities is to evaluate competitive performance characteristics. Figure 6.1 depicts a simple framework to accomplish this. In this exercise, the horizontal axis measures market share relative to the market leader.

The vertical axis depicts a measure of profits relative to resources employed, which could be total assets, invested capital, or equity. This information is admittedly difficult to find for privately held companies, but rough estimates will suit the purpose. After placing each of the competitors within a given industry on this business-performance map, an individual company will find itself in one of four quadrants, each with clear implications for the appropriate strategic focus. Industry leaders are arrayed in the upper right-hand quadrant. These players enjoy the largest market share and profit levels, often with distinct advantages in image strength, distribution breadth, and economies of scale. Current examples include Apple, Nike, and Costco. The strategic priority for industry leaders should be to exploit their current marketplace advantages, while reinvesting in new products and technologies to preempt disruptive competition. At the opposite extreme, industry followers have low market shares and returns, and often this disadvantaged position is a sign of weak products, poor image, or high costs. ... For such companies, the only logical strategic response is radical repositioning in pursuit of a significantly different consumer value proposition. Incremental tweaks to a follower's extant strategy are unlikely to close the gap against industry leaders and will further consume what little time a follower may have left to survive. [Moi ici: Recordar "despedir é sempre resultado de uma maldade ou de preguiça da gestão" (parte V)] In the upper left quadrant of figure 6.1, some competitors are in the overperformer category, with relatively low market share, but high levels of profitability. This is a characteristic of niche specialists whose well-designed products appeal to a distinct consumer segment. ... Because of their extremely attractive returns, overperformers need to anticipate aggressive attacks from traditional and new competitors. Overperformers should commit to continuous product innovation to retain best-in-class performance or to a strategic exit for the benefit of shareholders. .... Some overperformers may perceive ahead of the market that their product category will face inevitable commoditization, and choose to exit at a high acquisition premium for the benefit of shareholders. Companies in the lower right quadrant are profit laggards, who suffer low profitability despite relatively high market share. The root causes can often be traced to high costs, weak products requiring steep discounts, poor product mix focused on inherently unprofitable market segments, or a combination of all of the above. ... The appropriate strategic response is often to shrink to grow, refocusing the company around defensible and profitable product categories."

Mongo é tudo menos linear

"For the perishable, every additional day in its life translates into a shorter additional life expectancy. For the nonperishable like technology, every additional day may imply a longer life expectancy." (1)Efeito Lindy:

"Lindy is a deli in New York, now a tourist trap, that proudly claims to be famous for its cheesecake, but in fact has been known for the fifty or so years of interpretation by physicists and mathematicians of the heuristic that developed there. Actors who hung out there gossiping about other actors discovered that Broadway shows that lasted, say one hundred days, had a future life expectancy of a hundred more. For those that lasted two hundred days, two hundred more. The heuristic became known as the Lindy Effect." (2)Para explicar isto:

"E-book sales plunged 17% in the UK in 2016 and 18.7% in the US over the first nine months of 2016. Sales of physical books went up significantly during the same period." (3)Mongo é tudo menos linear.

"Num momento em que gurus e futurologistas garantiam que a tecnologia ia virar do avesso a edição, que os livros digitais iam pôr fim ao papel, Vale manteve-se impassível, recusou as propostas que lhe foram feitas pelos grandes grupos, e venceu a crise, crescendo nunca menos de 5% a cada ano." (4)BTW, nesta entrevista a Francisco Vale apreciei o pensamento estratégico e o desmascarar do problema das empresas grandes sem paixão.

(1) - The surprising truth: Technology is aging in reverse

(2) - An Expert Called Lindy

(3) - Publishers say e-book sales dropped in 2016 with readers going back to physical books

(4) - Francisco Vale. "Os intelectuais estão hoje à defesa face a esta rebelião das massas"

"S-D logic needs to be informed by systems thinking"

"as presently constituted, S-D logic needs to be informed by systems thinking. This means more than just acknowledging interconnectedness. It requires a profound ontological shift in how we see the subject matter of science. As Capra and Luisi (2014) point out, it requires a shift in perspectives from parts to wholes, from objects to relationships, from measuring to mapping, from structures to processes, and from Cartesian certainty to approximate knowledge. Thus, it differs significantly from the more mechanistic underpinnings of scientific thought that have provided its paradigmatic foundation for centuries."

Trecho retirado de "Service-dominant logic 2025"

Danos na reputação/marca

"Aon's 2107 Global Risk Management survey has revealed a host of daunting challenges driven by today’s divisive and yet interdependent environment. The report focuses on the elected Top 10 risks for detailed discussion, one of the perennial highlights:

...Como não recordar o caso recente da United Airlines, ou este outro com a Delta:

The majority of the top risks identified in the survey are nothing new to risk managers. However, a closer examination has revealed many new driving factors that are now transforming the traditional risks, adding new urgency and complexity to old challenges.

.

Take "damage to reputation" as an example. Over the past few years, while defective products, fraudulent business practices or corruption continue to be key reputation wreckers, new media technologies have greatly amplified their negative impact, making companies more vulnerable. In the age of Twitter or viral videos, damage to reputation could occur because of an inappropriate tweet by an executive, or a video by an employee complaining about sexual harassment or discrimination."

E mais este:Smh #deltaairlines kicked a passenger off because he had to pee during a 30 minute delay before takeoff 😤😤😤 pic.twitter.com/Pdf6t5fJgI— My Mixtapez (@mymixtapez) April 28, 2017

No passado estas cenas aconteciam e morriam no local. Agora podem ser amplificadas até mais não.Shocking video emerges of Delta Airlines pilot HITTING passenger... DoG https://t.co/y15b740Q3w— Dog (@u2biker) April 30, 2017

segunda-feira, maio 01, 2017

Curiosidade do dia - TINA

"Mas o relevante aqui é que, de facto, já ninguém se atreve a defender défices orçamentais. Pelo contrário, este relatório, ao invés de optar por uma política de rutura, com “reestruturação” e expansionismo orçamental, opta por cumprir as regras orçamentais. É aquilo que dizia há umas semanas: a rendição aos “conservadores orçamentais”. Ainda bem!Trechos retirados de "Jogar à roleta russa com a dívida pública?"

...

No fundo, o relatório mostra que grande parte da conversa fiada da extrema-esquerda já foi à vida (nada como estar no poder para nos mostrar a realidade, que falar na oposição é fácil). Já tinha sido assim na Grécia. Depois, é apenas a estratégia de ir sobrevivendo no poder: sacar umas receitas extraordinárias para ir reduzindo o défice, por em risco o refinanciamento da República e culpar a Europa. A sério, não há nada de novo?"

"despedir é sempre resultado de uma maldade ou de preguiça da gestão" (parte VI)

Parte V.

"When a company finds itself in severe distress, often the best corrective course of action is to strip away the broken core to rebuild around an initially smaller but more defensible and profitable business segment. By analogy, if a large, old building is teetering on a shaky foundation, it makes little sense to continue renovating the top floors. Better to demolish the building and rebuild on a new solid foundation."Trecho retirado de "If You're in a Dogfight, Become a Cat!: Strategies for Long-Term Growth"

Mongo será fértil em criatividade focada

Gente com skin-in-the-game, gente com os pés assentes na terra e com um job to be done é capaz de milagres, "Quando os doentes e familiares inventam soluções que a medicina não dá".

Mongo vai ser terreno fértil para esta criatividade focada que não procura o crescimento acima de tudo.

Mongo vai ser terreno fértil para esta criatividade focada que não procura o crescimento acima de tudo.

Para reflexão

"Repainting your house the same color it already was feels like a waste. It's a lot of effort merely to keep things as they are.Trecho retirado de "The unfairness (and wisdom) of paint"

.

But if you don't do it, time and entropy kick in and the house starts to fade.

.

The same can be said for 1,000 elements of your organization, including your relationships with customers, staff, suppliers and technology. The way you approach your market, the skill you bring to your craft, the culture in your organization—it constantly needs another coat of paint.

.

Rust never sleeps."

"nenhum treinador é pau para toda a obra"

Há tempos tive esta troca de tweets:

Que recordei ao acabar de ler "As virtudes do trabalho integrado":

Só encostadas à parede é que algumas empresas, só algumas mesmo assim, se libertam dos hábitos antigos e constroem uma nova hipótese de trabalho.

Por isto, é sinal de alguma ignorância aparecer e afirmar em abstracto que o futuro de uma empresa passa pela inovação e valor acrescentado sem ter em conta o seu passado.

@agodinholuz há uma frase venenosa no texto. Frase q ilustra q o q reina é a quantidade ñ o valor acrescentado. Pena pq têm potencial para mais pic.twitter.com/Ot70qHAt7b— Carlos P da Cruz (@ccz1) April 24, 2017

@agodinholuz novos comerciais, enfim, novo modelo de negócio. têm dificuldade em mergulhar no novo mundo do valor— Carlos P da Cruz (@ccz1) April 24, 2017

Que recordei ao acabar de ler "As virtudes do trabalho integrado":

"Mas o que os dirigentes têm de entender é que nenhum treinador é pau para toda a obra, que as hipóteses de sucesso crescem sempre que um clube pensa o seu futebol de uma forma integrada, na qual as ideias de uns coincidem com as ideias dos outros e as práticas têm que ver com as ideias de ambos. Quando isso acontece, tudo fica mais simples."Por isto, é muito difícil uma empresa fazer a transição, o abandono de um modelo que resultou mas se tornou obsoleto.

Só encostadas à parede é que algumas empresas, só algumas mesmo assim, se libertam dos hábitos antigos e constroem uma nova hipótese de trabalho.

Por isto, é sinal de alguma ignorância aparecer e afirmar em abstracto que o futuro de uma empresa passa pela inovação e valor acrescentado sem ter em conta o seu passado.

domingo, abril 30, 2017

Antes da proposta de valor

"Before focusing on the value proposition and the other elements of a business model, it is very important to get a deep insight and holistic understanding of the customers' world, their contexts, activities and experiences. In this block, the customers' explicit and latent reasons for buying and the benefits that the customer desires are analyzed. The questions to be answered include:E volto à figura do ovo e da galinha...

- How do we get a deep insight and holistic understanding of the customer's world, their future strategies, and their own customers' world?

- Why does the customer buy?

- What kind of benefits (functional, economic, emotional, social, ethical, environmental, symbolic) does the customer desire?"

E ao tema do concreto para o abstracto...

Também proponho às PME que comecem por identificar os clientes-alvo antes de pensar na proposta de valor. No entanto, antes de identificar os clientes-alvo recomendo que se faça o recenseamento do que se tem. Uma PME tem de partir daquilo que tem, daquilo que pode funcionar como um ponto forte, daquilo que pode servir de alicerce para a construção de um modelo de negócio.

Trecho inicial retirado daqui.

Ecossistemas de serviço

"As one zooms out from dyadic interactions and discreet transactions, the first thing noticed is that these dyadic interactions do not take place in isolation, but rather within networks of actors, of which the dyad is just a part. These networks can be seen at various levels of aggregation (e.g., macro, meso, micro). Structurally then, these networks reflect what S-D logic captures axiomatically in the resource-integration specification of Axiom 3 [All social and economic actors are resource integrators]. Likewise, they emphasize that the benefit (value) realized by a beneficiary (e.g., a “customer”) does not occur in isolation either, but rather through integration of the resources from many sources, [Moi ici: Recordar o objectivo de maximizar a criação de valor a nível do ecossistema, "The market is a goal collective"] thus best understood as holistic experiences (FP9/Axiom3 and FP10/Axiom4).[Value is always uniquely and phenomenologically determined by the beneficiary]

At first glance, it might appear that there is little new here, just the acknowledgement that service provision, value cocreation and value realization take place in networks, ... However, the S-D logic framework adds several key characteristics that are not in all cases typical of these network conceptualizations. Most obvious among these is that the connections represent service-for-service exchange, rather than just connections of resources, people, or product flows; thus, in S-D logic, network actors are linked by common, dynamic processes (service provision). Second, the actors are defined not only in terms of this service provision (resources applied for benefit) but also in terms of the resource-integration activities that the service exchange affords. Finally, the network has a purpose, not in the sense of collective intent but rather in the sense of individual survival/wellbeing, as a partial function of collective wellbeing."

Trecho retirado de "Service-dominant logic 2025"

Qual é a distribuição?

Uma forma interessante de analisar um setor de actividade e a sua cadeia de fornecimento (ecossistema):

Quem é que emergiu e teve uma década seguinte de sonho?

E na cadeia de fornecimento em que a sua empresa participa, qual é a distribuição?

Imagem retirada de "If You're in a Dogfight, Become a Cat!: Strategies for Long-Term Growth"

Quem é que emergiu e teve uma década seguinte de sonho?

E na cadeia de fornecimento em que a sua empresa participa, qual é a distribuição?

Imagem retirada de "If You're in a Dogfight, Become a Cat!: Strategies for Long-Term Growth"

Pensa que só acontece aos outros?

"Aon's 2107 Global Risk Management survey has revealed a host of daunting challenges driven by today’s divisive and yet interdependent environment. The report focuses on the elected Top 10 risks for detailed discussion, one of the perennial highlights:

...

cyber risk stands out as another illustration of the influence of news events on risk perception.

...

cyber crimes have evolved from stealing personal information and credit cards to staging coordinated attacks on critical infrastructures. ... Cyber threat has now joined a long roster of traditional causes—such as fire, flood and strikes that can trigger business interruptions because cyber attacks cause electric outages, shut down assembly lines, block customers from placing orders, and break the equipment that companies rely on to run their businesses."

Nem de propósito, este exemplo, "Hacker rouba série da Netflix: “Ou pagam o resgate ou ponho tudo na Internet”":

"A empresa já reagiu e reconheceu que uma pequena produtora com sede em Los Gatos, na Califórnia, que trabalha com vários dos grandes estúdios de televisão, foi alvo de um ataque cibernético. De acordo com o serviço de streaming, o FBI e outras autoridades já estarão a investigar o caso."Pensa que só acontece aos outros?

sábado, abril 29, 2017

Curiosidade do dia

"Os portugueses não são avessos à liberdade por desconhecerem os respectivos benefícios. Os portugueses são avessos à liberdade por conhecerem as respectivas desvantagens – e as vantagens da atitude oposta. Na medida em que deposita o destino nas mãos de cada um, a liberdade implica responsabilidade, risco e uma trabalheira desgraçada, em suma exactamente aquilo que o português evita, ou procura evitar, ao roçar-se diligentemente no Estado."Trecho retirado de "Não me levem a mal, mas não haverá revolução liberal"

"when we have these resources in excess, we don’t become efficient"

Em "Expose Your Constraints Before Chasing Additional Resources" encontro um excelente texto não só aplicável a startups mas também a empresas em sectores tradicionais.

Numa outra onda, recordo o empresário que recentemente defendeu que é tempo da sua empresa deixar de estar viciada em stress e começar a investir em recursos humanos e não só.

E como não recordar os keynesianos e outros degenerados que defendem que a produção cria a sua própria procura...

"We all hustle, struggle, and fight to acquire more resources for our projects. But ironically, when we have these resources in excess, we don’t become efficient. We become wasteful.Como não pensar na moda corrente de dinheiro público ser despejado em ideias que ainda andam à procura de product-market fit.

.

Much has been written about how by limiting choices, constraints force the requisite creativity needed to innovate.

...

Constraints force the requisite focus needed to innovate."

Numa outra onda, recordo o empresário que recentemente defendeu que é tempo da sua empresa deixar de estar viciada em stress e começar a investir em recursos humanos e não só.

E como não recordar os keynesianos e outros degenerados que defendem que a produção cria a sua própria procura...

"Harness Immediate Benefits to Increase Your Persistence"

"The importance of delaying gratification is universally recognized. Being able to forgo immediate benefits in order to achieve larger goals in the future is viewed as a key skill.Algo que me faz recuar ao final do século passado e à descoberta em 1992 na HBR, no mesmo número que apresentou o primeiro artigo sobre o balanced scorecard, do autor Robert Schaffer:

...

But wouldn’t immediate benefits also help us follow through on our long-term goals?

...

We found that enjoyment predicted people’s goal persistence two months after setting the goal far more than how important they rated their goal to be.

.

Yet people overestimated how much delayed benefits influenced their goal persistence. When we asked people what would help them stick with their goal in the upcoming months, they believed both immediate and delayed benefits—enjoyment and importance—mattered for their success. In actuality, delayed benefits had less influence on persistence; they mainly played a role in setting the goal in the first place.

.

We found this pattern—immediate benefits are a stronger predictor of persistence than delayed benefits—across a range of goals, in areas including fitness, nutrition, and education.

...

Harness Immediate Benefits to Increase Your Persistence

...

First, factor in enjoyment when choosing which activity to pursue to achieve your goals.

...

Second, give yourself more immediate benefits as you pursue long-term goals.

...

Third, reflect on the immediate benefits you get while working toward your goal."

- A dança da chuva e outros rituais (Julho de 2006)

- Small Wins (Junho de 2009)

- Uma sucessão de pequenos projectos que produzem resultados rapidamente (Dezembro de 2012)

Escolher desafios relevantes e alinhados com a estratégia e desdobrá-los em vários projectos mais pequenos que não só reduzem o tempo para obter resultados como o tempo para obter feedback.

Trechos retirados de "What Separates Goals We Achieve from Goals We Don’t"

O típico para as nossas PME

O típico para as nossas PME:

Segundo trecho retirados de "A revolução das malhas na TMG"

"Conhecida pela marca ROQ, a empresa constrói máquinas customizadas e de alta performance e precisão para a indústria têxtil, com recurso a tecnologia de ponta, nas áreas do corte a laser e da quinagem."E ainda:

"Aqui conseguimos fazer amostras no tempo que eles pretendem – às vezes temos de fazer amostras em três, quatro dias e em malhas não é fácil. Mas é a amostra que vai trazer o cliente e isso diferencia-nos»"Primeiro trecho retirado de "ROQ reforça liderança mundial e cria mais 31 empregos em Famalicão"

Segundo trecho retirados de "A revolução das malhas na TMG"

sexta-feira, abril 28, 2017

Curiosidade do dia

Excelentes noticias: O desemprego já está abaixo dos 10% (@pt_INE). Quem esteve contra a reforma laboral de 2012 deve estar arrependido pic.twitter.com/OdIg7K5AVI— Alvaro SantosPereira (@santospereira_a) April 28, 2017

Volume is vanity, Profit is sanity

"Market leadership is even more precarious. The percentage of companies falling out of the top three rankings in their industry increased from 2% in 1960 to 14% in 2008. What’s more, market leadership is proving to be an increasingly dubious prize: The once strong correlation between profitability and industry share is now almost nonexistent in some sectors. According to our calculation, the probability that the market share leader is also the profitability leader declined from 34% in 1950 to just 7% in 2007. And it has become virtually impossible for some executives even to clearly identify in what industry and with which companies they’re competing."

Como não recordar o clássico "Manage For Profit, Not For Market Share: A Guide to Greater Profits In Highly Contested Markets"

Trecho retirado de "Adaptability: The New Competitive Advantage"

"People buy products for one reason only"

This simple principle has changed the way I view product design: pic.twitter.com/HxNgZNgKFf— Justin Jackson (@mijustin) April 26, 2017

Produtividade para o século XXI (parte V)

Parte I, parte II, parte III e parte IV

O artigo é de 2004, descobri-o em 2011.

Continua.

"the only theoretically correct and practically relevant approach to measuring service productivity seems to be to base productivity calculations on financial measures. In principle, the correct way of measuring service productivity as a function of cost effects of internal efficiency, revenue effects of external efficiency and cost and revenue effects of capacity efficiency is, therefore, the following measure:

As a global productivity measure of the operations of a service provider, the following measure can be used:

the productivity of service processes can be measured as the ratio between revenues and costs. This is a true measurement of service productivity. If revenues increase more than costs, productivity goes up. On the other hand, if a cost reduction leads to lost revenues, but the decline in revenues is less than the cost savings that have been achieved, productivity still improves. However, this may be a less recommendable strategy because in the long run it may lead to a negative image and unfavorable word of mouth, which can have a further negative effect on revenues. Thus, cost reductions may lead to a bigger drop in revenues than the savings on the cost side. If this is the case, in the long run service productivity declines."A equação que uso há anos, talvez desde 2007.

O artigo é de 2004, descobri-o em 2011.

Continua.

Onde trabalhar?

Excelente figura:

Valor é criado quando uma empresa consegue criar uma oferta em que a willingness to pay (WTP) supera o cost to serve (CTS). A diferença entre o WTP e o CTS define a dimensão do valor criado. valor esse que terá de ser dividido entre o cliente e o produtor.

Tal como na figura, a vantagem competitiva de uma empresa pode ser uma função de conseguir fornecer o mercado com custos mais baixos, ou uma WTP superior ou uma mistura de ambas.

Infelizmente, muitas PME contentam-se em trabalhar na zona A muito mais do que na zona B (se soubessem o que aprendi com Marn e Rosiello naquele mês de Janeiro de 1992, na verdade só aprendi mais tarde - nunca é tarde para aprender, ás vezes é demasiado cedo)

Continua.

Trecho e imagem retirada de "If You're in a Dogfight, Become a Cat!: Strategies for Long-Term Growth"

Valor é criado quando uma empresa consegue criar uma oferta em que a willingness to pay (WTP) supera o cost to serve (CTS). A diferença entre o WTP e o CTS define a dimensão do valor criado. valor esse que terá de ser dividido entre o cliente e o produtor.

Tal como na figura, a vantagem competitiva de uma empresa pode ser uma função de conseguir fornecer o mercado com custos mais baixos, ou uma WTP superior ou uma mistura de ambas.

Infelizmente, muitas PME contentam-se em trabalhar na zona A muito mais do que na zona B (se soubessem o que aprendi com Marn e Rosiello naquele mês de Janeiro de 1992, na verdade só aprendi mais tarde - nunca é tarde para aprender, ás vezes é demasiado cedo)

"Where does price fit in? As shown in the right-hand panel of figure 5.2, companies can choose to price their products anywhere between WTP and CTS. This is a strategic decision that reflects how a company wants to divide the product value between itself and its customers. Consumers benefit from lower prices by enjoying a higher consumer surplus, the difference between what a consumer is willing to pay for a product and the actual price charged. High consumer surpluses spur sales, increasing growth and customer satisfaction. Producer surplus is an equivalent concept from the opposite perspective—the difference between the price a company charges and its unit cost. Obviously, companies that enjoy a competitive advantage in the marketplace have more pricing flexibility when choosing how to allocate value between the company and consumers."A não ser que uma empresa queira ser o fornecedor com o custo mais baixo o truque é trabalhar para aumentar o WTP, trabalhar na zona B.

Continua.

Trecho e imagem retirada de "If You're in a Dogfight, Become a Cat!: Strategies for Long-Term Growth"

quinta-feira, abril 27, 2017

Curiosidade do dia

A 5 de Abril de 2017 escrevi:

Hoje, 27 de Abril o mesmo governo volta a aparecer na capa do Público com:

E Santana Lopes é que fazia trapalhadas...

Como não recordar o 1º Princípio de Deming:

"Ontem ao ler "Costa garante: Malparado não vai fazer “nascer um banco mau”" lembrei-me logo de "Costa quer tirar 'lixo' dos bancos. E passá-lo para um 'banco mau'"".

Hoje, 27 de Abril o mesmo governo volta a aparecer na capa do Público com:

E Santana Lopes é que fazia trapalhadas...

Como não recordar o 1º Princípio de Deming:

Constância de propósito

"Pricing is a game"

"Pricing is a game – one with asymmetric and imperfect information. So what does this mean for you? Basically, you’re very unlikely to nail pricing the first time. And even if you do come close, you’ll have to adjust as your product and market mature.Trechos e imagem retirados de "Want to Nail Pricing? Understand Market Dynamics First."

...

Price elasticity of demand is the basic economic insight that price influences demand and that in most cases (with the exception of certain luxury goods) demand will increase as the price goes down.

...

Cross-price elasticity is the tendency of customers to switch vendors (or products from the same vendor) in response to price changes. In some markets, there are well understood alternatives and when the price of one increases some customers will abandon it for the alternative."

Clareza estratégica

"To put the issue of strategic clarity in context, let's start by defining terms. Figure 5.1 illustrates the four hierarchical elements required to formulate and execute effective business strategy. The starting point is a set of overarching goals that establish a company's long-run intent and management priorities. ... A company's stated goals identify the broad boundaries of business scope and the areas of business activity and performance of greatest concern to management, e.g., consumer satisfaction, employee safety and welfare, shareholder value, and sustainable business practices.

...Pessoalmente trabalho com outra versão daquela hierarquia:

A company's strategy describes how it plans to meet its stated objectives. Strategy is all about making choices, and a company's strategy guides which market opportunities to pursue, which products to create, which distribution channels to exploit, and which business partnerships to form. Strategic choices to ignore certain opportunities are just as important as actionable commitments."

E mais, às vezes interrogo-me se não fará mais sentido trabalhar com esta versão:

Trechos e imagem retirados de "If You're in a Dogfight, Become a Cat!: Strategies for Long-Term Growth"

"despedir é sempre resultado de uma maldade ou de preguiça da gestão" (parte V)

Aproveitei umas horas do 25 de Abril para descarregar uns caixotes de livros no meu novo escritório. A certa altura passou-me pelas mãos um livro que muito me marcou, "Grow to be Great: Breaking the Downsizing Cycle", e com ele na mão, olhando para a capa sorri e recordei-me de alguns postais com mais de 10 anos.

OK, por vezes regras como o LIFO levam a despedir não com base em critérios alinhados com a estratégia o que não é muito saudável. No entanto, IMHO, pode fazer sentido encolher uma empresa quando ela precisa de mudar de vida, quando uma estratégia deixou de fazer sentido e a empresa tem de se renovar.

E recordo a série "despedir é sempre resultado de uma maldade ou de preguiça da gestão" (parte IV) e a imagem:

Por vezes, encolher é a única alternativa para poder recomeçar.

E foi daquela frase "You cannot shrink to greatness" que me recordei ao ler "If You Think Downsizing Might Save Your Company, Think Again".

Confesso que o artigo me pareceu algo infantil:

"we tested the theory that downsizing could lead to a host of problems that eventually increases the likelihood of bankruptcy.Por que é que estas empresas encolheram? Porque já estavam com problemas!

...

We found that downsizing firms were twice as likely to declare bankruptcy as firms that did not downsize. While downsizing may be capable of producing positive outcomes, such as saving money in the short term, it puts firms on a negative path that makes bankruptcy more likely."

OK, por vezes regras como o LIFO levam a despedir não com base em critérios alinhados com a estratégia o que não é muito saudável. No entanto, IMHO, pode fazer sentido encolher uma empresa quando ela precisa de mudar de vida, quando uma estratégia deixou de fazer sentido e a empresa tem de se renovar.

E recordo a série "despedir é sempre resultado de uma maldade ou de preguiça da gestão" (parte IV) e a imagem:

Por vezes, encolher é a única alternativa para poder recomeçar.

"What he did was both obvious and, at the same time, unexpected. He shrunk Apple to a scale and scope suitable to the reality of its being a niche producer in the highly competitive personal computer business. He cut Apple back to a core that could survive."Uma coisa é encolher para sobreviver numa versão 2.0, outra é encolher porque sim, para pressionar aumentos de eficiência.

"nature evolves away from constraints, not toward goals" (outra vez)

"nature evolves away from constraints, not toward goals"

Foi uma frase que captei em 2007.

E foi dela que me lembrei assim que o Paulo Vaz me chamou a atenção para este artigo "I Have Seen The Future, And The Future Is a Free Market".

Por um lado a ideia de que a economia é uma espécie de ser vivo em permanente mutação:

"The “economy” is not some granite block that remains unchanged for decades and decades. Like any other thing, manifestations of it arise and then pass away. But they do not disappear. They become something else. It’s like people think the Earth came into being, it’s a done deal, and everything here is permanent and remains the same for thousands of years. No. Things come into being here, pass away, and become something else."Por outro lado a ideia de Mongo relacionada com as empresas grandes:

"as Nature shows, the bigger will always fall to be replaced by the smaller. Thus, the big retailers will go out of business. Of course! The malls will fall into ruins. Of course! And why? Because people can shop online, yes, that’s one reason. But another is because there are literally tons upon tons of consumer goods, clothes, and various other things in perfectly good condition out there to be had for a penny on the dollar of original purchase price."E ainda:

"None of this means the economy is getting ready to pop another Great Depression on us. It means the economy is changing as all things must. There is no such thing as any human creation being a permanent structure.

...

The little restaurants of the shopping mall food courts discovered they could do better business as “food trucks” and not bother with paying rent or having furniture. The smaller shops of the malls found they could move into lower rent strip malls. Chain retailers flooded the markets with thousands of tons of consumer goods that thrift stores sell used and, therefore, no one needs to go get this stuff from the chain retailers anymore. In a word, what is happening is a free market is coming into existence right under everyone’s noses and few see it.

.

How so? Because those food trucks have found a way to beat the government out of property tax or the malls out of rent. The second-hand shops have found a way to sell goods without buying them from major corporations. What’s more, ethnic populations often import goods direct from their own countries, often from their own families, and sell them in their own independent shops and offer new goods at a fraction of the price of what the mall would ask.

...

The big retailers and malls need to understand that their time has passed. The free market is coming into existence as we speak.

...

So, no, the economy is not tanking. It is changing.

...

The free market scares the government because it carves huge chunks out of government revenue garnered through taxes. [Moi ici: Algo que escrevemos aqui há anos] Food trucks alone represent huge losses in property taxes they can’t levy against a moving vehicle that parks where it pleases and vends food. The free market scares Wall Street because they’re locked out of it. Thrift stores move into abandoned or vacant buildings paying cheap rents to landlords just grateful someone moved in after Big Retailer, Inc. went belly up. And they sell all the tons of goods the big retailers flooded America with for decades.

...

This free market changes faster than the government can adapt and come up with new taxes to go after them. [Moi ici: Daí aquela frase lá de cima "nature evolves away from constraints, not toward goals"] I have seen de facto swap meets pop up in vacant lots and just garner passers-by as customers. They sell out of vans and pickup truck beds and communicate locations on Facebook and through text messages to their customers. They move around from abandoned storefront parking lots to empty lots where buildings once stood. Food trucks passing by see them and pull in and set up. Sometimes it’s all coordinated between them. And the cops don’t care. The presence of people like that deters crime."

...

The free market does not mean Wall Street gets to continue to exist and run it. In fact, Wall Street is passing away as we speak.

...

I have seen the future and the future is the true free market. It is being created by people. Not the government, not some political party, not corporations, and not Wall Street. All of them are headed for the same destination as the dinosaurs: Museums."

quarta-feira, abril 26, 2017

Curiosidade do dia

Aldous Huxley é a primeira coisa que me vem à mente.

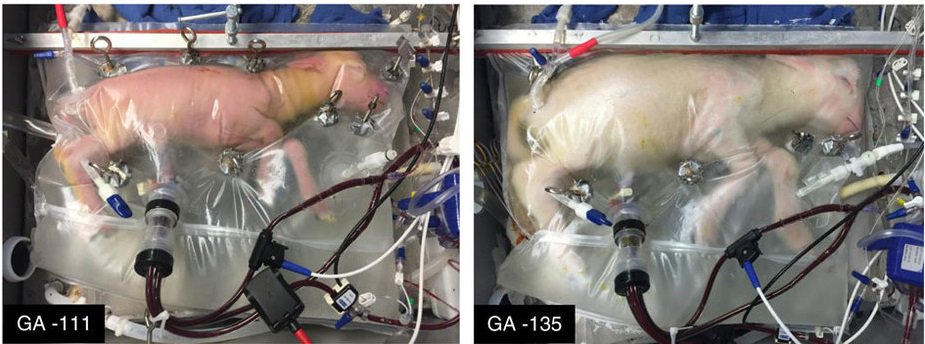

Ler "Artificial womb helps premature lamb fetuses grow for 4 weeks" e pensar em tudo o que se pode "desenvolver" a partir daqui.

Produtividade para o século XXI (parte IV)

Parte I, parte II e parte III.

"According to the traditional manufacturing-related productivity concept, productivity is defined as the ratio between outputs produced and inputs used, given that the quality of the outputs is kept constant (the constant quality assumption), or

Only if the quality of the production output is constant and there is no significant variation in the ratio between inputs used and outputs produced with these inputs, productivity can be measured with traditional methods. The constant quality assumption is normally taken for granted and not explicitly expressed. Therefore, the critical importance of this assumption is easily forgotten. [Moi ici: Forgotten por todos este pormaior fundamental. Subir na escala de valor é uma forma de dinamitar a constant quality assumption. É ela que gera o fenómeno da perseguição entre gato e o rato (salário e produtividade)] However, in most service processes it does not apply.

In services, it is not only the inputs that are difficult to calculate, it is also difficult to get a useful measurement of the outputs. Output measured as volumes is useful only if customers are willing to buy this output. In manufacturing, where the constant quality assumption applies, customers can be expected to buy an output produced with an altered input or resource structure. However, in services we do not know whether customers indeed will purchase the output produced with a different input structure or not. It depends on the effects of the new resources or inputs used on perceived process-related and outcome-related quality. Hence, productivity cannot be understood without taking into account the interrelationship between the use of inputs or production resources and the perceived quality of the output produced with these resources. The interrelationship between internal efficiency and external efficiency is crucial for understanding and managing service productivity."

Industria 4.0 e a cadeia de fornecimento

"The digitization of the supply chain enables companies to address the new requirements of customers, the challenges on the supply side, and the remaining expectations in efficiency improvement. Digitization leads to a Supply Chain 4.0, which becomes …Imagem e trechos retirados de "Supply Chain 4.0 in consumer goods"

- … faster. New approaches to product distribution can reduce the delivery time of fast runners to few hours. ...

- … more flexible. Supply Chain 4.0’s ad hoc, real-time planning allows companies to respond flexibly to changes in demand or supply, minimizing planning cycles and frozen periods. ...

- … more granular. With customers looking for more and more individualization in the products they buy, companies must manage demand at a much more granular level, through techniques such as microsegmentation, mass customization, and more-sophisticated scheduling practices. ...

- … more accurate. Next-generation performance management systems provide real-time, end-to-end transparency throughout the supply chain. ...

- … more efficient. The automation of both physical tasks and planning boosts supply-chain efficiency."

Analogias interessantes

Nesta interessante apresentação, "14 Tips to Entrepreneurs to start the Right Stuff", encontrei este slide:

Que logo relacionei com o mapa da estratégia e o balanced scorecard:

Que logo relacionei com o mapa da estratégia e o balanced scorecard:

"Sequencing markets correctly is underrated"

“Sequencing markets correctly is underrated, and it takes discipline to expand gradually. The most successful companies make the core progression—to first dominate a specific niche and then scale to adjacent markets—a part of their founding narrative.” – Peter Thiel, Zero to OneTrecho retirado de "Modeling Your Total Addressable Market"

terça-feira, abril 25, 2017

Curiosidade do dia

Gente sem noção:

Estou a imaginar batatas de Chaves a um custo interessante em Jacarta...

Estou a imaginar morangos de Gaia a um custo espectacular em Camberra...

Estou a imaginar tomate ribatejano a um custo de amigo em Joanesburgo...

Gente sem skin in the game farta-de fazer propostas deste calibre, é imaginar a mesma bitola na Saúde, na Educação, na Justiça, na Agricultura, ...

Estou a imaginar batatas de Chaves a um custo interessante em Jacarta...

Estou a imaginar morangos de Gaia a um custo espectacular em Camberra...

Estou a imaginar tomate ribatejano a um custo de amigo em Joanesburgo...

Gente sem skin in the game farta-de fazer propostas deste calibre, é imaginar a mesma bitola na Saúde, na Educação, na Justiça, na Agricultura, ...

Estratégia, essa neblina

"According to research recently cited in the Harvard Business Review, [Moi ici: Pena que não a identifiquem] only 29 percent of employees of high-performing companies with publicly stated strategies could correctly identify their company's strategy out of six choices. As such, a majority of employees are not in a position to link their personal work initiatives and decision-making to the desired direction of the firm.' Think of it like this: a racing scull with rowers each choosing their own pace or direction would not win many races.

...

Discouragingly, this problem exists between senior executives and their boards as well. Of the 772 directors surveyed by McKinsey in 2013, a mere 34 percent agreed that the boards on which they served fully comprehended their companies' strategies. Only 22 percent said their boards were completely aware of the ways their firms created value, and just 16 percent claimed that their boards had a strong understanding of the dynamics of their firms' industries."

Para fazer uns cortes epistemológicos

"The number of patent applications filed by emerging market countries has overtakenthose filed by the developed world for the first time.Trecho retirado de "Emerging markets file more patents than the west"

The 12 leading EM nations applied for 1.49m patents in 2015, outstripping the 1.48m in developed market countries, according to figures from the World Intellectual Property Organisation, collated by Comgest, a Paris-based asset manager, as the first chart shows.

The figures are a far cry from 2004, when the 12 emerging market countries, which account for the vast majority of developing world filings, made just 372,000 applications, 29 per cent of the 1.3m made by the advanced world.

“This signals the dawn of a new age of innovation as EM economies start to shake off their image as purely centres for low-cost manufacturing for companies in developed markets,” said Emil Wolter, co-head of Comgest’s global emerging markets team."

"Da 'comoditização' para os artesãos - subir na escala de valor "

Agora aqui está um bom exemplo sobre o que escrevemos e defendemos acerca do caminho a seguir pelas PME para lidar com a China e com o advento de Mongo.Da 'comoditização' para os artesãos - subir na escala de valor pela diferenciação c/c @ccz1 https://t.co/PXIFg7f2EU— Jorge Cangaia (@jcangaia) April 24, 2017

"Com menos de uma dezena de funcionários, e com uma carteira de fornecimento que assenta no trabalho de artesãos externos, a UrbanMint, a empresa que detém as marcas Munna e Ginger & Jagger, é ainda o protótipo representativo do sector mobiliário português.Recordar o que escrevi ao longo dos anos quando não era cool falar do mobiliário (ou do calçado, ou do têxtil, ou do ...):

.

A empregar cerca de 30.000 trabalhadores, o sector é muito disperso e de dimensão quase familiar. Das 4466 empresas registadas no final de 2015, 3837 tinham menos de dez trabalhadores; cerca de 600 empregava, entre 10 e 249 pessoas e apenas quatro empresas é que não caberiam na definição de pequena e média empresa, por terem mais de 250 trabalhadores.

...

reconhece ao sector do mobiliário um peso crescente nas exportações de Portugal: passou de uma quota de 1,67% em 2012, para os 2,08% atingidos no final de 2016.

.

Apesar de ser um sector com um tecido produtivo muito disperso e atomizado, exportou cerca de 66% da sua produção, que em 2016 atingiu um volume de negócios de 1586 milhões de euros.

...

o sector enfrentou uma reestruturação do seu tecido produtivo, e uma análise ao rácio entre empresas produtoras e exportadoras mostra alterações relevantes. Se em 2011 existiam 5252 empresas a produzir mobiliário em Portugal, apenas 2500 é que eram consideradas exportadoras.

.

Em 2016 o tecido produtivo encolheu (desapareceram 806 empresas), mas aumentou aquelas que se dedicam à exportação: das 4466 empresas registadas, 3187 são exportadoras."

- O exemplo do mobiliário (parte I), (parte II), (parte III), (parte IV) e (parte V)

- Trabalhar para aumentar os preços

- Campeões escondidos versus campeões nacionais

- ""Às vezes somos alcunhados de loucos, uns miúdos que fazem umas asneiras."

- Autópsia de uma estratégia (parte I e parte II)

Empresas mais pequenas, menos dependentes da quantidade pura e dura.

BTW, e encadear isto nos postais recentes sobre os artesãos? (aqui e aqui , por exemplo)

Trechos retirados de "Micro empresas de mobiliário contribuem para 2% das exportações nacionais"

A ascensão do artesão e da arte na produção (parte II)

Ontem publicámos "A ascensão do artesão e da arte na produção". Depois, ao princípio da tarde fui brindado com:

Entretanto, ao fim da tarde de ontem ainda deparei com:

— highalpha (@veryhighalpha) April 24, 2017

Entretanto, ao fim da tarde de ontem ainda deparei com:

- Barbearias. “Para se ser barbeiro tem de se ter amor à arte”

- Este pão antigo é fresco e só tem cereais portugueses

- The Artisanal Economies, Entry # 1: the Sofi interview (muito bom, a ler na íntegra)

"Several things happen in this conversation but one of them is that we begin to see into the history, we might even say the “intentions,” of the objects on the shelves. We begin to see that these things come from someone, that they were crafted to a purpose that begins with “coffee mug” and then scales up to include the lifestyle, the community, the economy, the culture that might be loosely designed artisanal.

Ah, now we get it. That’s why things cost more. That object on the shelf of Wal-mart doesn’t have a story. It was made by a stranger in a factory in Chengdu, shipped across an ocean, and banged around in the distribution system until it just happened to roll to a stop here on a shelf. It doesn’t mean very much because capitalism was so busy giving it value, it forgot to give it meaning.

And that’s what Sofi is for, to gently help you see what the mug means. Yes, we can buy a cheaper mug somewhere. But ,by this standard, cheaper doesn’t feel better, it feels poorer. As if everyone in the production – consumption chain as been diminished by the effort.

So, we could say, if we were rushing to conclusions (and that is what we do here), that retail is not merely the last moment in the distribution chain. It completes the meaning making process. And more to the point, it helps consumers understand and grasp the “artisanal premium” they are required to pay. It’s always true to say “we get what we pay for.” The very point of Olives and Grace is to help us see what we’re paying for. It helps solve the problem of cheap food."

segunda-feira, abril 24, 2017

"não saem da cepa torta"

Ler este texto "What’s the Second Job of a Startup CEO?":

"A CEO’s first job is to build a product users love; the second job is to build a company to maximize the opportunity that the product has surfaced; and the third is to harvest the profits of the core business to invest in transformative new product ideas.Lê-lo e pensar nas muitas PME que não saem da cepa torta porque, sem o percepcionarem, estão prisioneiras do tecto de vidro. Talvez por causa desta dificuldade em passar do perfil da fase 1 para o perfil da fase 2.

...

As a Phase 2 CEO, you need to transition from “Doer-in-Chief” to “Company-Builder-in-Chief.” This is how you scale as a CEO, and CEO scaling is the first step in company-building. For most founders, this is very difficult. When you’ve been a successful Doer-in-Chief, it’s hard to stop. It’s hard to stop coding, designing product specs, and interacting with customers on a daily basis. It’s hard to stop answering support tickets, doing all the product demos, and debugging the latest build. It’s even hard to delegate the random and sometimes menial tasks that you’ve accumulated over the years because they were “no one’s job.” But you have to stop doing all of these things so that you can safeguard your time for high leverage tasks that only CEOs can do."

Produtividade para o século XXI (parte III)

Parte I e parte II.

Trechos retirados de "Service productivity Towards a conceptualization of the transformation of inputs into economic results in services"

"From the firm’s point of view, managing productivity is a matter of the management of the economic results. By increasing productivity, the economic results are assumed to improve. As long as this indeed is the case, managing productivity makes sense. However, if improved productivity does not lead to better economic results, increasing productivity does not make sense.

The traditional productivity concept has been developed for manufacturers of physical goods as a production efficiency concept. Existing productivity models and produc- tivity measurement instruments are also geared to the context of manufacturers. Moreover, they are based on assumptions that production and consumption are separate processes and that customers do not participate in the production process. [Moi ici: E a co-criação?] Although following market research customer preferences are incorporated into the manufactured products, traditional production systems in manufacturing are closed systems, and traditional productivity models and measurement instruments are developed for such systems. In such closed systems where customers are not directly involved in design and production processes, these assumptions make perfect sense, of course. In service contexts, where the service process (or service production process) to a large extent is an open system, they create confusion, lead to misleading measurements and may guide decision making astray.

...

A totally different approach to productivity has to be taken to obtain a global measure of how well a service provider uses resources to create outputs in the form of acceptable perceived quality and customer value. This is the case for most high-tech and high-touch services."

Trechos retirados de "Service productivity Towards a conceptualization of the transformation of inputs into economic results in services"

"The habits we groove become who we are, one minute at a time"

"The difference between who you are now and who you were five years ago is largely due to how you've spent your time along the way.Também por isto, a minha fixação em "começar pelo fim". Visualizar um ponto de chegada, lançar uma corda ninja e começar a convergir, sem magia, sem estalidos de dedos, um passo de cada vez.

...

The habits we groove become who we are, one minute at a time. A small thing, repeated, is not a small thing.

[And the same thing is true for brands, organizations and movements.]"

E destaco ainda:

"If you spend a little bit more time each day whining or feeling ashamed, that behavior will become part of you."Como não recordar os cortisol-addicted.

E a sua empresa? Qual é a cultura que é alimentada todos os dias?

Trechos retirados de "Who are we seeking to become?"

Subscrever:

Comentários (Atom)

%2006.21.jpeg)