"SHAREHOLDER VALUE CREATION is the outcome—not the driver—of effective business strategy, which should be aimed at profitably creating and retaining satisfied customers. But how can a business best do this? In this chapter, I will show how the actions of a firm at all levels can create value for shareholders and other stakeholders.[Moi ici: A nossa ideia de que há objectivos que devem ser encarados como consequências, a obliquidade]Quantas empresas se preocupam com isto? Quantas empresas investem realmente em fazer com que os trabalhadores percebam o que é realmente importante?

...

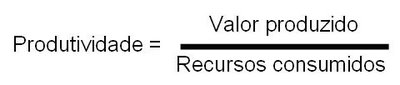

how can a firm improve its ROIC? [Moi ici: Return on invested capital] Figure 4.1 suggests that the drivers of ROIC include actions that either increase the numerator (by improving operating margins) or decrease the denominator (by reducing the amount of investment required for a given level of business output). [Moi ici: Outra ideia que acarinhamos no nosso trabalho, a diferença entre o numerador e denominador] These measures themselves can be further deconstructed into a set of management actions that drive higher-level business results.

...

...

every business function can and should contribute to shareholder value enhancement. Business functions can do this by improving revenue growth, which is the primary domain of marketing and innovation, or through operational and capital efficiency, which is a shared responsibility throughout the organization. As such, every employee within an organization should clearly understand how the creation and retention of satisfied customers drives overall profits, revenue growth, and shareholder value, and how their actions contribute to this. If employees do not understand the value of their daily activities, they are probably working ineffectively, working for a company with a poorly communicated management strategy, or both."

Trechos e figura retirados de "If You're in a Dogfight, Become a Cat!: Strategies for Long-Term Growth"