Há dias escrevi aqui sobre o desenvolvimento

canceroso do turismo.

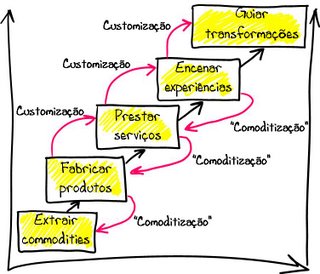

Qual a alternativa? A mesma que para os outros sectores de actividade, subir na escala de valor.

Nunca me esqueço deste exemplo, "

inGamba", ou do meu sonho, nunca realizado, com o casamento entre o birdwatching e a posta mirandesa (na Gabriela).

Recentemente, 17.09, encontrei no FT um artigo que fez recordar isto tudo e mais, "Goodwood earns its place in the global luxury experience race".

O artigo descreve como o Goodwood Revival, um evento automóvel de três dias em West Sussex, Inglaterra, se consolidou como um dos principais encontros de carros clássicos e experiências de luxo no mundo.

A partir da visão empreendedora de Charles Gordon Lennox, 11.º duque de Richmond, Goodwood transformou-se num polo de entretenimento global, com corridas, festivais de velocidade, música e moda, atraindo mais de 100 mil visitantes internacionais por ano e gerando receitas significativas. A ambição do duque é posicionar Goodwood como a “leading luxury experience brand”, mas o desafio é equilibrar expansão global com a preservação da autenticidade do lugar.

“The 70-year-old duke’s ambition meets his sense of caution, based on duty to hand over the estate in good shape to his heir Charlie March.” [Moi ici: A fazer lembrar os espalhadores de bosta de Estarreja]

O texto sobre Goodwood mostra um exemplo de gestão consciente das externalidades do turismo e do entretenimento de luxo. O duque percebe que há limites para crescer sem destruir a autenticidade do lugar, e opta por um equilíbrio entre espetáculo, comunidade e sustentabilidade.

O caminho não é mais volume, mas mais valor — como inGamba, ou no exemplo do birdwatching e da posta mirandesa.

O valor acrescentado já não está em vender um produto ou um serviço, mas em criar experiências memoráveis, autênticas, que envolvem emocionalmente o cliente.

Por exemplo, o Goodwood Revival não é apenas um evento automóvel: é uma imersão cultural e sensorial onde os visitantes “entram num filme”.

“The amazing thing is, they all feel they are part of it, they are in the movie.”

A alternativa ao turismo de volume é investir em nichos de experiência premium, que além de criarem mais valor económico, reduzem os efeitos perversos das externalidades.

%2006.21.jpeg)