"O meu conselho inicial era para situar o preço das trutas fumadas em lata junto do salmão fumado a 3,5€ as 100 ou 150g em vez das latas de sardinhas a 0,60€. Esse conselho motivado pela percepção de que o preço é contextual, aqui é reforçado por uma outra percepção, o JTBD da truta fumada se calhar está mais próximo do JTBD do salmão fumado do que o JTBD das conservas de sardinha ou cavala."

quinta-feira, setembro 25, 2025

O contexto é fundamental

terça-feira, maio 28, 2024

Valor e preço são contextuais

Aqui, escrevi (2011):

"No fim de semana passado entrei numa loja de uma cadeia de distribuição de material desportivo e a certa altura descubro, lado a lado, várias marcas de mochilas, da cadeia de distribuição, de marcas internacionais e uma, pelo menos, de uma marca nacional. Para espanto meu (minha ignorância) a marca mais cara, mas com mais variedade, mais cores, mais modelos, melhor aspecto nos acabamentos era ... a portuguesa.

Por que é que não comprei?

Como vi que a fábrica é em S. João da Madeira resolvi ir lá. E porquê? Para não dar dinheiro a ganhar à cadeia de distribuição, e porquê? Porque o produto estava maltratado. Estava desprezado, estava lá num canto apertado, tudo meio a monte."

Aqui, escrevi (2018):

"Recordo um lojista a ser entrevistado na sua loja com as camisas de modelos arcaicos amontoadas no chão."

Some of the problems of Britain's egg farmers would go away if supermarkets paid some attention to the presentation of eggs. Miracle food trashily displayed as a worthless item. pic.twitter.com/N8qcmPeAY5

— Rory Sutherland (@rorysutherland) May 26, 2024

É impressionante o impacte significativo que a apresentação e comercialização dos produtos têm na percepção e no valor do produto.

A forma como os ovos, as mochilas, as camisas, ... são expostos nos supermercados afecta a forma como os consumidores percebem o seu valor. Quando os ovos são apresentados de forma deficiente ou "inútil", isso sugere que são de baixo valor ou importância, o que pode influenciar as decisões de compra e levar à redução das vendas e aos preços mais baixos para os agricultores.

Ao melhorar a apresentação através de melhores embalagens, expositores atraentes e rotulagem informativa, o retalho pode aumentar o valor percebido dos produtos. Isto pode levar a um maior interesse dos consumidores e à vontade de pagar preços mais elevados, beneficiando assim os produtores ou fabricantes.

O autor do tweet defende que mudanças simples na forma como os ovos são comercializados e exibidos nos supermercados poderiam ter um impacte positivo significativo na indústria da produção de ovos, aumentando o valor percebido do produto e aumentando a procura do consumidor.

Recordo o preço da Coca-Cola e da lata de conserva em função do contexto. O preço é contextual.

segunda-feira, janeiro 24, 2022

O quanto dinheiro se deixa em cima da mesa ...

Num livro que li em 2008, "“The social atom – Why the rich get richer, cheaters get caught, and your neighbor usually looks like you”" de Mark Buchanan, fixei uma coisa que já tinha reparado. Quando estamos em grupo agimos de uma forma muita parecida com as leis da física. Na altura visualizei logo a circulação da mole humana nos corredores da Estação de Campanhã em hora de ponta, tão parecida com o perfil de velocidades de um fluido dentro e um tubo, como aprendi nas aulas de Mecânica de Fluidos. Nesse livro sublinhei, e escrevi aqui em, "O animal adaptativo":

“… the way people make most decisions has little to do with logic, and a lot to do with using simple rules and learning by trial and error. In particular, people try to recognize patterns in the world and use them to predict what might come next.”

…

“… people tend to hold a number of hypotheses in their heads at once, and to act on whichever seems to be making the most sense at the time.”

O tema do preço e do contexto é um tema que gosto de seguir. Por exemplo:

- Conservas e pricing (2014)

- Preço e JTBD são contextuais (2016)

"This article examines how proximity to high-status neighbors enables lower-status firms to engage in aspirational pricing. While prior studies have focused on associations based on bilateral agreements, we argue that mere spatial proximity to other high-status firms creates perceived associations, which positively affects the focal firm's aspirational pricing. Furthermore, middle-status firms are most likely to engage in aspirational pricing because they are sufficiently similar to high-status neighbors to expect assimilation, not contrast, effects."

quinta-feira, maio 23, 2019

Mongo e magia (parte VI)

“People are highly contradictory....Our very perception of the world is affected by context, which is why the rational attempt to contrive universal, context-free laws for human behaviour may be largely doomed.

...

Economic exchanges are heavily affected by context and attempts to shoehorn human behaviour into a single, one-size-fits-all straitjacket are flawed from the outset – they are driven by our dangerous love of certainty: However, this can only come from theory, which by its very universal nature doesn’t take context into account.

...

I hope it will free you slightly from the modern rationalist straitjacket, and help you understand that many problems might be solved if we abandoned the rationalist obsession with universal, context-free laws. Once free of this constraint, you might have the freedom to generate magical ideas, some of which may be silly but of which others will be invaluable."

Trechos retirados de "Alchemy: Or, the Art and Science of Conceiving Effective Ideas That Logical People Will Hate" de Rory Sutherland.

quarta-feira, maio 22, 2019

Mongo e magia (parte V)

“it is perfectly possible to be both rational and wrong.

Logical ideas often fail because logic demands universally applicable laws but humans, unlike atoms, are not consistent enough in their behaviour for such laws to hold very broadly.

...

The drive to be rational has led people to seek political and economic laws that are akin to the laws of physics – universally true and applicable. The caste of rational decision makers requires generalisable laws to allow them confidently to pronounce on matters without needing to consider the specifics of the situation. And in reality ‘context’ is often the most important thing in determining how people think, behave and act: this simple fact dooms many universal models from the start. Because in order to form universal laws, naïve rationalists have to pretend that context doesn’t matter.

...

Logic requires that people find universal laws, but outside of scientific fields, there are fewer of these than we might expect. And once human psychology has a role to play, it is perfectly possible for behaviour to become entirely contradictory.

...

While in physics the opposite of a good idea is generally a bad idea, in psychology the opposite of a good idea can be a very good idea indeed: both opposites often work."

Um tema que abordo há anos quando recordo os que pensam que a economia é como a física newtoniana ou galilaica. Um tema que também abordo quando recordo que o preço é contextual

Trechos retirados de "Alchemy: Or, the Art and Science of Conceiving Effective Ideas That Logical People Will Hate" de Rory Sutherland.

terça-feira, abril 16, 2019

Preço e contexto no dia-a-dia

"value is always co-created in markets because value is phenomenologically derived and determined by a service beneficiary (e.g., customer) through the use of a market offering. This view on value differs from traditional economic measures of value. In particular, Vargo et al. (2008) discuss two measures of value that have been deliberated since the time of Aristotle – value-in-exchange and value-in-use. Whereas value-in-exchange represents the nominal amount for which something can be exchanged, value-in-use represents the value derived through integration and use, or application, of an available resource. Vargo et al. (2008) point toward the need for conceptualizing “value-in-context,” which they propose as an extension of value-in-use because it centers on value derived through use, but influenced by a particular context (e.g., time, place and social setting). In this way, value is always contextual because it is based on a phenomenological perspective and influenced by time, place and social surroundings, as well as other environmental factors, including access to other internal and external resources."Trecho lido em mais uma caminhada matinal em "The context of experience", Journal of Service Management, Vol. 26 Iss 2 de Melissa Archpru Akaka, Stephen L Vargo e Hope Jensen Schau.

terça-feira, fevereiro 19, 2019

"usando o que produzimos como um input para o seu processamento"

"You’re either pregnant or you’re not. And the market for pregnancy testing kits would appear to be similarly dichotomous: you either need a pregnancy test kit, or you don’t. If you do, you buy one and it helps you answer the first question in the affirmative or in the negative.Recordar:

.

So you’d think there’s not much to the market – not much market segmentation potential.

...

“why do consumers buy pregnancy kits?”

.

The answer was surprisingly far from obvious.

.

It revealed two very different kinds of buyer of pregnancy kits: those who hopefully await a positive result, and those who anxiously wish for a negative one.

.

These two segments deserved to be served differently. So the product was launched differently for the two types of consumer: one for “the hopefuls” and another for “the fearfuls,” differentiated in name, packaging, pricing and in-store placement.

.

For the fearfuls the product was named “RapidVue,” it came in a plain white clinical pack design, priced at $6.99 and displayed near the condoms in the contraception aisle.

.

For the hopefuls, on the other hand, the company created a pretty pink box labeled “Babystart,” featuring a gurgling, rosy-cheeked infant, priced 50% higher at $9.99 and sold near the ovulation predictor kits.

.

It was a dramatically successful strategy for Quidel. A new way of segmenting the market was born."

- Preço e JTBD são contextuais (Novembro 2016)

- Conservas e pricing (Janeiro de 2014)

domingo, abril 29, 2018

Privilegiar os inputs sobre os outputs (parte IX)

Estão a ver tudo arrumado, tudo em caixas identificadas, tudo localizado...

Quando se perguntava onde tinham arranjado a estrutura metálica X a resposta foi: na empresa G.

Quando se perguntava onde tinham arranjado a estrutura metálica Y a resposta foi: na empresa G.

Quando se perguntava onde tinham arranjado as prateleiras para caixas Z a resposta foi: na empresa G.

Quando se perguntava onde tinham arranjado os carros metálicos W a resposta foi: na empresa G.

A empresa G é uma serralharia industrial que fornece uma outra empresa do ramo da metalomecânica com que trabalho. Por acaso estacionei o carro perto da G. E ao olhar para o edifício da G. descobri um cartaz metálico na fachada onde listavam o que faziam:

- montras industriais

- estruturas metálicas

- ...

"servicification. This means that the emphasis, when we look at offerings, is no longer on the production process that historically created them as outputs, but in their property as inputs in the value creating process of the customers system."

- começar a frequentar um ginásio pela primeira vez? O que precisa?;

- começar a praticar campismo pela primeira vez? O que precisa?

- começar a praticar ciclismo de recreio para abater banhas, ou para melhorar a relação com os filhos, ou para aproveitar o Verão e ... O que precisa?

sexta-feira, novembro 24, 2017

Talvez focar primeiro o valor e só depois o preço

Ainda no mesmo dia obtive resposta:

"Já apresentamos cotação e perdemos, por preço..."Confesso que na altura não processei esta resposta convenientemente.

Entretanto, no meio de uma sessão de jogging, comecei a relacionar a resposta com as lições de "Value First then Price: Quantifying value in Business to Business markets", editado por Andreas Hinterhuber e Todd Snelgrove.

Tenho ideia que a empresa é competitiva em termos de custos... fiquei a pensar no que poderia ter feito de diferente para conseguir um resultado diferente.

Talvez focar primeiro o valor e só depois o preço. Talvez pensar no ciclo de vida do produto: a empresa produz mas o cliente precisa de armazenamento, distribuição, embalamento, ...

segunda-feira, novembro 06, 2017

Preço e contexto

"Should brick-and-mortar retailers set different prices in-store and online? If Amazon (or another web retailer) is not significantly stealing business away, it doesn’t make sense to slash online prices. Best to accept the minimal customer loss, maintain current prices, and be thankful.Imagino que o preço que a multinacional está a propor aos clientes do retalho físico permite que estes ganhem dinheiro e, por isso, permite que os que vendem online tenham retornos muito interessantes. E isso não criará uma janela de oportunidade para que produtores concorrentes, dedicados a servir a distribuição online, possam oferecer produtos semelhantes que podem ser vendidos a preços mais baixos?

.

However, if a web retailer is successfully poaching a sizable number of customers, it’s time to reconsider whether having identical online and in-store prices makes sense. Making this decision gets at the pricing dilemma faced by many brick and mortar retailers: If a company sets rock-bottom prices in order to compete against internet rivals, it will lose money on in-store purchases due to the store’s higher costs (employees, high rent locations, etc.). But if prices are set at what’s profitable for in-store purchases, web prices won’t be competitive. A one-price-fits-all-channels mandate can result in a disadvantage in one market.

...

Retailers should view their online and in-store channels as unique services, much like gas stations offering self-service and full-service options. Relatively higher prices can capture the premium that some customers place on purchasing in-store. Web prices can be lower to compete against aggressive e-tailers.

.

Will discount web prices mean that everyone will purchase online? No. Many people choose to purchase in stores and pay premiums even though they can order from Amazon. In the third quarter of 2016, e-commerce accounted for 7.7% of all retail sales."

Até que ponto a marca da multinacional consegue servir de barreira? Ou, até que ponto a multinacional deve criar marcas diferentes, com preços diferentes, para cada tipo de canal?

A multinacional pode ver o seu produto como único mas o cliente está perante um contexto diferente, e o preço é contexual:

"To succeed in the modern world of retail, executives need to embrace web and in-store as unique operations that cater to customers with different needs and price sensitivities"Trechos retirados de "How Retailers Should Think About Online Versus In-Store Pricing"

quarta-feira, agosto 02, 2017

Um preço é um palpite!

Quando é que as pessoas vão aprender que o preço não resulta de uma equação? Quando é que as pessoas vão perceber que o preço não depende do custo? Quando é que as pessoas vão aprender que o preço não é justo nem injusto? Quando é que as pessoas vão aprender que um preço é um palpite?

E os palpites são verdadeiros ou falsos hoje e, depois, falsos ou verdadeiros amanhã. Por isso, gosto da frase: os preços são contextuais. Porque os preços são contextuais, recomendo às empresas que contribuam para o contexto:

segunda-feira, junho 12, 2017

Contextual pricing

Interessante a diferença de preços entre o almoço e o jantar.

Especulo que os pratos sejam os mesmos, o que muda é o contexto, é o contexto do jantar, o que muda é o job to be done.

- "Pricing isn’t a Math Problem — it’s a Psychology Problem.

- "Price the customer, not the service"

Exemplo concreto do contextual pricing:

- Porque o preço não é tudo! (Novembro de 2013)

- O poder do contexto (Novembro de 2013)

- O Valor é co-criado e contextual (Abril de 2014)

- "Pricing is Contextual" (parte IV) (Novembro de 2014)

- O contexto é fundamental (Janeiro de 2015)

- "Pricing isn’t a Math Problem — it’s a Psychology Problem" (Abril de 2015)

- Preço e JTBD são contextuais (Novembro de 2016)

segunda-feira, janeiro 09, 2017

"There are no pricing problems; only segmentation problems"

"What is the most important thing you can share about pricing?

- There are no pricing problems; only segmentation problems. [Moi ici: Qual é mesmo a segmentação que a sua empresa faz?]

- Think about your end-customer first.

- Value is in the perspective of the person with whom you are talking.

...

- The value changes in context as well.

How does a price war destroy value?

- War results in destruction and casualties and price war leads to value destruction. – Dropped Mobile Profits

- There is a misconception of success when you capture market share.

- The causation effect is lost in the minds of people during a price war.

- Market share at any cost is chasing the wrong target.

- Which comes first, market share or profit?

- Profit comes first as it creates value for the customer; value comes first."

Trechos retirados de "The Ethics of Price Discrimination with Rags Srinivasan"

segunda-feira, dezembro 12, 2016

Acerca do pricing

Gostei sobretudo de:

"Whenever a provider contacts customers about their current offer, customers “wake up” and think about what they are getting in return for their money. Inevitably, some customers will choose to leave, or “churn,” even if prices don’t rise. In fact, the wake-up effect is often the single largest contributor to churn—and sometimes it occurs even when prices go down or product value goes up. So if a price increase is too low, the incremental revenue from remaining customers can be insufficient to offset the loss of customers who have been “ [Moi ici: Até porque esta semana fui contactado pela Vodafone e é nesta altura que nos lembramos que o tempo de fidelização está a terminar]E de:

"“turning the other cheek” may not seem like an effective response in a highly competitive market. It takes courage. But sometimes it is the least of all evils."Talvez a sua empresa possa reflectir sobre estas técnicas.

sábado, dezembro 10, 2016

"Align Prices with Value by Segment"

"Narrow your customer groups as tightly as possible. Segment them by how profitable they are now, by their willingness to pay, for the extras they request and more. Each transaction represents a different buying situation and therefore a different value proposition. Group these customers by the deal elements they value, and then dedicate a monetary price to these value propositions. Consider shipping rates, support fees, discounts, and allowances as potential value drivers.Trechos retirados de "3 Ways to Raise Prices: The Grand Slam of Your Pricing Strategy"

.

During this process, you’ll find plenty of opportunities to raise prices for a handful of your smaller segments.

...

If (and let’s be honest when) customers balk at your effort to raise prices, your sales team won’t persuade them to pay up by just listing your product or service features. They need to explain why your customers need the products and/or services and what they get out of them. They have to sell on value.

.

You already know what your customers value from segmenting them during the pricing strategy process. It’s time to put that knowledge to good use during the sales process. As value propositions resonate different from customer to customer, so should your sales strategy."[Moi ici: Na sequência de uma auditoria recente a um departamento comercial fiquei a matutar nas eventuais vantagens e problemas da empresa ter comerciais não por áreas geográficas mas por segmentos de clientes]

quarta-feira, novembro 09, 2016

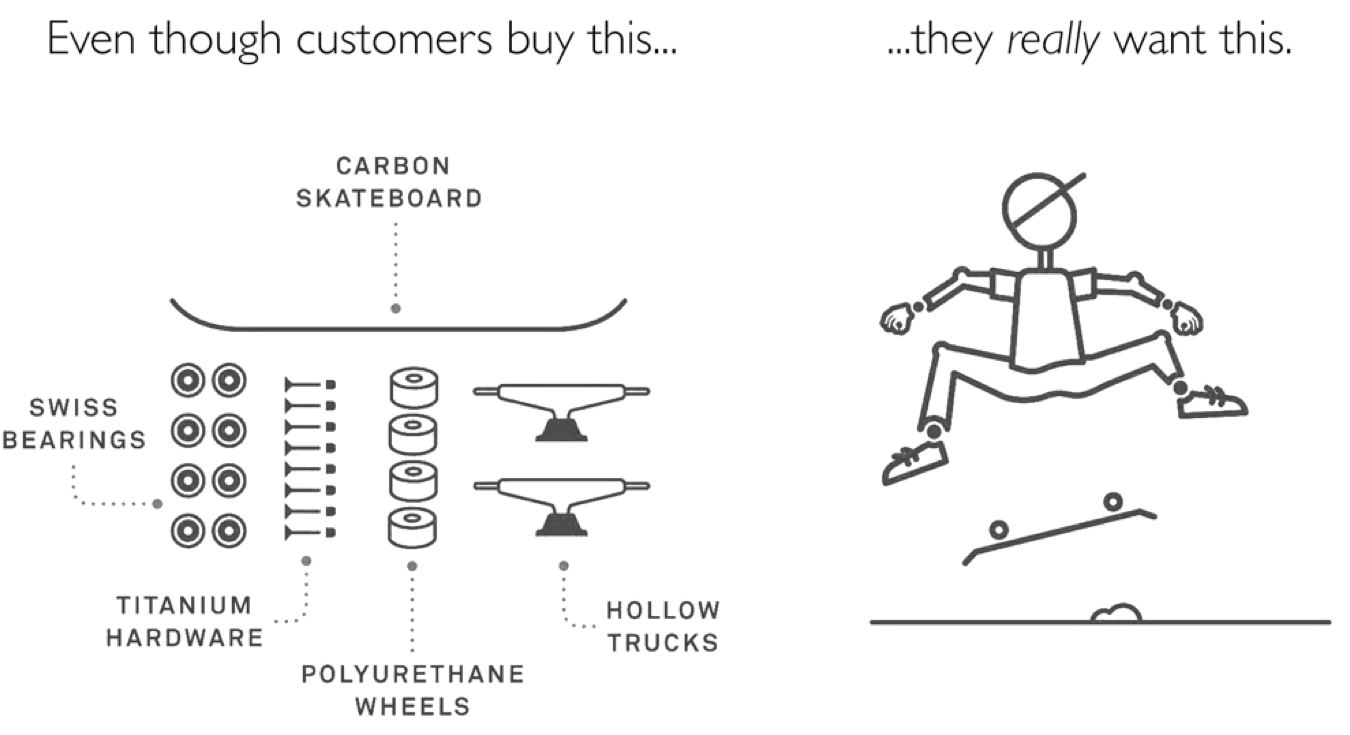

Preço e JTBD são contextuais

"Consider another illustration. A maker of boxed drinks, whose products were a mixture of 40% fruit juice and 60% flavored sugar water, had placed its products in the boxed drink section of supermarkets, juxtaposed with competing products that were 100% fruit juice.A venda depende do contexto!

.

Though the pure juice products were much more expensive, sales of the juice/water drinks were languishing. When interviewed about their purchases, customers, who were mostly parents, revealed that the job they were trying to get done had a functional dimension — to put a healthy drink in their children’s school lunches — and an emotional dimension — to feel like they were taking good care of their children. When pitted against the job candidates that contained 100% juice, the mixture drink simply wasn’t qualified; it rarely got hired. The company then had its drink placed in another location in the supermarket, in snack foods, and sales improved markedly. When compared to the job candidates in the snack aisle, a drink that had 40% real fruit juice solved the emotional component of the “good parent” job much better than the competing candidates."

.

Recordar as conservas de truta fumada da Comur e o meu conselho em "Conservas e pricing".

.

O meu conselho inicial era para situar o preço das trutas fumadas junto do salmão fumado a 3,5€ as 100 ou 150g em vez das latas de sardinhas a 0,60€. Esse conselho motivado pela percepção de que o preço é contextual, aqui é reforçado por uma outra percepção, o JTBD da truta fumada se calhar está mais próximo do JTBD do salmão fumado do que o JTBD das conservas de sardinha ou cavala.

sábado, outubro 03, 2015

Acerca do pricing

- Generic Drug Regulation and Pharmaceutical Price-Jacking

- My Product Deserves its Price and Other Fallacies

- What Is Price Anchoring? (And Should You Do It?)

- 3 Pricing Strategy Examples Using Decision Science

- Greedy Pharmaceutical CEO Raises Drug Price From $13.50 To $750, Just Because

- Competitive pricing is about getting smarter, not cheaper

- 16 Pricing Page Tips That Will Drive More Sales

quinta-feira, junho 25, 2015

Acerca do pricing

"Many chains use a cost-plus approach. That is, prices are based on food costs plus a labor charge and an overhead factor. The problem with cost-plus pricing is that it is a short-term, inside-out approach. Not only does it leave you vulnerable to variability in commodities pricing, but it also doesn’t reflect the full margin potential of your offerings. Customers may be willing to pay more for some items, but cost-plus pricing essentially treats all products the same. Pricing should be decided from the outside in.

...

You should approach pricing as thoughtfully and strategically as your menu.

...

Reinforce your brand identity. Use price to communicate what your brand stands for.

...

Be clear about your competitive positioning. Don’t be afraid to charge more if you’re competing on quality, exclusivity, or a superior experience.

...

Vary price to emphasize brand differentiation and value. Variable pricing draws attention to the value you offer or to the one dimension that most meaningfully differentiates you from competitors.

...

Vary price to target customer segments.

...

Anchor your pricing. Price anchoring uses cues to set the customer’s expectations.

...

Pricing is too important to be made as an arbitrary decision. And just because consumers have cut back on spending doesn’t mean pricing is simply a game of “how low can you go.” With a strategic approach, you can use price as a helpful tool in your brand-building toolbox."

"1. Similarity Can Cost You Sales...

Sometimes marketing (and pricing) needs to help customers get the difference between products, because as it turns out, too many options can be demotivating to consumers.

...

if two similar items are priced the same, consumers are much less likely to buy one than if their prices are even slightly different.

...

2. Utilizing Price AnchoringWhat's the best way to sell a $2,000 watch? Right next to a $10,000 watch!

...

By placing premium products and services near standard options you can create a clear sense of value for potential customers, who will then view your less expensive options as a bargain in comparison.

.

3. The Secrets of Weber's Law...

the just noticeable difference between two stimuli is directly proportional to the magnitude of the stimuli.

...

4. Reduce Pain Points in the Sales ProcessAccording to neuroeconomics experts, the human brain is wired to "spend 'til it hurts."

...

Reframe the product's value.

...

Bundle commonly bought items.

...

Sweat the small stuff.

...

Appeal to utility or pleasure.

...

It's either free or it isn't.

...

5. Try Out an Old ClassicEnding prices with the number 9 is one of the oldest pricing methods in the book...

...

6. Emphasize Time Spent vs. Saved...

study shows that consumers tend to recall more positive memories of a product when they are asked to remember time spent with the product over the money they saved.

...

7. Never Compare Prices Without a Reason...

the act of comparative pricing can cause unintended effects in consumer evaluations if there is no context for why prices should be compared.

...

The focus should be on why prices are cheaper, not just that they are.

.

8. Utilize the Power of Context...

Where you buy is just as important as what you buy.

...

9. Test Different Levels of Pricing...

Some customers are always going to want the most expensive option, so adding a super-premium price will give them that option and will make your other prices look better by comparison.

.

10. Keep Prices Stupidly Simple"

"Let the consumer – not your competition – determine the value of your product and remember that it is much easier to lower your price after a product launch than it is to raise it down the line."

"no great companies can be all things to all people; you have to choose what sort of organization you are-- and exactly what value you're delivering. They divide the world in three: Are you primarily a product company? a customer-service driven operation? or an operationally efficient enterprise?

...

Until you decide what kind of company you are, you can't develop an effective pricing strategy. Product-oriented companies can command premium prices because they deliver truly distinctive goods and services. Customer-centric companies have to be middle-of-the pack in their pricing, though they can command a degree of a premium based on outstanding service. Companies grounded in operational efficiency present a value-based model, and so must price themselves below the midpoint. What are you? You can be some of all three. But you have to major on one."

- "A Penny Saved: Psychological Pricing"

- "19 Pricing Strategies for Your Business to Try"

- "The Psychology of Pricing: A Gigantic List of Strategies"

sexta-feira, maio 22, 2015

"how prices are framed and the context of the purchase significantly influence our willingness to pay"

"When economists were treating preference, price, and value as stable and absolute, Kahneman, Tversky, and other psychologists argued that in the human mind, everything is relative and depends on context. And when we say everything we really mean everything, from judgments of physical attractiveness to judgments of reference, price, and value. Almost all human judgments are made in relation to a reference point.

...

“Our perception of, and reaction to, reality is subjective. How you feel about products, or even about your life, is at least as important, and probably much more important, than the product or your life’s objective characteristics.”

...

the brain didn’t evolve to perceive reality as it is. It evolved to make approximations that are reliable.

...

Coherent arbitrariness tells us that absolute preferences are volatile, but relative preferences are stable. This creates an illusion of order that disguises the largely arbitrary nature of how we value things.

...

If we accept coherent arbitrariness, we should dismiss (or at least discourage) the idea that market price is solely determined by a balance between demand and supply. [Moi ici: Ehehehe subversão para cima da tríade] Just like the valuation of the man’s wealth depends on his wife’s sister’s husband, his willingness to pay for a product depends on his perception of fairness, not a cold calculation of what the product should be worth based on its market price. The behavioral economist would argue that even though market price is not entirely arbitrary - no one could get away with selling a six-pack of beer for one thousand dollars - how prices are framed and the context of the purchase significantly influence our willingness to pay.

...

The second interpretation is that high and low anchors make us feel like we’re deciding rationally, even though we’re probably just responding to social pressures and loss aversion—we don’t want to be perceived as cheap, but we don’t want to get ripped off, so we opt for the middle option.

...

in the luxury trade where expensive items that don’t sell change what does. Thus, if a retailer wants to sell a pair of shoes that cost $100, they should put them next to a pair of shoes that cost $150. That way, the retailer will activate the trade-off contrast principle, which says that if item X is clearly better than item Y consumers will tend to buy X, even when X is only better relative to Y—and potentially worse than comparable items.[Moi ici: Recordar o exemplo das conservas da Comur]

.

Neoclassical economic models predict that customers weigh all the options rationally. In reality, when we encounter too much choice - just like we would in a shoe store - we tend to opt for items that we can justify. We talk ourselves into X because it looks better than Y."

Deliciosos trechos retirados de "What Makes Us Tick?"

terça-feira, abril 21, 2015

"Pricing isn’t a Math Problem — it’s a Psychology Problem"

"não lhe chateia o facto dos combustíveis premium serem vendidos como bons e mais caros quando são iguais aos outros do supermercado?"Ontem, lembrei-me deste comentário por causa destes trechos:

"Pricing isn’t a Math Problem — it’s a Psychology Problem.É que ninguém é obrigado a comprar e valor é uma experiência pessoal e muito subjectiva.

...

Pavlovian Association: Higher Price = Better Product.

There’s an amazing phenomenon in pricing, where an increase in price leads to an increase in sales because of a basic guideline that is programmed into all of us. We’re so used to better products costing more, that when something costs more we assume that it is better.

...

Price is a choice that determines which customers you’re speaking to, and which you’ll attract. This is a powerful, counterintuitive effect that you won’t get from the Economic or a math-based approach to pricing."

.

Trecho retirado de "How Strategy and Psychology Work Together to Perfect Pricing (well, almost)"

%2014.08.jpeg)

%2006.21.jpeg)