"Salesforce is expected to surpass $6 billion in revenue this year, making it the fastest enterprise software company to ever do so. Now it’s worth over $45 billion..It took almost 16 years for Salesforce to get to this point, but its cofounder Parker Harris believes there’s one key reason to its massive growth in a relatively short period of time: focus..Unlike some of its bigger rivals like Oracle and SAP, who are virtually in every area of enterprise software, Salesforce has kept its business focused on the customer relationship management (CRM) space, largely comprised of sales, marketing, and service automation....“Many people have said we just need to add more products. Look at Oracle, look at SAP. Add ERP and inventory or compensation. Add all this stuff,” Harris told IDG. “What we realized is we’re the customer company. We’re the front office solution and our customers would be really upset if we just added a whole bunch of stuff and lost focus.”"Foco, foco, foco!

.

Em vez de querer ser tudo para todos, em vez de uma oferta alargada, just-in-case"; foco, foco, foco!!!

.

Interessante como o tema está presente numa série de outros artigos publicados recentemente.

.

Por exemplo, "In Technology, Small Fish (Almost Always) Eat Big Fish" (este artigo merece outro postal futuro, sobre outra vertente) pode ler-se:

"Eventually, and inevitably, these “small” entrants eat their way up the food chain into the market, capturing a larger and larger share, until the behemoths of the sector are forced to retreat back into a narrowing market niche.Ainda um outro artigo sobre o poder do foco "The Increasing Fragmentation of SaaS":

...

One sterling example is in the CRM (customer relationship management) space. For as long as anyone could remember, the market was owned by Siebel. It was big, offering an incredibly complex solution that had to be installed for customers on their servers, licensed in bulk, with tons of training and customer service attached. Sounds unwieldy, but it was the norm, and everyone needed it.

.

Then along came a company called Salesforce.com, offering just one capability of the many Siebel already provided. Only they offered it differently — instead of having to buy hundreds of licenses, customer companies could pay per employee using Salesforce.com, and use it in their web browsers hassle free. They became the automatic choice for the many young companies that couldn’t afford to do anything but start small with SaaS.

.

Even so, the larger incumbents like Siebel comforted themselves that enterprise customers would never entrust their precious data and prospect lists to an offsite cloudbased system. Today, Salesforce.com completely dominates the CRM market and has an enormous ecosystem around it. Siebel, having had their lunch eaten right in front of them, became acquisition bait for Oracle.

.

Salesforce.com’s ascent highlights the momentum of all cloud solutions, led by small, specialized companies purveying simple, easy-to-understand benefits for consumers and enterprises alike. Think Dropbox and Box, respectively. They are now what people think of when they hear the term “cloud,” not the large, vertically integrated storage solutions of yesteryear.

...

[Moi ici: Recordando o exemplo de ontem sobre as peúgas, sobre a decomoditização] Your rallying objective should be to build something truly great for the low end of the marketplace, solving an important problem with a simple, low-friction product in a segment of the market that's underserved by the incumbents. Once you've achieved excellent market traction in this arena, you can nibble your way upward until you're competitive with the heavyweights of your industry."

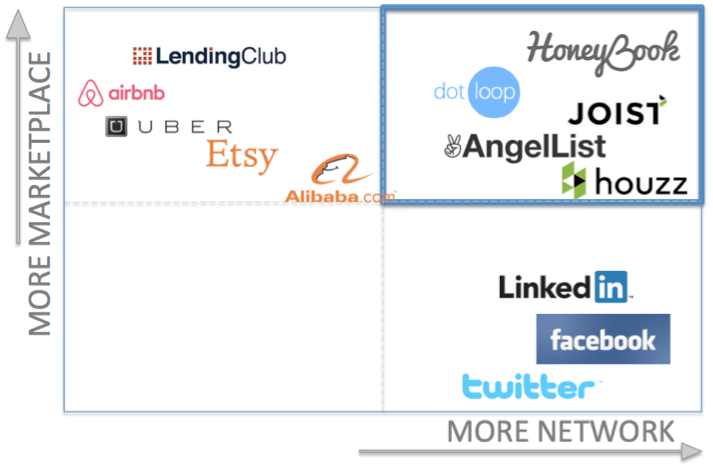

"According to ChiefMarTec, in 2015 there are 1875 marketing technology companies, up from 947 last year. If the number of marketing software companies is any indication, there is a huge expansion in the number of SaaS companies in almost every segment including sales tools, engineering productivity, finance, and human resources.O que é isto senão Mongo? Diversidade, focalização, especialização, decomoditização...

.

This fragmentation trend has been happening for quite some time. In the old model of software procurement, companies would call one of the large software monoliths (Oracle, SAP, IBM, etc) and negotiate an enterprisewide license for a software suite to serve the majority of their departments. These suite offerings promised simplified negotiation and procurement, a single integrated platform with free data interchange across departments, and one point of support. But, this promise was never fulfilled. For example, according to a recent study by Panorama Consulting Solutions, the average

ERP implementation requires 16 months to deploy and 20% of them are considered failures.

.

The alternative, which is the fragmented market of today, enables teams to purchase best-of-breed point solutions, try them, and quickly cycle through all the different offerings until they find the best one for their needs. This change in purchasing behavior is happening broadly across SaaS.

...

These department specific software stacks serve their customers much better than a single suite ever could, because each team in each company can select precisely the products that offer the features that meet their specific needs. and if requirements should change, it’s as simple as canceling a subscription, and starting with another product."

.

BTW, em sectores completamente diferentes, recordar:

- "Hits" versus nichos;

- "Ter uma estratégia clara = escolhas claras = ideias claras = desejar sucesso à concorrência (parte V)"

Especialização, diferenciação, nichos...

%2006.21.jpeg)