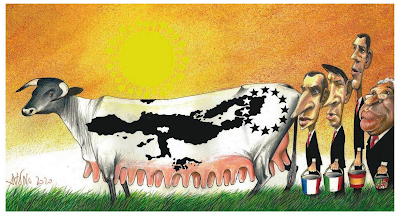

A ideia das cooperativas surgiu-me na sequência da democratização da produção e da fuga à proletarização "uberiana". Alguns postais ao longo dos anos sobre o tema foram:

- Acerca do pós-Uber ou não, uma aposta (Fevereiro de 2016)

- Isto é só o começo... (Abril de 2016)

Ontem em "From the Gig Economy to the Guild Economy" encontrei os mesmos três temas relacionados:

"there’s a problem – actually, many problems. Efficiency is a diminishing returns proposition. The more efficient we become, the longer and harder we need to work to get the next increment of efficiency. Diminishing returns is a problem on its own, but it’s compounded by the fact that we live in a Big Shift world of mounting performance pressure – competition is intensifying, change is accelerating, and extreme disruptive events occur with increasing frequency.Acerca de Mongo, no mesmo artigo, algo que parece retirado aqui do blogue acerca da profusão de tribos e do bailado entre oferta e procura:

...

We’re already starting to see some of that start to happen in the gig economy. Individual workers are discovering that there are others who share their passion and coming together so that they can work on projects as a group, rather than individuals.

...

On the other side, institutions are going to begin to see that the real value of contract workers is the diversity of experience and expertise that they bring to the work. These contract workers can help the institution’s employees to learn faster by exposing them to different perspectives and approaches to addressing work. These institutions will begin to expand their focus beyond just cost savings and see gig workers as an opportunity to learn faster.

...

We’re going to begin to see impact groups forming and coming together into broader networks that will help them to learn even faster.

That’s where guilds come in.

...

As independent workers become more aware of the imperative for accelerating learning, they will tend to affiliate into guilds that will help to connect them with others who might become part of their impact group and, more broadly, with other impact groups that share their passion for increasing impact in a particular set of activities. These guilds can help to knit together larger and larger networks of impact groups, generating something that I call “creation spaces,” to help scale and accelerate learning."

"Beyond the gig economy, there’s another area that will see the re-emergence of guilds. That’s in product and service businesses that will increasingly fragment as customers demand more and more tailored products and services to serve their specific needs. The participants in these small, but very profitable, product and service businesses will see value in connecting with others in their particular domains so that they can all learn faster and create even more value with less resource. For example, think of a guild for craft chocolate companies that are serving very specific customer niches.

...

To address the opportunity to help participants to learn faster, these guilds need to find a way to move beyond fear of competition and foster the excitement that can come from addressing the exponentially expanding opportunities created by the Big Shift. Rather than embracing a scarcity mindset, these guilds need to cultivate an abundance mindset. They need to recognize that, the more people that come together, driven by a commitment to learn faster, the more opportunity there will be for value creation. It’s a very different heartset and mindset from the ones generated by the fear that is engulfing more and more of the world’s population.

The bottom line

The imperative to learn faster is going to motivate individuals to come together in very different ways. In at least one dimension, our future may represent a return to the past, when we see the re-emergence of guilds. Rather than isolated individuals driven by fear as they confront mounting performance pressures, we are likely to see people coming together, excited about the opportunity to learn faster and embrace exponentially expanding opportunity."

/https%3A%2F%2Fiterativepath.files.wordpress.com%2F2009%2F10%2Fatt_prices1.png%3Fw%3D648)