"The term `competitiveness' is also a product of end-of-history economics, coming into fashion in the early 1990s. At first the term was highly contested. `National competitiveness', wrote Robert Reich in 1990, `is one of those rare terms of public discourse to have gone directly from obscurity to meaninglessness without any intervening period of coherence.' Later Reich, a professor at Harvard's John F. Kennedy School of Government, was to become US Secretary of Labor under President Bill Clinton. Here he championed the idea that the United States should move into high-value sectors of the economy (a view consistent with our quality index of economic activities). In a paper published a couple of years later, MIT's Paul Krugman twice referred to Reich as a `pop internationalist' and somewhat unacademically condemned his Harvard colleague's notion of `high-value sectors' as `a silly concept'. But in the same paper Krugman also had a go at the term `competitiveness': `if we can teach undergrads to wince when they hear someone talk about "competitiveness", we will have done our nation a great service'. To Krugman the key insights were still those of David Ricardo.

...

Competitiveness may be defined as the degree to which, under open market conditions, a country can produce goods and services that meet the test of foreign competition while simultaneously maintaining and expanding domestic real income.

By this definition, competitiveness can be seen as a process where real wages and national income are jacked up by a system of imperfect competition, producing a `rent' to the nation. This is probably the reason why neo-classical economists opposed the term. This perspective, however, is compatible with our Other Canon view of how the rich countries got rich. Traditionally, when this development was not possible under market conditions, tariffs were established to protect the areas that experienced the most technological change, while competition was maintained. The more backward the nation, the higher the tariffs had to be in order to produce the desired effects.

...

Competitiveness, then, denotes a process that makes people and nations richer by increasing real wages and income. And yet, while visiting Uganda a few years ago, I experienced at first-hand how the term was used in order to argue for the opposite, for lower wages. The textile plants attracted to Uganda by the African Growth and Opportunity Act (AGOA) - a maquila-type set-up between the USA and Africa - could no longer compete internationally, and President Museveni argued that in order for Uganda to achieve 'competitiveness', workers' wages had to come down.

So competitiveness is a wonderfully flexible term, fitting a confused age of muddy thoughts and a need to explain away the utter failure of key economic theories. It can be used to describe a mechanism which makes everyone richer (the OECD definition), but it can also be used as a term describing the opposite, to convince workers that they must accept more poverty (Museveni's definition). The sad thing in Europe is that the term competitiveness is increasingly used in the Ugandan sense, coupled with `labour market flexibility' (which invariable means flexibility downwards). In order to be `competitive' we must lower our standards of living."

Em Portugal estamos com outra via, a via do absurdo.

Ou seja, "Governo volta a dar apoio aos patrões para compensar subida do salário mínimo". Vivemos no mundo do lerolero no poder.

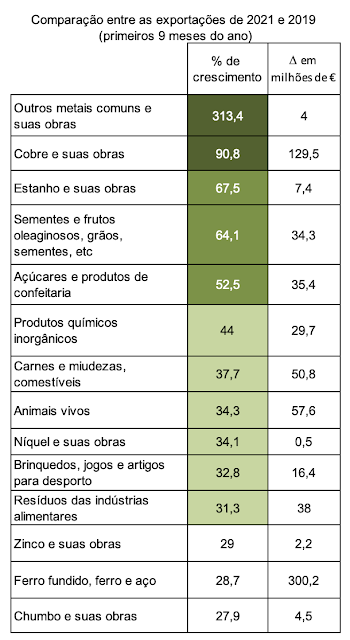

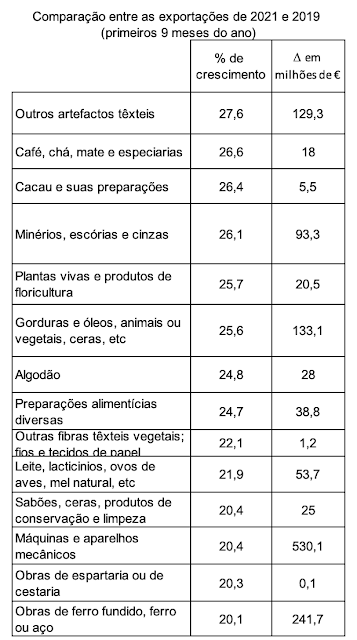

Pensam que os saltos de produtividade vão ser obtidos pelo grosso das empresas portuguesas? Num mundo de fronteiras abertas? Pensem outra vez:

Trechos retirados de "How Rich Countries Got Rich and Why Poor Countries Stay Poor" de Erik S. Reinert