Mais uns trechos de "Windows of Opportunity: How Nations Make Wealth".

Recordar Irlanda e João Duque:

- Tamanho, produtividade e a receita irlandesa

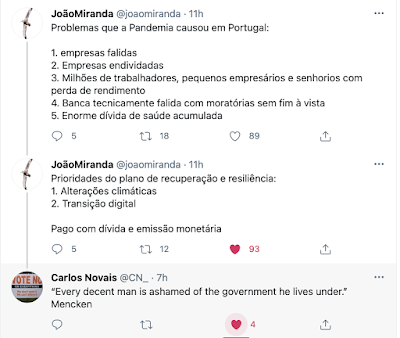

- A caminho da Sildávia, portanto.

- Ah! Claro que os macacos não podem faltar. Eles não voam, trepam às árvores.

"If we want to know why some countries grow faster than others, it is also important to understand that there is a ladder of economic development, the rungs of which represent different types of industry. It is a ladder developing countries have to climb in order to be successful - no developing country tries to start growing by creating a pharmaceutical industry, and no country has ever achieved a high GDP per capita by having a cheap garment industry.

...

perhaps a more useful way of thinking about the rungs of the ladder of economic development is to see them as representing industries which require increasingly complex organisational and technological capabilities. On the bottom rungs are simple industries involved in, for example, the production of cheap clothes, the assembly of electronic components and the making of simple toys. On the top rungs are industries requiring complex organisational and technological capabilities that can only be acquired experientially, cumulatively and collectively; such as the aerospace, pharmaceutical and semiconductor industries. In simple industries, such as the production of cheap clothes or the assembly of electronic components, it is difficult for any firm to gain a competitive advantage. Consequently, the value-added per capita of firms is low, and the wages and salaries they can pay is also low.

...

Knowledge involves understanding the relationships or linkages between entities, and being able, therefore, to predict the outcome of events without having to act them out.

...

Knowhow is different, as it involves the capacity to perform tacit actions; that is actions that cannot be explicitly described.

...

Before knowledge and knowhow can be used to make new products and services, they have to be embodied in individuals and organisations. The knowledge and knowhow that a single individual can acquire is limited, as an individual can only absorb so much information. Therefore, the knowledge and knowhow to make complex products and services have to be embodied in a number of different individuals and co-ordinated by a firm's organisation.

...

This point about the difficulty of accumulating the knowledge and knowhow to make products and services is important for two reasons. Firstly, neoclassical economists tend to assume that demand and incentives are enough to stimulate the production of a product or service anywhere in the world, and if they don't it must be because the system of allocating resources is not working efficiently. However, while incentives and demand may be enough to motivate intermediaries and traders, the people who produce goods and services also need to know how to make them.

Secondly, if the ability to accumulate the knowledge and knowhow to make products and services is difficult, it is likely that countries will have accumulated varying levels of knowledge and knowhow on their economic history, and therefore the complexity of the products and services they can produce will vary.

...

products requiring a large input of knowledge and knowhow would tend to be exported from only a few countries. Some of the products exported by a large number of countries include simple garments, such as underwear, shirts and pants; while some of the products exported by a relatively few countries include optical instruments, aircraft and medical imaging devices. Such a simple scan suggests that industries requiring less knowledge and knowhow are present in more places, as one might expect."