Excelentes noticias: O desemprego já está abaixo dos 10% (@pt_INE). Quem esteve contra a reforma laboral de 2012 deve estar arrependido pic.twitter.com/OdIg7K5AVI— Alvaro SantosPereira (@santospereira_a) April 28, 2017

sexta-feira, abril 28, 2017

Curiosidade do dia

Volume is vanity, Profit is sanity

"Market leadership is even more precarious. The percentage of companies falling out of the top three rankings in their industry increased from 2% in 1960 to 14% in 2008. What’s more, market leadership is proving to be an increasingly dubious prize: The once strong correlation between profitability and industry share is now almost nonexistent in some sectors. According to our calculation, the probability that the market share leader is also the profitability leader declined from 34% in 1950 to just 7% in 2007. And it has become virtually impossible for some executives even to clearly identify in what industry and with which companies they’re competing."

Como não recordar o clássico "Manage For Profit, Not For Market Share: A Guide to Greater Profits In Highly Contested Markets"

Trecho retirado de "Adaptability: The New Competitive Advantage"

"People buy products for one reason only"

This simple principle has changed the way I view product design: pic.twitter.com/HxNgZNgKFf— Justin Jackson (@mijustin) April 26, 2017

Produtividade para o século XXI (parte V)

Parte I, parte II, parte III e parte IV

O artigo é de 2004, descobri-o em 2011.

Continua.

"the only theoretically correct and practically relevant approach to measuring service productivity seems to be to base productivity calculations on financial measures. In principle, the correct way of measuring service productivity as a function of cost effects of internal efficiency, revenue effects of external efficiency and cost and revenue effects of capacity efficiency is, therefore, the following measure:

As a global productivity measure of the operations of a service provider, the following measure can be used:

the productivity of service processes can be measured as the ratio between revenues and costs. This is a true measurement of service productivity. If revenues increase more than costs, productivity goes up. On the other hand, if a cost reduction leads to lost revenues, but the decline in revenues is less than the cost savings that have been achieved, productivity still improves. However, this may be a less recommendable strategy because in the long run it may lead to a negative image and unfavorable word of mouth, which can have a further negative effect on revenues. Thus, cost reductions may lead to a bigger drop in revenues than the savings on the cost side. If this is the case, in the long run service productivity declines."A equação que uso há anos, talvez desde 2007.

O artigo é de 2004, descobri-o em 2011.

Continua.

Onde trabalhar?

Excelente figura:

Valor é criado quando uma empresa consegue criar uma oferta em que a willingness to pay (WTP) supera o cost to serve (CTS). A diferença entre o WTP e o CTS define a dimensão do valor criado. valor esse que terá de ser dividido entre o cliente e o produtor.

Tal como na figura, a vantagem competitiva de uma empresa pode ser uma função de conseguir fornecer o mercado com custos mais baixos, ou uma WTP superior ou uma mistura de ambas.

Infelizmente, muitas PME contentam-se em trabalhar na zona A muito mais do que na zona B (se soubessem o que aprendi com Marn e Rosiello naquele mês de Janeiro de 1992, na verdade só aprendi mais tarde - nunca é tarde para aprender, ás vezes é demasiado cedo)

Continua.

Trecho e imagem retirada de "If You're in a Dogfight, Become a Cat!: Strategies for Long-Term Growth"

Valor é criado quando uma empresa consegue criar uma oferta em que a willingness to pay (WTP) supera o cost to serve (CTS). A diferença entre o WTP e o CTS define a dimensão do valor criado. valor esse que terá de ser dividido entre o cliente e o produtor.

Tal como na figura, a vantagem competitiva de uma empresa pode ser uma função de conseguir fornecer o mercado com custos mais baixos, ou uma WTP superior ou uma mistura de ambas.

Infelizmente, muitas PME contentam-se em trabalhar na zona A muito mais do que na zona B (se soubessem o que aprendi com Marn e Rosiello naquele mês de Janeiro de 1992, na verdade só aprendi mais tarde - nunca é tarde para aprender, ás vezes é demasiado cedo)

"Where does price fit in? As shown in the right-hand panel of figure 5.2, companies can choose to price their products anywhere between WTP and CTS. This is a strategic decision that reflects how a company wants to divide the product value between itself and its customers. Consumers benefit from lower prices by enjoying a higher consumer surplus, the difference between what a consumer is willing to pay for a product and the actual price charged. High consumer surpluses spur sales, increasing growth and customer satisfaction. Producer surplus is an equivalent concept from the opposite perspective—the difference between the price a company charges and its unit cost. Obviously, companies that enjoy a competitive advantage in the marketplace have more pricing flexibility when choosing how to allocate value between the company and consumers."A não ser que uma empresa queira ser o fornecedor com o custo mais baixo o truque é trabalhar para aumentar o WTP, trabalhar na zona B.

Continua.

Trecho e imagem retirada de "If You're in a Dogfight, Become a Cat!: Strategies for Long-Term Growth"

quinta-feira, abril 27, 2017

Curiosidade do dia

A 5 de Abril de 2017 escrevi:

Hoje, 27 de Abril o mesmo governo volta a aparecer na capa do Público com:

E Santana Lopes é que fazia trapalhadas...

Como não recordar o 1º Princípio de Deming:

"Ontem ao ler "Costa garante: Malparado não vai fazer “nascer um banco mau”" lembrei-me logo de "Costa quer tirar 'lixo' dos bancos. E passá-lo para um 'banco mau'"".

Hoje, 27 de Abril o mesmo governo volta a aparecer na capa do Público com:

E Santana Lopes é que fazia trapalhadas...

Como não recordar o 1º Princípio de Deming:

Constância de propósito

"Pricing is a game"

"Pricing is a game – one with asymmetric and imperfect information. So what does this mean for you? Basically, you’re very unlikely to nail pricing the first time. And even if you do come close, you’ll have to adjust as your product and market mature.Trechos e imagem retirados de "Want to Nail Pricing? Understand Market Dynamics First."

...

Price elasticity of demand is the basic economic insight that price influences demand and that in most cases (with the exception of certain luxury goods) demand will increase as the price goes down.

...

Cross-price elasticity is the tendency of customers to switch vendors (or products from the same vendor) in response to price changes. In some markets, there are well understood alternatives and when the price of one increases some customers will abandon it for the alternative."

Clareza estratégica

"To put the issue of strategic clarity in context, let's start by defining terms. Figure 5.1 illustrates the four hierarchical elements required to formulate and execute effective business strategy. The starting point is a set of overarching goals that establish a company's long-run intent and management priorities. ... A company's stated goals identify the broad boundaries of business scope and the areas of business activity and performance of greatest concern to management, e.g., consumer satisfaction, employee safety and welfare, shareholder value, and sustainable business practices.

...Pessoalmente trabalho com outra versão daquela hierarquia:

A company's strategy describes how it plans to meet its stated objectives. Strategy is all about making choices, and a company's strategy guides which market opportunities to pursue, which products to create, which distribution channels to exploit, and which business partnerships to form. Strategic choices to ignore certain opportunities are just as important as actionable commitments."

E mais, às vezes interrogo-me se não fará mais sentido trabalhar com esta versão:

Trechos e imagem retirados de "If You're in a Dogfight, Become a Cat!: Strategies for Long-Term Growth"

"despedir é sempre resultado de uma maldade ou de preguiça da gestão" (parte V)

Aproveitei umas horas do 25 de Abril para descarregar uns caixotes de livros no meu novo escritório. A certa altura passou-me pelas mãos um livro que muito me marcou, "Grow to be Great: Breaking the Downsizing Cycle", e com ele na mão, olhando para a capa sorri e recordei-me de alguns postais com mais de 10 anos.

OK, por vezes regras como o LIFO levam a despedir não com base em critérios alinhados com a estratégia o que não é muito saudável. No entanto, IMHO, pode fazer sentido encolher uma empresa quando ela precisa de mudar de vida, quando uma estratégia deixou de fazer sentido e a empresa tem de se renovar.

E recordo a série "despedir é sempre resultado de uma maldade ou de preguiça da gestão" (parte IV) e a imagem:

Por vezes, encolher é a única alternativa para poder recomeçar.

E foi daquela frase "You cannot shrink to greatness" que me recordei ao ler "If You Think Downsizing Might Save Your Company, Think Again".

Confesso que o artigo me pareceu algo infantil:

"we tested the theory that downsizing could lead to a host of problems that eventually increases the likelihood of bankruptcy.Por que é que estas empresas encolheram? Porque já estavam com problemas!

...

We found that downsizing firms were twice as likely to declare bankruptcy as firms that did not downsize. While downsizing may be capable of producing positive outcomes, such as saving money in the short term, it puts firms on a negative path that makes bankruptcy more likely."

OK, por vezes regras como o LIFO levam a despedir não com base em critérios alinhados com a estratégia o que não é muito saudável. No entanto, IMHO, pode fazer sentido encolher uma empresa quando ela precisa de mudar de vida, quando uma estratégia deixou de fazer sentido e a empresa tem de se renovar.

E recordo a série "despedir é sempre resultado de uma maldade ou de preguiça da gestão" (parte IV) e a imagem:

Por vezes, encolher é a única alternativa para poder recomeçar.

"What he did was both obvious and, at the same time, unexpected. He shrunk Apple to a scale and scope suitable to the reality of its being a niche producer in the highly competitive personal computer business. He cut Apple back to a core that could survive."Uma coisa é encolher para sobreviver numa versão 2.0, outra é encolher porque sim, para pressionar aumentos de eficiência.

"nature evolves away from constraints, not toward goals" (outra vez)

"nature evolves away from constraints, not toward goals"

Foi uma frase que captei em 2007.

E foi dela que me lembrei assim que o Paulo Vaz me chamou a atenção para este artigo "I Have Seen The Future, And The Future Is a Free Market".

Por um lado a ideia de que a economia é uma espécie de ser vivo em permanente mutação:

"The “economy” is not some granite block that remains unchanged for decades and decades. Like any other thing, manifestations of it arise and then pass away. But they do not disappear. They become something else. It’s like people think the Earth came into being, it’s a done deal, and everything here is permanent and remains the same for thousands of years. No. Things come into being here, pass away, and become something else."Por outro lado a ideia de Mongo relacionada com as empresas grandes:

"as Nature shows, the bigger will always fall to be replaced by the smaller. Thus, the big retailers will go out of business. Of course! The malls will fall into ruins. Of course! And why? Because people can shop online, yes, that’s one reason. But another is because there are literally tons upon tons of consumer goods, clothes, and various other things in perfectly good condition out there to be had for a penny on the dollar of original purchase price."E ainda:

"None of this means the economy is getting ready to pop another Great Depression on us. It means the economy is changing as all things must. There is no such thing as any human creation being a permanent structure.

...

The little restaurants of the shopping mall food courts discovered they could do better business as “food trucks” and not bother with paying rent or having furniture. The smaller shops of the malls found they could move into lower rent strip malls. Chain retailers flooded the markets with thousands of tons of consumer goods that thrift stores sell used and, therefore, no one needs to go get this stuff from the chain retailers anymore. In a word, what is happening is a free market is coming into existence right under everyone’s noses and few see it.

.

How so? Because those food trucks have found a way to beat the government out of property tax or the malls out of rent. The second-hand shops have found a way to sell goods without buying them from major corporations. What’s more, ethnic populations often import goods direct from their own countries, often from their own families, and sell them in their own independent shops and offer new goods at a fraction of the price of what the mall would ask.

...

The big retailers and malls need to understand that their time has passed. The free market is coming into existence as we speak.

...

So, no, the economy is not tanking. It is changing.

...

The free market scares the government because it carves huge chunks out of government revenue garnered through taxes. [Moi ici: Algo que escrevemos aqui há anos] Food trucks alone represent huge losses in property taxes they can’t levy against a moving vehicle that parks where it pleases and vends food. The free market scares Wall Street because they’re locked out of it. Thrift stores move into abandoned or vacant buildings paying cheap rents to landlords just grateful someone moved in after Big Retailer, Inc. went belly up. And they sell all the tons of goods the big retailers flooded America with for decades.

...

This free market changes faster than the government can adapt and come up with new taxes to go after them. [Moi ici: Daí aquela frase lá de cima "nature evolves away from constraints, not toward goals"] I have seen de facto swap meets pop up in vacant lots and just garner passers-by as customers. They sell out of vans and pickup truck beds and communicate locations on Facebook and through text messages to their customers. They move around from abandoned storefront parking lots to empty lots where buildings once stood. Food trucks passing by see them and pull in and set up. Sometimes it’s all coordinated between them. And the cops don’t care. The presence of people like that deters crime."

...

The free market does not mean Wall Street gets to continue to exist and run it. In fact, Wall Street is passing away as we speak.

...

I have seen the future and the future is the true free market. It is being created by people. Not the government, not some political party, not corporations, and not Wall Street. All of them are headed for the same destination as the dinosaurs: Museums."

quarta-feira, abril 26, 2017

Curiosidade do dia

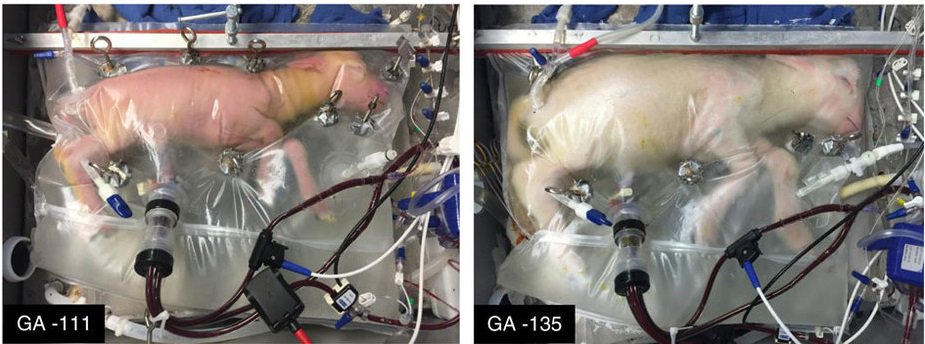

Aldous Huxley é a primeira coisa que me vem à mente.

Ler "Artificial womb helps premature lamb fetuses grow for 4 weeks" e pensar em tudo o que se pode "desenvolver" a partir daqui.

Produtividade para o século XXI (parte IV)

Parte I, parte II e parte III.

"According to the traditional manufacturing-related productivity concept, productivity is defined as the ratio between outputs produced and inputs used, given that the quality of the outputs is kept constant (the constant quality assumption), or

Only if the quality of the production output is constant and there is no significant variation in the ratio between inputs used and outputs produced with these inputs, productivity can be measured with traditional methods. The constant quality assumption is normally taken for granted and not explicitly expressed. Therefore, the critical importance of this assumption is easily forgotten. [Moi ici: Forgotten por todos este pormaior fundamental. Subir na escala de valor é uma forma de dinamitar a constant quality assumption. É ela que gera o fenómeno da perseguição entre gato e o rato (salário e produtividade)] However, in most service processes it does not apply.

In services, it is not only the inputs that are difficult to calculate, it is also difficult to get a useful measurement of the outputs. Output measured as volumes is useful only if customers are willing to buy this output. In manufacturing, where the constant quality assumption applies, customers can be expected to buy an output produced with an altered input or resource structure. However, in services we do not know whether customers indeed will purchase the output produced with a different input structure or not. It depends on the effects of the new resources or inputs used on perceived process-related and outcome-related quality. Hence, productivity cannot be understood without taking into account the interrelationship between the use of inputs or production resources and the perceived quality of the output produced with these resources. The interrelationship between internal efficiency and external efficiency is crucial for understanding and managing service productivity."

Industria 4.0 e a cadeia de fornecimento

"The digitization of the supply chain enables companies to address the new requirements of customers, the challenges on the supply side, and the remaining expectations in efficiency improvement. Digitization leads to a Supply Chain 4.0, which becomes …Imagem e trechos retirados de "Supply Chain 4.0 in consumer goods"

- … faster. New approaches to product distribution can reduce the delivery time of fast runners to few hours. ...

- … more flexible. Supply Chain 4.0’s ad hoc, real-time planning allows companies to respond flexibly to changes in demand or supply, minimizing planning cycles and frozen periods. ...

- … more granular. With customers looking for more and more individualization in the products they buy, companies must manage demand at a much more granular level, through techniques such as microsegmentation, mass customization, and more-sophisticated scheduling practices. ...

- … more accurate. Next-generation performance management systems provide real-time, end-to-end transparency throughout the supply chain. ...

- … more efficient. The automation of both physical tasks and planning boosts supply-chain efficiency."

Analogias interessantes

Nesta interessante apresentação, "14 Tips to Entrepreneurs to start the Right Stuff", encontrei este slide:

Que logo relacionei com o mapa da estratégia e o balanced scorecard:

Que logo relacionei com o mapa da estratégia e o balanced scorecard:

"Sequencing markets correctly is underrated"

“Sequencing markets correctly is underrated, and it takes discipline to expand gradually. The most successful companies make the core progression—to first dominate a specific niche and then scale to adjacent markets—a part of their founding narrative.” – Peter Thiel, Zero to OneTrecho retirado de "Modeling Your Total Addressable Market"

terça-feira, abril 25, 2017

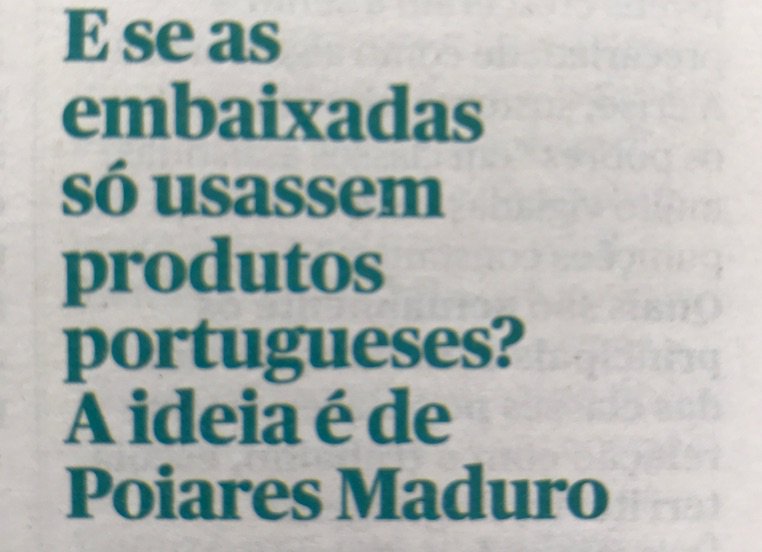

Curiosidade do dia

Gente sem noção:

Estou a imaginar batatas de Chaves a um custo interessante em Jacarta...

Estou a imaginar morangos de Gaia a um custo espectacular em Camberra...

Estou a imaginar tomate ribatejano a um custo de amigo em Joanesburgo...

Gente sem skin in the game farta-de fazer propostas deste calibre, é imaginar a mesma bitola na Saúde, na Educação, na Justiça, na Agricultura, ...

Estou a imaginar batatas de Chaves a um custo interessante em Jacarta...

Estou a imaginar morangos de Gaia a um custo espectacular em Camberra...

Estou a imaginar tomate ribatejano a um custo de amigo em Joanesburgo...

Gente sem skin in the game farta-de fazer propostas deste calibre, é imaginar a mesma bitola na Saúde, na Educação, na Justiça, na Agricultura, ...

Estratégia, essa neblina

"According to research recently cited in the Harvard Business Review, [Moi ici: Pena que não a identifiquem] only 29 percent of employees of high-performing companies with publicly stated strategies could correctly identify their company's strategy out of six choices. As such, a majority of employees are not in a position to link their personal work initiatives and decision-making to the desired direction of the firm.' Think of it like this: a racing scull with rowers each choosing their own pace or direction would not win many races.

...

Discouragingly, this problem exists between senior executives and their boards as well. Of the 772 directors surveyed by McKinsey in 2013, a mere 34 percent agreed that the boards on which they served fully comprehended their companies' strategies. Only 22 percent said their boards were completely aware of the ways their firms created value, and just 16 percent claimed that their boards had a strong understanding of the dynamics of their firms' industries."

Para fazer uns cortes epistemológicos

"The number of patent applications filed by emerging market countries has overtakenthose filed by the developed world for the first time.Trecho retirado de "Emerging markets file more patents than the west"

The 12 leading EM nations applied for 1.49m patents in 2015, outstripping the 1.48m in developed market countries, according to figures from the World Intellectual Property Organisation, collated by Comgest, a Paris-based asset manager, as the first chart shows.

The figures are a far cry from 2004, when the 12 emerging market countries, which account for the vast majority of developing world filings, made just 372,000 applications, 29 per cent of the 1.3m made by the advanced world.

“This signals the dawn of a new age of innovation as EM economies start to shake off their image as purely centres for low-cost manufacturing for companies in developed markets,” said Emil Wolter, co-head of Comgest’s global emerging markets team."

"Da 'comoditização' para os artesãos - subir na escala de valor "

Agora aqui está um bom exemplo sobre o que escrevemos e defendemos acerca do caminho a seguir pelas PME para lidar com a China e com o advento de Mongo.Da 'comoditização' para os artesãos - subir na escala de valor pela diferenciação c/c @ccz1 https://t.co/PXIFg7f2EU— Jorge Cangaia (@jcangaia) April 24, 2017

"Com menos de uma dezena de funcionários, e com uma carteira de fornecimento que assenta no trabalho de artesãos externos, a UrbanMint, a empresa que detém as marcas Munna e Ginger & Jagger, é ainda o protótipo representativo do sector mobiliário português.Recordar o que escrevi ao longo dos anos quando não era cool falar do mobiliário (ou do calçado, ou do têxtil, ou do ...):

.

A empregar cerca de 30.000 trabalhadores, o sector é muito disperso e de dimensão quase familiar. Das 4466 empresas registadas no final de 2015, 3837 tinham menos de dez trabalhadores; cerca de 600 empregava, entre 10 e 249 pessoas e apenas quatro empresas é que não caberiam na definição de pequena e média empresa, por terem mais de 250 trabalhadores.

...

reconhece ao sector do mobiliário um peso crescente nas exportações de Portugal: passou de uma quota de 1,67% em 2012, para os 2,08% atingidos no final de 2016.

.

Apesar de ser um sector com um tecido produtivo muito disperso e atomizado, exportou cerca de 66% da sua produção, que em 2016 atingiu um volume de negócios de 1586 milhões de euros.

...

o sector enfrentou uma reestruturação do seu tecido produtivo, e uma análise ao rácio entre empresas produtoras e exportadoras mostra alterações relevantes. Se em 2011 existiam 5252 empresas a produzir mobiliário em Portugal, apenas 2500 é que eram consideradas exportadoras.

.

Em 2016 o tecido produtivo encolheu (desapareceram 806 empresas), mas aumentou aquelas que se dedicam à exportação: das 4466 empresas registadas, 3187 são exportadoras."

- O exemplo do mobiliário (parte I), (parte II), (parte III), (parte IV) e (parte V)

- Trabalhar para aumentar os preços

- Campeões escondidos versus campeões nacionais

- ""Às vezes somos alcunhados de loucos, uns miúdos que fazem umas asneiras."

- Autópsia de uma estratégia (parte I e parte II)

Empresas mais pequenas, menos dependentes da quantidade pura e dura.

BTW, e encadear isto nos postais recentes sobre os artesãos? (aqui e aqui , por exemplo)

Trechos retirados de "Micro empresas de mobiliário contribuem para 2% das exportações nacionais"

A ascensão do artesão e da arte na produção (parte II)

Ontem publicámos "A ascensão do artesão e da arte na produção". Depois, ao princípio da tarde fui brindado com:

Entretanto, ao fim da tarde de ontem ainda deparei com:

— highalpha (@veryhighalpha) April 24, 2017

Entretanto, ao fim da tarde de ontem ainda deparei com:

- Barbearias. “Para se ser barbeiro tem de se ter amor à arte”

- Este pão antigo é fresco e só tem cereais portugueses

- The Artisanal Economies, Entry # 1: the Sofi interview (muito bom, a ler na íntegra)

"Several things happen in this conversation but one of them is that we begin to see into the history, we might even say the “intentions,” of the objects on the shelves. We begin to see that these things come from someone, that they were crafted to a purpose that begins with “coffee mug” and then scales up to include the lifestyle, the community, the economy, the culture that might be loosely designed artisanal.

Ah, now we get it. That’s why things cost more. That object on the shelf of Wal-mart doesn’t have a story. It was made by a stranger in a factory in Chengdu, shipped across an ocean, and banged around in the distribution system until it just happened to roll to a stop here on a shelf. It doesn’t mean very much because capitalism was so busy giving it value, it forgot to give it meaning.

And that’s what Sofi is for, to gently help you see what the mug means. Yes, we can buy a cheaper mug somewhere. But ,by this standard, cheaper doesn’t feel better, it feels poorer. As if everyone in the production – consumption chain as been diminished by the effort.

So, we could say, if we were rushing to conclusions (and that is what we do here), that retail is not merely the last moment in the distribution chain. It completes the meaning making process. And more to the point, it helps consumers understand and grasp the “artisanal premium” they are required to pay. It’s always true to say “we get what we pay for.” The very point of Olives and Grace is to help us see what we’re paying for. It helps solve the problem of cheap food."

Subscrever:

Mensagens (Atom)