- Hong Kong pode ficar em confinamento até 2024

- Año nuevo chino: más tensión para el ‘sourcing’ y el consumo al ralentí

quarta-feira, fevereiro 02, 2022

"hay que construir nuevas cadenas de aprovisionamiento regionalizadas” (parte III)

terça-feira, fevereiro 01, 2022

"hay que construir nuevas cadenas de aprovisionamiento regionalizadas” (parte II)

"Splits are emerging in corporate America's response to a supply chain crisis which growing numbers of executives expect to last all year, heralding a wave of spending on new capacity, better data, and support for weaker vendors.

This earnings season, companies have complained of shortages, delays, and spiking costs in a quarter in which they scrambled to procure semiconductors, were left waiting for components and suffered the effects of suppliers' staffing gaps.

...

The pandemic has pushed manufacturers to redesign their supply chains in favor of certainty of supply and locating inventory closer to customers.

...

Companies including VF Corp, the clothing group behind The North Face, said they had moved some production to suppliers closer to their biggest markets.

...

Companies with more domestic suppliers and those that had moved before the pandemic o broaden their supply chains were faring better than others with more complex, global logistics, said Tim Ryan, chair of PwC US. mid-January survey of US executives by PwC found that less than half expected supply chain disruptions to ease by the end of the year, and more than 60 percent planned to raise prices in response.

...

“The engineers have designed supply chains around predictability and when that predictability goes away everything goes to hell in a handbasket,” he told the FT.

“Most companies are realising that they over-tuned their operation for performance versus resilience,”"

Trechos retirados "Winners and losers emerge from lingering US supply chain crisis"

segunda-feira, janeiro 31, 2022

"hay que construir nuevas cadenas de aprovisionamiento regionalizadas”

"La cadena de suministro sigue sumando costes. Las continuas interrupciones en la supply chain podrían suponer pérdidas de entre 9.000 millones de dólares y 17.000 millones de dólares en para la industria norteamericana de la confección y el calzado en 2022

...

En los últimos doce meses, entre los aumentos de costes que sufrieron los sectores de la confección y el calzado en Norteamérica se incluyen el incremento del precio del algodón, que aumentó en un 40%, el de los contenedores marítimos, que se disparó un 300%, el transporte aéreo, con un alza del 50%, y por carretera, que se incrementó en un 20%.

Todo esto, sumado a la escasez de la mano de obra, repercutió en los salarios de los trabajadores de la logística, el almacenamiento y la venta al por menor, contribuyendo, aún más, a los gastos de todas las industrias en términos generales.

...

“Hay diversas prácticas que se pueden llevar a cabo para que las cadenas de suministro sean más resistentes”, señaló Brian Ehrig, socio de Kearney en Nueva York, en un comunicado. “Lo primero es poner el foco en aquellos aspectos que se pueden controlar como nuevas estrategias de aprovisionamiento y una gestión más rigurosa del inventario”, añadió Ehrig.

“A largo plazo, las empresas mejoran su capacidad de resistencia mediante la deslocalización; para que la cadena de suministro sea menos vulnerable, hay que construir nuevas cadenas de aprovisionamiento regionalizadas”, sostuvo.

A su vez, la creación de plataformas para generar sinergias también podría generar un impacto positivo en la agilización de la supply chain de empresas de confección y calzado, especialmente reduciendo los costes de la cartera de productos cuando se produzca una interrupción en la cadena."

Trechos retirados de "Estados Unidos: las pérdidas por la rotura de la ‘supply chain’ podrían alcanzar 17.000 millones en 2022"

segunda-feira, janeiro 10, 2022

Era bom que se aproveitasse esta boleia ...

Recordo Emprego, preços e desglobalização

"A variante Ómicron pode tornar a China vítima do seu sucesso, à medida que a política de “zero covid” prolonga o isolamento do país, quando o resto do mundo vislumbra uma fase endémica para a doença, apontam analistas.

“Em 2022, a China vai enfrentar a altamente transmissível [variante] Ómicron, com vacinas aparentemente menos eficazes e muito menos pessoas protegidas por anticorpos criados por infeções anteriores”, observou a consultora de riscos políticos norte-americana Eurasia Group, num relatório.

As medidas de bloqueio para conter os surtos deverão ser ainda mais frequentes e duras, envolvendo dezenas de milhões de pessoas, lê-se no mesmo documento.

“Esta crise vai continuar até que a China possa lançar vacinas de RNA mensageiro desenvolvidas internamente e reforços para os seus 1,4 mil milhões de habitantes, o que ainda deve demorar pelo menos um ano”, acrescentou.

A política de zero casos implicou a suspensão das viagens de negócios e turismo ou intercâmbios académicos com o exterior.

Quem chega ao país tem que realizar uma quarentena cujo período varia entre duas e quatro semanas, dependendo da província de destino. As autoridades exigem ainda a apresentação do certificado negativo dos testes serológicos tipo IgG e IgM e o teste de ácido nucleico PCR antes do embarque."

Depois, queixem-se e chamem-me nomes por achar que anda muito optimismo mal justificado no ar.

Era bom que se aproveitasse esta boleia para preparar a próxima etapa, antes que a maré mude outra vez.

Trecho retirado de "Ómicron deve deixar China mais isolada com insistência na política de zero casos"

quinta-feira, janeiro 06, 2022

Suspeito de demasiado optimismo

"Na altura em que as empresas asiáticas encerraram, em virtude da covid-19, o comércio de produtos têxteis não parou. As pessoas deixaram de comprar vestuário, com os confinamentos e o teletrabalho, mas passaram a dar mais importância ao conforto e à decoração do lar. As marcas que antes mandavam fazer na Ásia foram obrigadas a procurar soluções em outras geografias....Segundo Mário Jorge Machado, presidente da Associação Têxtil e Vestuário de Portugal, os custos de contexto, a energia e os impostos determinaram o fim da competição pelo preço. [Moi ici: Gostava de acreditar nesta conclusão, acho demasiado cedo para chegar a ela. Sim, o artigo é sobre o têxtil-lar]...Para este investigador, o têxtil português sobreviveu porque se reinventou, passou de uma indústria que vendia pelo preço baixo para uma que vende valor acrescentado e que tem marca própria. [Moi ici: Gostava de acreditar nesta conclusão, acho demasiado cedo para chegar a ela. Sim, o artigo é sobre o têxtil-lar]...A China continua na competição pelo preço, mas, segundo o investigador, "este já não é o campeonato das nossas empresas. "Depois dos transportes e da refinação, a indústria a têxtil é o maior poluente do planeta", aponta João Gomes. Isto apresenta-se como uma oportunidade para a indústria portuguesa, "porque já está a traçar o caminho de uma produção mais sustentável e com maior valor acrescentado e isso é reconhecido pelos clientes". [Moi ici: Se é um factor relevante, porque é que foi preciso a covid-19? Ainda não percebeu que o factor crítico não é a produção menos poluente, mas também a redução da produção. Recordar a Inditex]

Numa coluna encontro o título: "Quando a China fechou, o têxtil aproveitou a oportunidade" onde se pode ler:

"Clientes que fogem da Ásia atraídos por processos eficientes e pela inovação" [Moi ici: Fogem da Ásia por causa da covid-19 ou por causa da inovação?]

As encomendas no sentido da subida na escala de valor têm de ter preço unitário mais elevado e serem de menores quantidades.

segunda-feira, dezembro 06, 2021

Emprego, preços e desglobalização

- mais emprego; (falta de mão de obra) e

- preços mais altos (inflação)

"Since the end of May, China has recorded 7,728 covid-19 infections. America has recorded 15.2m. And yet China’s curbs on movement and gathering have been tighter, especially near outbreaks (see chart 1). Its policy of “zero tolerance” towards covid-19 also entails limited tolerance for international travel. It requires visitors to endure a quarantine of at least 14 days in an assigned hotel. The number of mainlanders crossing the border has dropped by 99%, according to Wind, a data provider....Businesspeople in Shanghai have started talking about travel restrictions persisting until 2024. The virus is highly mutable. China’s policy towards it, however, is strikingly invariant."

Acerca do emprego este exemplo "Desemprego do passado dá lugar a falta de mão-de-obra no têxtil no Vale do Ave".

Acerca dos preços este exemplo "Retreat From Globalization Adds to Inflation Risks":

"While supply-chain disruptions, labor shortages and fiscal stimulus have all been blamed for the rise in short-term inflation, another long-term force could also be at work: “deglobalization.”

Economists and policy makers have long argued that globalization helped to lower prices. As trade barriers fell, domestic companies were forced to compete with cheaper imports. Technology and trade liberalization encouraged businesses to outsource production to low-wage countries.

...

“The reorganization and shortening of supply chains…will have a cost that will be passed down to the vendors and ultimately to consumers,”"

domingo, outubro 03, 2021

Onde é que isto nos está a levar?

"Nike, which makes about half of its shoes in Vietnam, said last week it had lost 10 weeks of production there due to plant closures. Those 10 weeks translate to about 100 million pairs of unmanufactured Nike shoes, according to BTIG LLC, an American brokerage firm. Nike now expects demand for its products to exceed available supply over the next eight months.

“Our experience with Covid-related plant closures suggests that reopening and returning to full scale production will take time,” Matt Friend, chief financial officer of Nike, said last week....A survey conducted at the end of August among nearly 100 representatives of companies in the manufacturing sector by the American Chamber of Commerce in Vietnam found that a fifth had already transferred part of the production to other countries.“What people realize, whether it’s China or Vietnam, or whatever, you can’t have all your eggs in one basket, you can’t be vulnerable to a country from a chain perspective. procurement, ”said Jonathan Moreno, head of the House manufacturing and supply chain task force....Andrew Rees, CEO of Crocs Inc., the shoe company, said in mid-September that it was moving some production to other parts of the world. He said the company had already planned to migrate some of its production out of Vietnam and was adding facilities in Indonesia and India. “Continuous diversification is basically the name of the game,” he said."

Onde é que isto nos está a levar?

Que jogo de vasos comunicantes está a ser accionado?

segunda-feira, agosto 30, 2021

Qual o impacte disto?

Há dias citei:

"the word ‘strategy’ derives from the Ancient Greek position of ‘strategos’. The image that the Greeks liked to use to convey the skill of a great strategos was that of the kubernetes – the helmsperson on an inshore fighting ship. The kubernetes’ skill lay in his recognizing that because he could not make waves he had to passively accept the currents, but at the same time he was active working the rudders so as to change direction within the parameters of what was possible."

Ontem publiquei um relato sobre a disrupção nas cadeias de fornecimento.

Hoje, durante a caminhada matinal, li "Shipping chaos gives top importers ‘massive competitive edge’":

"The largest importers are paying far lower freight rates than smaller importers, the playing field is becoming increasingly uneven, and foreign ocean carriers are in position to pick the American import sector’s winners and losers.

“We’re seeing a price differential of $15,000 [per forty-foot equivalent unit or FEU] between the lowest short-term price in the [trans-Pacific] market and the top price,”

...

“That implies a huge competitive advantage for established players, which has consequences across the economy and for everyday life, and also, from a point of view of lowering competition and increasing barriers to entry for future competitors.”

Patrik Berglund, CEO of Xeneta, added, “Everybody’s seeing price increases but … being really big is really a massive competitive edge in this market.”

...

“To put this price differential of $15,000 into context, last year, it was $500.”"

Qual o impacte disto no próximo Natal?

Qual o impacte disto nos preços para os consumidores?

Qual o impacte disto no campo de possibilidades para os produtores na proximidade dos centros de consumo?

Como minimizar, ou como aproveitar o dominó de situações gerado por este evento?

Que realidades podem ser criadas?

quinta-feira, agosto 05, 2021

Implicações no curto prazo?

Não é só para os brinquedos é para muitas outras coisas.

Os preços do transporte:

"Toy makers currently are playing a high stakes game in which they have to outbid and outmaneuver competitors for shipping containers to get their goods from overseas factories to U.S consumers in time for the holiday season.

In July, the time when toy companies typically start shipping their holiday toys to retailers, prices for shipping containers increased by as much as 500%, according to industry group The Toy Association.

Toy makers say they are being charged $20,000 to $25,000 for 40-foot containers that previously would have cost $3,000 to $4,000."

O espaço nos portos:

"Paying the inflated container costs still doesn’t guarantee toys will be delivered on time, due to backlogs at U.S. ports, railyards, and trucking companies.

“Even if you pay these crazy $20,000, $25,000 prices, there is a delay to get it to you,” said Isaac Larian, CEO of MGA Entertainment, which makes the L.O.L Surprise! and Rainbow High fashion dolls, the Little Tikes outdoor toys, and other playthings. “Once it gets here, there are no truck drivers, no chassis to put the containers on,” Larian said. “Everything that could go wrong has gone wrong at the same time.”

Os incumbentes e as marcas novas:

"Some manufacturers, Zahn said, have told The Toy Book that they opted to delay releasing new toys this fall because they couldn’t be sure they could get them shipped.

New toy brands “are not even attempting to bring product to market in this environment,”"

Quanto tempo vai isto durar?

"“In terms of when this will normalize, nobody is sure,”"

Implicações no curto prazo para os fabricantes nacionais?

Trechos retirados de "Shipping Container Crisis Could Derail Holiday Toy Sales"

Imagem retirada daqui.

sexta-feira, abril 17, 2020

Peak globalization?

"It's almost impossible for Partow [Moi ici: A designer] to work remotely. Fashion is a tactile pursuit. She can't do proper fittings by video conference. Patternmakers can't function."(1)Por outro:

"This is serious business. When Jetro polled 552 of its company members in Thailand last month about their chief coronavirus-related concerns, “the loss of opportunity to attend business meetings” in Thailand and abroad, and new measures affecting travellers such as quarantine came near the top, right after slower sales but above supply challenges.Veremos marcas europeias e americanas de moda a regressar à produção de proximidade nos países europeus? Ou para a Turquia e Norte de África?

.

Some futurologists are describing the pandemic as the peak of globalisation, while consultants predict companies will need to shorten and localise their supply chains post-pandemic.

.

McKinsey recently said the “next normal” would spur “a massive restructuring of supply chains” as production and sourcing moved closer to markets."(2)

Fonte 1 - Fashion will survive, but many of the designers at the heart of the industry might not

Fonte 2 - Coronavirus threatens to shake up the expat supply chain

sábado, março 28, 2020

O mundo que conhecemos nos últimos 20 anos vai mudar (parte IV)

Não é impunemente que se está a passar por este evento.

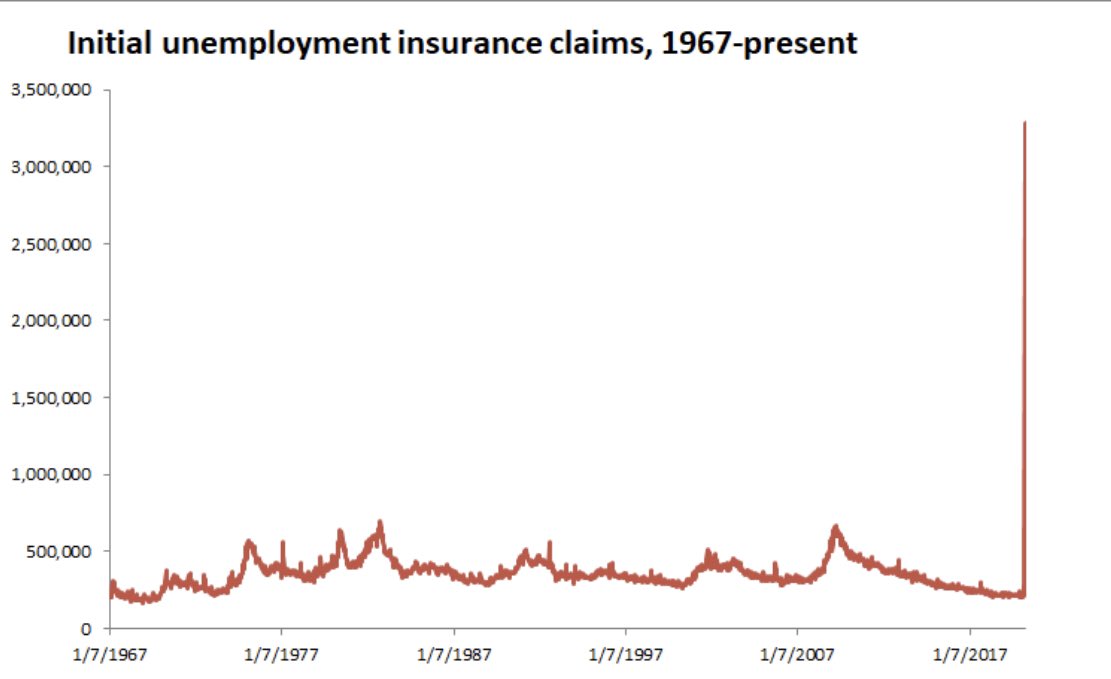

Definitivamente, o mundo não vai ficar o mesmo. Tal como este evento que estamos a viver representa, em linguagem da química, um delta de Dirac que fez parar bruscamente a economia:

Está em paralelo a acelerar a emergência de uma nova economia. Ontem, chamaram-me a atenção para este grupo no FB - "Coisas Que Imprimem E Outras Que Entopem". Não é impunemente que se criam estas redes de capacidade produtiva, de cumplicidade e partilha de saberes. Não é impunemente que se passa por cima de regulação que protege incumbentes.

Entretanto, para meu espanto, parece que os chineses ainda não perceberam o quanto o mundo mudou "The Second Virus Shockwave Is Hitting China’s Factories Already". Agora, começam a sentir o impacte das decisões de sobrevivência e de bom senso tomadas pela micro-economia: cancelamento de encomendas, recusa em levantar encomendas terminadas.

Depois virá a segunda onda, o impacte das decisões estratégicas das empresas que vão retirar as produção na China e adoptar o que há muito diziam, mas demoravam a implementar, unidades produtivas por bloco económico.

Depois virá a terceira onda, o impacte das decisões políticas dos blocos económicos para evitarem futura dependência do gigante asiático.

sexta-feira, dezembro 20, 2019

Reshoring e reshaping

Recordar Fevereiro de 2012, Dezembro de 2011 e Maio de 2006.

"Back in 2010, a company could employ 8.3 Chinese manufacturing workers for the same price as one American worker. By 2018, the figure had plummeted to just 2.9, according to calculations based on the two countries’ statistical bureaux. Real average wages in the advanced country constituents of the G20 rose just 9 per cent between 1999 and 2017. In emerging G20 states, meanwhile, they tripled, according to the International Labor Organization.

.

Given this trend, it is unsurprising that the offshoring of jobs from high wage countries to what were far cheaper emerging economies is no longer the contentious political issue it once was in some parts of the world..

“Asia is growing richer quicker than everybody else. That means that their competitive advantage is diminishing very quickly,” says Gabriel Sterne, head of global macro research at Oxford Economics.

...

The McKinsey Global Institute, a think-tank, reported this year that in 2017, 43 per cent of trade in textiles and clothing was based on labour-cost arbitrage — defined as exports from countries whose GDP per capita is a fifth or less than that of the importing country. This is compared with 55 per cent in 2009.

...

For furniture, toys and other labour intensive goods, the corresponding figure fell from 43 per cent to 35 per cent over the same period..

“The image of globalisation as companies searching for the lowest labour cost around the world is increasingly outdated,” says Susan Lund, co-author of the McKinsey report. “Companies are looking at a whole range of factors, like the talent base and workforce, the quality of the infrastructure and logistics, the ability to tap into innovation ecosystems,” adds Ms Lund, who also cites the growing importance of speed to market as consumer tastes change rapidly.

.

Peter Colson, assistant economist at consultancy Oxford Economics, says “the tables have turned”, in terms of US manufacturers’ desire to shift production to China, with “reshoring” activity in the opposite direction starting to pick up. He notes that the gap in unit labour costs between the US and China will be even smaller than the hourly wage gap suggests, given higher US productivity."

Trechos retirados de "Wage compression slows offshoring of jobs" na versão internacional do FT de ontem.

quinta-feira, setembro 05, 2019

O backshoring do calçado em Espanha

O crescimento do backshoring é um tema querido a este blogue desde quando ainda ninguém falava nele (2006 e 2010, por exemplo).

Um artigo que documenta as observações que fomos fazendo aqui sobrea a evolução portuguesa. Com uma diferença. Espanha tem marcas com tradição e dimensão e fez deslocalizações. Portugal sempre foi mais terra de subcontratação. No entanto, as razões que levaram ao regresso dos clientes em Portugal, são as mesmas que levaram ao retorno de parte da produção espanhola à Europa.

BTW, lembram-se das previsões de quem não andava no terreno? Dois exemplos: Sérgio Figueiredo no Jornal de Negócios e André Macedo no Diário de Notícias)

"During the 1990'0 and the first decade of the twenty-first century, outsourcing and offshoring became one of the most important changes made by companies throughout the world. Many companies outsourced tasks which were formerly internalised in order to gain competitiveness through reduced costs or increased flexibility or efficiency. Meanwhile, many activities located in developed countries were transferred to other places; production processes were no longer geographically concentrated in one location but were split up into phases which were each located where the advantages to be gained were greatest.

...

However, in more recent years, it has come to light that this relocation of production activities is being reconsidered by some industry leaders which has given rise to cases of "repatriating manufacturing to the country of origin". These cases have been called 'reverse offshoring', 'reshoring, 'backshoring', insourcing' or inshoring as opposed to outsourcing/offshoring.

...

Three of the four comapnies that have not offshore their production justify this with one main reason: the range of footwear that they produce. The fourth company explained that it was due to the size of the firm. Table 3 summarises the character-istics of these companies. The three companies (Wonders, Pedro Mirages and NordikaT) manufacture only one type of footwear, the mid-high range, and have not considered the possibility of extending their collection with lower-end lines. To produce this type of footwear, highly-skilled labour is required and the companies do not believe that they would be able to maintain the high quality levels that they achieve in Spain if they produced their output in low-wage countries. As production is located in the company's own factory or outsourced to other factories nearby, the company is able to control the entire manufacturing process and guarantee the desired quality levels. These companies commented that they benefit from lower transaction costs due to the geographical proximity (which goes hand-to-hand with more fluid relationships) to the companies that carry out the production activities.

...

The fourth company that has not offshored production, Pedro Iniesta - Biostep, provides qualitatively different reasons for this decision. This company's product can be classified within the mid-range, and competes basically on price. As we shall see later, most of the offshoring in this segment was motivated by efficiency reasons (the search for alternative locations to Spain that provide comparative advantages in production costs). The location that offered the lowest costs was Southeast Asia, particularly China. The manufacturing structure of the sector in China requires large batches to be ordered and Pedro Iniesta - Biostep, due to its small size, could not order these large volumes, and continued to manufacture all of its production in Spain. The company has been able to maintain its presence in the domestic and export markets although with a reduction in sales. Other similar firms (with mid-range footwear which did not offshore their production), were not able to survive the price competition of footwear manufactured in countries with lower costs causing them to close during the last ten years.[Moi ici: A mesma mortandade que ocorreu por cá e que descrevemos graficamente em "O emplastro iluminado"]

...

When Spain joined the EEC in 1986 and any remaining trade barriers with the member countries were dismantled, the position of Spanish footwear companies did not weaken. This was because the strategy widely used at that time consisted in abandoning the low-range lines which many companies had produced in the past and. specialising in another type of higher range footwear with greater differentiation and value added. This strategy enabled them to compete in the European markets and to maintain their share of the domestic market based on elements other than price. As could be expected, during these years, many footwear manufacturers that produced low-range products and competed on price closed down.

.

However, in the mid-1990s, when China was negotiating for membership in the World Trade Organisation, Spanish companies became concerned about the future threat to their positioning. The incorporation of China would lead to a huge increase in exports to Europe of the shoes produced by the foreign multinationals in the sector, mainly from Europe and America, which offshored their production to Southeast Asia? This output was characterised by highly competitive prices and a moderate level of quality due to the comparative advantages in production costs, especially labour. and the enormous scale of this industry in some countries. Responding to these structural changes in the industry, the majority of the larger Alicante-based footwear companies began a process of offshoring production to Southeast Asia between the end of the 1990s and the beginning of the 2000s.

...

The aim of the companies that outsourced the production of their mid-range lines abroad was to obtain the highest possible growth in sales, based on the increased price competitiveness derived from the lower costs in foreign countries. The revenue obtained from this growth was used to increase investment in those activities carried out within the companies in Spain, such as design, product innovation, marketing, distribution. quality control and the manufacture of high quality footwear. With this strategy, these activities became the core business and internal departments were created or expanded and had a strategic role.

...

Panamá Jack and Ras Shoes encountered problems in developing their offshoring strategy due to the type of their output and the characteristics of the industrial structure of the foreign country. Problems arose because they only made small orders and their high and mid-high ranges of footwear required the almost permanent presence of highly qualified technical and managerial staff to supervise quality levels. These companies concluded that offshoring production to China was only profitable if large orders were made as the costs involved in transferring staff were too high for small quantities. Also, large volumes of stock were permanently accumulated in Spain as the minimum quantifies established by the foreign countries were not compatible with the sales of the companies which comprised small quantities of a wide range of models. For these reasons both companies abandoned the strategy and have reshored all of their production activities to Spain and have no intention of manufacturing abroad again.

...

...

The main differences between firms reside in the relationship between the current strategy and the decisions previously made with regard to offshoring. Those companies that order small quantities have reshored all of their production to Spain. However, those that order larger quantities are increasing their manufacturing operations in Spain or nearby countries but complementing this with offshoring and have no intention to abandon this strategy. Summing up, the different "reshoring" strategies observed can be explained by three main reasons. First, the volumes that are outsourced abroad; second, the type of product that is offshored; and third, the improvement in distribution which is also related to volume but also to lead times. From a more general perspective, our results show that reshoring in the footwear industry does not constitute a correction of prior misjudgements.

...

First, the cost differential between China and Spain has narrowed due to the evolution of the economies of Southeast Asia. In addition, the demand for smaller batches makes it difficult to exploit scale economies in China or even to gain access to the Chinese shoemakers at a reasonable price. Second, transportation costs have become a key element in this case not because of changes in traditional issues linked to logistics, but because the demand of the final goods has changed. This new demand introduces conditions (lead times, batch sizes. etc.) that the existing logistic structure does not cater for and even seems to evolve in the opposite direction with the introduction of steam shipping, larger vessels, etc.

...

From the results of the study, we can conclude that the reshoring process most likely constitutes a permanent relocation of footwear manufacturing in Spain. This strategy has increased the competitiveness of firms engaged in the mid-range footwear segment and can be expected to prevail in the long term as it fulfils the need to serve new collections with greater frequency. However, if Spanish unit labour costs rise, these increases in production in Spain could be redirected to other nearby countries such as Morocco or Portugal where batch size is not important In any case, the results of the study indicate that part of the offshoring wave should be undone."

sexta-feira, agosto 30, 2019

Frequência e motivos para o backshoring

A vantagem destes artigos é recolherem informação com base em empresas reais (amostra de 2450 empresas apenas) e não com base em especulação. A mim, ajuda-me a calibrar as ideias. Por vezes, valorizo mais ou menos um factor e estes artigos chegam e obrigam-me a reformular e a dar mais peso a uns factores e menos a outros.

Olhando para os dados.

"4.1. Frequency of backshoringIn the countries covered by the EMS 2015, 4.3% of all firms have moved production activities back to the home country between 2013 and mid-2015. The sample includes 105 backshoring firms; these are more observations than most empirical papers on backshoring can provide, but, nevertheless, it makes backshoring a rare event. The highest shares of backshoring firms are reported from Spain (7.9%)...

...

We can distinguish further between backshoring from suppliers and backshoring from own subsidiaries. 1.7% of the firms have backshored from suppliers, while 2.6% backshored from their own subsidiaries abroad. In a sectoral perspective, the share of backshoring firms is lowest in low-technology industries such as paper, wood, food and beverages, or textiles, and highest in high-technology industries. However, offshoring frequency also rises with technology intensity,

...

Further descriptive results show that backshoring frequency rises steadily with firm size, from around 2% in small firms with less than 50 employees to 7% in large firms with more than 1000 employees. However, offshoring frequency also rises with firm size, making backshoring simply more probable in large firms, as they have previously more often offshored manufacturing activities.

4.3. Motives for backshoringThe most frequent reasons for backshoring of production activities are a lack of flexibility and poor quality, which are both named by more than half of the firms. Unemployed capacity at home takes the third rank with 42%, followed by transportation and coordination costs (24% and 22%) and labour costs (15%). Quality and flexibility show a high consistency as backshoring motives over time, as they have also been the most important reasons for backshoring in the 2012 EMS survey. Innovation-related factors play a minor role as backshoring motives. The perceived loss of know-how in the source country (2%) and the vicinity to R&D capacities at the home base (5%) are the least frequent motives for backshoring of manufacturing activities.

...

Firms move production activities back to the home country mostly because of a lack of flexibility, quality problems, and low capacity utilization. Rising labour costs in source countries as a motive to backshore production are, so far, just in sixth place, right behind transportation and coordination costs. The motives for backshoring are heavily dependent on the source country.

...

hightech firms are backshoring more frequently, as superior products and quality are inevitable for these firms. They seem to find it difficult to “slice” the value chains for their hightech products vertically into different components, and, therefore, prefer to organise and control them under their own governance in close vicinity to their parent plants, providing additional insights for transaction cost and internalization economics of backshoring activities

...

The importance of a production relocation strategy to low-wage countries seems to be diminishing, and local manufacturing strategies seem to be gaining in importance. The reasons to strengthen local manufacturing are, in a way, similar to the main backshoring motives: To reduce complexity and coordination of global supply chains, to provide customised products and services in a flexible and agile way, to adapt to increasing labour costs in emerging countries and the rapid pace of innovations in ICT and advanced manufacturing technologies towards smart and digital factories."

segunda-feira, agosto 05, 2019

Sintomas de um mundo em mudança

- A Deluge of Batteries Is About to Rewire the Power Grid (Interessante cada vez mais ver referências a algo sobre o qual comecei a escrever há vários anos "And the end of utility companies as we know them")

- Refashioning clothing’s environmental impact

- Baby Amazons take on their American role model

- China scrambles to stem manufacturing exodus as 50 companies leave

segunda-feira, julho 09, 2018

Qual é a teoria da conspiração?

Há muito neste blogue que se fala do refluxo da maré da globalização e da reindustrialização da Europa. Fenómeno que represento metaforicamente com uma imagem da Torre de Babel. Por exemplo:

- "Exige um pouco mais de sofisticação intelectual do que ir comprá-la simplesmente ao supermercado" (Dezembro de 2010)

- Pós pico da globalização... (Abril de 2011)

- A reindustrialização em curso (Dezembro de 2012)

- Passamos ao nível seguinte do jogo? (Fevereiro de 2015)

- Globalização, uma maré a recuar (Abril de 2015)

- "o impacte da "reversão" da maré da globalização" (Setembro de 2016)

- Turn, turn, turn (Novembro de 2016)

- "Estou otimista ... é fantástico." (Novembro de 2016) [onde escrevi: BTW, tenho uma teoria da conspiração acerca da globalização. A globalização está a recuar, não por causa de barreiras alfandegárias mas por causa de coisas que falo aqui no blogue: rapidez, flexibilidade, interacção, co-criação, salários na China, Evangelho do valor, ... Quem perde com o retrocesso da globalização? As empresas grandes, as marcas grandes (ver o marcador hollowing), quando os Trumps da direita e da esquerda agora vêm falar dos perigos da globalização desconfio que andam a tramar algo para impedir a hemorragia das empresas grandes nem que para isso tenham de tramar as PME deste mundo.]

- Em curso o fim da globalização (Maio de 2017)

BTW, o título do Wall Street Journal é um bom sinal da cegueira em que o mainstream financeiro vive face à economia real. Até parece que a globalização só agora vai ser revertida. Come on!

domingo, agosto 13, 2017

Decisões de localização (parte I)

Por exemplo, nesta estrada onde em 1984 dançava o can-can:

Recordo o esqueleto antigo de uma unidade industrial junto a uma ribeira seca no Verão.

É fácil pensar num Portugal distante onde a rede de estradas era fraca e regional. Nesse Portugal a indústria podia surgir em qualquer lugar e viver do mercado regional. Depois, surgiu o comboio e a camioneta e a rede de estradas melhorou. Então, as empresas localizadas em mercados maiores, como junto das capitais de distrito, começaram a crescer e a aproveitar as vantagens da competição no século XX:

Não deixa de ter a sua ironia ácida, associar a cada choraminga de autarca do interior nos anos 80 e 90 do século passado, melhores estradas para o interior, melhor acesso do litoral ao interior, melhor acesso das empresas do litoral com custos mais competitivos, porque maiores, incapacidade das empresas do interior competirem pelo preço, encerramento das empresas do interior, desaparecimento de postos de trabalho no interior, aumento do êxodo humano do interior para o litoral e para a emigração.

Podemos subir na escala de abstracção e passar do nível interno para o domínio do internacional.

Com a adesão de Portugal à EFTA primeiro e à CEE depois, o país começou a receber muito investimento directo estrangeiro para a indústria, por causa dos baixos da sua mão de obra e relativa proximidade dos mercados de consumo no centro da Europa. E chegámos aos gloriosos anos em que a taxa de desemprego em Portugal rondava os 3%. Éramos a china da Europa antes de haver China.

Depois, as Texas Instruments na Maia e as Seagate na margem sul deram o sinal, e as empresas de capital estrangeiro pelas mesmas razões que tinham escolhido Portugal, escolhiam agora a Ásia e começou a debandada para a China. As lojas dos 300 deram o outro sinal, muita produção nacional habituada a trabalhar para o mercado interno com base no preço começou a ser dizimada pelas importações baratas da Ásia. No domínio da economia transaccionável só sobreviveu quem de certa forma conseguiu algum tipo de diferenciação (rapidez, inovação, flexibilidade, moda, design, autenticidade, qualidade, experiência, proximidade, ...).

Agora a onda está a virar outra vez e falamos e escrevemos sobre o reshoring, sobre a importância da proximidade entre a produção e o consumo para tirar partido da interacção que permite a co-criação, a personalização, a customização.

Nesta nova etapa do comércio mundial quais podem ser as principais decisões de localização?

Continua.

terça-feira, agosto 08, 2017

Acerca do reshoring

"One is the notion of reshoring: some Western manufacturers are “bringing manufacturing back home,” but our understanding of why exactly this occurs is limited.

...

Location decisions must be understood not just through the lens of economic attractiveness of one region or country over another, but also as a decision where many organizational and technological interdependencies become relevant: decisions about where to locate manufacturing link to other decisions, such as location of research and development activities with other value chain activities and actors, such as product development, suppliers, and markets.

...

When and why should policy makers be interested in production location decisions? Understanding value creation is central to understanding the role of production both within a firm and within a national economy.

...

Our results suggest that contemporary location decisions link intimately to three dimensions of interdependence with suppliers, market, and development activities: formalization, coupling, and specificity.

...

...Mongo implica mais proximidade e interacção com clientes e fornecedores, e maior rapidez na evolução da produção e do desenvolvimento.

we find the proposition that coupling is the most important source of interdependence in location decisions plausible. Specifically, if production is tightly coupled with development, relocating one implies relocating the other. In contrast, low formalization of the Production- Development Dyad may make it easier to manage the relationship if the two activities are geographically collocated, but coordination can succeed even without collocation as well.

We also observe that the common denominator in the cases where production takes place only in the low-cost country is high formalization combined with low specificity. This is not surprising: It is specifically the routinized, generic forms of production that become candidates for both outsourcing and offshoring.

...

In our analysis of the 35 location decisions, the key theme that repeated itself throughout the cases was the notion of interdependence of activities. As a general finding, this is hardly surprising, but the detailed understanding of how formalization, specificity, and coupling link to location decisions has the potential to both inform firm-level strategies and to at least introduce new vocabulary into discussions of economic policy."

Trechos e imagem retirada de "Why locate manufacturing in a high-cost country? A case study of 35 production location decisions" publicado por Journal of Operations Management 49-51 (2017) 20-30

quinta-feira, agosto 03, 2017

Em busca de um novo oásis

"Portugal está a perder terreno face a Itália no que à produção e exportação de calçado diz respeito.Quando li este trecho, meio a correr, pensei logo na evolução do perfil da produção portuguesa como forma de justificar esta evolução. Recordar a série "Comparações enganadoras"

...

é no preço médio que a diferença se acentua: 26,09 dólares por par, pouco mais de metade dos 47,76 euros a que são exportados os sapatos italianos."

Depois, quando li com atenção o resto artigo encontrei uma comparação mais útil:

"no calçado de couro, o fosso face a Itália agravou-se: os sapatos italianos de couro são exportados, em média, a 63,78 dólares, mais 2,28 dólares do que em 2015, enquanto os portugueses não vão além dos 31,16 dólares, praticamente o mesmo valor do ano anterior."Como é que o artigo explica esta evolução?

"“uma parte significativa do diferencial de preços” é explicado pelo facto de Itália ter uma posição muito superior à portuguesa nos mercados extracomunitários, que registam, habitualmente, preços médios de exportação superiores aos europeus."Esta explicação parece-me tão simplista...

Em interessante conversa com alguém que pensa o sector encontrei explicações muito mais plausíveis, IMHO.

O calçado português com marca própria, embora tenha um peso muito baixo na quantidade produzida, tem um preço à saída da fábrica bem mais alto. Onde se vendem essas marcas? No retalho tradicional. O que é que está a acontecer ao retalho tradicional? Recordo este trecho que escrevi em Abril passado:

"A evolução do retalho é um tema que me interessa porque é super importante para as PME com que trabalho. A maioria das PME portuguesas não tem marca própria relevante. Ou produzem para marcas de outros ou produzem componentes que serão incorporados nas marcas de outros (B2B2C ou B2B2B2C).A revolução do retalho tradicional disrupciona as cadeias de fabrico.

.

Assim, o seu futuro depende em larga escala, segundo o modelo de negócio actual, do sucesso da última interacção da cadeia, aquele ...B2C. Se esta última interacção falhar, tal como falharam em massa as sapatarias de rua quando chegaram os centros comerciais, as nossas PME terão um problema em mãos."

Primeira explicação: a disfunção do retalho tradicional. Se os clientes dos clientes deixam de comprar, os fornecedores ficam sem procuram.

Segunda explicação: o impacte do reshoring e a tentação pelo caminho mais fácil.

"O regresso da produção industrial à Europa vai voltar a colocar em cima da mesa a hipótese de apostar no low-cost. E o low-cost parece tão intuitivo, tão atraente..."Ainda esta semana um empresário me contava que um seu cliente tinha recebido um encomenda muito grande de meios de produção para o fabrico de calçado. Algo que relacionei com uma visita de há alguns meses de alguém que procurava empregas muito grandes em Portuga para produzir calçado.

Neste momento, a primeira explicação é a que mais me preocupa. Daí a escolha da expressão "placa teutónica" e o recurso à imagem do equilíbrio pontuado. O mundo mudou e agora é preciso correr atrás do prejuízo para voltar a encontrar um novo oásis.

BTW, uma terceira explicação o abandono do couro.

Trechos retirados de "Preço do calçado português é quase metade do italiano"

quarta-feira, julho 19, 2017

Anónimo da província rules!

"It’s no mystery why the data used by economists and other social scientists so rarely throws up incontestable answers: it is human data. Unlike people, subatomic particles don’t lie on opinion surveys or change their minds about things. Mindful of that difference, at his own presidential address to the American Economic Association nearly a half-century ago, another Nobel laureate, Wassily Leontief, struck a modest tone. He reminded his audience that the data used by economists differed greatly from that used by physicists or biologists. For the latter, he cautioned, “the magnitude of most parameters is practically constant”, whereas the observations in economics were constantly changing.Trechos retirados de "How economics became a religion"

...

Leontief wanted economists to spend more time getting to know their data, and less time in mathematical modelling. However, as he ruefully admitted, the trend was already going in the opposite direction. Today, the economist who wanders into a village to get a deeper sense of what the data reveals is a rare creature.[Moi ici: Por isso é que este anónimo da província bate nas suas previsões os Sarumans mediáticos fechados nas suas torres de marfim com os seus modelos matemáticos desenvolvidos para a realidade de há 15/20 anos]

...

ideas in economics can go in and out of fashion. The progress of science is generally linear. As new research confirms or replaces existing theories, one generation builds upon the next. Economics, however, moves in cycles. A given doctrine can rise, fall and then later rise again.[Moi ici: Estratégias que resultam num dado período tornam-se tóxicas num período seguinte para renascerem mais tarde. Um dos meus receios actuais, que muitas PME optem por voltar ao preço como o principal factor competitivo, por causa do reshoring massivo.]

...

Noting that pure theory was making economics more remote from day-to-day reality, he said the problem lay in “the palpable inadequacy of the scientific means” of using mathematical approaches to address mundane concerns. So much time went into model-construction that the assumptions on which the models were based became an afterthought.

...

Leontief thought that economics departments were increasingly hiring and promoting young economists who wanted to build pure models with little empirical relevance. Even when they did empirical analysis, Leontief said economists seldom took any interest in the meaning or value of their data."