Recordo "Mongo a bater à porta. Tão bom!!!" e:

"O artigo é um exemplo da tendência que enquadramos no fenómeno a que chamamos de Mongo. Os gigantes, emaranhados com o seu umbigo, muito preocupados com a eficiência e os custos, tentando ser tudo para todos, abrem as oportunidades a novos actores."Agora encontro "When Patients Become Innovators":

"Patients are increasingly able to conceive and develop sophisticated medical devices and services to meet their own needs — often without any help from companies that produce or sell medical products.Recordo também "Os humanos são todos diferentes":

...

Unlike traditional producers, who start with market research and R&D, free innovation begins with consumers identifying something they need or want that is not available in the marketplace. To address this, they invest their own funds, expertise, and free time to create a solution. Rather than seeking to protect their designs from imitators, as commercial innovators do, we found that more than 90% of consumer innovators make their designs available to everyone for free.

...

The ability of patients to develop new medical products to serve their own needs is growing, and we expect the system to become stronger over time for several important reasons. First, the DIY design tools that patient innovators need are becoming cheaper and increasingly capable. People with fairly rudimentary engineering skills can acquire powerful design software that can run on an ordinary personal computer either for free or for very little money. Second, the materials and tools used to build products from DIY designs are also becoming both cheaper and increasingly capable."

“There is no perfect product, because there is no perfect patient” and “It’s a good product, but it’s not right for everyone.”Recordo também esta leitura de 2007:

"In 1970, 5% of global patents were issued to small entrepeneurs, while today the number is around one-third and rising. When P&G realized this, it saw that its old model of purely internal innovation was suboptimal. Why not tap these entrepeneurs and scientists?"E esta outra de 2011:

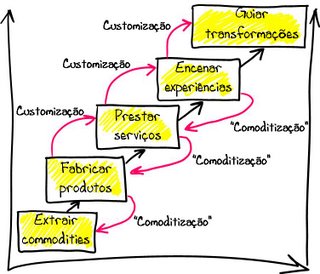

"The mass market — which made average products for average people was invented by organizations that needed to keep their factories and systems running efficiently.E deixo-vos com os industrialistas e a sua tendência para a suckiness.

.

Stop for a second and think about the backwards nature of that sentence.

.

The factory came first. It led to the mass market. Not the other way around."