"mass markets is basically where multiple customers [indivíduos] represented a single marketTrechos captados em "Interview with Joe Pine on Infinite Possibility"

...

then mass customization where able for the first to get down to markets of one where we recognize that every individual is his own market

...

well that's not where the progression ends: the progression flips on its head where the next step is that instead of multiple customers comprising a market

...

multiple markets comprise every customer [indivíduo]

then what the multiverse recognizes it's not just a few markets

is basically infinite possibility for creating experiences that each individual person is going to want to have at differing times"

Mostrar mensagens com a etiqueta segmentação. Mostrar todas as mensagens

Mostrar mensagens com a etiqueta segmentação. Mostrar todas as mensagens

sábado, abril 15, 2017

"multiple markets comprise every customer "

quarta-feira, abril 12, 2017

Super importante

Para quem quer seduzir clientes, para quem quer identificar os clientes-alvo, cuidado com a segmentação "Netflix says Geography, Age, and Gender are “Garbage” for Predicting Taste":

"Netflix uses one predictive algorithm worldwide, and it treats demographic data as almost irrelevant.

...

“Geography, age, and gender? We put that in the garbage heap,” VP of product Todd Yellin said. Instead, viewers are grouped into “clusters” almost exclusively by common taste, and their Netflix homepages highlight the relatively small slice of content that matches their taste profile.

...

Netflix (nflx) seems to have discovered (or built on) a powerful insight from sociology and psychology: That in general, the variation within any population group is much wider than the collective difference between any two groups.

...

There’s a huge, crucial lesson here for other businesses—and perhaps a slightly scary reality for consumers. In the era of big data, consumer profiling can’t rely on broad categories like race or location. To target the customers who want what you’re offering, you have to get past the surface and see what really makes them tick."

segunda-feira, fevereiro 20, 2017

Ainda acerca da segmentação

Ainda acerca da segmentação:

Trechos retirados de Stephan M. Liozu. em "Dollarizing Differentiation Value: A Practical Guide for the Quantification and the Capture of Customer Value"

"If you find out that 20 percent of your customers consume 80 percent of your service time, have you incorporated that into how you set priorities, how you treat these customers, and how you price your products and services? You can look at the extremes, too. Which customers are clearly the price buyers? You have them. Every company does, and they will make up a good chunk of your customer base. Who are your value buyers, the ones who recognize the value you provide and are willing to pay for it? A good place to start is to assume that 15 to 20 percent of your customers are value buyers. Figure 4.5 gives more clues about what kinds of segments you may have within your market.

A third common segment is speed and convenience. In some cases the company has a separate division by segment (such as Allstate; see figure 4.6).[Moi ici: O como eu gosto do exemplo da Xiameter vs Dow]

They avoid confusing the two divisions. Sometimes your brand can't cover more than one or two segments. Trying to stretch a brand across too many segments will muddy your message. You have to make these brands and segments as watertight as possible. If you don't, you risk giving some customers cheap products with state-of-the-art service for too low a price."Na sequência de "Em que situações ou contextos" pensar: em que situação/contexto um cliente insere-se no segmento do preço? e no segmento da qualidade e do valor? e ...

Trechos retirados de Stephan M. Liozu. em "Dollarizing Differentiation Value: A Practical Guide for the Quantification and the Capture of Customer Value"

domingo, fevereiro 19, 2017

Em que situações ou contextos

Muitas empresas não fazem qualquer esforço de segmentação dos seus clientes. Outras segmentam com base em factores que nada têm a ver com as suas vantagens competitivas, baseando-se em factores como a geografia, a dimensão dos clientes ou o tipo de produto que compram.

Recordar "Quem vê":

Trust me! Isto é mesmo verdade!

Recordar "it is the situation rather than the customer" e pensar em que situações ou contextos vividos por potenciais clientes o nosso ADN dá-nos uma vantagem competitiva?

Em certos contextos ou situações os potenciais clientes vivem um problema. Estão num ponto e querem chegar a outro, para isso precisam de contratar um trabalho que lhes resolva o problema.

Subitamente ... recuei a 2009 e a "Don't think on innovation, think on solving a problem"

Recordar "Quem vê":

""I see a drink," I answered.Stephan M. Liozu. em "Dollarizing Differentiation Value: A Practical Guide for the Quantification and the Capture of Customer Value" lista uma série de consequências associadas a uma má ou inexistente segmentação:

.

"Exactly. You see a beverage. I see a vineyard. I smell the grapes. I can picture a family meal. I see them smile. I hear them laugh.""

Recordar "it is the situation rather than the customer" e pensar em que situações ou contextos vividos por potenciais clientes o nosso ADN dá-nos uma vantagem competitiva?

Em certos contextos ou situações os potenciais clientes vivem um problema. Estão num ponto e querem chegar a outro, para isso precisam de contratar um trabalho que lhes resolva o problema.

Subitamente ... recuei a 2009 e a "Don't think on innovation, think on solving a problem"

segunda-feira, fevereiro 13, 2017

Quem são os vossos clientes-alvo?

"When I ask a B2B company about its customer segmentation, the answers almost always fall into one of two categories.

.

Some teams will say they have a segmentation based on size, geography, applications, product types, or in some cases a combination of some criteria. I will hear "yes, we segment our customers into large, medium, and small companies" or "yes, we break down customers by their locations" or "we have the automotive segment and the health care segment." They will say that their segmentation has several advantages: it's intuitive, easy to do, and data-driven. Other teams will explain that they don't have a customer segmentation, because they invest their resources in solving problems. These are often companies that have a strong engineering focus, and whose very talented R&D teams have discovered ways to help customers accomplish hard tasks more efficiently or more effectively. Many such companies don't even have a formal marketing department, especially in traditional industrial or manufacturing markets.

.

It is a major wake-up call for companies in both groups when I explain to them that these approaches to customer segmentation are not only inadequate and obsolete but also dangerous, because they cost their companies a lot of money. I am not talking only about the proverbial money on the table, one of the most important incentives for pursuing value-based pricing (VBP). I am talking about real costs you incur right now! Not having a proper segmentation is expensive and inefficient.

.

The companies in the first group above are using "firmographic" data to group their customers. They adjust their value propositions based on measurable but superficial differences between their customers. That is where the problem begins. A small company can behave the same way as a large one, rendering that size distinction meaningless. A large company based in the US can have the same needs and exhibit the same behaviors as a small company in Asia, which renders the geographic labels meaningless as well.

.

The companies in the second group are using a one-size-fits-all approach, which guarantees three things.

- They overcharge a lot of customers. ...

- They undercharge a lot of customers. ...

Segmentation is the most neglected step in VBP. This is because it is the most complex step and the most difficult to change. Think back to what you read in the introduction. Around 85 percent of companies do not incorporate customer value adequately into their pricing decisions. One of the root causes of this is the lack of a scientific customer segmentation, one that goes far beyond the traditional firmographic labels of the 198os and 199os and takes advantage of the rich breadth and depth of customer data available to companies in the 21st century. This is a core issue in B2B and industrial sectors, where knowing your customers is just as essential as knowing your competitors, if you want to succeed at VBP."

- They annoy or even anger customers. ...

Trechos retirados de "Dollarizing Differentiation Value: A Practical Guide for the Quantification and the Capture of Customer Value" de Stephan M. Liozu.

segunda-feira, fevereiro 06, 2017

"The industrial age was about limiting the scope of choices"

Quando penso em Mongo penso nesta mudança de paradigma e nas suas consequências:

Vamos ver desaparecer a ideia de referencial, de família-modelo, de média como uma boa representação da sociedade.

Trechos retirados de "Interactive competence".

"The industrial age was about limiting the scope of choices. This was accepted since the need to gather costly information and to communicate with low quality and expensive tools was minimized. Furthermore, as the scope of decision-making and action was narrowed, the learning requirements for workers and customers were limited, reducing the transaction costs of work. The efficiency contribution of mass production was in fact derived from these lower information- and communication-related costs.Mongo é acerca de uma explosão crescente de opções de escolha que vão dar cabo da noção de sociedade herdada da Revolução Francesa e da Revolução Industrial.

.

Today, in contrast to people being content with limited choices, offerings as problem definitions and solutions to problems are created on-demand to meet diverse, sometimes unique requirements.

...

The context matters more than ever. The easier the access that people have to one another and to (different) information is, the more possibilities there are."

Vamos ver desaparecer a ideia de referencial, de família-modelo, de média como uma boa representação da sociedade.

Trechos retirados de "Interactive competence".

quarta-feira, fevereiro 01, 2017

"Because for them, your approach is a bad idea"

Para montar o cenário recordo:

- Não há almoços grátis: Há que optar (Julho de 2008)

- The Most Important Orders are... (Agosto de 2008)

- Justin Bieber e o preço da diferença (Novembro de 2010)

- Será maldade? (Maio de 2012)

- Aprender a ser mau (Agosto de 2012)

- Biever, Cyrus, IKEA ... e a sua empresa? (Outubro de 2013)

- Assim, talvez ter inimigos entre os clientes ou ex-clientes seja bom sinal (Maio de 2015)

- Não esquecer os "mas" (Setembro de 2015)

- "Because if nobody hates it, nobody loves it" (Novembro de 2016)

É importante fazer escolhas e quanto mais dolorosas melhor.

Assim, faz sentido considerar este conselho:

"Competition is a fact of life in startup land. A differentiated position in the market is vital. Good competitive positioning communicates to the world the set of assumptions one has to believe to envision your success.Trechos retirados de "How to stand out from your competition"

...

Too often do we find competition framed in the context of better/faster/cheaper. ... It fits a limited number of businesses that sell a commodity product.

...

My advice is to ignore better/faster/cheaper, and instead focus on a differentiator that your competitor would agree with. This is a subtle, but powerful move. If you get it right, your competition will actually reinforce your positioning. Why? Because for them, your approach is a bad idea. [Moi ici: E vice-versa] They love telling customers why you’re not really focused on the same thing they do. By trivializing what you do, they’re inadvertently spreading your gospel."

quinta-feira, janeiro 26, 2017

"In B2B, customer value is a number, not a verbal expression"

A maioria das PME resiste a segmentar os seus clientes. Qual Bruce Jenner, com um histórico de generalista, não querem dizer não a ninguém, querem servir todos em simultâneo. Por isso, este sublinhado:

"You also need to define your segments and know them well. This means needs-based segments, not ones based on superficial factors such as geography or company size (small, medium, large). Only then can you begin to define and extract your true differentiation in your market, by segment. What you deliver in terms of value will differ from segment to segment, which means you can't make blanket assumptions about the benefits you provide customers in each segment. Their problems their solutions are all different, even if the differences are subtle. So the reality is and that you start building general customer propositions and introduce your teams to them. This first step often helps people realize the need to move away from one-size-fits-all processes to needs-based segmentation.

...

In B2B, customer value is a number, not a verbal expression.

...

continue with a discussion around how to share that value pool, because both parties need to derive some benefit from the relationship. It is unfair for the customer to claim all of the value, leaving you as the supplier with no material benefit. There is a name for the art and science of striking that balance.

That name is "pricing." It is also the end game!

But you will notice that in the previous three paragraphs, plus the statements, the word "pricing" never appears. There is a good reason for that. You need to lay the specific foundation before you can start with setting prices. That foundation is the central element to successful VBP. It depends highly on that third C, customer value. This foundation is the missing piece in most companies. It requires investments of time, money, and in many cases political and social capital. These are the foundational pillars of VBP. One does not become intimate with customers overnight."

Trechos retirados de "Dollarizing Differentiation Value: A Practical Guide for the Quantification and the Capture of Customer Value" de Stephan M. Liozu.

quinta-feira, dezembro 29, 2016

“this product is not for you”

"If a consumer doesn’t see his job in your product, it’s already game over. Even worse—if a consumer hires your product for reasons other than its intended Job to Be Done, you risk alienating that consumer forever. As we’ll discuss more later, it’s actually important to signal “this product is not for you” or they’ll come back and say it’s a crummy product."Quem tem coragem de assumir isto? Quem sabe quais são as encomendas mais importantes?

Trecho retirado de "Competing Against Luck".

sábado, dezembro 10, 2016

"Align Prices with Value by Segment"

"Narrow your customer groups as tightly as possible. Segment them by how profitable they are now, by their willingness to pay, for the extras they request and more. Each transaction represents a different buying situation and therefore a different value proposition. Group these customers by the deal elements they value, and then dedicate a monetary price to these value propositions. Consider shipping rates, support fees, discounts, and allowances as potential value drivers.Trechos retirados de "3 Ways to Raise Prices: The Grand Slam of Your Pricing Strategy"

.

During this process, you’ll find plenty of opportunities to raise prices for a handful of your smaller segments.

...

If (and let’s be honest when) customers balk at your effort to raise prices, your sales team won’t persuade them to pay up by just listing your product or service features. They need to explain why your customers need the products and/or services and what they get out of them. They have to sell on value.

.

You already know what your customers value from segmenting them during the pricing strategy process. It’s time to put that knowledge to good use during the sales process. As value propositions resonate different from customer to customer, so should your sales strategy."[Moi ici: Na sequência de uma auditoria recente a um departamento comercial fiquei a matutar nas eventuais vantagens e problemas da empresa ter comerciais não por áreas geográficas mas por segmentos de clientes]

sexta-feira, novembro 25, 2016

Estratégia - as bases que todos os dias se esquecem

Pelos vistos a TAP (aqui e aqui) não é a única, recomendo a leitura de "Quit Chasing Every Customer!":

"United Airlines announced last week a new cheap fare that does not allow ticket holders to carry on any luggage. Their reasoning is they want to attract customers who are now attracted to the ultra low fare airlines like Spirit.

...

Let me call United’s decision what I believe it is… STUPID!

.

United is trying to attract a segment of the flying public they feel they aren’t attracting now. On the surface it sounds logical, but what they’ve done now is take their basic product and segment it enough to attract everyone.

.

The idea is stupid, because for the increased revenue they might get, they are willing to put all of their other revenue at risk. We maximize our opportunities when we do what we do best and that means not trying to do it all.

...

We maximize product when we know who our customer is and stick to taking care of them in the best possible manner.

...

How this concept is lost on somebody like United Airlines blows me away. Yes they can do whatever they want, but I’ll say they are risking their core business. They are thinking they can add a couple of pennies to the bottom line, but fail to realize they risk the dollars they already have."

terça-feira, outubro 18, 2016

Segmentar porque os clientes não são todos iguais

"A paper company took this approach in developing a new offering (product plus services) for its North American customers. The company makes packaging material and is one of several such firms in the market, some of which are tiny shops while others are enormous global companies.E a sua empresa segmenta o mercado que serve? Qual é o critério que segue? E esse critério é útil? Qual é o segmento-alvo da sua empresa?

.

Historically, the paper company segmented based on customer size— small, medium, and large. But several functions, including sales and customer service, had routinely pointed out this segmentation was not actionable. For example, some of the largest customers only needed the most basic features and were willing to pay less as a consequence, while others needed fully featured offerings. To make matters worse, many small and medium-sized customers valued features such as support services that had only been offered to large customers. What's more, many customers of all sizes complained delivery was too slow and needed to be “just in time.” Other customers, those with large warehouses that could stock plenty of paper, didn't care about just-in-time delivery. They could just pull it from their warehouses."

.

So in thinking about how to design its new product and service offering, the paper company realized it would have a failure on its hands if it continued with the status quo segmentation."

.

Conheço muitas empresas que teimam em não segmentar o mercado onde actuam. Querem ir a tudo o que mexe, querem servir toda a gente... cuidado com a curva de Stobachoff. E... cuidado com as fiambreiras.

Trecho retirado de "Monetizing Innovation" de Ramanujam e Tacke.

segunda-feira, outubro 03, 2016

Pricing para a subida na escala de valor

Um trecho curto mas que resume bem uma série de temas importantes para o pricing, para a subida na escala de valor, para o aumento das margens:

"With respect to pricing, the literature has only fairly recently expanded from its microeconomic foundations to incorporate the notions of customer heterogeneity, bounded rationality, and imperfect competition. [Moi ici: OMG até que enfim!!!] Core elements of profitable and effective pricing are the abilities to create meaningful differentiation, to quantify the (differential) value to customers, to measure customer price elasticity, to segment customers, and to document value to customers. In the scale development process these items obviously play a vital role."Trecho retirado de "Pricing capabilities: the design, development, and validation of a scale", publicado por Management Decision Vol. 52 No. 1, 2014 pp. 144-158

sexta-feira, setembro 30, 2016

Fugir do granel

"Know your customers at a granular level. Leading companies are moving beyond traditional quantitative segmenting.A malta do granel ainda não definiu quem são os seus clientes-alvo, tem medo de se focar, tem medo de não abranger certos mercados, certos clientes e certas ofertas. Por isso, não se define e continua indiferenciada e insípida.

...

To raise your own customer analytics ability, start with thoroughly defining your market and customers. Deepen your knowledge by applying techniques such as mapping the customer journey.

...

Link your company’s customer strategy to its overall identity. Every successful company has a strong value proposition that distinguishes it from rivals. It consistently offers something for its customers that no competitor can match. To deliver this value proposition, it must develop and deploy a group of interrelated, distinctive capabilities. All of these must work together across the full portfolio of products and services. This combination of value proposition, capabilities, and offerings, when they all fit in a coherent way, gives the company its identity. The company’s customer experience can be thought of as the visible edge of that identity: the way in which people interact with the company and learn to appreciate it.

...

Linking your customer strategy to your company’s value proposition goes beyond lining up the right processes from marketing, sales, and data analytics. It means aligning the emotional elements of your customer strategy, and all customer touch points including pricing, with the strongest capabilities your company has.

...

Target customers with whom you have the right to win. When your company has a strong identity, you don’t need to claim the right to compete in every marketplace — only in the categories where you are reasonably confident of winning against competitors in a profitable way. Your value proposition will be consistent enough to appeal to a group of customers whom you can serve profitably. This is where you have the right to win, a reasonable expectation that you can compete effectively against rivals.

.

If you try to grow your business where you don’t have the right to win, you risk investing time and resources on fundamentally indifferent customers. You can and should branch out to other customers and markets, but those new customers and markets should be reachable with the same capabilities that gave you an edge with your core base."

.

Cuidado com as fiambreiras, liquidam indiferenciados com uma perna às costas.

Trechos retirados de "10 Principles of Customer Strategy"

quinta-feira, setembro 22, 2016

Clientes-alvo e estratégia

A nossa grande preocupação quando trabalhamos a vertente estratégica com empresas:

Trechos retirados de "Why Distinctive Customer Targeting Is a Smart Strategy"

"These examples both illustrate an aspect of smart strategy that companies often overlook: choosing a unique definition of their target customer to gain a competitive edge or minimize head-to-head competition.Identificar os clientes-alvo!

...

Of course, sometimes strategy works in the other direction: You choose your value proposition and let customers self-select.

...

Sooner or later, though, this approach to strategy will require sharper thinking about target customers

...

The best strategies always include a sharp definition of the target customer. And the more unique it is, the better. For example, if your competitors define their target customers by where they are — say, in certain parts of the world or in particular parts of town — you could instead define them by one or more of the following:

.

How they buy (perhaps through specific channels)

Who they are (their particular demographics and other innate characteristics)

When they buy (for example, on particular occasions)

What they buy (are they price buyers or service hounds?)

For whom they buy (themselves, friends, family, their company, or their customers).

The possibilities are infinite. They key is to distinguish your strategy, and give your business a competitive edge."

Trechos retirados de "Why Distinctive Customer Targeting Is a Smart Strategy"

segunda-feira, setembro 12, 2016

E quantas PME segmentam o seu mercado?

"product positioning is telling (targeting) specific customers (segments) what job you want them to hire the product for. Remember, if you do not position your product they will do it themselves or if they don’t your competitors will do it for you.[Moi ici: O primeiro exemplo que me veio à cabeça foi o da Comur. O potencial de lucro perdido deve ser ... triste]Trechos retirados de "Product Positioning Comes to iPad Pro"

...

So it decided to target a segment that has budget to pay (business customers) and telling them what specific job it wants them to hire an iPad Pro for.

...

Marketing is nothing more than Segmentation,[Moi ici: E quantas PME segmentam o seu mercado? Quantas continuam a tratar tudo como granel? Quantos empresários continuam a praticar o marxianismo entranhado sem o saberem?] Targeting and Positioning."

Para pessoas e para empresas

"In business, differentiation is the path to success: standing out from the competition, through your position or capabilities or sheer force of will, enough to carve a future for yourself. You will be called upon, throughout your career, to establish a distinct identity for your company. The more capable your future employer (whether a business or a not-for-profit) is at doing things other companies can’t copy — for example, creating powerful products, meeting customer expectations, or cornering the market in a particular sector — the more likely you will find success. You will also, if you are sharp enough, be able to use similar techniques to establish a distinct identity for yourself."

Trecho retirado de "In the Country of the MBAs"

sábado, setembro 03, 2016

Podia ser em Portugal

Um exemplo do que acontece em muitas PME em Portugal, "Explosives Saved an American Company From Chinese Competition".

.

Empresa familiar, com muitos empregos que já não se justificam mas que não se eliminam porque são ocupados por familiares ou por trabalhadores leais há décadas e que são tratados como se fossem da família. Empresa com uma vasta gama de produtos, desfocada e perdendo dinheiro com a produção da maioria desses produtos... a mania da one-stop-shop.

.

Empresa familiar, com muitos empregos que já não se justificam mas que não se eliminam porque são ocupados por familiares ou por trabalhadores leais há décadas e que são tratados como se fossem da família. Empresa com uma vasta gama de produtos, desfocada e perdendo dinheiro com a produção da maioria desses produtos... a mania da one-stop-shop.

"After three decades of losses brought on by changing technology and foreign competition, the family-owned business had been placed in the care of a court-appointed receiver—a form of bankruptcy.

...

The business logged revenue of $1.2 million in 2015 and projects $1.4 million this year. Its net margin now runs from 7 percent to 10 percent. Of the plant’s 20 floor workers, 17 have been rehired.

.

NEPT survived for three reasons. Like auto manufacturers and airlines, it shed liabilities as it emerged from receivership, though with less fanfare. Then it limited production to only those tubes that no other company, here or abroad, can or is willing to make. Finally, Cournoyer refused to give up.

...

didn’t have access to the company’s records on its more than 500 products, so he began building a detailed spreadsheet. That’s how he discovered NEPT was losing money on more than two-thirds of what it made.[Moi ici: Quantas PME são capazes de dizer quanto ganham (ou não) com cada SKU que produzem?]

...

The owners of family businesses can have a hard time seeing a company as an asset rather than a way of life,

...

The bottom line: A paper-tube maker in Rhode Island avoided collapse by refocusing production on 140 products where it can still make money."

quarta-feira, agosto 31, 2016

Sem interacção ... vai ser difícil

"Can there be too much personalisation? ... that now the ‘segment of one’ can truly exist, we could run the risk of making marketing too predictable.Isto chama-me a atenção para 2 pontos:

...

Now that we have the technology to effectively personalise every communication, the concept of mass customisation has been able to move itself forward and the ‘segment of one’ can truly exist.

...

The paradox of personalisation is that identifying our past behaviour may not indicate future behaviour and if marketers personalise too much, curiosity is curbed outside of pre-defined preferences. It all comes down to how we use the technology available to us and the extent to which we allow these tools to dictate how we engage with consumers."

- a importância da interacção; e

- o desejo de transformação.

.

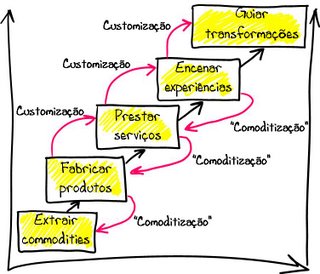

Sobre o desejo de transformação quero recordar o esquema de Pine & Gilmore:

E o recente "A economia das transformações".

.

Como saber se alguém quer ser transformado sem interagir e criar um projecto de co-criação de um resultado que nenhuma das partes à partida sabe qual vai ser?

Trechos retirados de "Segment of One: Why Personalisation Could Become a Victim of its Own Success"

segunda-feira, agosto 22, 2016

Nas fronteiras

"1.Don't buy what the sector has defined itself as. If you accept the definition, you also accept the boundaries and you will fail to see potential for innovation.Bem na onda da mensagem de "Edge Strategy" de Alan Lewis e Dan McKone e, bem na onda de casos como estes:

2.Be aware that opportunities are all around you, waiting to be recognized."

Aqueles clientes minoritários nos quadrantes sorridentes quase de certeza que saem das fronteiras tradicionais. Ver "Why Are We Still Classifying Companies by Industry?"

Trecho retirado de "Culture Stop competing for less: How to adopt a 'blue ocean strategy' and unlock value innovations in the Boardroom"

Subscrever:

Mensagens (Atom)