"Even in a historic downturn, Buffett’s instinct is worth keeping in mind. Many managers underestimate the power of pricing, and the unanimous advice from pricing experts in this troubled economy is to price with courage and creativity. In businesses where demand has plunged, slashing prices may be a terrible idea—and it may not be necessary at all....For the vast majority of businesses—those facing strapped customers and shrunken demand—the No. 1 imperative is to avoid cutting prices if at all possible, what experts in the field call “maintaining price integrity.” In the B2B world, “you get a lot of pressure back from your customers to reduce price, which can manifest itself as hesitancy to move forward with the purchase,” says Ron Kermisch, a Bain consultant who leads the firm’s global pricing practice. “Companies too quickly move to price as the lever, without really understanding what’s driving the customer hesitancy.”...If you cut prices 20%, you have to sell 25% more units just to maintain revenue. In a severe downturn, how likely is that? And if a competitor matches your price cut, the pain will be much worse. The economics of every business are different, but McKinsey research has found that in a typical S&P 1500 company, a 5% price cut would have to spark a 19% volume increase just to pay for itself, and that hardly ever happens. Even if holding prices steady reduces sales and profits, price cuts may reduce them even more.The long-term effects can be more harmful. Price cuts, even temporary ones, train customers to behave badly, always waiting for the next sale. Perhaps worse, they destroy brand equity."

quinta-feira, julho 23, 2020

"Pricing is an undervalued discipline"

quarta-feira, julho 22, 2020

Análise do contexto

"The American economy is in a double bind. On the one hand, Covid-19 has made it necessary to reduce American dependence on China’s economy, and Chinese manufactured imports in particular. The alarm over China’s stranglehold on America’s access to important pharmaceuticals and health-care goods like ventilators is only the leading edge of this concern.According to the Los Angeles Times, there are no fewer than 62 bills pending in Congress to alter one aspect or another of our economic relationship with China. Yet at the same time, if the U.S. isn’t prepared to deploy a reshoring strategy to restore itself as a manufacturing and industrial power, decoupling won’t do any good. In the 1960s, manufacturing made up 25% of U.S. gross domestic product. It’s barely 11% today. More than five million American manufacturing jobs have been lost since 2000."

terça-feira, julho 21, 2020

Curiosidade do dia

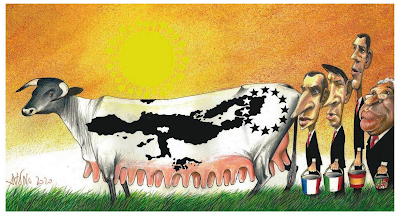

"The European Union Recovery Fund cannot be used as an excuse to perpetuate bloated political spending and create a transfer union where governments use taxpayers’ money to increase bureaucracy, because it would be the end of the European project.A union based on excess spending, debt and extractive policies would be destroyed in a few years. The strength of a unified group of countries comes from diversity and responsibility....If we want a united Europe we must listen more to the most dynamic countries and stop using the bureaucratic steamroller to turn all the member states into interventionist satellites.The European Union faces a deep crisis. It cannot become a depression by using important funds that should boost competitiveness and strengthen the recovery to finance massive political transfer plans that serve as a political tool to keep bloated administration and political budgets."

Torrar dinheiro em hidrogénio e outras cenas não me assiste

“Effects on travel and tourism, hospitality, entertainment, retail, aerospace and even the automotive industry [Moi ici: Turismo, aviação e automóvel. Nos primeiros 5 meses de 2019 o sector aeronáutico aumentava as exportações em 70%, o automóvel em 17% e o turismo batia recordes por cá]The ways in which consumers interact with each other as well as what and how they consume have been significantly affected by the pandemic. Consequently, the ensuing reset in different industries will vary fundamentally depending on the nature of the economic transaction involved. In those industries where consumers transact socially and in person, the first months and possibly years of the post-pandemic era will be much tougher than for those where the transaction can be at a greater physical distance or even virtual. In modern economies, a large amount of what we consume happens through social interaction: travel and vacations, bars and restaurants, sporting events and retail, cinemas and theatres, concerts and festivals, conventions and conferences, museums and libraries, education: they all correspond to social forms of consumption that represent a significant portion of total economic activity and employment (services represent about 80% of total jobs in the US, most of which are “social” by nature). [Moi ici: 80% nos Estados Unidos!!! Quanto será por cá?]...Industries that have social interaction at their core have been hit the hardest by the lockdowns. Among them are many sectors that add up to a very significant proportion of total economic activity and employment: travel and tourism, leisure, sport, events and entertainment. For months and possibly years, they will be forced to operate at reduced capacity, hit by the double whammy of fears about the virus restraining consumption and the imposition of regulations aimed at countering these fears by creating more physical space between consumers....In many of these industries, but particularly in hospitality and retail, small businesses will suffer disproportionately, having to walk a very fine line between surviving the closures imposed by the lockdowns (or sharply reduced business) and bankruptcy. Operating at reduced capacity with even tighter margins means that many will not survive. The fallout from their failure will have hard-felt ramifications both for national economies and local communities. Small businesses are the main engine of employment growth and account in most advanced economies for half of all private-sector jobs. If significant numbers of them go to the wall, if there are fewer shops, restaurants and bars in a particular neighbourhood, the whole community will be impacted as unemployment rises and demand dries up, setting in motion a vicious and downward spiral and affecting ever greater numbers of small businesses in a particular community."

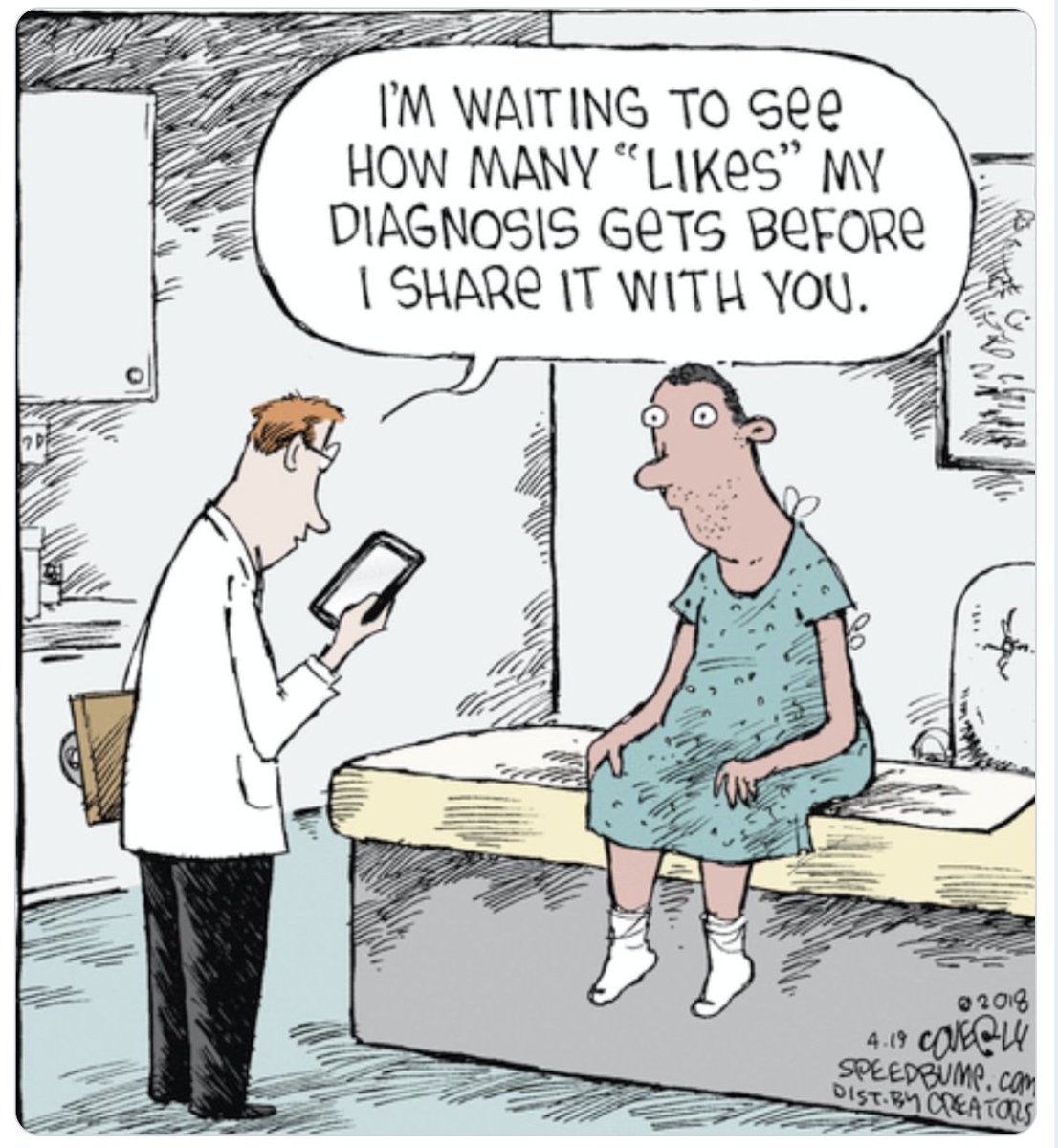

Mongo na medicina

“We are in a race to the holy grail of precision medicine—bringing the right treatments to the right patients at the right time. Progress is being made on so many fronts—life sciences companies are developing cell therapies in cancer, artificial pancreas device systems in diabetes, apps that help battle neurodegenerative diseases and optimize nutrition, and wearables that can track everything from heart disease to fertility. Technology companies are creating algorithms to select cancer treatments....We are at the intersection of biological and technological revolution, at a point where the digitization of health and medicine is becoming a reality at the same time that medical innovation is catching up with—and possibly even exceeding the speed of—growth in computational capacity....The convergence of these digital and biological revolutions means that the next breakthrough cure—or treatment that turns a fatal condition into a chronic disease—will come from computers and algorithms working in concert with patients, physicians, and scientists.”

- Um antropologista entra num bar... (parte II) (Fevereiro de 2014)

- Os humanos são todos diferentes (Fevereiro de 2019)

- Uma parte importante da revolução económica do futuro vai passar por aqui (Abril de 2020)

segunda-feira, julho 20, 2020

The alternative

"The question for most of us is: What if the work you do is:

- compliance-based

- standardized

- repetitive

- not based on innovative or flexible customer interaction…

If it is, it’s pretty likely that you’ll be replaced by a combination of robots, AI and outsourcing.If they can find someone or something cheaper than you, they’re going to work overtime to do so.The alternative is to be local, creative, energetic, optimistic, trusted, innovative and hard to replace."

Mongo, land of the weird

Some say that the 20th century in economic terms started in October 1913 with the opening of the first Ford assembly line.

"On October 7, 1913, the production of the model that was to become the classic of the classics moved to Highland Park."

The Ford founder said that the customer could choose the color of the car as long as it was black, but more, it was not just any black, it had to be Japan Black, because it was the color that dried faster.

"it was the ability of japan black to dry quickly that made it a favorite of early mass-produced automobiles such as Henry Ford's Model T. The Ford company's reliance on japan black led Henry Ford to quip" Any customer can have a car painted any color that he wants so long as it is black ".

While other colors were available for automotive finishes, early colored variants of automotive lacquers could take up to 14 days to cure, whereas japan black would cure in 48 hours or less. "

The twentieth century, in economic terms, was a time when demand was greater than supply.

And when demand is greater than supply, the boss is the one who produces. Who produces is who establishes what is produced, what is put on the market and with what specifications. In this type of competitive universe, the critical success factor is price. Therefore, everything is done to be efficient, to increase the production rate, to reduce unit costs.

· "economics of scale;

· large, physically and temporally concentrated production facilities;

· long production runs;

· mass markets;

· task specialization; and

· standardization. "

Customers agreed to exchange variety for uniformity because they were able to access goods at a lower price. Seth Godin uses admirable metaphor to portray this world. The world in which producers treat consumers like plankton, an indistinct and homogeneous mass, without individual wishes.

When the deal is price, when the deal is dictated by efficiency, when everything produced has a way out, then it is enough to look inside, it is enough to measure performance based on financial results. So I call the 20th century economic model Magnitogorsk or Levittown.

The city of Magnitogorsk in the USSR was rebuilt during Stalinism:

"In Magnitogorsk, there were two types of apartment, named 'A' and 'B'. They were the city’s sole concession to variety."

I read somewhere that the difference between type A and type B lay in the color of the lamps, white or orange. Do not think that the Magnitogorsk were a hallmark of the communist world. No, they were a consequence of an industrial model based on mass production and with little or no care with what users intended or valued. The United States also had its version, Levittown:

"In July 1947, on potato fields 20 miles from Manhattan, William Levitt pioneered the mass production of affordable homes. Variations in the 17,477 houses were minor; each had two bedrooms, a bath, living room and kitchen on a 750-square-foot By standardizing the units, Levitt eventually was able to put up more than two dozen a day, helping fill the enormous postwar demand. Over the years, innumerable changes to the homes have transformed the community. But even now, Levittown remains a kind of shorthand for the sameness of mass production that's starting to give way to mass customization. "

When the competitive landscape begins to ripple

As the twentieth century progressed, the imbalance between supply and demand was reduced until it passed to the other side: supply became bigger than demand.

When this happens, a real epistemological shock occurs. It is not enough to produce, power passes to those who buy, not to those who produce. And that changes everything. What is the use of being very efficient if the product does not leave the warehouse?

The more the imbalance accentuated, the more power passed to the buyer, the more the producer had to get off the pedestal and try to seduce the buyer.

And it is in this context of increasing competition, increasing variety, the growing power of choice for customers and consumers translates into a growing complexity and variety with a more uncertain, faster world, with many variants, with many more strategies.

I like to use the image of a landscape that ripples over time to illustrate what happens in the economic world as we abandon the 20th century paradigm:

While the twentieth century could be represented by a landscape with a single peak, and the further up the peak, the more return organizations had. And they were all looking for the same, to climb as high as possible and as quickly as possible to the top of the same peak. Whoever climbs faster will have a competitive advantage over the rest, given the virtuous mechanism of the effect of scale in a scenario governed by efficiency. The 21st century economy, on the other hand, is progressively wrinkling and generating more and more peaks. More and more companies, despite appearing to be operating in the same economic sector, do not compete with each other, as they specialize in serving different types of customers in different circumstances. One of the phrases I often repeat is that economics is a continuation of biology. And biology gives us great lessons that can be translated into economics. One of the stories I most like to tell is that of doctoral student Robert MacArthur who discovered that five different species of warblers could feed on the same tree without competing with each other, each species fed on a different area:

An example of what the Russian biologist G. Gause published in 1934 in the book “The struggle for existence”, where he reported the conclusions of a set of experiments, he carried out with paramecia and from which I quote the principle of exclusive competition:

"Two species cannot coexist indefinitely if they feed on the same type of scarce nutrient."

Making the parallelism for organizations; in a world bursting with variety, companies cannot be managed in the same way. Different "species" serve different types of customers. So, they need to be managed differently.

I use the label Mongo to describe this world of increasing variety where effectiveness is much more important than efficiency.

domingo, julho 19, 2020

The 90% economy"

"IN MANY THINGS 90% is just fine; in an economy it is miserable, and China shows why. The country started to end its lockdown in February. Factories are busy and the streets are no longer empty. The result is the 90% economy. It is better than a severe lockdown, but it is far from normal. The missing bits include large chunks of everyday life....Discretionary consumer spending, on such things as restaurants, has fallen by 40% and hotel stays are a third of normal. People are weighed down by financial hardship and the fear of a second wave of covid-19. Bankruptcies are rising and unemployment, one broker has said, is three times the official level, at around 20%..If the post-lockdown rich world suffers its own brand of the 90% economy, life will be hard...Many businesses will emerge from lockdown short of money, with strained balance-sheets and facing weak demand....The longer the world has to endure a 90% economy, the less likely it is to snap back after the pandemic."

Plano de reflexões

sábado, julho 18, 2020

Modelos e decisões

“Models should not be judged by the sophistication of the mathematics – in itself neither good nor bad – but by the insights which that model provides into a particular problem that we are trying to solve....Models are tools like those in the van of the professional plumber, which can be helpful in one context and irrelevant in others. As with the tools in the van, there may be several models which contribute to the solution of a specific problem. And there are times when there is no good model to explain what we see. But we still have to make decisions. So the test of a model is therefore whether it is useful in making the decisions which need to be made in government, business and finance, and in households, in a world of radical uncertainty.The pursuit of practical knowledge which gives useful advice to policy-makers begins from the question ‘What is going on here?’ The plumber looks first for the origin of the leak. A doctor conducts a consultation by observing symptoms and taking readings until he or she can begin to formulate a diagnosis and prescribe a treatment. An engineer or architect begins by scoping the project, and a dentist makes an examination and assessment before recommending a course of action. All these approaches are distinct from the search for abstract knowledge of ‘the world as it really is’ which characterises the work of physicists and philosophers. But the crucial contribution of economics to the world is defined by its role as practical knowledge, not as scientific theory.”

sexta-feira, julho 17, 2020

quinta-feira, julho 16, 2020

"Being nimble is easier for a small structure "

“In the post-COVID-19 era, apart from those few sectors in which companies will benefit on average from strong tailwinds (most notably tech, health and wellness), the journey will be challenging and sometimes treacherous. For some, like entertainment, travel or hospitality, a return to a pre-pandemic environment is unimaginable in the foreseeable future (and maybe never in some cases…). For others, namely manufacturing or food, it is more about finding ways to adjust to the shock and capitalize on some new trends (like digital) to thrive in the post-pandemic era. Size also makes a difference. The difficulties tend to be greater for small businesses that, on average, operate on smaller cash reserves and thinner profit margins than large companies. Moving forward, most of them will be dealing with cost–revenue ratios that put them at a disadvantage compared to bigger rivals. But being small can offer some advantages in today’s world where flexibility and celerity can make all the difference in terms of adaptation. Being nimble is easier for a small structure than for an industrial behemoth.”

"In the world as it is, we cope rather than optimise"

“the lesson of experience is that there is no single approach to financial markets which makes money or explains ‘what is going on here’, no single narrative of ‘the financial world as it really is’. There is a multiplicity of valid approaches, and the appropriate tools, model-based or narrative, are specific to context and to the skills and judgement of the investor. We can indeed benefit from the insights of both Thales of Miletus and Harry Markowitz, and learn from both of the contradictory narratives of the world of finance propagated by Gene Fama and Bob Shiller. But we must also recognise the limits to the insights we derive from their small-world models....Radical uncertainty precludes optimising behaviour. In the world as it is, we cope rather than optimise.”

quarta-feira, julho 15, 2020

Engenheiros sociais, decreto, cobardia e conversa da treta

“The green economy spans a range of possibilities from greener energy to ecotourism to the circular economy. For example, shifting from the “take-make-dispose” approach to production and consumption to a model that is “restorative and regenerative by design” can preserve resources and minimize waste by using a product again when it reaches the end of its useful life, thus creating further value that can in turn generate economic benefits by contributing to innovation, job creation and, ultimately, growth. Companies and strategies that favour reparable products with longer lifespans (from phones and cars to fashion) that even offer free repairs (like Patagonia outdoor wear) and platforms for trading used products are all expanding fast.”

"O líder do setor do vestuário e confeção considera que o Estado português deve “investir em salvar o emprego” nesta indústria, que corre o risco de perder um saber-fazer que é difícil de recuperar....Há uma mais-valia que o vestuário português tem a nível mundial. Temos uma indústria excelente, amiga do ambiente, um ecossistema do melhor que há. Sem o lay-off simplificado, com os termos que tinha ou até melhorados para não penalizar tanto a empresa, corremos o risco de perder este ecossistema e o saber-fazer, que é difícil de criar novamente. O Estado tem de fazer um plano agressivo para evitar o colapso das empresas e de investir na manutenção dos postos de trabalho nos próximos meses, até ao final do ano. Não é em equipamento; é em salvar o emprego."

Cuidado com o que desejas, pode ser que o obtenhas. Ou, como Karma is a bitch

"when you get what you want but not what you need"

"César Araújo propõe que 60% dos artigos consumidos sejam fabricados na Europa...Tudo tem de partir da consciência dos nossos governantes em Bruxelas. Não vale a pena só injetar dinheiro. A Europa tem de fazer um Plano Marshall e dizer que 60% dos produtos consumidos têm de ser manufaturados na Europa."

"Vocacionada para a produção de vestuário para marcas da gama média-alta e luxo, a Calvelex exporta as cerca de 800 mil peças que fabrica anualmente para os quatro cantos do mundo, com enfoque especial na Europa e nos EUA....Quais vão ser os principais mercados da Calvelex em 2018?.Vão ser toda a Europa, que é o nosso mercado doméstico, os EUA, o Canadá, a Coreia do Sul e o Japão."

terça-feira, julho 14, 2020

E não tem mais nada para dizer?

"Como é que os dirigentes associativos mais mediatizados costumam reagir perante a mudança? Defendendo o passado e anatemizando a mudança" (daqui)

"Qual o papel do presidente de uma associação? Não é também o de ajudar os associados a agarrar o touro pelos cornos? Não é também o de sugerir alternativas? Não é também o de ser vanguarda?" (daqui)

"Já por várias vezes escrevi aqui no blogue sobre a importância das associações empresariais serem lideradas por gente optimista, gente que consegue subir mais alto e ver mais longe, gente que em vez de defender o passado, tem como prioridade abraçar o futuro, conquistar o futuro, criar o futuro... mais, deviam ser refinados batoteiros, gente que não espera pelo futuro, antes aspira a criá-lo, a construí-lo, a influenciá-lo..Já por várias vezes escrevi aqui no blogue sobre as direcções de associações empresariais que estão tão preocupadas com a salvação do passado que não conseguem sentir as oportunidades do futuro. Por isso, escrevo que são associações em que os associados individualmente estão muito à frente do pensamento dos dirigentes associativos." (daqui)

"O espírito de um sector industrial é um espelho do ambiente que os seus líderes associativos criam!!!" (daqui)

"o presidente da Associação das Indústrias de Vestuário e Confeção (ANIVEC) explica que as marcas estão a “atirar a coleção primavera/verão para o próximo ano”, por estarem neste momento “cheios de stock” e não terem maneira de o escoar a preços favoráveis para o negócio. César Araújo diz ao jornal que esta opção dos comerciantes “só têm o impacto de capital – e para muitos nem será grande porque arrastaram os pagamentos às fábricas para mais meses”."

"Making choices"

"You cannot treat the whole market as one. The market has never been homogeneous and is becoming increasingly less so. People and businesses differ in how they value a product, how they value different product attributes and in their spending power. Marketing is about segmentation and targeting, find what is relevant and important to different segments and deliver a version they are willing to pay for.

most interesting to me are the regions outside the diagonal band. Notice the holes in top left and bottom right. Just because holes exist in a segmentation strategy it does not mean it must be targeted. What would the price look like for these two segments? Are there sizable number of customers in these two segments? If yes can AT&T target them with more versions without confusing the “diagonal” customers? Do these holes open up opportunities for competitors to enter the market? If yes, why didn’t AT&T choose not to go after these segments? What do they know that competitors don’t?.If marketing is about segmentation and targeting, strategy is about making choices – choices about how to effectively apply limited resources to maximize profit."

segunda-feira, julho 13, 2020

A importância da estratégia de uma organização

"In summary, our research shows the following:New CEOs often cause a significant, sustained change in performance. The companies of the top 20% of CEOs outperformed their sector by 9 percentage points per year over the course of their tenure, controlling for other factors, whereas the companies of the bottom 20% underperformed by 11 points.The spread of CEO impact varies by strategic context. The gap between the most and the least successful CEOs is up to 9 points wider in fast-growing, technology-driven businesses than in slower-growing, more-regulated contexts.The CEO effect tends to decline with scale. The performance spread caused by the CEO effect is greater among smaller firms (driven largely by a higher potential upside), but a significant spread exists in companies of all sizes.Some actions are associated with CEO success across nearly all contexts. Top-performing CEOs are more likely to take a long-term approach to strategy, accelerate M&A activity, increase their company’s ESG scores, and pay more attention to diversity."

Disciplinar a inovação?

"Teams need to show hard evidence that a market exists and customers are interested (i.e. desirability), that the required infrastructure can be built and managed (i.e. feasibility), and evidence that the projected revenues and profits are not a fantasy (i.e. viability)."

/https%3A%2F%2Fiterativepath.files.wordpress.com%2F2009%2F10%2Fatt_prices1.png%3Fw%3D648)

%2006.21.jpeg)