Parte II.

Ontem à noite comecei a ler "On Value and Value Creation in Service: A Management Perspective" de Christian Grönroos e publicado muito recentemente por

Jornal of Creating Value. É sempre um gosto ler este pensador.

O Abstract soou a algo de familiar:

"To develop a managerially relevant understanding of value and value creation, these phenomena must be analysed on a micro level. Seen from above, they lack a microfoundation. In the present article, value and value creation are discussed from a micro position, based on a service logic (SL) analysis of the service perspective on business and marketing."

E continuou:

"Viewing from above, or taking a macro-perspective, ... it can be observed that a whole host of actors, such as firms in various stages in the supply chain and end users, contribute to the value that emerges for the end user and other actors in the process. ... However, although a macro- analysis reveals phenomena which are not visible from below, ... at the same time, micro-level phenomena can only be observed from below and remain disguised for an analysis on a system- of-actors level. [Moi ici: Como não recordar os encalhados da tríade, qual Sarumans incapazes de abandonarem o alto das suas torres, incapazes de apanharem o que um anónimo engenheiro da província observa todos os dias há anos] The many different ways in which the actors contribute to value cannot be observed from above and, therefore, are not analysed in detail. ... ‘value co-creation is difficult to observe empirically’, and in order to theoretically develop the service perspective further, researchers must pay more attention to the micro-foundations that underpin SDL’s macro- constructs. ... ‘[M]acro scholars too often work with firm-level constructs which often unclear microfoundations, and proceed as if there are direct causal relations between macro variables (e.g. arguments that capabilities cause performance), where, in fact, the real causal relations involve lower level actions and interactions’.

...

What takes place on an actor level, in contrast to a level of systems of actors, is invisible to macro- analysis. ... the need to avoid the ‘black- boxization of concepts’ . In macro-analysis, the roles and goals of the actors cannot be observed, and even the nature of value as value-in-use is difficult to capture ... To be able to draw conclusions about this, interactions must be observable and the nature of interactions clearly understood.

...

First, analysing the service perspective from below reveals that the nature of value-in-use is partly different from what is postulated in a macro-analysis. Indeed, value-in-use is determined in an idiosyncratic and phenomenological manner by customers, as suggested by SDL, but how value emerges or is created is not observable in a macro-analysis."

A micro-economia sabe coisas que a macro-economia ou ainda não sabe ou nunca chegará a saber. E, escrevo que "ainda não sabe" porque, quando o mundo muda, os encalhados continuam a tentar explicar o mundo com base nas

sebentas em que aprenderam. Os "

ignorantes", como não sabem, por tentativa e erro, o nosso querido

fuçar, descobrem ao nível micro as opções que funcionam no novo mundo.

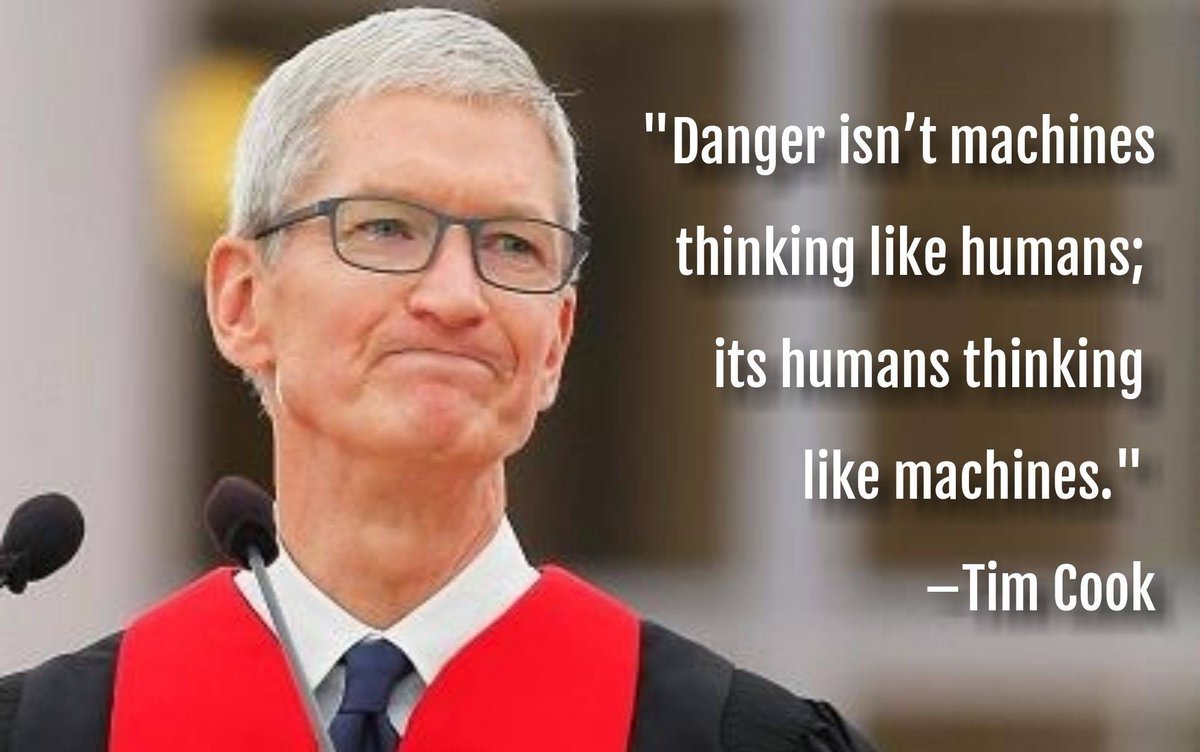

Ainda ontem num webinar a que assisti, vi esta imagem:

Quando o mundo muda, o conhecimento que funcionava transforma-se numa armadilha, só resta a acção. O novo conhecimento só virá depois da reflexão sobre as acções que resultaram.