Na passada quinta-feira circulava na cidade de Bragança quando deparei com este cartaz:

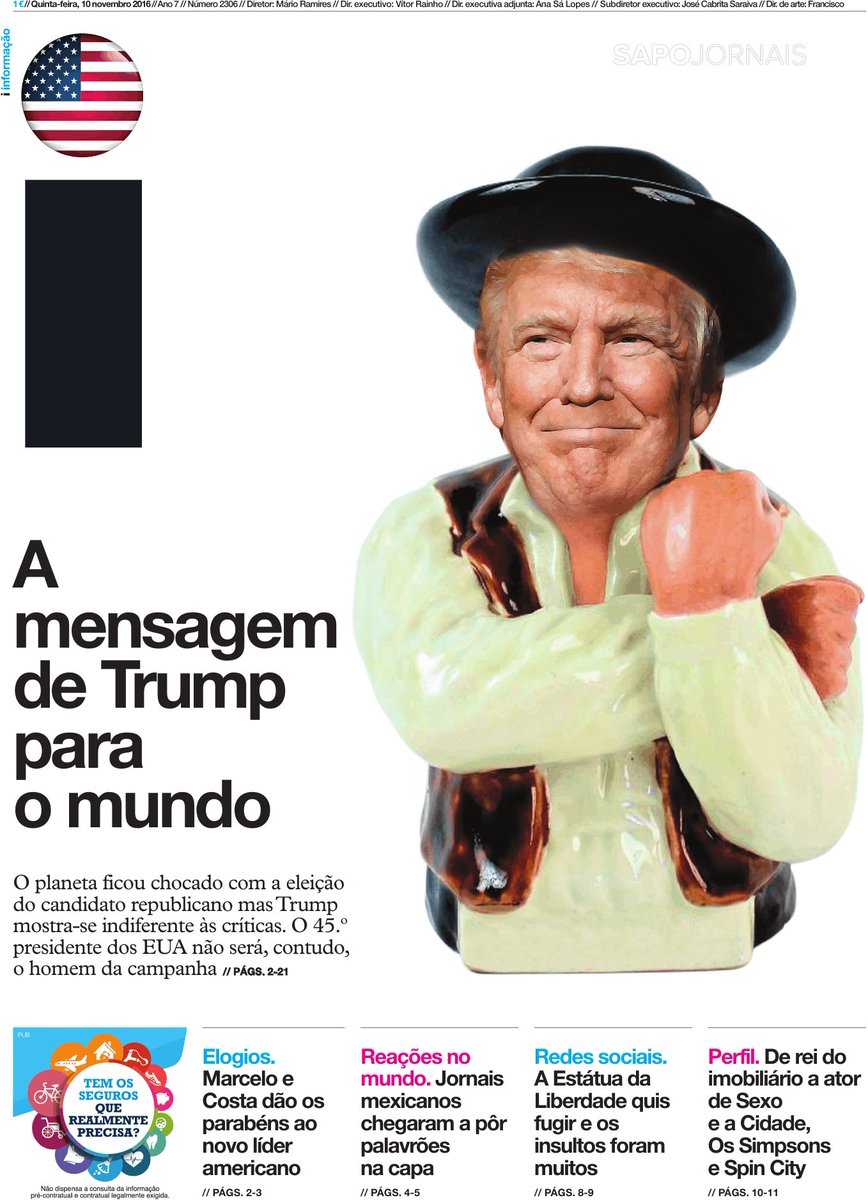

Não sei se influenciado pela capa do jornal i do dia:

A primeira coisa que me veio à mente ao ver o cartaz foi:

"Cartaz da campanha de Trump em plena cidade de Bragança."

Porque recordo isto?

.

É a primeira coisa que recordo ao ler "

Creative Destruction". Afinal Trump e o PCP estão tão próximos em tanta coisa. Escrevo aqui muitas vezes sobre o veneno dos subsídios para salvar empresas ou modelos de negócio obsoletos. Esse

activismo, esse

fragilismo, destrói os

stressors, destrói a informação, corrompe os sinais que deveriam obrigar as organizações a mudarem, a evoluírem.

"Over time, societies that allow creative destruction to operate grow more productive and richer; their citizens see the benefits of new and better products, shorter work weeks, better jobs, and higher living standards.

.

Herein lies the paradox of progress. A society cannot reap the rewards of creative destruction without accepting that some individuals might be worse off, not just in the short term, but perhaps forever. At the same time, attempts to soften the harsher aspects of creative destruction by trying to preserve jobs or protect industries will lead to stagnation and decline, short-circuiting the march of progress. Schumpeter’s enduring term reminds us that capitalism’s pain and gain are inextricably linked. The process of creating new industries does not go forward without sweeping away the preexisting order.

...

Through this constant roiling of the status quo, creative destruction provides a powerful force for making societies wealthier. It does so by making scarce resources more productive.

...

Attempts to save jobs almost always backfire. Instead of going out of business, inefficient producers hang on, at a high cost to consumers or taxpayers. The tinkering shortcircuits market signals that shift resources to emerging industries. It saps the incentives to introduce new products and production methods, leading to stagnation, layoffs, and bankruptcies. The ironic point of Schumpeter’s iconic phrase is this: societies that try to reap the gain of creative destruction without the pain find themselves enduring the pain but not the gain."

Interessante este exemplo "

Oreo Plant Moves to Mexico… Federal Subsidies to Blame?"

.

Depois, podemos pensar na multidão de exemplos destes subsídios-comporta:

Comporta porque tentam comprar tempo que não é usado para mais nada senão comprar tempo, em vez de pôr fogo no rabo dos empresários para mudarem e partirem em busca do próximo nível do jogo.