Along the same walk I read "Method for Strategic Objectives in Strategy Maps" by Luis E. Quezada, Felisa M. Cordova, Pedro Palominos, Katherine Godoy and Jocelyn Ross, published by Int. J. Production Economics 122 (2009) 492–500.

I'm a big fan of the balanced scorecard and even more of strategy maps.

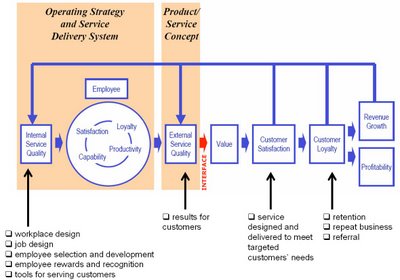

"The BSC establishes cause–effect relationships among strategic objectives, even though they do not state the way to establish and quantify those relationships. The relationships are represented in what the authors called strategy map, which is the main subject in this work.This figure shows an example of a strategy map:

...

The objective of this paper is to present a simple tool for identifying strategic objectives in order to build a strategy map. A strategy map is a component of a balanced scorecard that represents the cause–effect relationships among strategic objectives. Performance measurements are defined for each strategic objective."

The authors studied 12 companies and describe 3 methods used to develop strategy maps:

"Method 1 carries out a strategic process, including the definition of a vision and mission, internal and external analysis from which a SWOT (strengths, weaknesses, opportunities, threats) analysis is undertaken. The strategic objectives are defined from the SWOT analysis. Fig. 2 depicts the process."

"Method 2 is similar to method 1, but the difference is that two types of objectives are defined: global and specific. Global objectives are defined directly from the vision and mission, while specific objectives are defined from the SWOT analysis. This method has an advantage over method 1; it translates the vision and mission into general objectives, helping the organisation to identify the strategic directions within the strategy map.Then, the authors present their own method described by this figure:

...

Method 3 identifies strategic themes from the organisation's vision and mission, which are the basis for defining the strategic objectives."

When I saw using the SWOT analysis to develop a strategy map I smiled.

What is a strategy map?

A strategy map is a diagram that shows an organization's strategy as a chain of cause-efect relationships on a single page. And someone uses a SWOT analysis before getting the strategy? Come on!

Nothing is intrinsically a strength or a weakness, an opportunity or a threat independently of the strategy. I believe that only after formulating a strategy one can use the SWOT analysis. I can state that our organization has a tremendous strength: we have a very efficient high throughput production machine. But if our strategy is to work for customers that want small amounts, that want flexibility, that want customization... then that machine is not a strength. Most likely it is a weakness.

I smiled even more when I saw that the four methods started with "Vision and Mission". I smiled and while smiling I began to repeat Paul's words to the Corinthians: When I was a child (child-consultant) reading management books I also believed in these childish-scenes and I was amazed and said yes...

Then I started to work with SME's and I realized that it is a lot of BS.

Management books present this kind of method:

I learned long time ago that the order must be almost completly changed, and in October 2015 I wrote the blog post "From concrete to abstract and not the other way around" (in Portuguese).

A typical SME in Portugal cannot start with a blank sheet, and start from scratch in a rational strategy development exercise.

.

Stay with me and try to put on shoes of a SME in need of developing a strategy. Why do they need to do that? Normally, for one of two possible reasons:

- to seize an opportunity that it inadvertently discovered; or

- to stop a competitive bleeding that is weakening it, and find a way to recover.

SME have no money, no culture, no resources to be free and go after the next big hit. They have to start with what they have at hand.

To avoid daydreaming and to motivate participation I start the strategic thinking with the result of a competitive advantage: one or more sustainable satisfied customers.

My approach is based on their clients. Please tell me the name of one or two good clients you have. Those clients are your best clients, or the clients with whom you have the best margins or make more money. Give me a name.

And I put that name on the whiteboard.

Now, look at that client as a person, look into their eyes and answer me: customers are selfish, they only think about themselves. Why on earth do these customers think it's best for them to work with you? What do they get in their life for working with you? Why do they continue to choose your organization?

I don't care about vision or mission, at least for now. I just want a safe rock on which to lay the foundation of their competitive advantage. And they have to have a competitive advantage, the proof is that customer satisfaction and loyalty.

So, we reverse the order:

- Satisfied customers with whom we make good money;

- What is our competitive advantage behind working with them?

Knowing the competitive advantage one can start climbing the abstract ladder and go from the specific and concrete into the more abstract to develop rules and to practice the noble art of cheating. I call it cheating when an organization realizes what make customers satisfied and start to do that in a systematic way, not just hoping for the luck.

I will continue this post showing how to go from a specific customer into a strategy map.

Quais são os componentes do mapa de processos que são críticos para a execução da estratégia?

Quais são os componentes do mapa de processos que são críticos para a execução da estratégia? Um, ou mais processos estão a ter um desempenho que limita os resultados estratégicos da organização. O princípio de Pareto ajuda-nos a identificar esses elos mais fracos, ou mais relevantes para o sucesso.

Um, ou mais processos estão a ter um desempenho que limita os resultados estratégicos da organização. O princípio de Pareto ajuda-nos a identificar esses elos mais fracos, ou mais relevantes para o sucesso.